The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

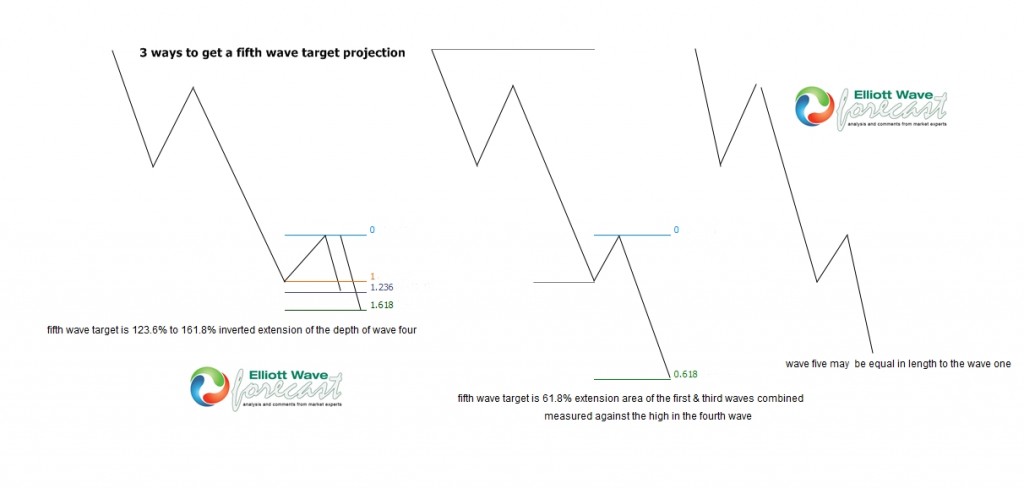

Fifth Wave Trading: Elliott Wave Target Strategies That Work

Read MoreUnderstanding Fifth Wave Projections In both bullish and bearish markets—whether the Elliott Wave trend is up or down, or the cycle and degree of the wave is bullish or bearish, you can determine fifth-wave targets in three ways, regardless of the trend’s degree. However, this list is not definitive, nor is it ranked in any […]

-

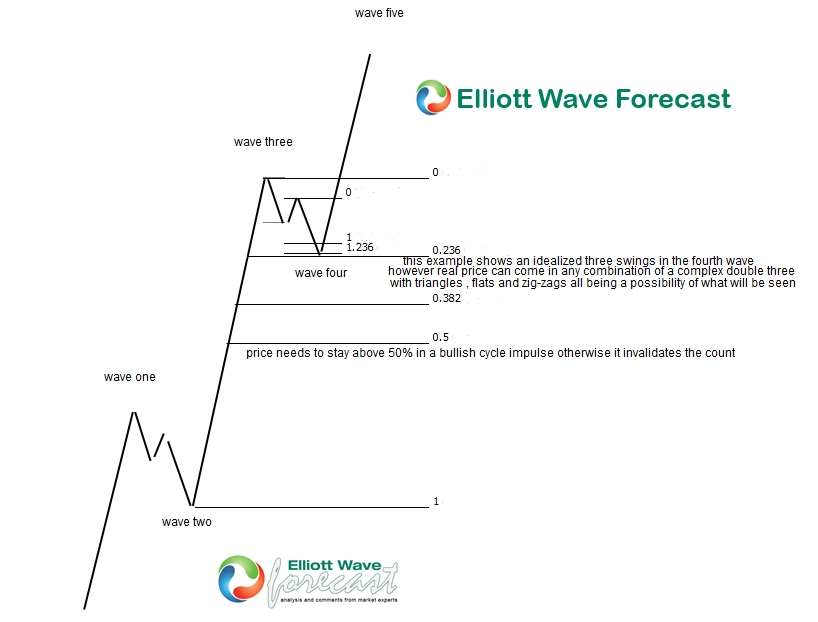

What to look for in an Elliott Wave four

Read MoreThe most widely recognized market move among participants is the powerful wave three. The following is what to look for after completion of the third wave impulse. In any degree of trend either in a bullish or bearish Elliott Wave cycle, a wave four consolidation following a third wave will usually show a three , […]

-

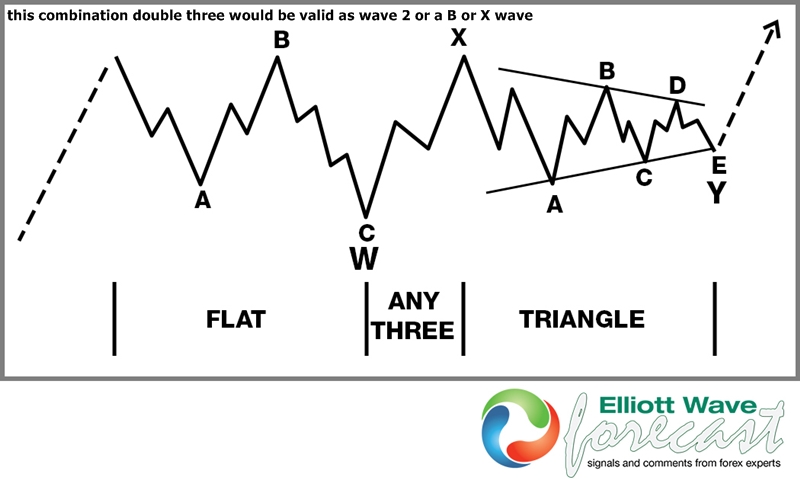

How to Trade Wave 2 or B Wave Corrections in any Elliott Wave Cycle or Degree

Read MoreThe point of this article is to help a trader get in position to profit from the expected market move thus the following is related to what to look for and how to trade it without fear or emotion. The first thing that is needed to be known is which direction higher or lower the […]

-

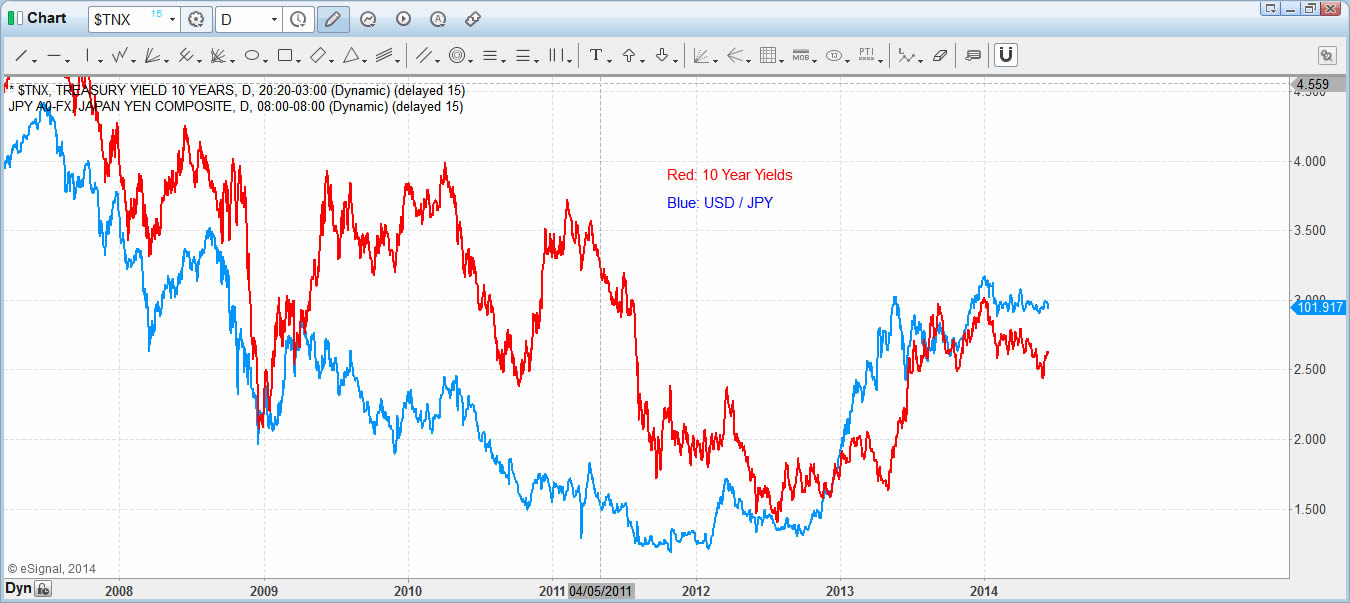

Using Market Correlation and RSI in the new EWF theory

Read MoreOne of the common challenges to practicioners of Elliott Wave principle is that the technique is subjective. There’s a saying that if you put 10 different Ellioticians together in the same room, they will all come up with a different Elliott Wave count. During our 20 years of experience with Elliott Wave Theory, we find […]