In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

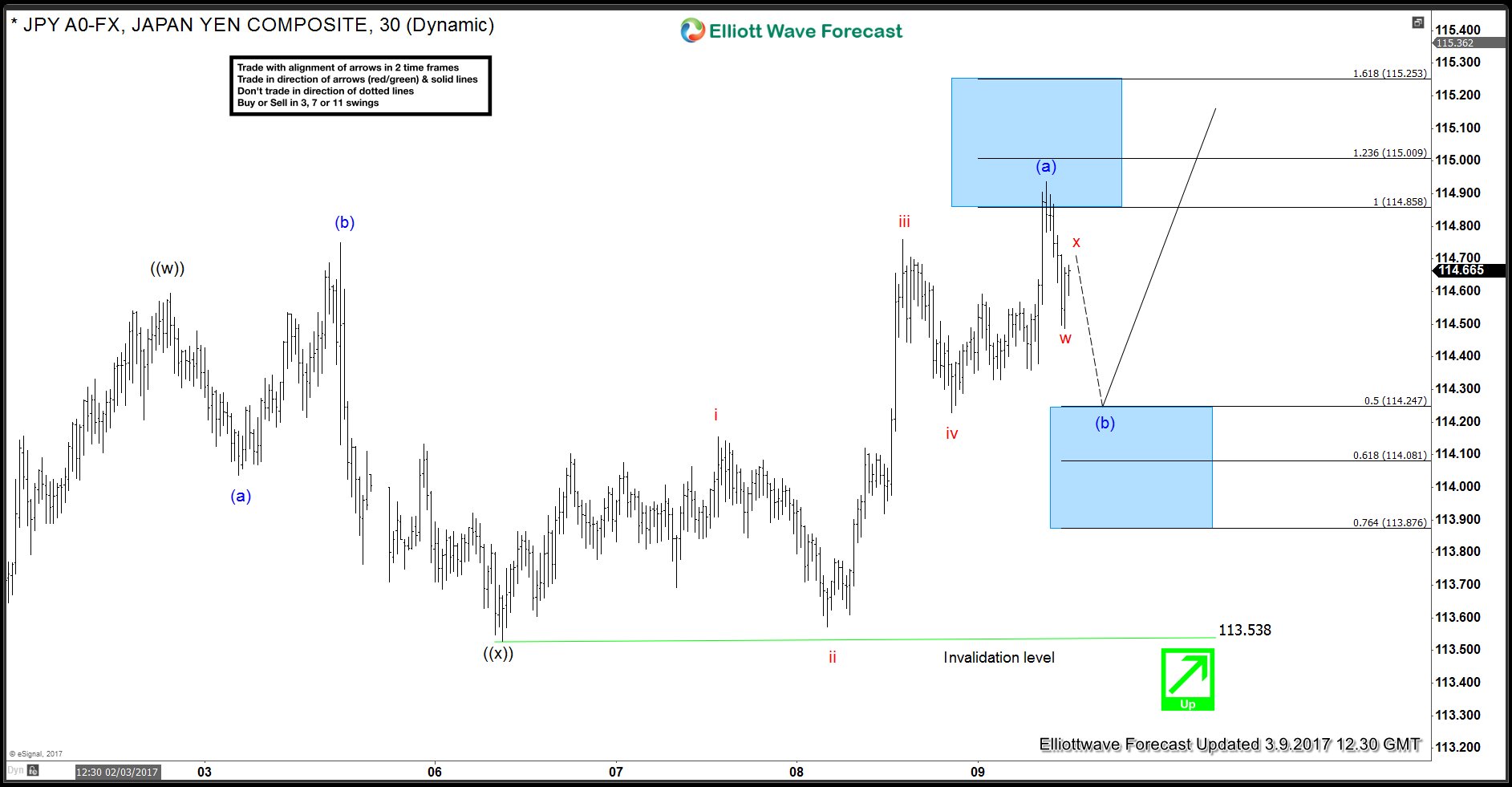

USDJPY Intra-day Elliott Wave view

Read MoreJPY (USDJPY) made a new high above last Friday’s peak and now seems to be pulling back. Move up from 113.53 ((x)) low could be viewed as a 5 swing Leading Diagonal Elliott Wave structure. There is RSI divergence (not showing) between red wave iii and blue (a) which further supports the idea of JPY […]

-

Bitcoin ( BTCUSD ) Warning Stage

Read MoreBitcoin Review Last year , Bitcoin was still considered as a fading project and many expected its price to keep dropping and break below $100. However in the recent months, the crypto-currency kept rising significantly and finally managed to make new all time high and break above $1200 last week ! That’s only $50 short of the equivalence to 1 […]

-

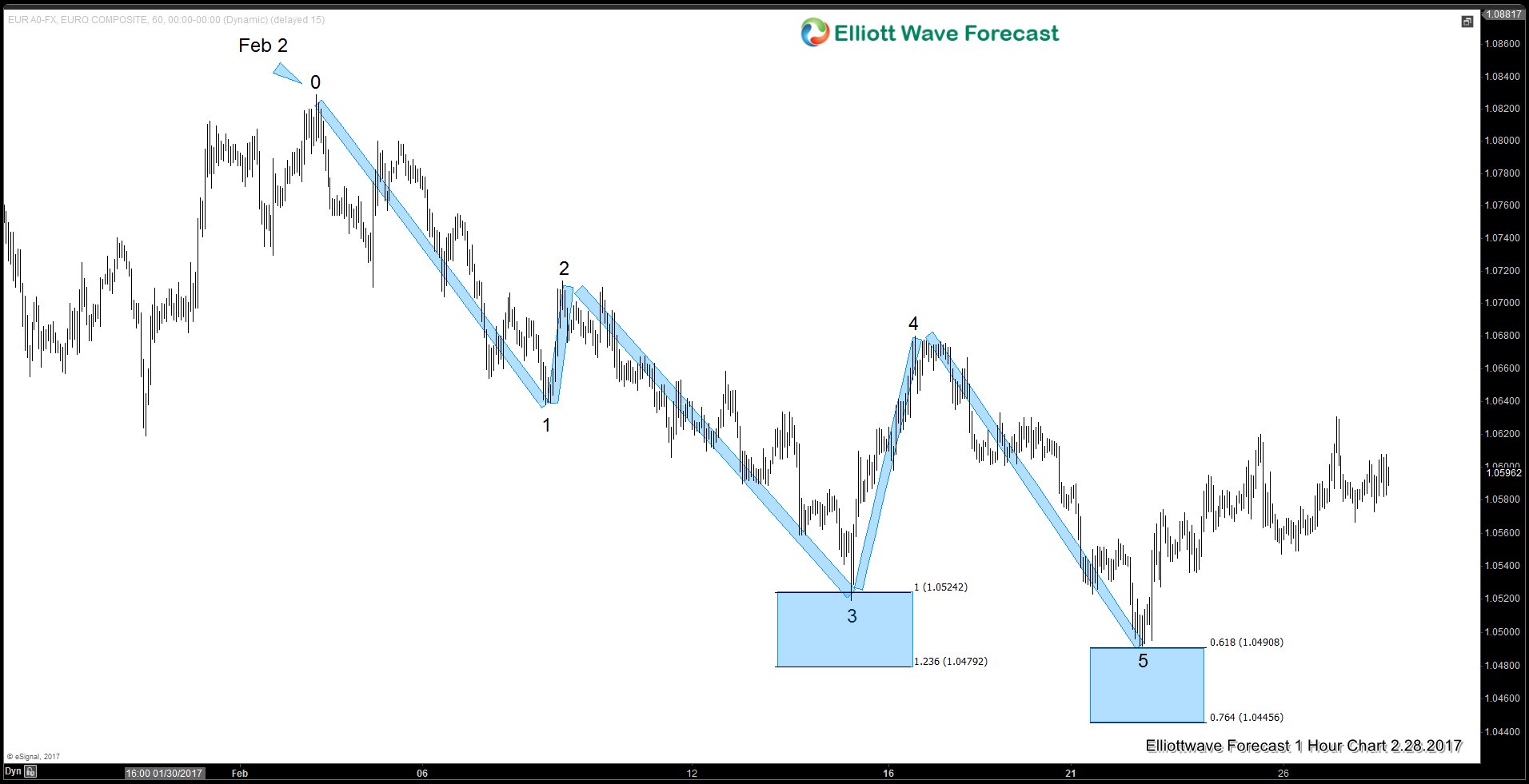

EURUSD: Euro area elections may limit strength

Read MoreThe Euro dollar (EURUSD) has been trading sideways since March 2015 before breaking into a new low in late December 2016. The single currency remains heavy technically and the underlying political and economic risks in the Euro-area in 2017 could provide a cap for any strength in the currency. The Euro zone has survived various crises […]

-

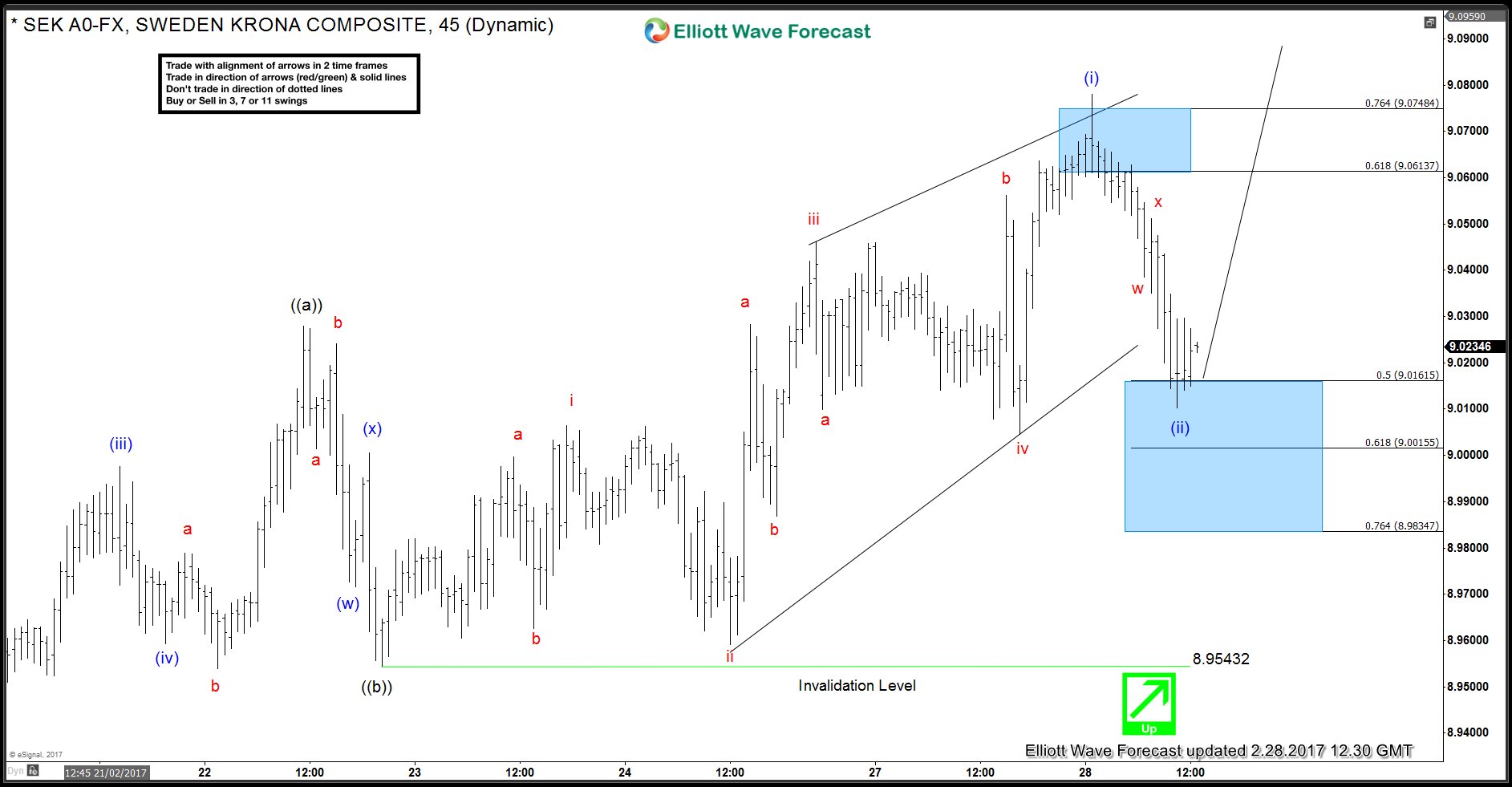

USDSEK Intraday Elliott Wave View

Read MoreUSDSEK move up from 2/22/2017 (8.9543) low could be viewed as 5 swings and hence we are labelling it as a leading diagonal Elliott Wave structure in wave (i). In the 2/28/2017 Asian update, we were expecting the pair to complete wave (i) and make a pull back in wave (ii) which would be a correction […]

-

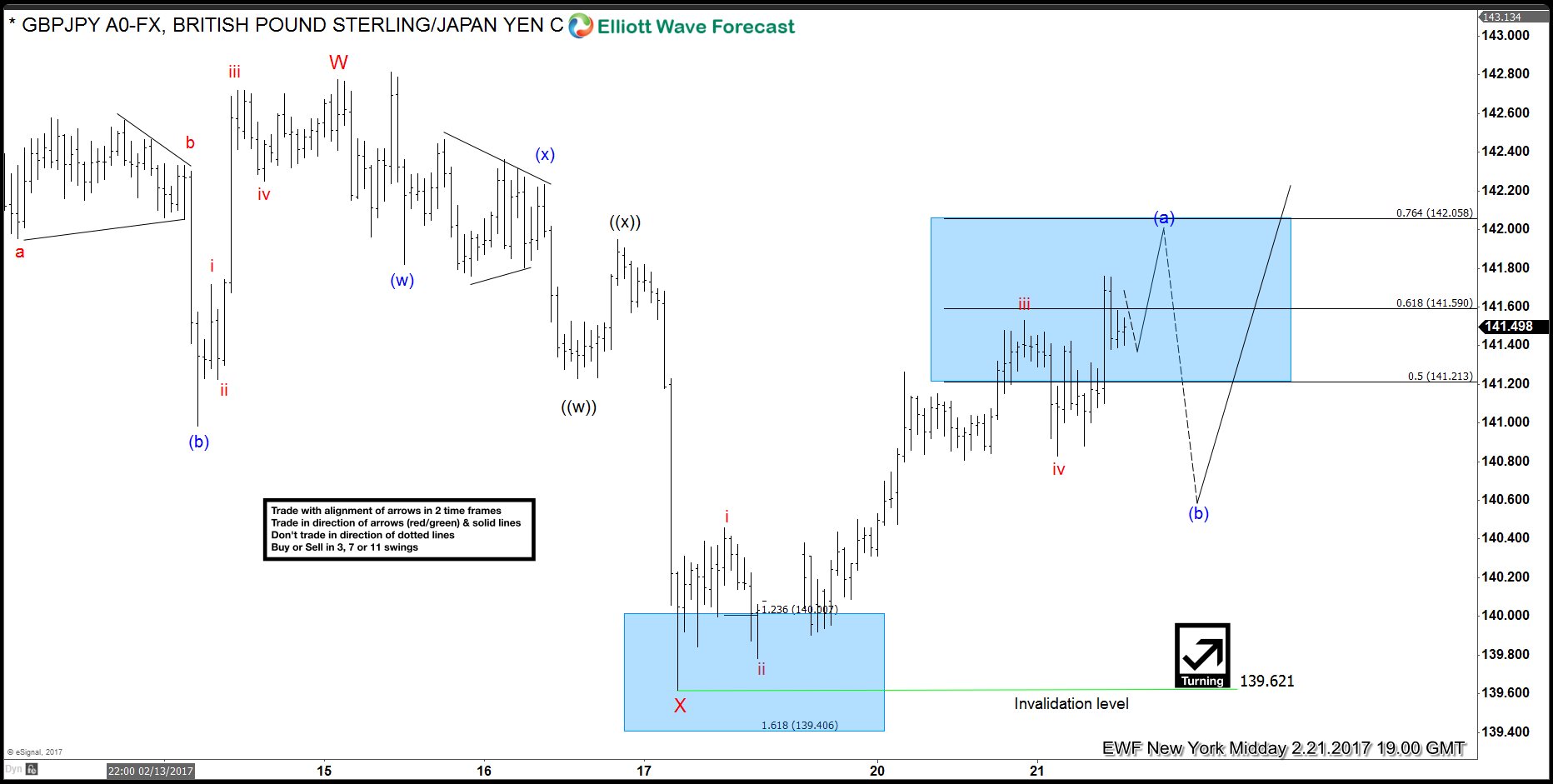

GBPJPY Shows 5 wave impulse up from 2/17 Lows

Read MoreGBPJPY Shows 5 wave impulse up from 2/17 Lows Firstly in the near term the GBPJPY pair shows 5 waves up from the 2/17 lows. The dip to 139.61 corrected the cycle up from the 2/7 lows. Secondly we favor seeing the pair ending this initial bounce from there in the 142.05 area. That per the […]

-

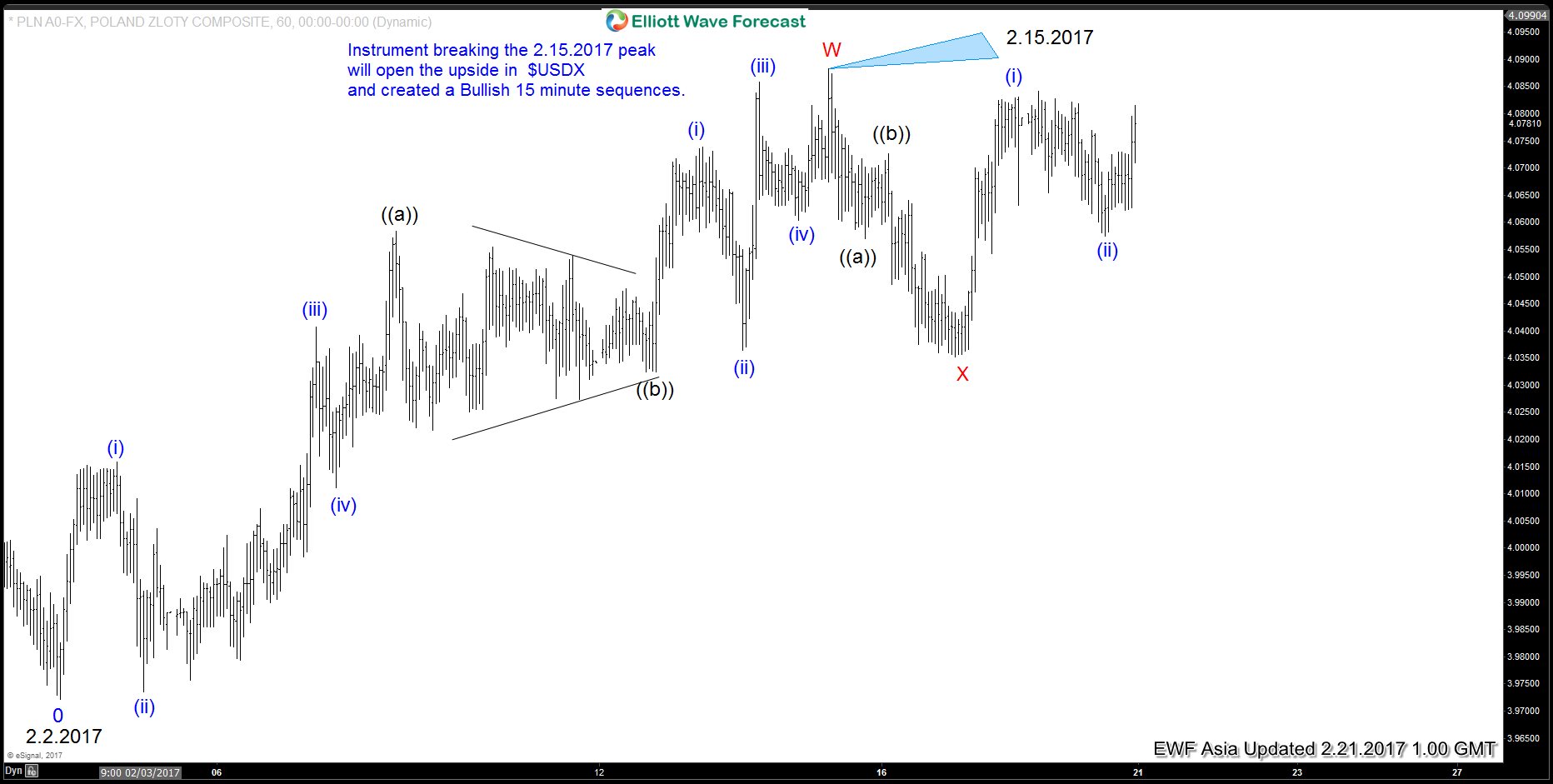

USDPLN Intraday Elliott wave view

Read MoreShort term Elliott wave view of USDPLN (Poland Zloty) suggests that the pair is on the verge of breaking above the 2.15.2017 high at 4.0883. Rally from 2.2.2017 low (3.9722) is unfolding as a double correction Elliott Wave structure where wave W ended at 4.0883 and wave X is proposed complete at 4.0352. Internal of wave W […]