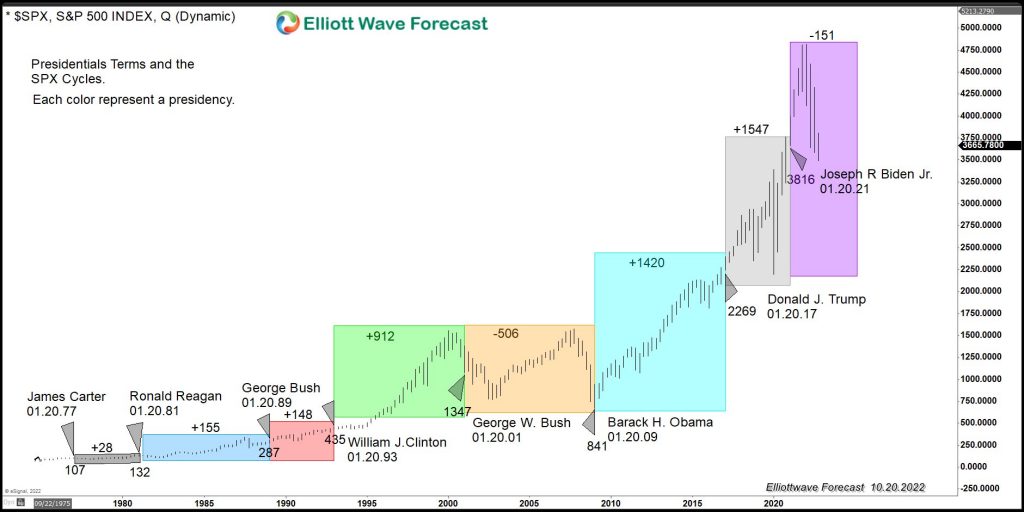

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

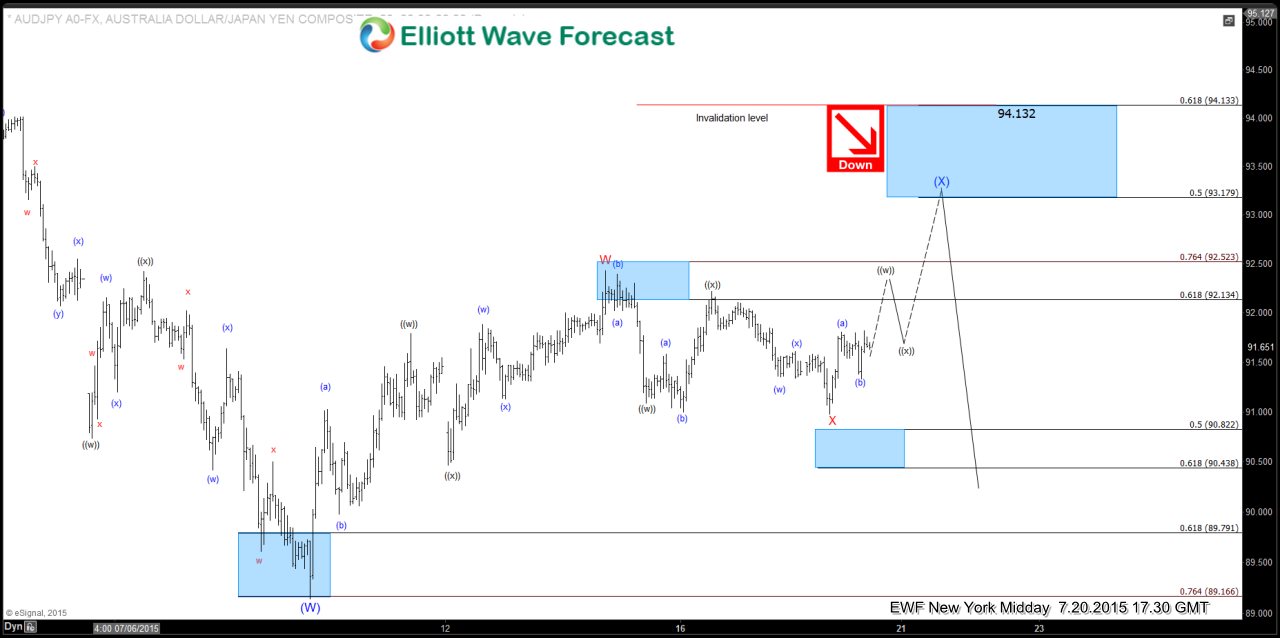

$AUD/JPY Short Term Elliott Wave Update 7.20.2015

Read MoreDecline to 89.14 completed wave (W), and pair has since bounced in wave (X) from this level. Short term Elliott Wave view suggests wave (X) bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43, wave X ended at 90.98, and wave Y is in progress towards 93.18 – 94.13 area to complete wave (X). We don’t […]

-

-

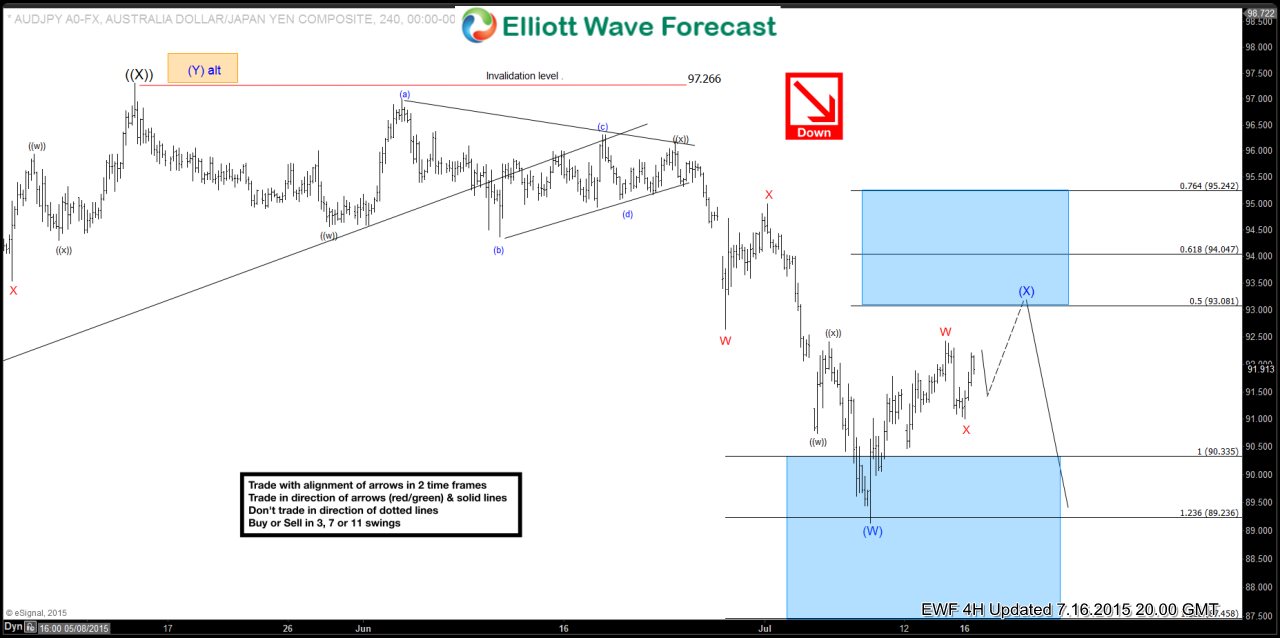

$AUD/JPY 4 Hour Elliott Wave Update 7.17.2015

Read MoreDecline to 89.15 completed wave (W), and pair has since bounced in wave (X) from this level. Updated Elliott Wave view suggests the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43, wave X ended at 91, and wave Y is in progress towards 93.08 – 95.24 area to complete wave (X). We don’t like […]

-

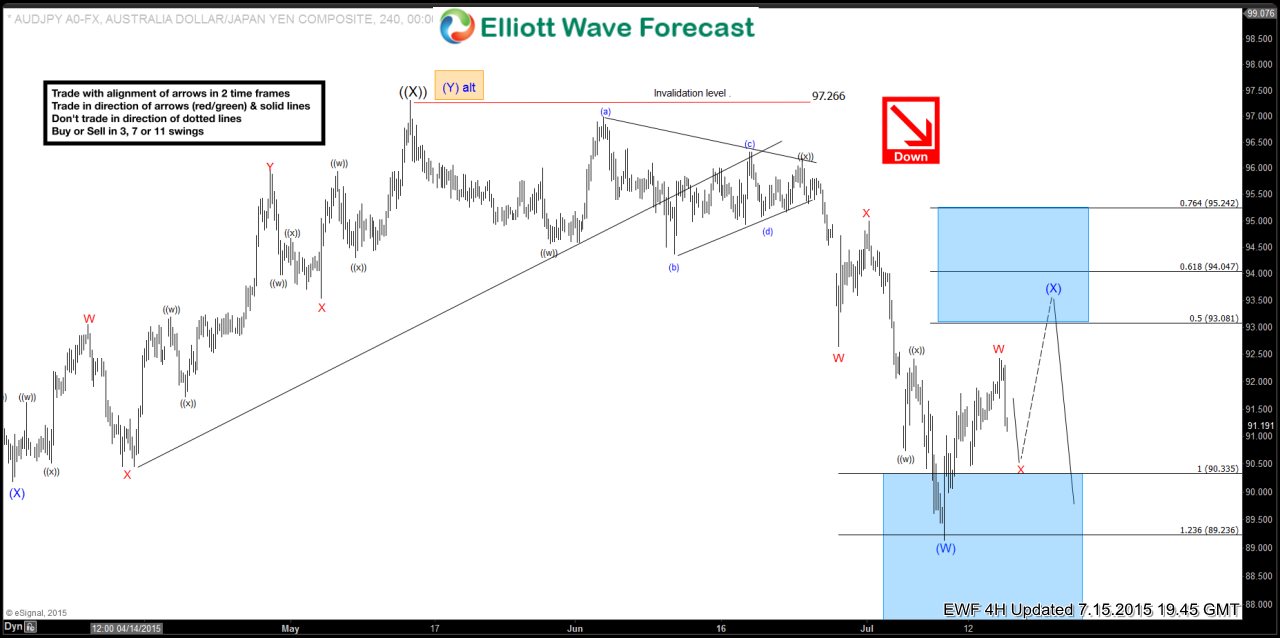

$AUD/JPY 4 Hour Elliott Wave Update 7.16.2015

Read MoreDecline to 89.15 completed wave (W), and pair has since bounced in wave (X) from this level. Revised Elliott Wave view suggests the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 92.43, and wave X is in progress towards 90.4 – 90.78 before turning higher one more leg in wave Y towards 93.08 – 95.24 […]