Natural Gas (NG) has lost over 63% in value since the peak in August 2022. It has been a rather sharp decline with a sizeable recovery in the middle before the decline resumed again. Today, we will take a look at Elliott Wave structure of the decline from August 2022 peak, show some charts from […]

-

Forecasting The Bounce Higher in Soybean Futures (ZS_F)

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of ZS_F (Soybean Futures). The 4 hour chart update from August 9 shows that Soybean has ended the cycle from April 21 low as wave A at 910 high. The sub-waves of the rally unfolded as 5 waves impulsive structure. […]

-

Supply Problems and Weak Dollar Buoy Sugar Prices

Read MoreSince the corona virus hit in March earlier this year, price of Sugar future (SB) has remained depressed as demands projected to plummet. Prices fell sharply lower at 42% to 9.2 cents per pound in April. Over the past few weeks however, prices have made impressive returns due to drought in Thailand and weaker U.S […]

-

Copper Looking for Bullish Breakout

Read MoreSince bottoming in January 2016 low at $1.93, Copper has traded in a narrow range between $1.9 – $3.3. Earlier this year, the red metal collapsed to the lowest in more than 4 years at $1.9725. This happened due to the Covid-19 breakout around the world which dampens global growth. However, despite the extremely challenging […]

-

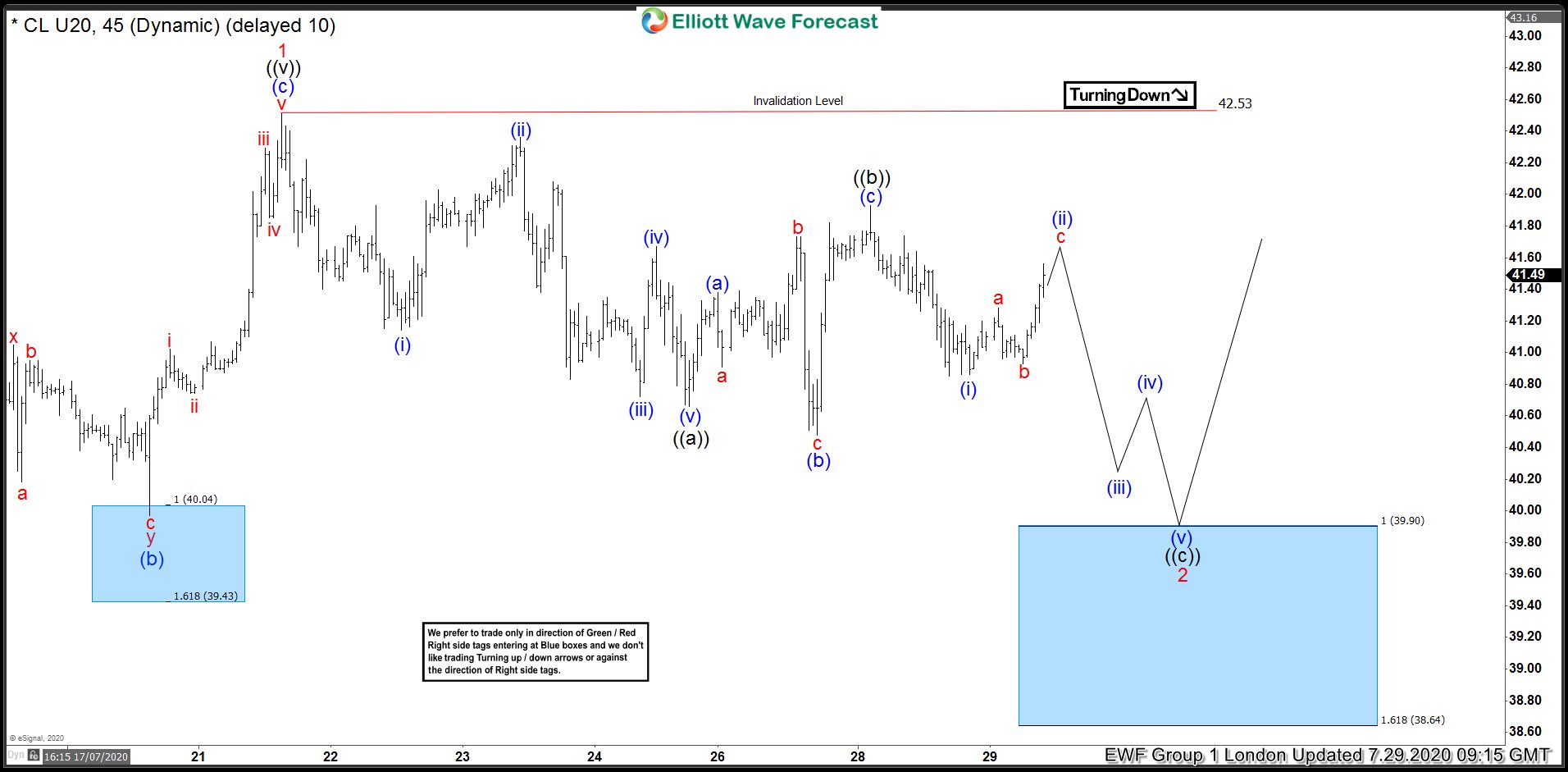

OIL ( $CL_F) Forecasting The Rally From The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL , published in members area of the website. As our members know, commodities have been giving us nice profits recently. OIL is another commodity that has given us rally from the Blue Box area. […]

-

Elliott Wave View: Break to Record High in Gold Confirms Bullish Market

Read MoreGold broke above September 2011 high. While above July 28 high, expect dips in 3,7 or 11 swings to find support for further upside later.

-

Break to New All-Time High in Gold Confirms Bullish Market

Read MoreGold has made a new all-time high suggesting the next leg higher has started. This article discusses potential target for Gold using Elliott Wave.