Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

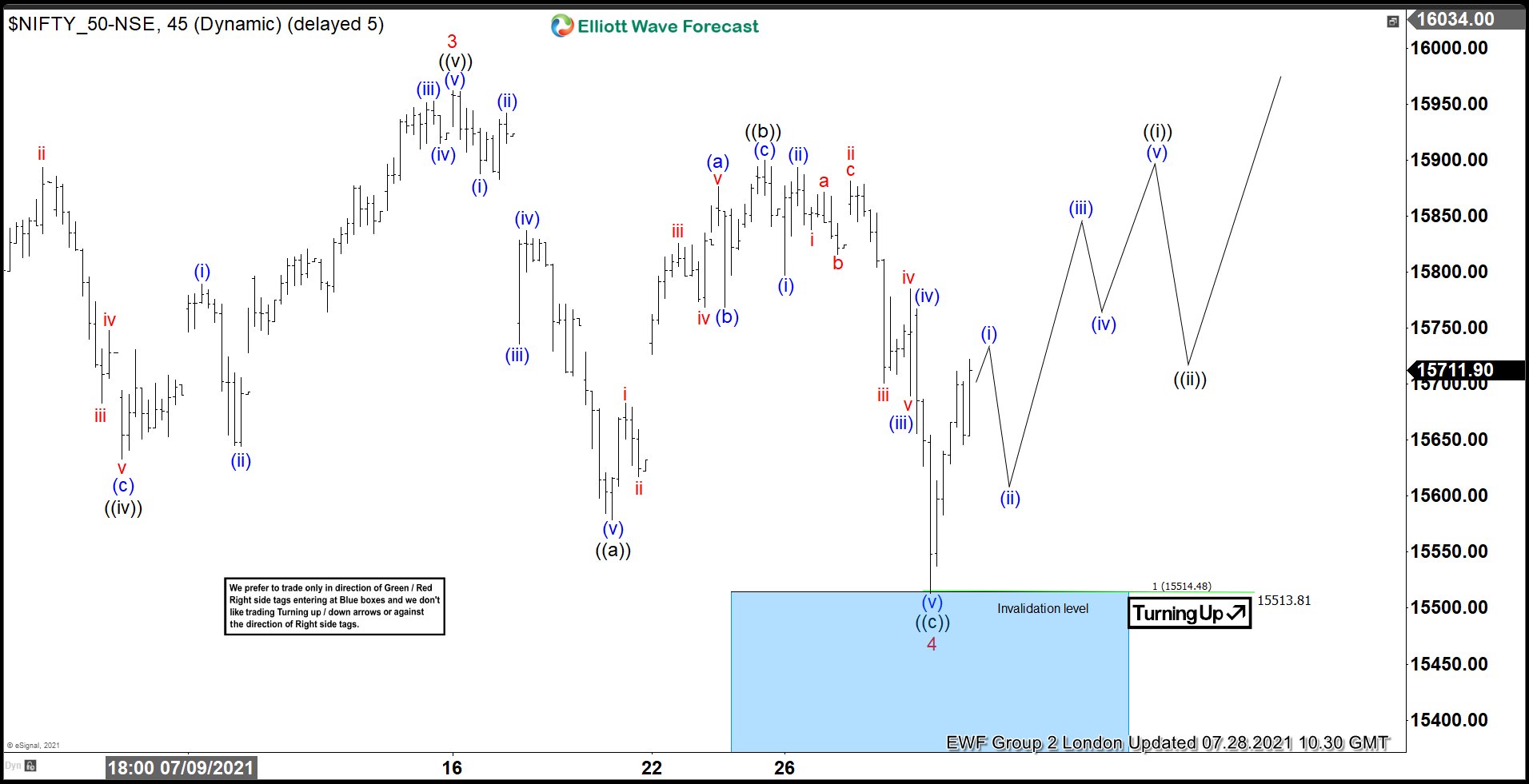

NIFTY Found Buyers Again After Elliott Wave ZigZag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIFTY , published in members area of the website. As our members know, we’ve been calling rally in the Index due to impulsive bullish sequences. We recommended members to avoid selling in any proposed pull […]

-

NIKKEI: Found Sellers After Elliott Wave Double Three Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI published in members area of the Elliottwave-Forecast . As our members know, NIKKEI is showing lower low sequences in the cycle from the February 16th peak. Recently we got recovery that has unfolded as Elliott […]

-

SUGAR ( $SB_F) Buying The Dips At The Blue Box Zone

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Sugar futures , published in members area of the website. As our members know Sugar is showing impulsive bullish sequences in the cycle from the April 2020 low . We expected the commodity to keep […]

-

NZDJPY Forecasting The Rally After Elliott Wave Zig Zag Pattern

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of NZDJPY , published in members area of the website. We’ve been calling rally in the Forex Pair due to impulsive bullish sequences. We recommended members to avoid selling in any proposed pull back and keep buying the dips […]

-

Sugar ( $SB_F ) Forecasting The Rally After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Sugar Futures ( $SB_F) , published in members area of the website. As our members know, we’ve been calling rally in the commodity. We recommended members to avoid selling in any proposed pull back and […]

-

Soybeans Futures ( $ZS_F ) Found Buyers After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Soybeans Futures ( $ZS_F ) , published in members area of the website. As our members know, the commodity is showing impulsive bullish sequences in the cycle from the 808’5 low. We’ve been calling rally […]