The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

How Much Farther Will US Dollar Rally?

Read MoreThe Dollar Index (DXY) continues to be firm and rallies higher since Dec 31.2019 low. Near term, it still has scope to extend higher towards 98.3 – 98.59 area which is the 100% – 123.6% Fibonacci extension target from December 31, 2019 low. From the above area, it’s possible larger 3 waves reaction against US […]

-

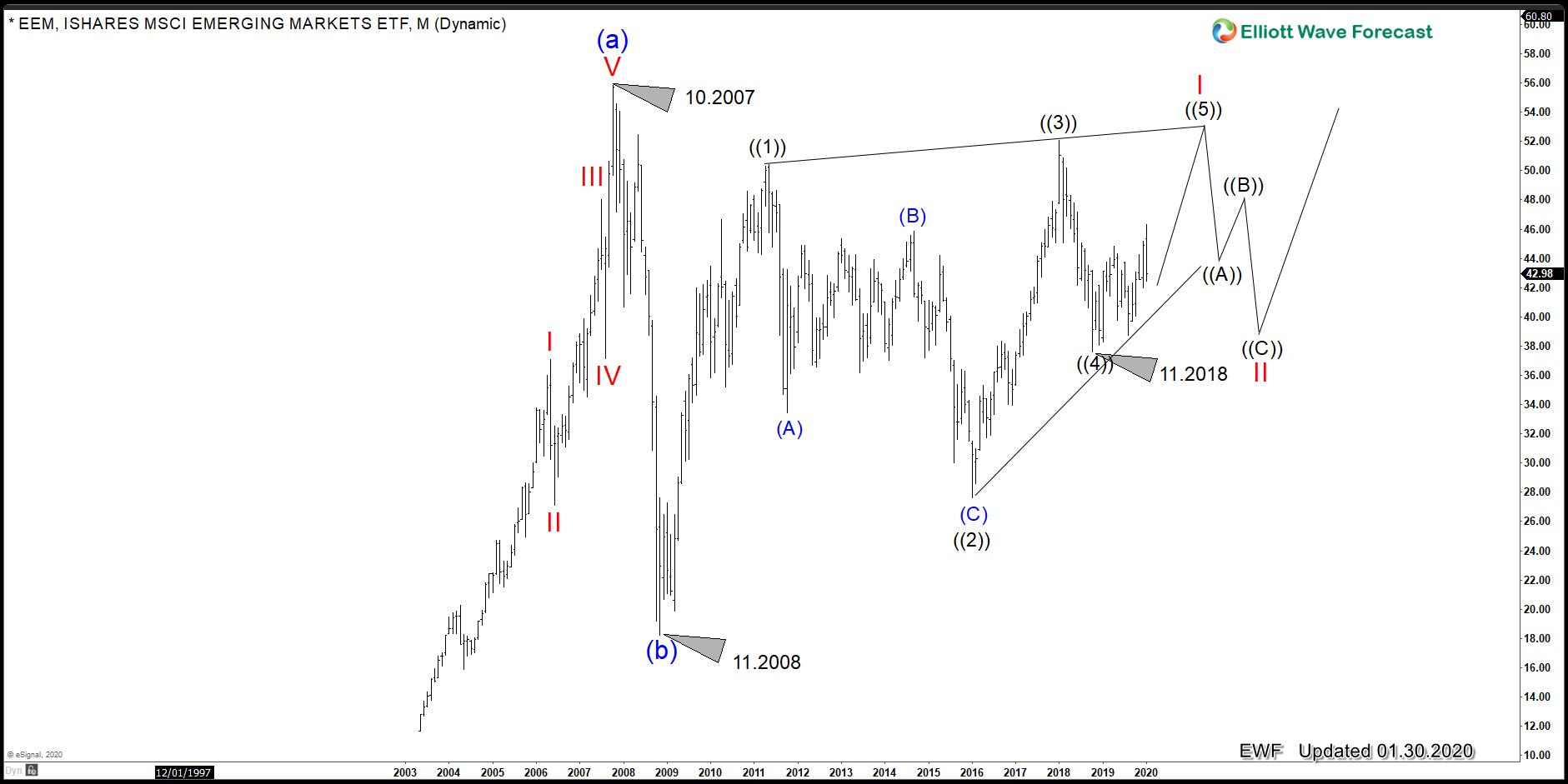

Emerging Market (EEM) Likely Will See New Highs

Read MoreThe Emerging Market (EEM) trade within the same cycles as World Indices. However, when comparing it to Indices like $SPY and $SPX, EEM lag behind after it bottomed in 11.2008. Looking at the Grand Super Cycle price action, EEM peaked in 10.2007 then dropped hard along with other Indices. It bottomed in 11.2008 and since […]

-

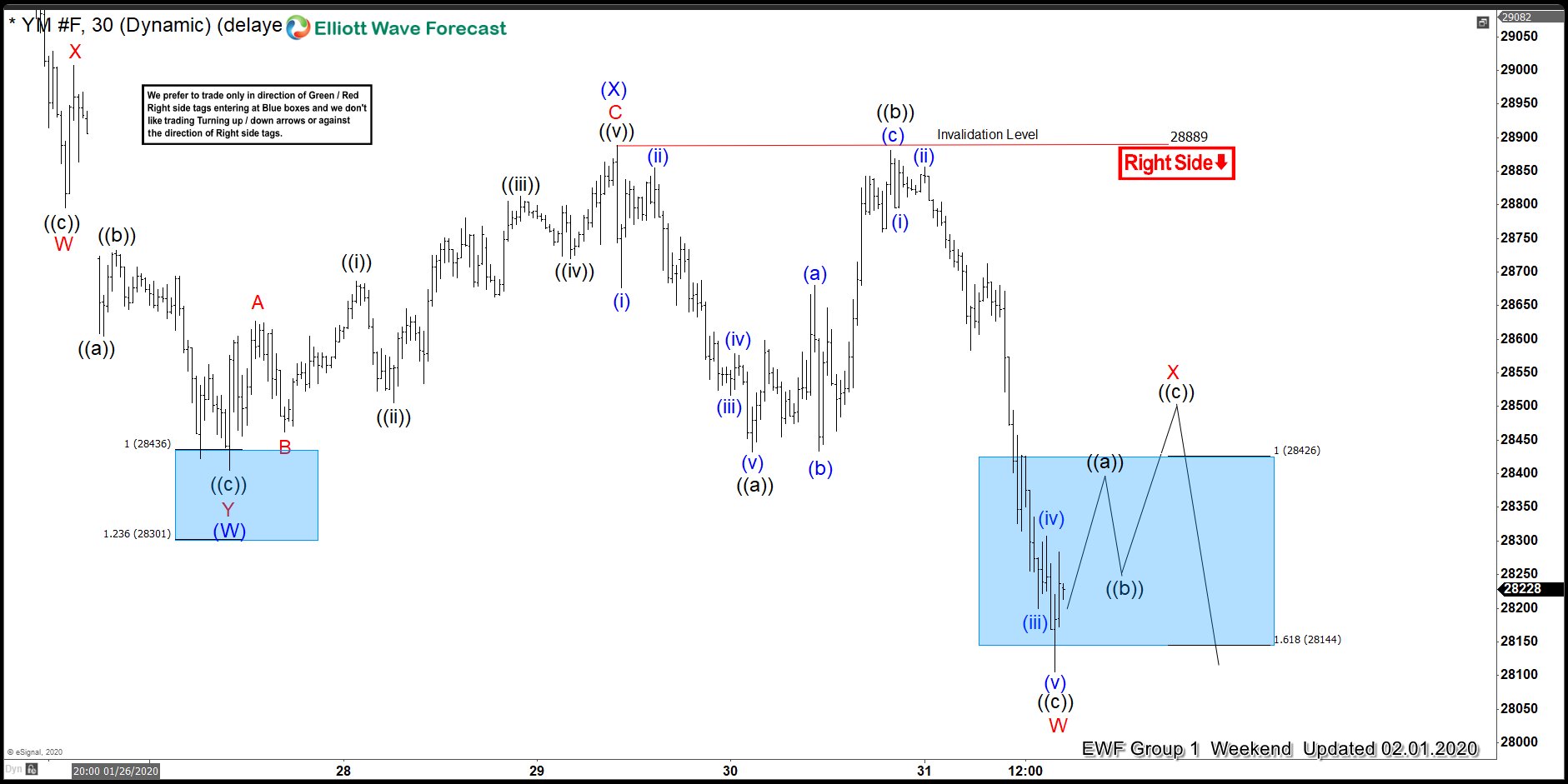

Elliott Wave View: Dow Jones Futures (YM_F) Within a wave ((4)).

Read MoreDow Jones Futures (YM_F) has ended wave ((4)) correction and starts the next leg higher. This analysis shows the potential Elliott Wave path for the Index.

-

Nvidia Corp (NVDA) Within Powerful Wave ((III))

Read MoreNvidia is one of those instrument across the market which has ended the Grand super cycle since the all-time low. The advance since the all-time low appears impulse or five waves advance which ended on 10.01.2018. As the Elliott Wave Theory explains, after five waves, there will be three waves pullback. The Instrument turned lower […]