The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

The Art of Trading

Read MoreThe Art of trading: Using Elliott wave as a compass Many years have passed since the creation of markets, trading and since the introduction of the Elliott wave Theory. The Reality is that for years traders have been trying the best way to get money out of the Market, which sometimes is easier than others. Trading, […]

-

Technical outlook for BJRI stock

Read MoreBJRI The California chain BJ’s Restaurants was founded in 1978 and went public in 1996 by raising $9.4 million . In 2010 , the National Retail Federation named it as one of the 10 fastest growing restaurants in the U.S. based on year-over-year sales as it keeps expanding by adding new locations and offering new services. Technical analysis of BJRI is showing […]

-

$FTSE Short-term Elliott Wave Analysis 10.7.2016

Read MoreShort term Elliott wave count suggests that pullback to 6640.3 at 9/15 ended wave (X). The rally from there is unfolding as a double three where wave (w) ended at 6899.5, wave (x) ended at 6728.5, and wave (y) of ((w)) is proposed complete at 7091. Near term, while bounces stay below 7091.5, expect the Index to […]

-

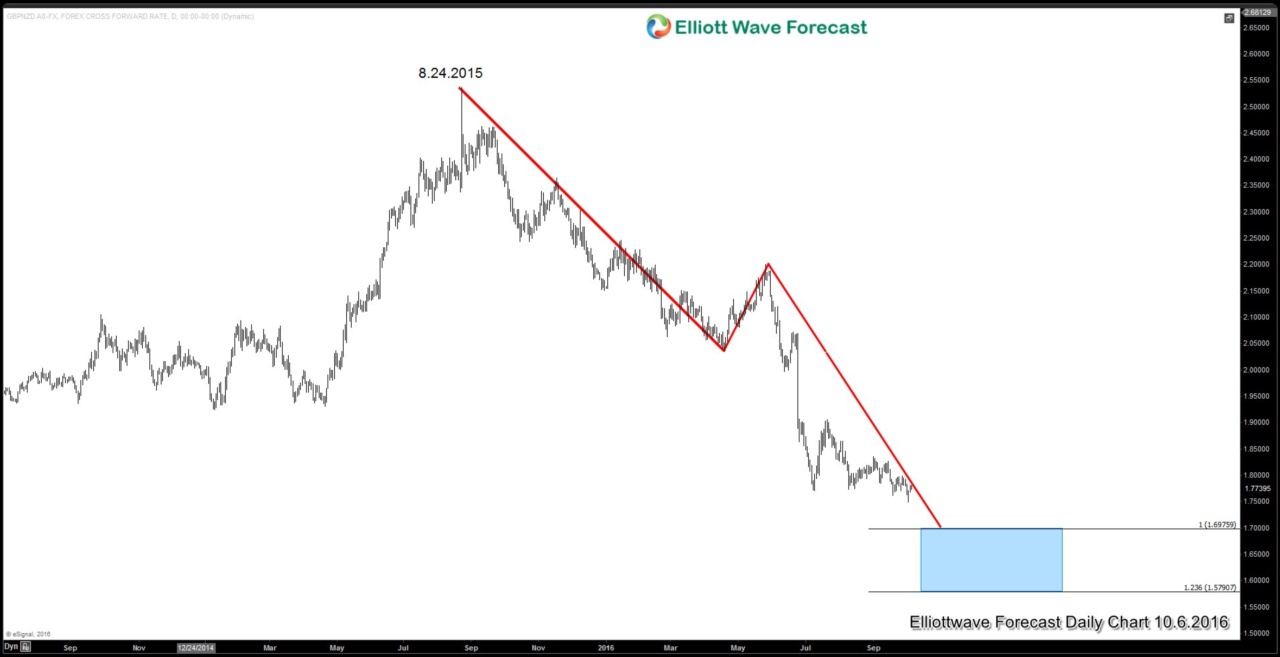

Fear of Hard Brexit and Poundsterling

Read MoreSince the Brexit vote in June, Poundsterling has fallen 13% against the U.S. dollar and it is now worth 22% less than a year ago. Today the pound worths around $1.27 while a year ago it was worth $1.55. The currency was further under pressure this week after the U.K Prime Minister Theresa May provided more […]