The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

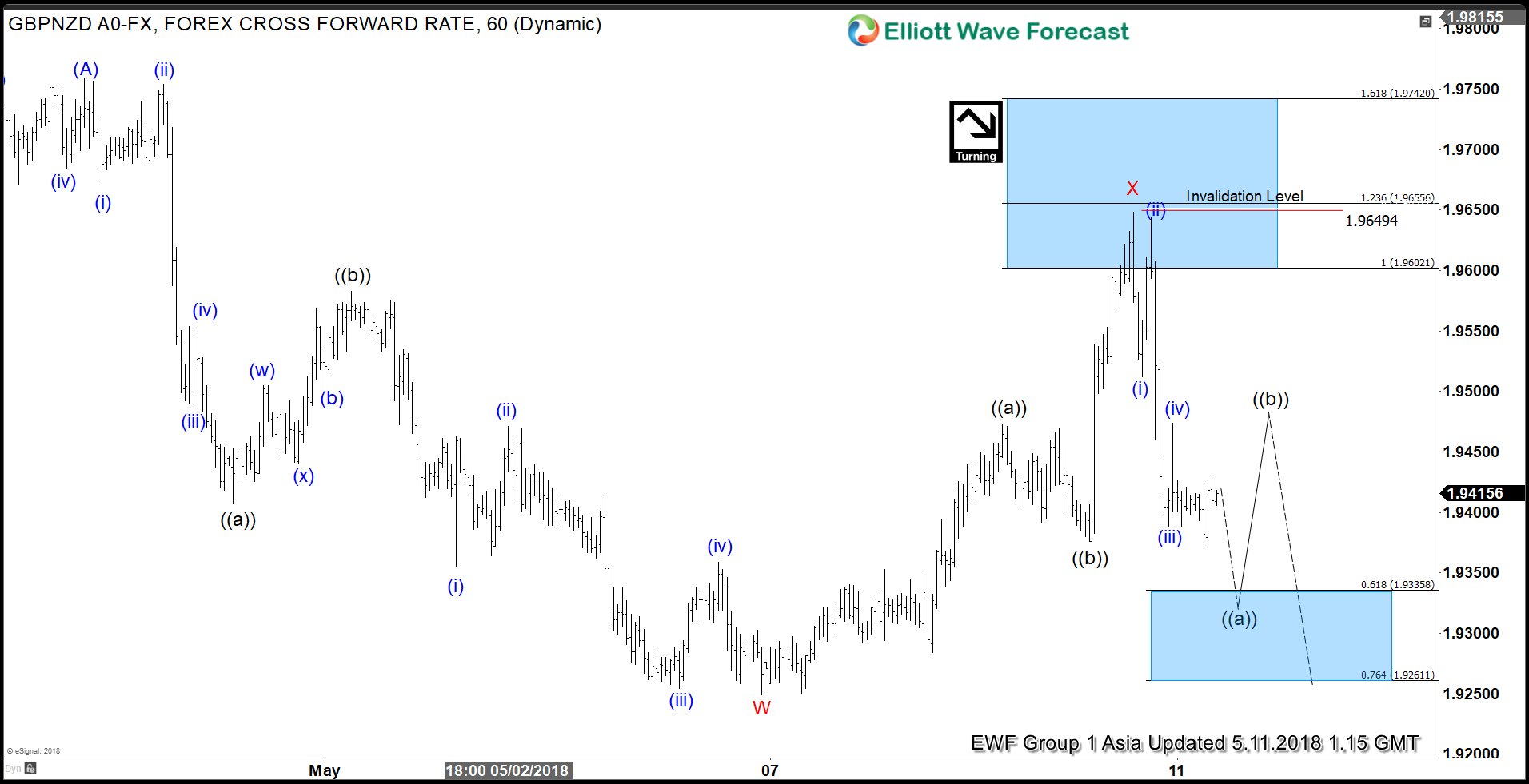

GBPNZD Elliott Wave View: Ending an Impulse Move

Read MoreGBPNZD short-term Elliott wave view suggests that the rally to 1.9758 on 4/26 high ended Intermediate wave (A). Down from there, Intermediate wave (B) remains in progress as a double three Elliott Wave structure. The internals of each leg in double three (WXY) sub-divides into 3 waves corrective sequence and usually is the combination of two […]

-

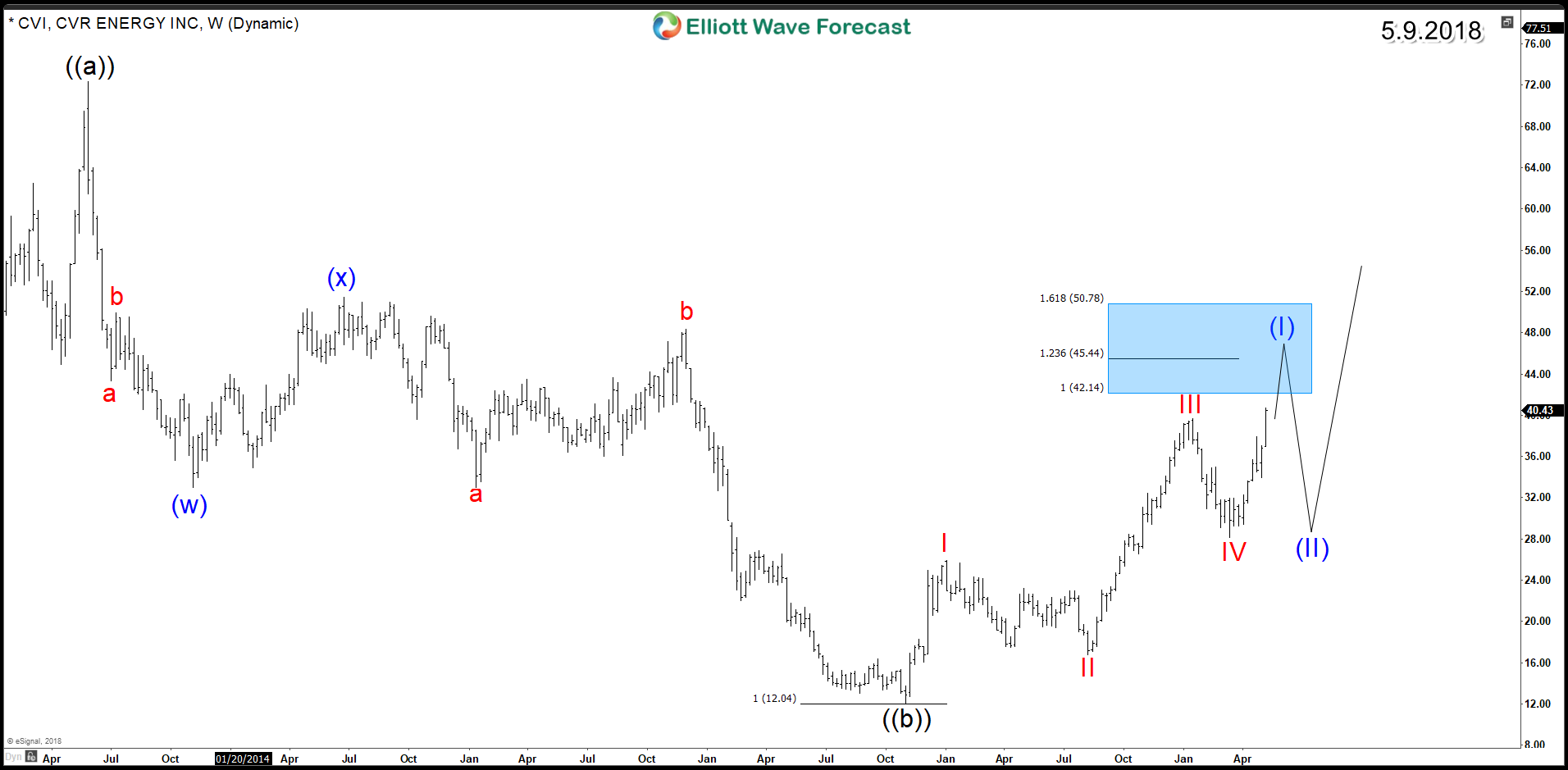

CVR Energy CVI Showing Bullish Structure

Read MoreCVR Energy (NYSE: CVI) is one of the best performing Energy stocks in the recent 2 years yielding +220% since November 2016 low. Despite the correction taking place in the stock market, CVI did manage to retrace the whole decline since January peak and it’s currently already up +7.9% year-to-date. To understand further the technical […]

-

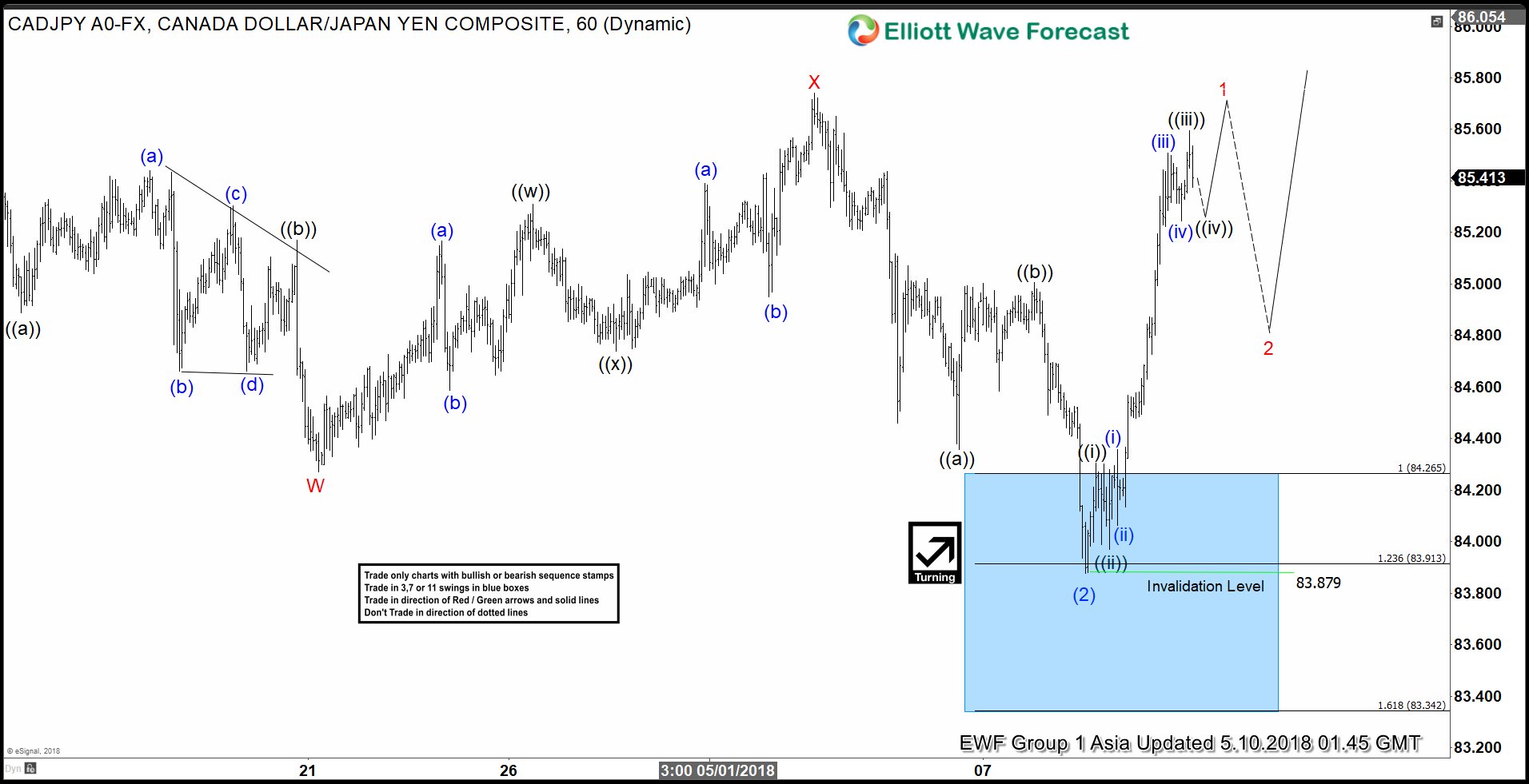

CADJPY Elliott Wave View: Calling Strength Higher

Read MoreCADJPY Short Term Elliott Wave view suggests that the decline from 4/13 peak at 85.76 to 83.87 low ended Intermediate wave (2) as a double three Elliott Wave structure. The internal subdivision of the decline from 85.76 high shows an overlapping structure. This suggests the decline is corrective in nature. We label the correctin as W-X-Y. […]

-

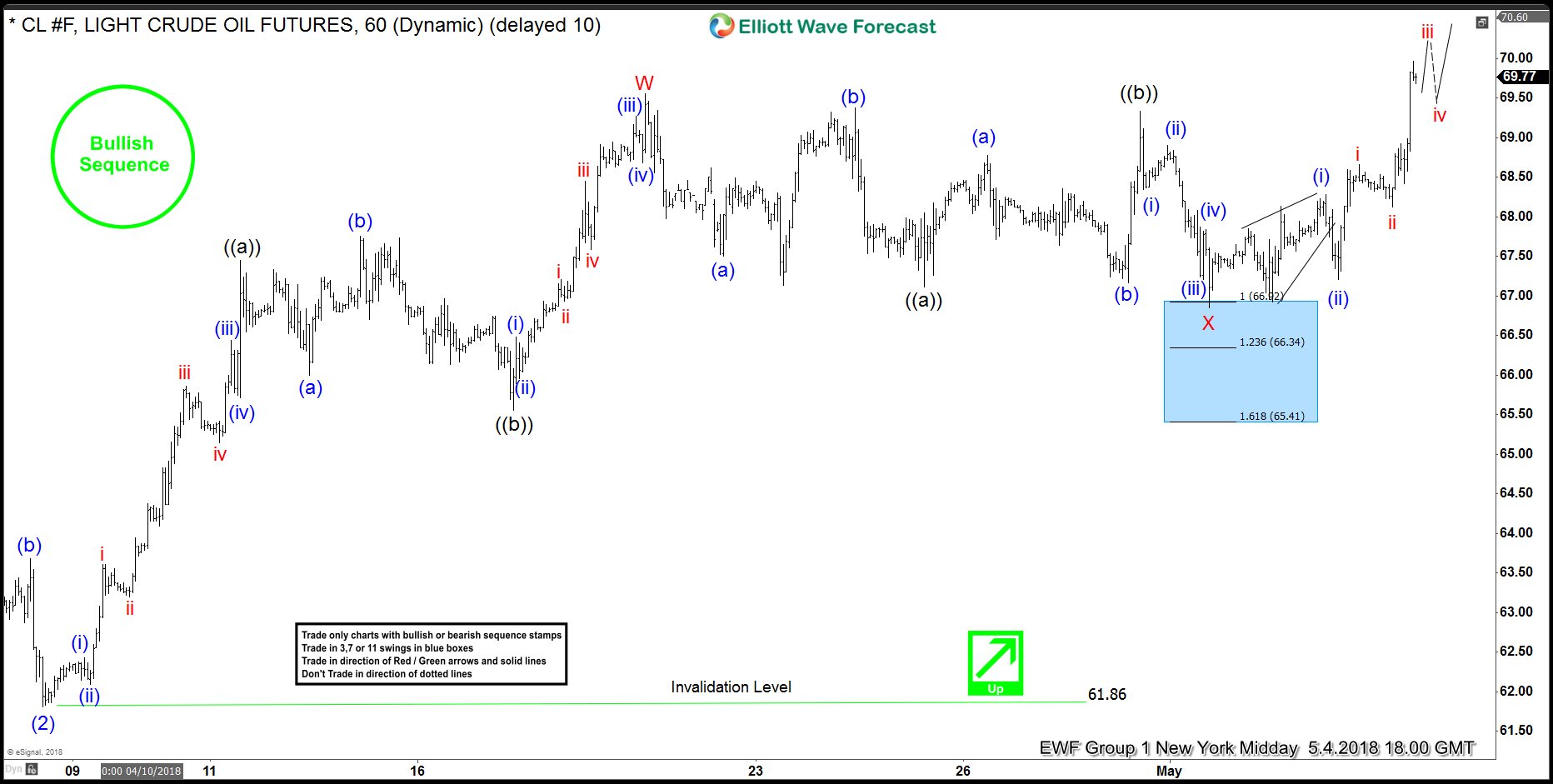

Oil Elliott Wave Analysis: Forecasting And Trading The Rally

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of Crude Oil which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 05/02/18 calling for more upside after ending the correction to the cycle from 09/04/18 in an Elliott Wave Flat correction in […]