In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

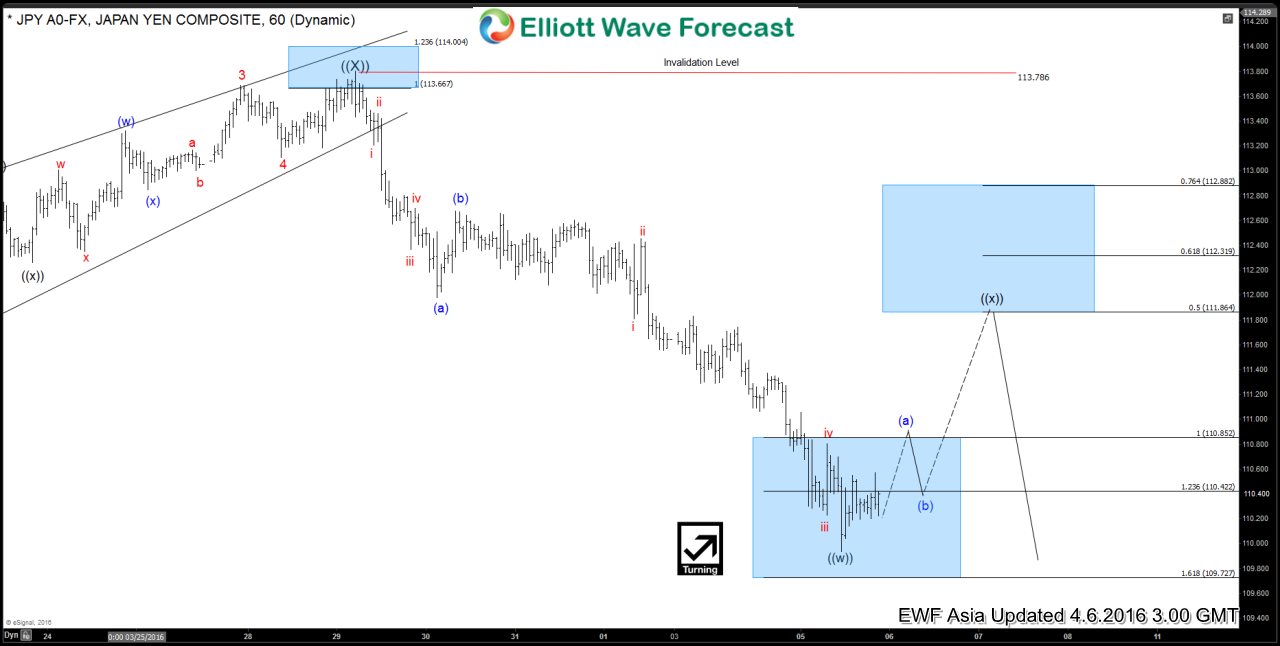

USDJPY Short-term Elliott Wave Analysis 4.7.2016

Read MoreRevised short term Elliottwave structure suggests decline from wave ((X)) at 113.8 is unfolding as an impulse 5 waves structure where wave ((i)) ended at 111.98, wave ((ii))) ended at 112.67, and wave ((iii)) is in progress. Internal of wave ((iii)) is also in impulsive structure and wave (iii) of ((iii)) is expected to complete at 108.58 […]

-

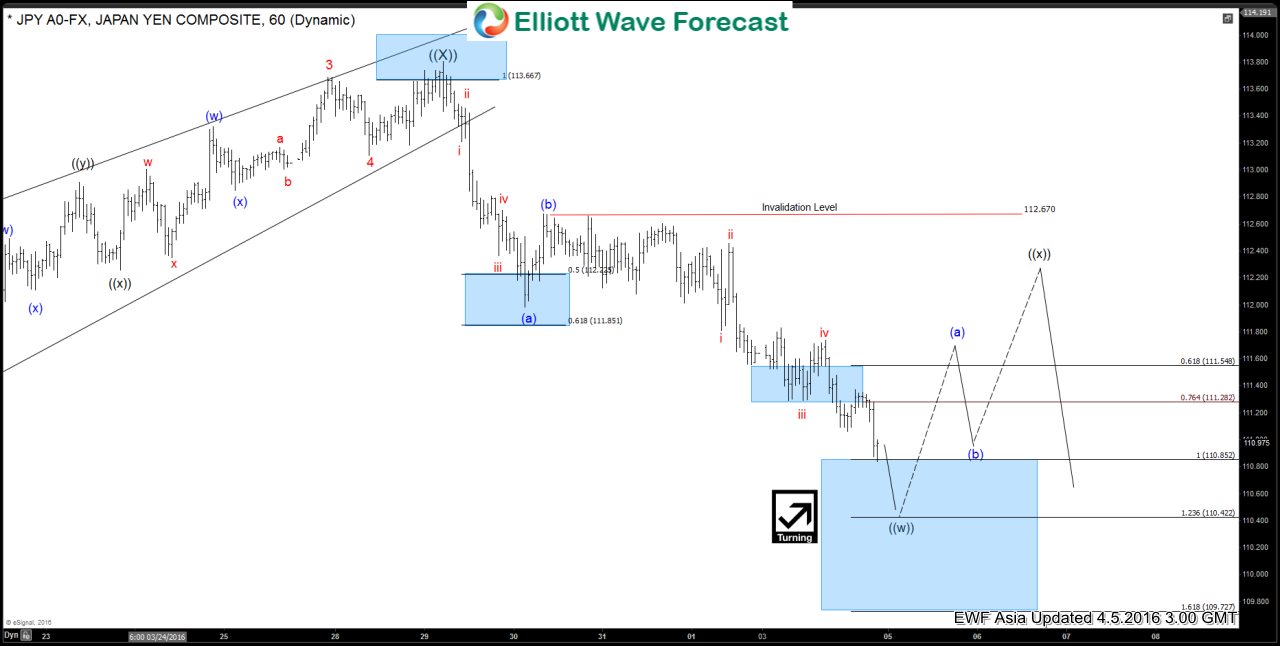

USDJPY Short-term Elliott Wave Analysis 4.6.2016

Read MoreShort term Elliottwave structure suggests decline from wave ((X)) at 113.8 is unfolding as a zig zag structure (5-3-5 structure) where wave (a) ended at 111.98, wave (b) ended at 112.67, and wave (c) of ((w)) is proposed complete at 109.93. Pair is currently correcting the decline from 113.786 in wave ((x)) towards 111.86 – 112.31 […]

-

USDJPY Short-term Elliott Wave Analysis 4.5.2016

Read MoreShort term Elliottwave structure suggests decline from wave ((X)) at 113.8 is unfolding as a zig zag structure (5-3-5 structure) where wave (a) ended at 111.98, wave (b) ended at 112.67, and wave (c) of ((w)) is in progress as 5 waves and expected to complete at 110.42 – 110.85 area before a bounce in wave […]

-

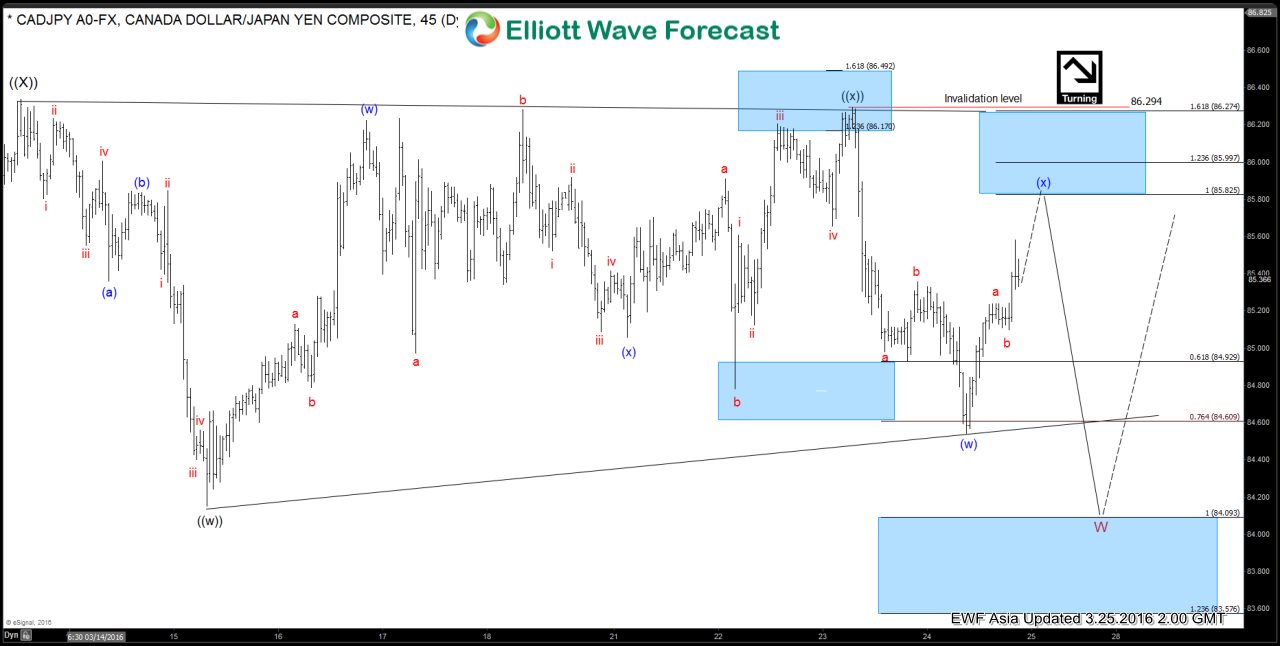

$CADJPY Short-term Elliott Wave Analysis 3.25.2016

Read MoreShort term Elliottwave structure suggests dips to 84.15 ended wave ((w)) and wave ((x)) bounce is proposed complete at 86.3 as a double correction. From 86.3 wave ((x)) high, pair has resumed lower with wave (w) ended at 84.54 and wave (x) bounce is currently in progress towards 85.82 – 86 area before the decline resumes […]

-

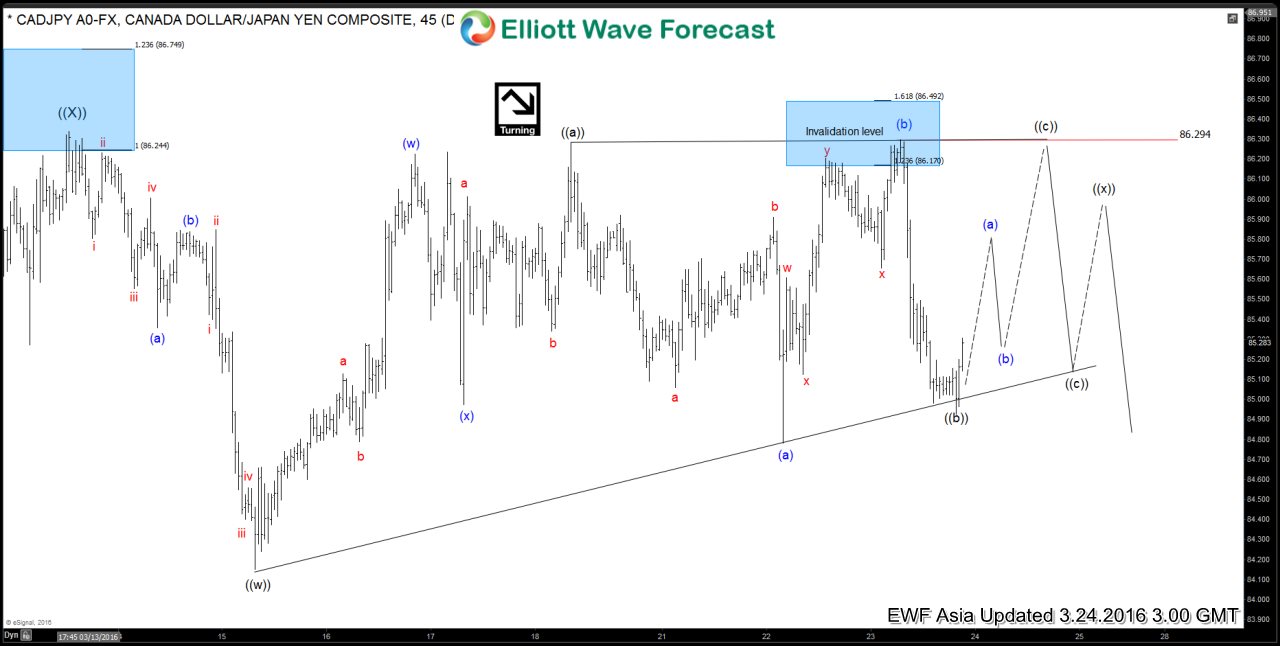

$CADJPY Short-term Elliott Wave Analysis 3.24.2016

Read MoreRevised short term Elliottwave structure suggests dips to 84.15 ended wave ((w)). Wave ((x)) bounce from there is unfolding as a triangle where wave ((a)) ended at 86.29, wave ((b)) ended at 84.92, and wave ((c)) is currently in progress. Pair is expected to do sideways movement and consolidate in the triangle while wave ((a)) at 86.294 needs […]

-

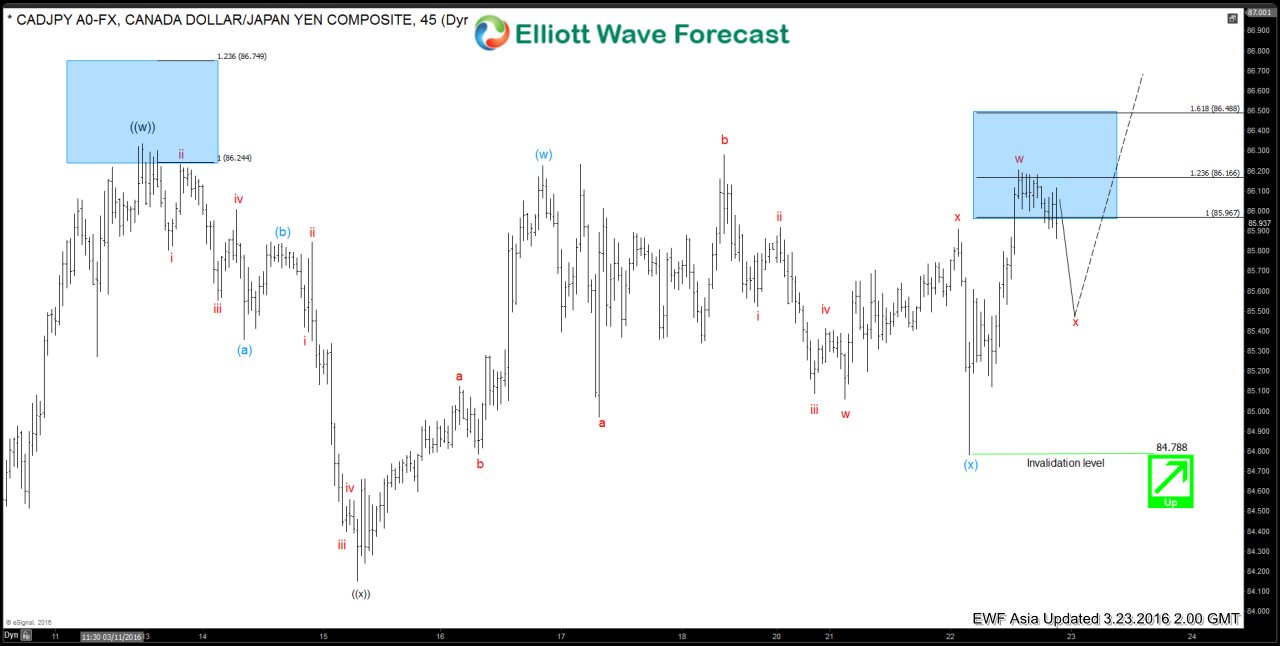

$CADJPY Short-term Elliott Wave Analysis 3.23.2016

Read MoreShort term Elliottwave structure suggests dips to 84.15 ended wave ((x)). Rally from there is unfolding in a double correction where wave (w) ended at 86.22, and wave (x) ended at 84.78. Near term, wave x pullback is in progress with an ideal target of 85.3 – 85.5 (50 – 61.8 back of the rally from 84.78), […]