In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

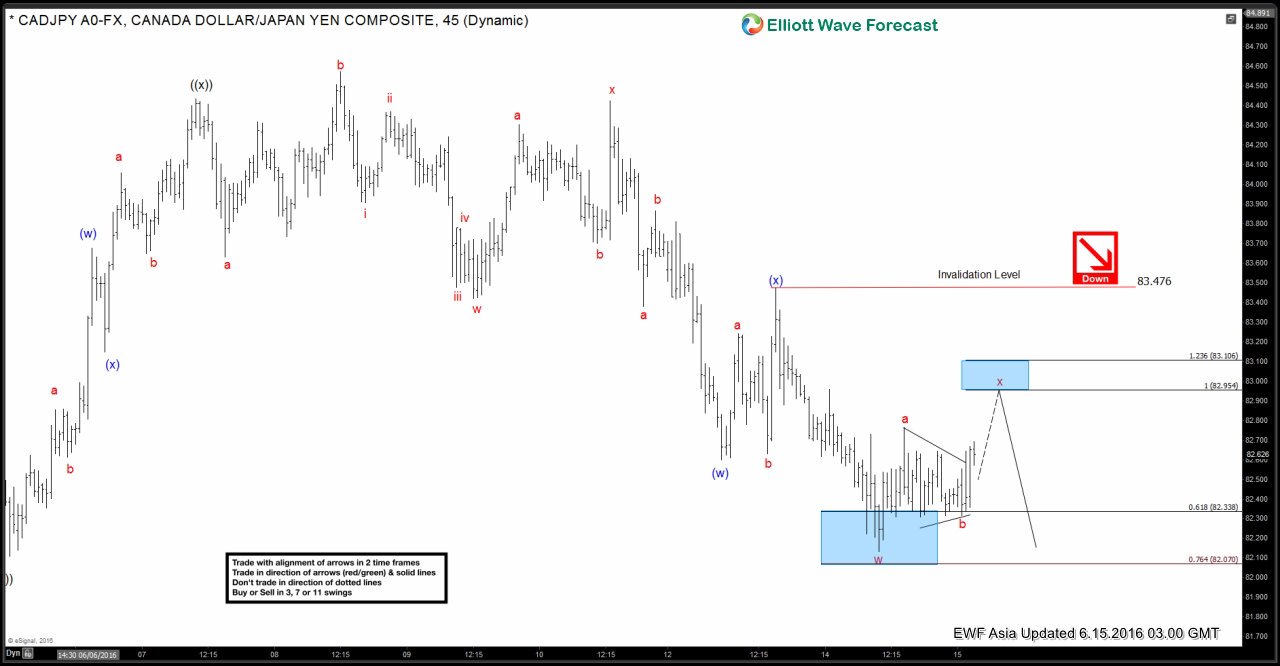

$CADJPY Short-term Elliott Wave Analysis 6.15.2016

Read MoreShort Term Elliottwave structure suggests that rally to 84.43 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 82.6 and wave (x) ended at 83.47. Wave (y) is in progress as a double three where wave “w” is proposed complete at 82.13 and wave “x” bounce is expected […]

-

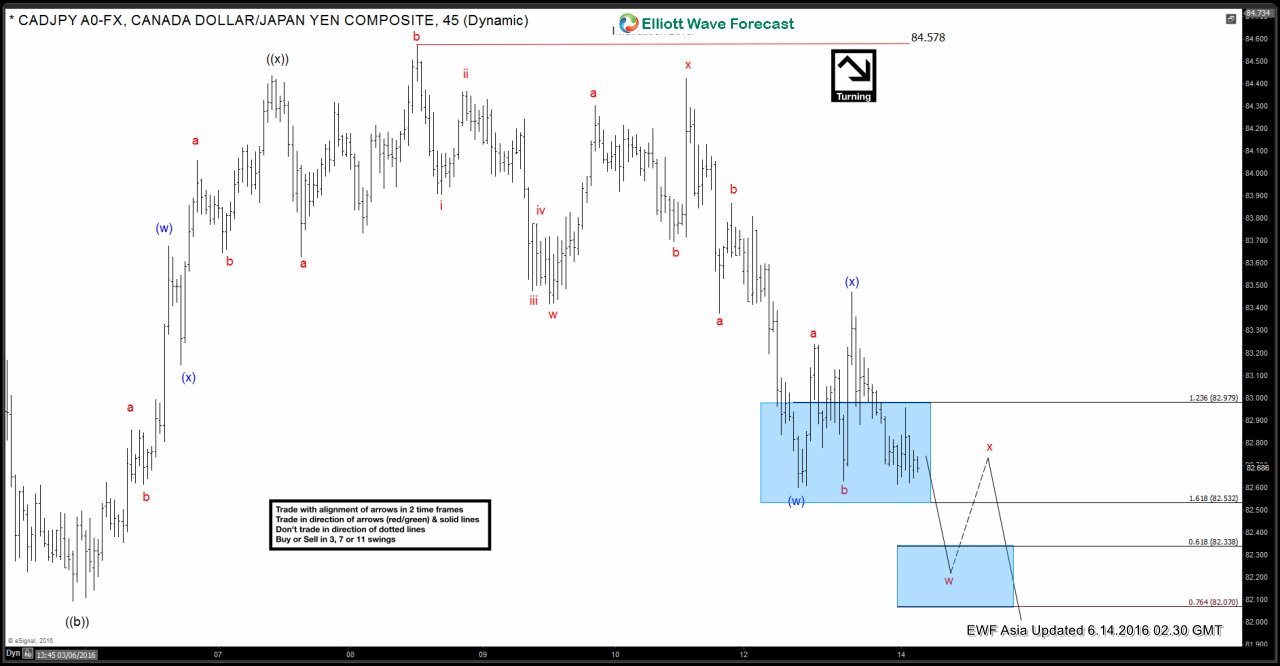

$CADJPY Short-term Elliott Wave Analysis 6.14.2016

Read MoreShort Term Elliottwave structure suggests that rally to 84.43 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 82.6 and wave (x) ended at 83.47. Near term focus is on 82.07 – 82.33 area to complete wave “w”, then it should bounce in wave “x” to correct the […]

-

$CADJPY Short-term Elliott Wave Analysis 6.2.2016

Read MoreShort term Elliottwave structure suggests that the cycle from 5/6 low has ended with wave (X) at 85.5. Decline from there is taking the form of a zigzag. Wave ((a)) of the zigzag is currently in progress as 5 waves diagonal where wave (i) ended at 84.13, wave (ii) ended at 84.85, wave (iii) ended at 83.28 and wave […]

-

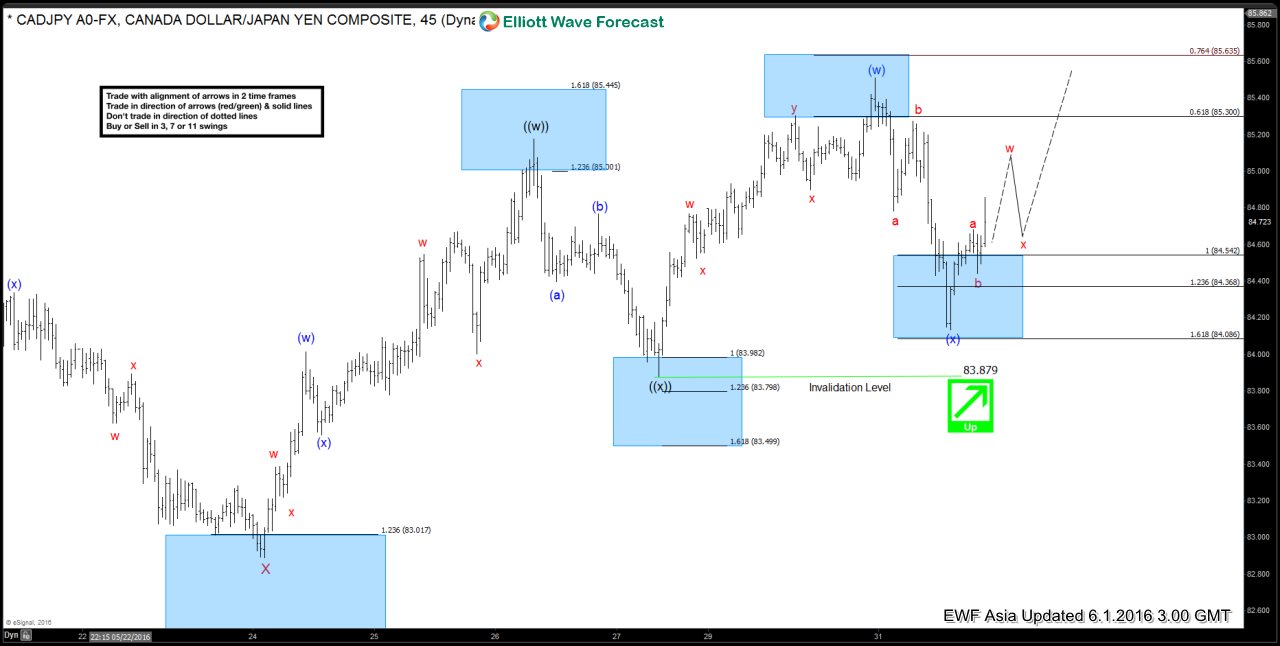

$CADJPY Short-term Elliott Wave Analysis 6.1.2016

Read MoreShort term Elliottwave structure suggests that dip to 82.88 on 5/24 ended wave X. Rally from there is unfolding as a double three where wave ((w)) ended at 85.17, wave ((x)) ended at 83.88, and wave ((y)) is in progress. Internal of wave ((y)) is also taking the form of a double three where wave (w) […]

-

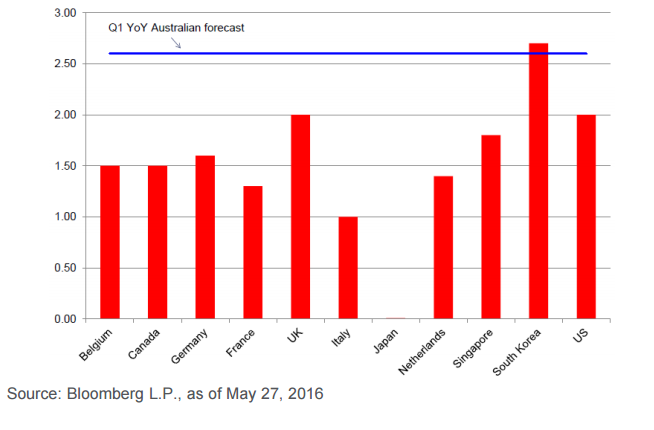

Australian Dollar may stabilize gradually

Read MoreUS Dollar Outlook A string of interview with Federal Reserve members in the past two weeks suggest that interest rate hike is imminent. Last Friday, Federal Reserve Chair Janet Yellen also confirmed that the Fed should “probably” raise interest rate “in the coming months” if economic growth picks up and the labour market continues to improve. The U.S. Dollar surged higher after Ms. […]

-

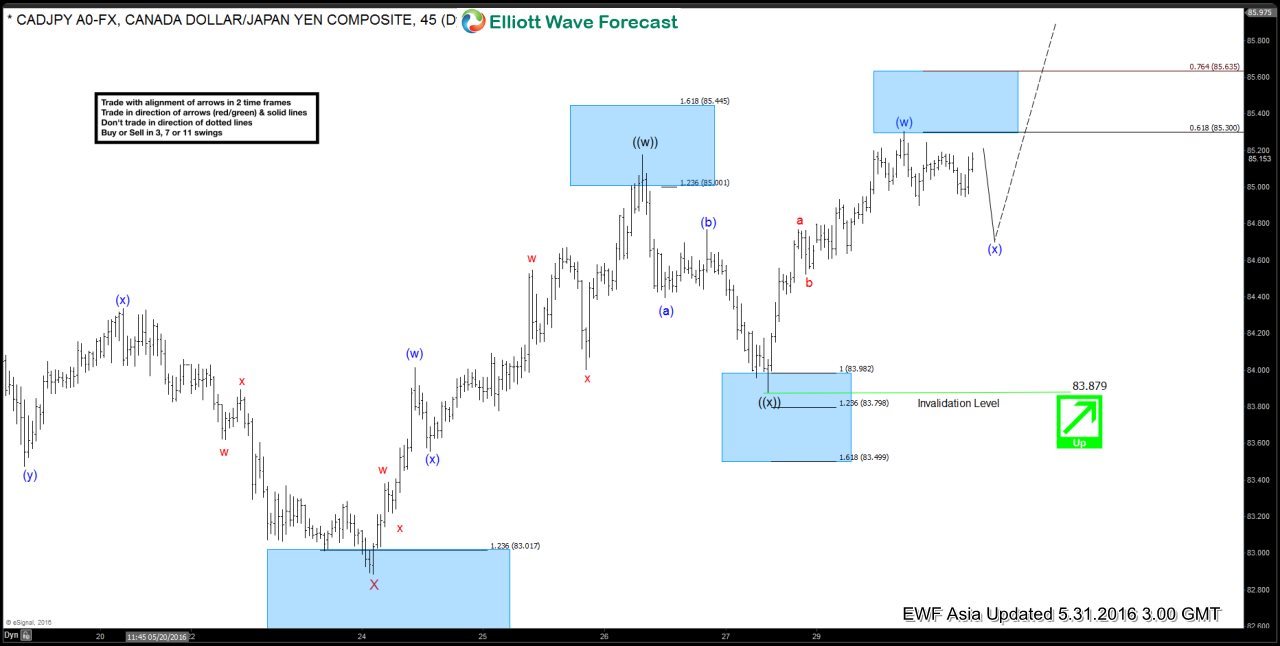

$CADJPY Short-term Elliott Wave Analysis 5.31.2016

Read MoreShort term Elliottwave structure suggests that dip to 82.88 on 5/24 ended wave X. Rally from there is unfolding as a double three where wave ((w)) ended at 85.17, wave ((x)) ended at 83.88, and wave ((y)) is in progress. Internal of wave ((y)) is also taking the form of a double three where wave (w) […]