The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

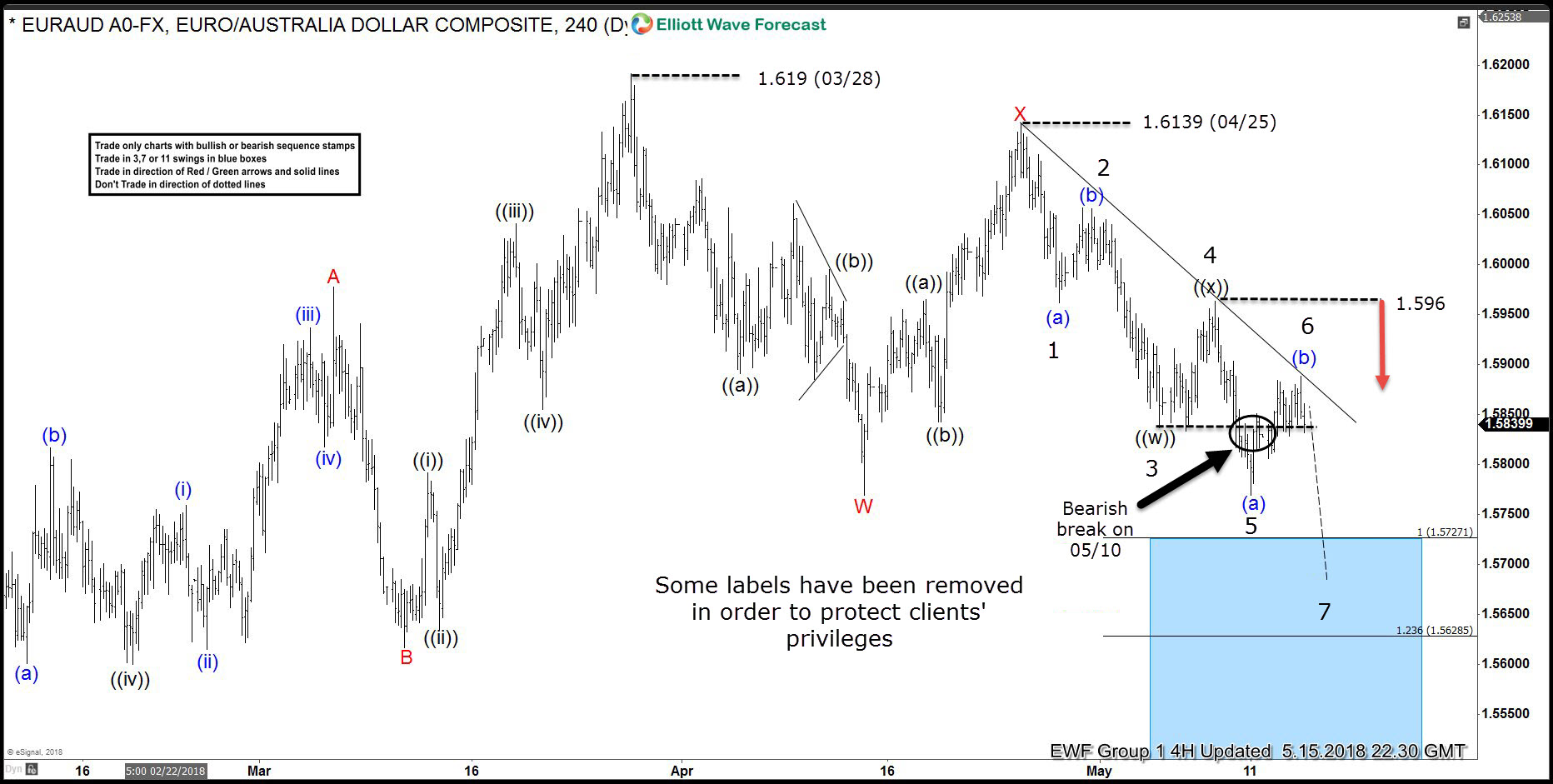

EURAUD Reaching The Extremes in March 28th Cycle

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of EURAUD published in members area of the website. In further text we’re going to explain Elliott Wave Forecast and Swings count. EURAUD Elliott Wave 4 Hour Chart 5.15.2018 EURAUD has made important break on May 10th, making short […]

-

Elliott wave Theory and Market Timing

Read MoreIn this blog, we will talk about the concept of Market Timing. Market is a wild animal which always, is in full control. Many traders want to trade every day and always getting in and out of the market which ends up more like gambling than trading. We at Elliottwave-Forecast.Com have practiced the Elliott wave […]

-

HFC HollyFrontier Corporation Impulsive Elliott Wave Rally

Read MoreHolly Corporation and Frontier Oil merged in July 2011 to form HollyFrontier Corporation (NYSE: HFC). The company is a petroleum refiner and distributor of petroleum products, from gasoline to petroleum-based lubricants and waxes. Over the past 2 years, Hollyfrontier Corp performed better than majority of its peers in the Oil & Gas Refining and Basic Materials sector. Its […]

-

DAX Elliott Wave Analysis: Wave 3 Remains In Progress

Read MoreDAX short-term Elliott Wave view suggests that the rally from March 26.2018 low (11704) is unfolding as Impulse Elliott Wave structure. As an impulse, the internals of Minor degree wave 1, 3 & 5 should have subdivision of 5 waves impulse of lesser degree. In the case of DAX, Minute wave ((i)), ((iii)) & ((v)) are all impulsive. […]