The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Invesco NASDAQ ETF $QQQ Blue Box Area Offering a Buying Opportunity

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Invesco NASDAQ ETF ($QQQ) through the lens of Elliott Wave Theory. We’ll review how the rally from the April 21, 2025 low unfolded as a 5-wave impulse followed by a 7-swing correction (WXY) and discuss our forecast for the next move. Let’s dive into the structure and expectations for this ETF. […]

-

Elliott Wave Outlook: Pan American Silver (PAAS) Pullback Offers Buying Opportunity

Read MorePan American Silver (PAAS) shows a bullish sequence and should continue to extend higher. This article and video look at the Elliott Wave path.

-

Taiwan Semiconductor Manufacturing (TSM) Riding The Impulse Wave

Read MoreTaiwan Semiconductor Manufacturing Co. (NYSE: TSM) operates as the world’s leading semiconductor foundry, powering the global AI and computing evolution. As demand for advanced chips surges, the stock has broken into new high territory, confirming a powerful bullish cycle is now in force. Today, we decode the Elliott Wave pattern driving this strategic breakout. Furthermore, […]

-

Advanced Micro Devices $AMD Soars 200% from Blue Box Area, With $260 Target Still Ahead

Read MoreHello everyone! In today’s article, we’ll examine the recent performance of Advanced Micro Devices ( $AMD ) through the lens of Elliott Wave Theory. We’ll review how the reaction from the April 2025 blue box areas unfolded as an impulsive 5 waves and discuss the incomplete bullish sequence towards $260 area. Let’s dive into the structure and expectations for this […]

-

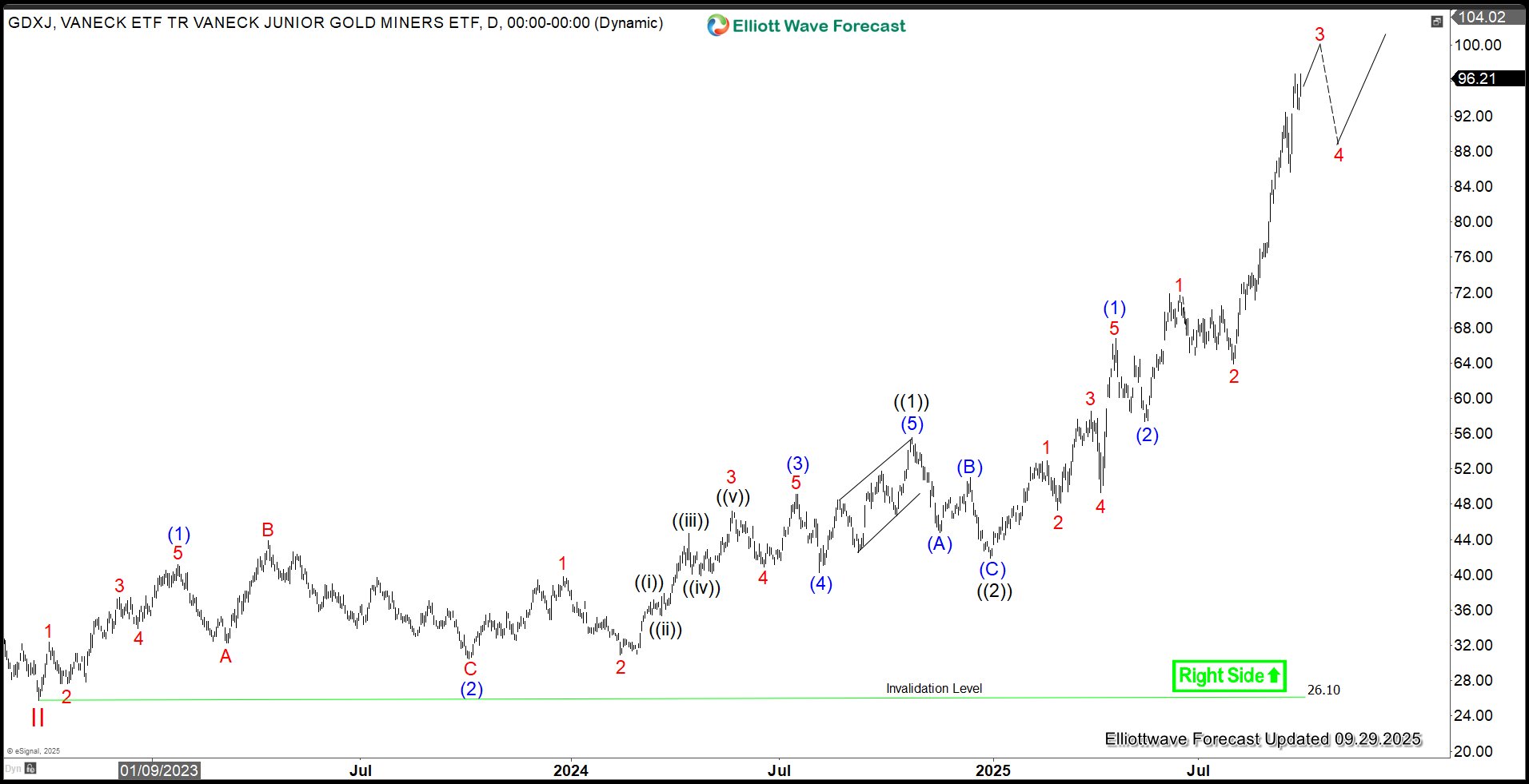

Gold Miners Junior (GDXJ) Strong Nesting Impulse in Progress

Read MoreThe GDXJ (VanEck Junior Gold Miners ETF) tracks a market-cap-weighted index of global junior gold and silver mining companies, offering investors exposure to smaller, high-growth potential firms in the precious metals sector. Recent Elliott Wave analysis suggests GDXJ is in a bullish phase, with the monthly chart indicating a grand super cycle wave ((II)) low […]

-

![[Recording] The AI Revolution Live Webinar: How to Trade & Invest in AI Stocks with Elliott Wave Forecast](https://elliottwave-forecast.com/wp-content/uploads/2025/09/AI-Revolution-Webinar-cover-slide.png)

[Recording] The AI Revolution Live Webinar: How to Trade & Invest in AI Stocks with Elliott Wave Forecast

Read MoreArtificial Intelligence is one of the biggest drivers of today’s stock market — but the real challenge is knowing how to invest and trade AI stocks. We hosted a free webinar on Thursday, 11th September 2025 on this topic. Below are some of the key highlights of the webinar. ✅ Elliott Wave analysis on the […]