The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

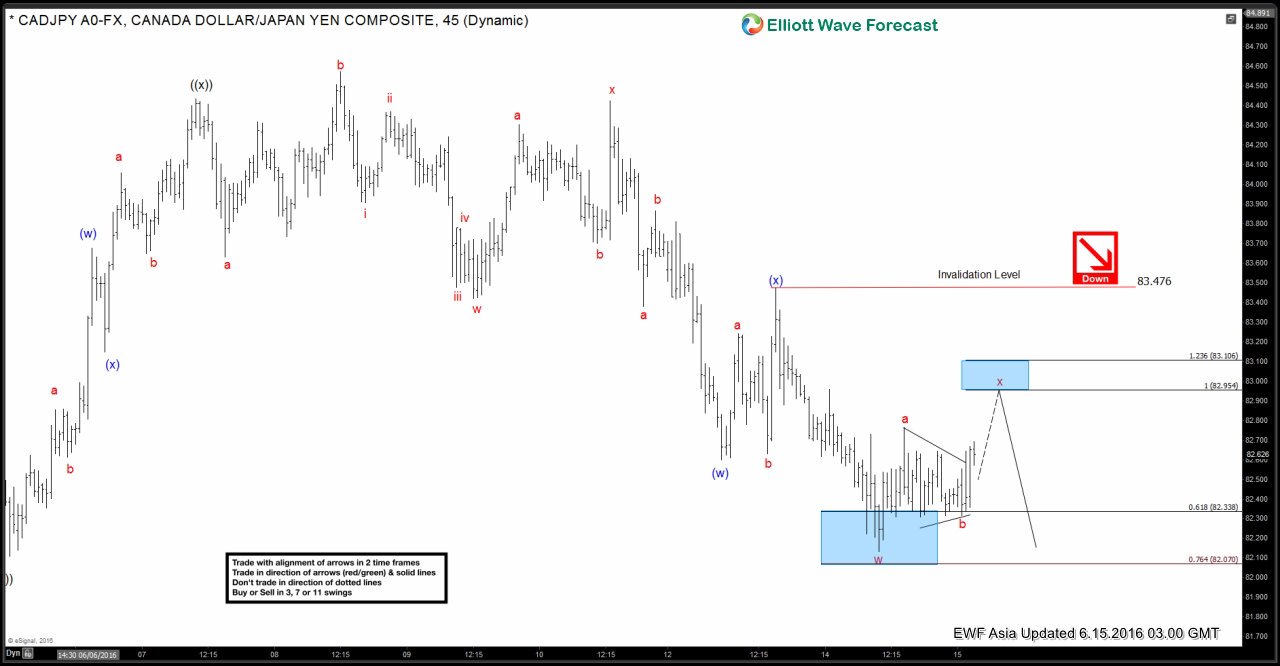

$CADJPY Short-term Elliott Wave Analysis 6.15.2016

Read MoreShort Term Elliottwave structure suggests that rally to 84.43 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 82.6 and wave (x) ended at 83.47. Wave (y) is in progress as a double three where wave “w” is proposed complete at 82.13 and wave “x” bounce is expected […]

-

Fundamental Trade-able??

Read MoreI was thinking today about how I really started taking this blog increasingly social jargon, investor’s education, competitions, contests values , and the like. And among all this remarkable, entertaining, educational, intellectual and I forgot to mention an important fact that every trader knows or should know information. The fact is that any rational analysis […]

-

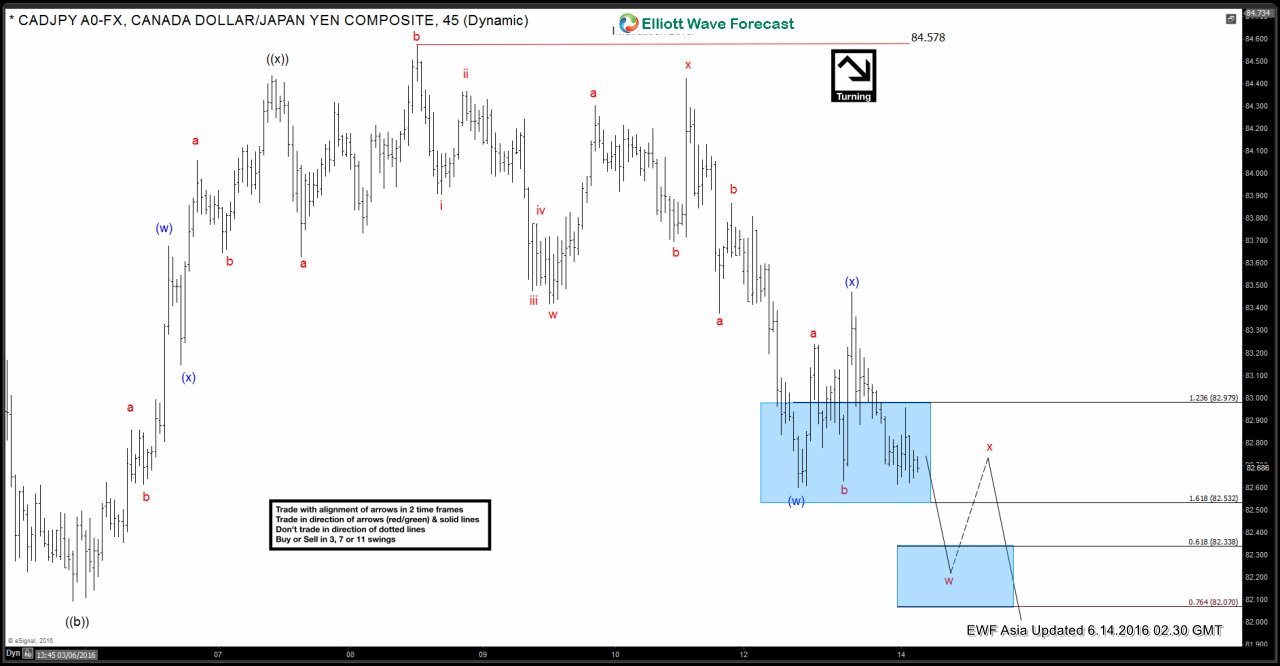

$CADJPY Short-term Elliott Wave Analysis 6.14.2016

Read MoreShort Term Elliottwave structure suggests that rally to 84.43 ended wave ((x)). Decline from there is unfolding as a double three where wave (w) ended at 82.6 and wave (x) ended at 83.47. Near term focus is on 82.07 – 82.33 area to complete wave “w”, then it should bounce in wave “x” to correct the […]

-

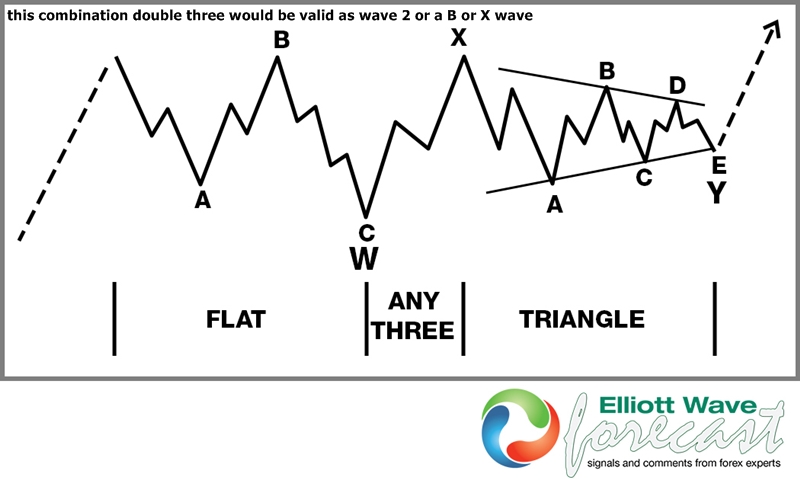

Elliott Wave Theory Structure : Double Three with a Triangle Y

Read MoreDouble three structures in general are common occurrences in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending in the larger degrees and time frames as it is simply impossible in some markets to get a legitimate impulsive […]