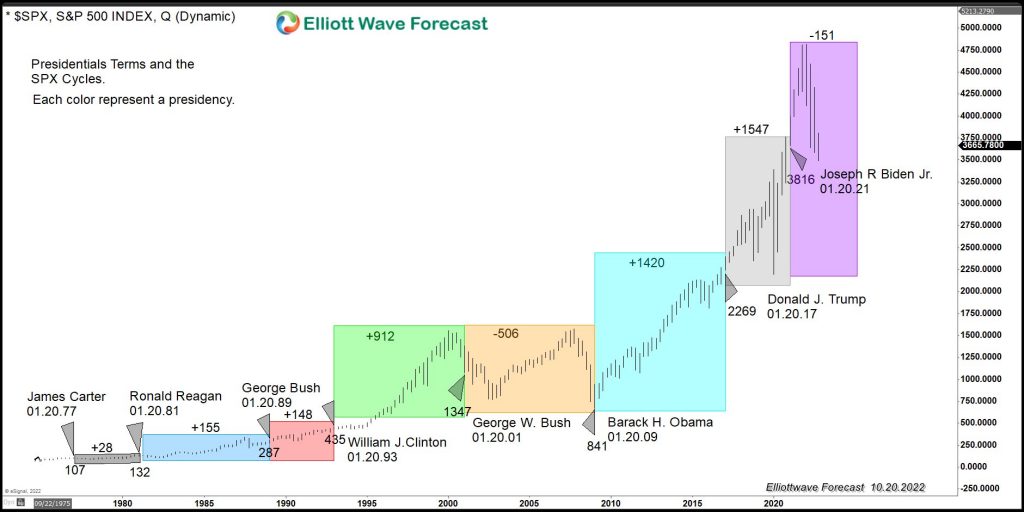

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

Impulsive 5 wave structure – ground rules

Read MoreIn this technical blog we’re going to learn how to identify the most popular among the Elliott Wave patterns: 5 wave Impulsive structure. We’ll get through all conditions which must be met for this popular structure. Many wavers believe that market is always trending in 5 waves, which certainly isn’t the case. Nowadays most markets […]

-

Elliottwave Analysis Update on $EUR/CAD 7.12.2015

Read MoreThis is a video update on $EUR/CAD using Elliott Wave Principle as the tool to analyze. This pair is not part of the 42 instrument we cover. You can watch the original analysis videos on $EUR/CAD by clicking the underlined words. If you are interested to learn more about Elliott Wave or how we can help you, click to […]

-

$GBP/NZD Short Term Elliott Wave Analysis 7.10.2015

Read MoreDecline from 2.347 is taking the form of impulsive 5 waves where wave ((i)) ended at 2.314, wave ((ii)) ended at 2.33, wave ((iii)) ended at 2.27, wave ((iv)) ended at 2.295, and wave ((v)) is in progress towards 2.253 – 2.26 to complete wave A. From this area, the pair is expected to bounce […]

-

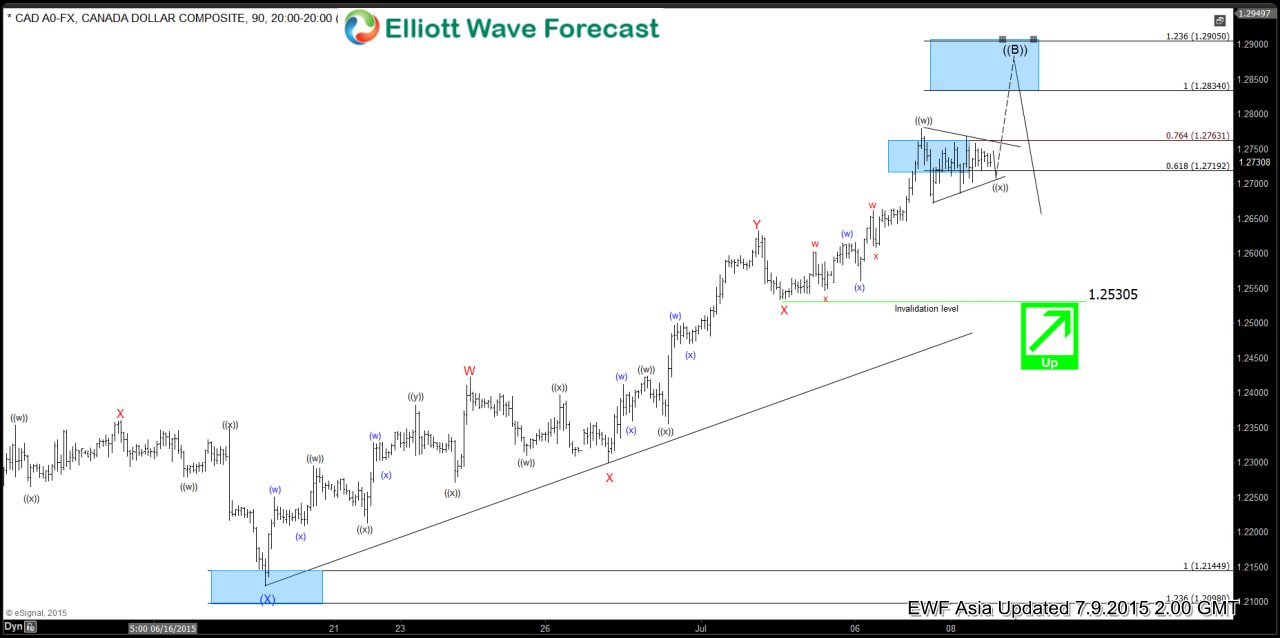

$USD/CAD Short Term Elliott Wave Update 7.9.2015

Read MoreRally from wave (X) low at 1.212 is unfolding in triple corrective structure WXYZ where wave W ended at 1.2423, wave X ended at 1.23, wave Y ended at 1.263, and second wave X ended at 1.253. Wave Z is in progress towards 1.283 – 1.29 to complete wave ((B)). The internal of wave Z is taking […]