Hello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

Platinum Elliott Wave Outlook

Read MorePrecious metals and other commodities continue their bullish run as a result of inflationary pressure and war in Ukraine. In this article, we will take a look at Platinum. Platinum is considered as a precious metal. However, unlike gold, Platinum has industrial application. 75% of the worlds’ supply of gold is used in coins, bars […]

-

Elliott Wave View: Gold Correction in Progress

Read MoreGold shows a lower low sequence from March 8 peak suggesting further downside can’t be ruled out. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Oil Looking for Further Pullback

Read MoreShort Term outlook in Oil suggests the decline from March 7, 2022 is unfolding as a double three Elliott Wave structure. Down from March 7 peak, wave (W) ended at 93.53 and rally in wave (X) ended at 116.64. Internal subdivision of wave (X) unfolded as a double three. Wave W ended at 106.28 and […]

-

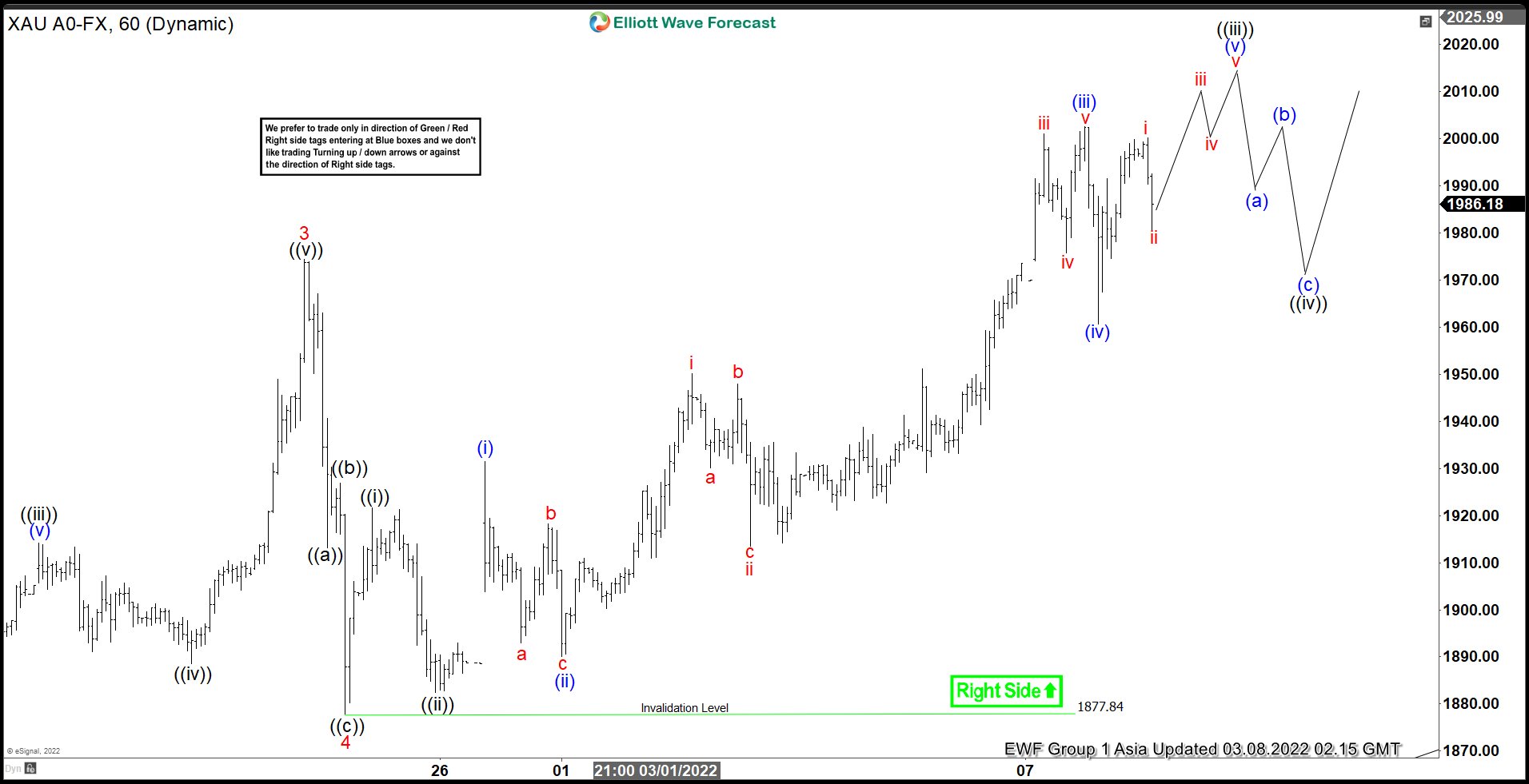

Elliott Wave View: Gold Rallies Higher After 3 Waves Pullback

Read MoreGold (XAUUSD) reacting higher after a 3 waves pullback. This article and video look at the short term Elliottwave path of the metal.

-

Elliott Wave View: Silver Buyers Should Appear Soon

Read MoreSilver (XAGUSD) is correcting cycle from February 3, 2022 low but buyers should appear soon. This article and video look at the Elliott wave path.

-

Elliott Wave View: Pullback in Gold Should Remain Supported

Read MoreGold (XAUUSD) has started the next leg higher and pullback should continue to find support. This article and video look at the Elliott Wave path.