In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

GBPUSD Elliott Wave Double Three Correction in Progress

Read MoreGBPUSD correction is in progress as a double three Elliott Wave structure. This article and video look at the Elliott Wave path of the pair.

-

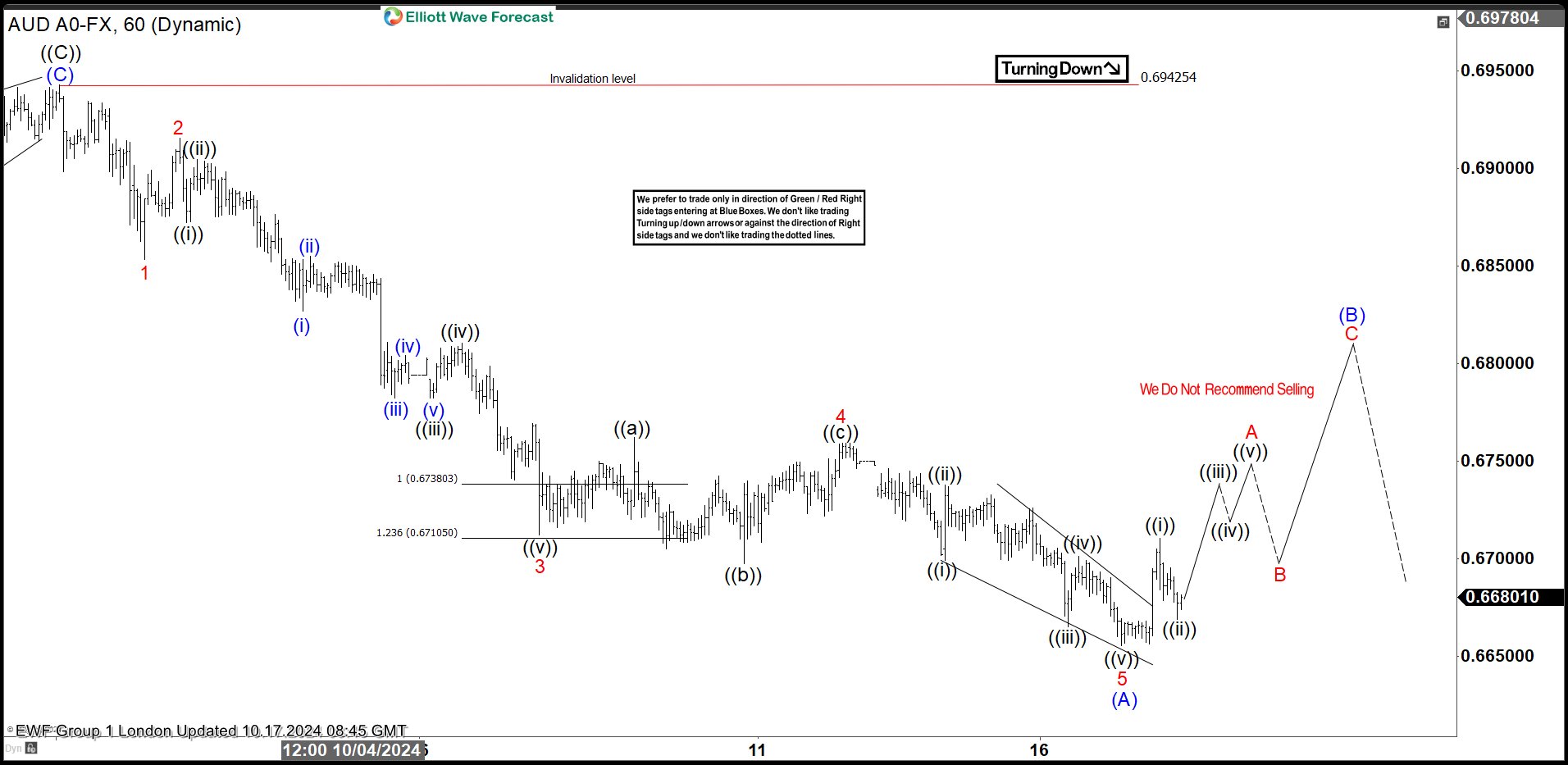

AUDUSD Elliott Wave Analysis: short term favors downside from bounces

Read MoreHello traders, welcome to a new Forex blog post. In this one, we will discuss AUDUSD short-term Elliott wave analysis. We believe the forex pair is still within a bearish corrective cycle from late September 2024. Thus, the current minor bounce should fail at some point, leading to a further intraday sell-off. From the perspective […]

-

Elliott Wave Intraday View in GBPJPY Looking for Further Upside

Read MoreGBPJPY is looking to extend higher to complete a zigzag from 9.11.2024 low. This article and video look at the Elliott Wave path.

-

EURUSD Looking for Expanded Flat Elliott Wave Correction

Read MoreEURUSD is looking to end an expanded flat Elliott Wave Correction. This article and video look at the Elliott Wave path of the pair.

-

Dollar Index (DXY) Looking for a Flat Elliott Wave Correction

Read MoreDollar Index (DXY) is looking to do a flat correction before it resumes lower again. This article and video look at the Elliott Wave path.

-

Intraday Elliott Wave View Favors More Downside in USDJPY

Read MoreUSDJPY rallied in 7 swing and turned lower. Pair should extend lower & rally to fail in 3, 7, 11 swing.This article and video look at the Elliott Wave path.