The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

The CAC 40 Index Long Term Bullish Cycles

Read MoreThe CAC 40 Index Long Term Bullish Cycles Firstly the CAC 40 index long term bullish cycles have been trending higher with other world indices. In September 2000 it put in an all time high. From there it followed the rest of the world indices lower into the March 2003 lows which was a larger […]

-

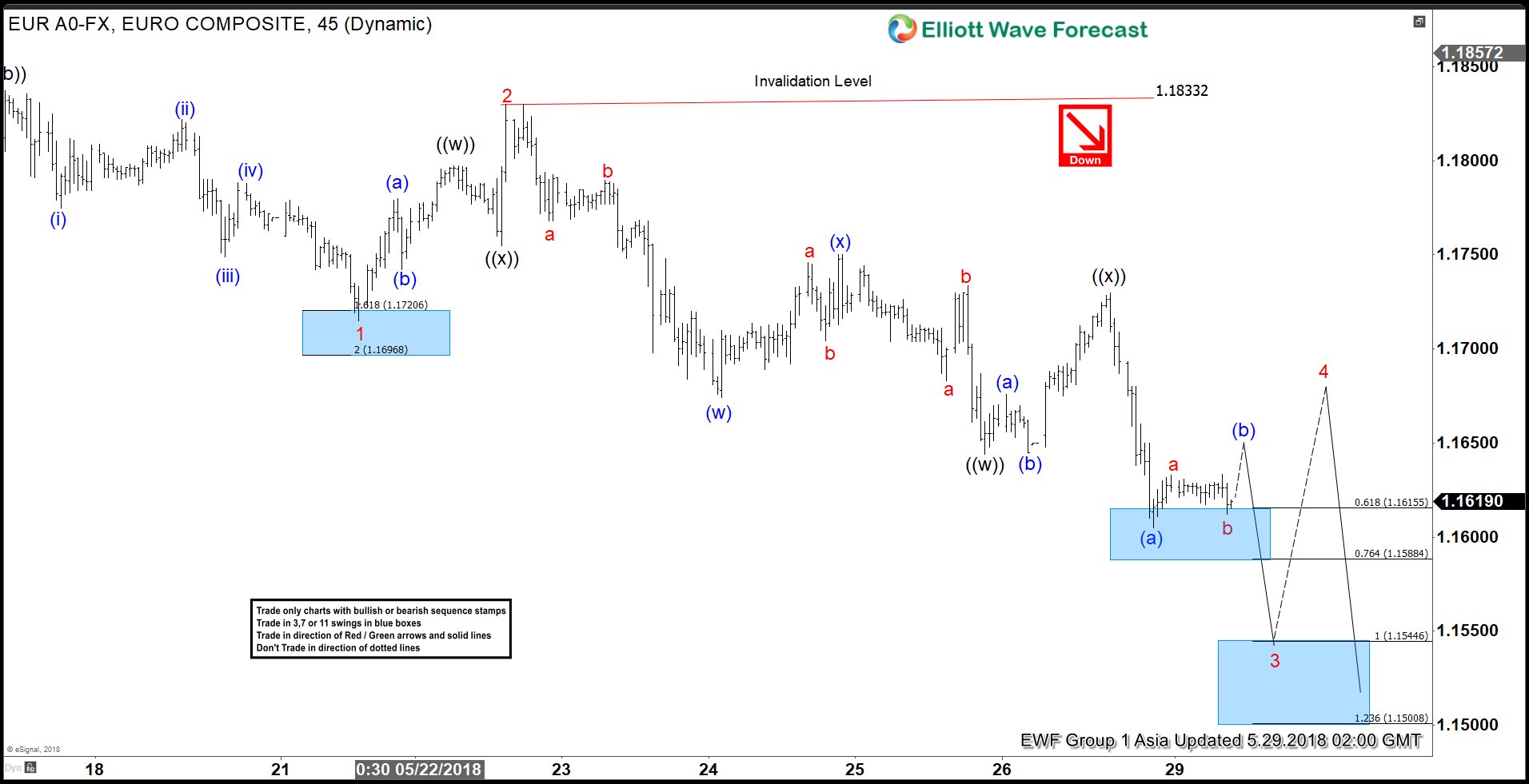

EURUSD Elliott Wave View: Bounces Are Expected To Fail

Read MoreEURUSD short-term Elliott wave view suggests that the decline from ( 1.1996 ) 5/14/2018 peak is unfolding as ending diagonal structure in Intermediate wave (5) lower as mentioned in the previous post here. The internals of each of leg in ending diagonal structure is the combination of a 3 waves corrective structure i.e the internal of wave […]

-

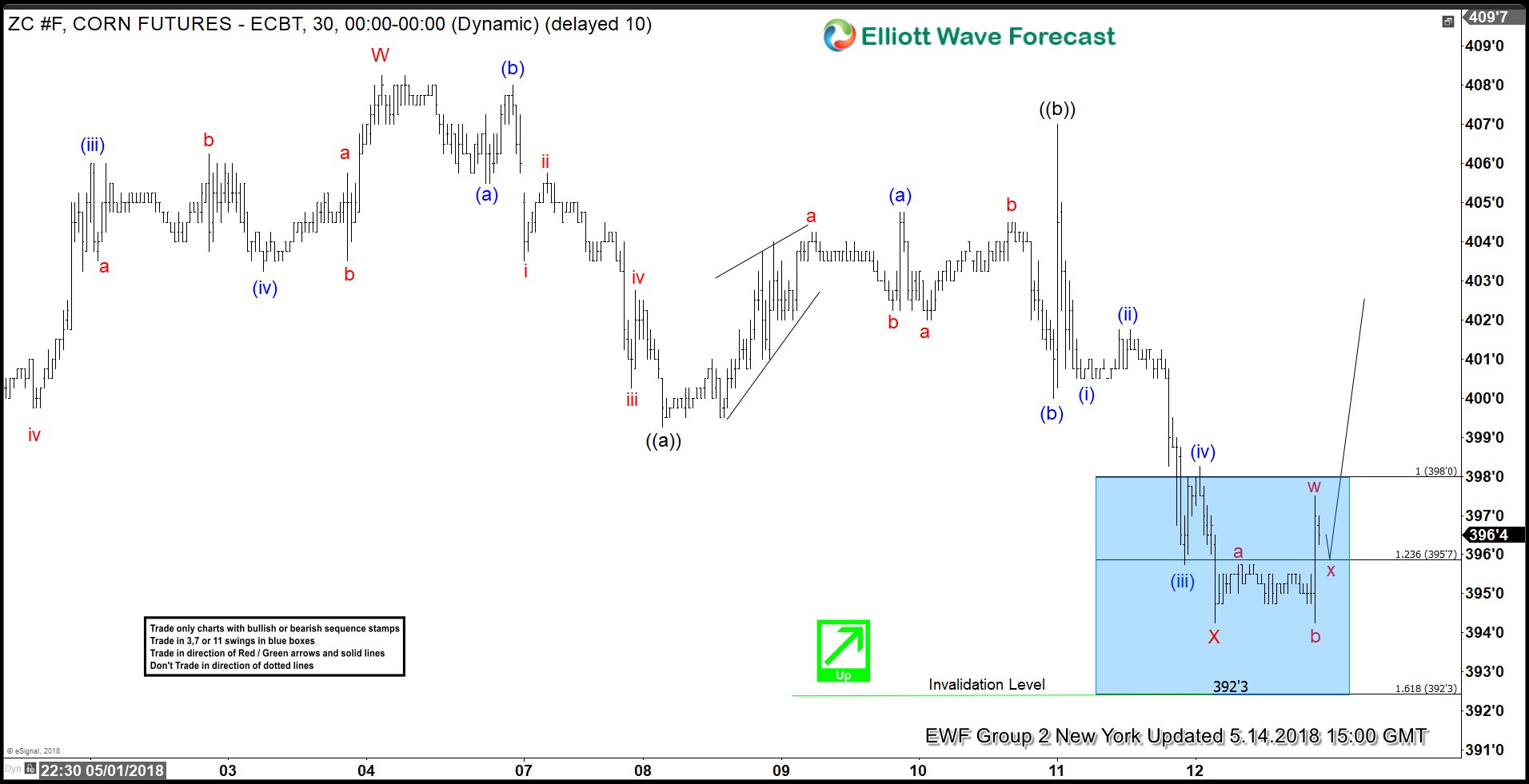

CORN (ZC #F) Futures Forecasting the Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is Corn Futures. In this technical blog we’re going to take a quick look at the Elliott Wave charts of ZC #F published in members area of the website. In further text we’re going to explain the forecast and trading setup. As our members know, […]

-

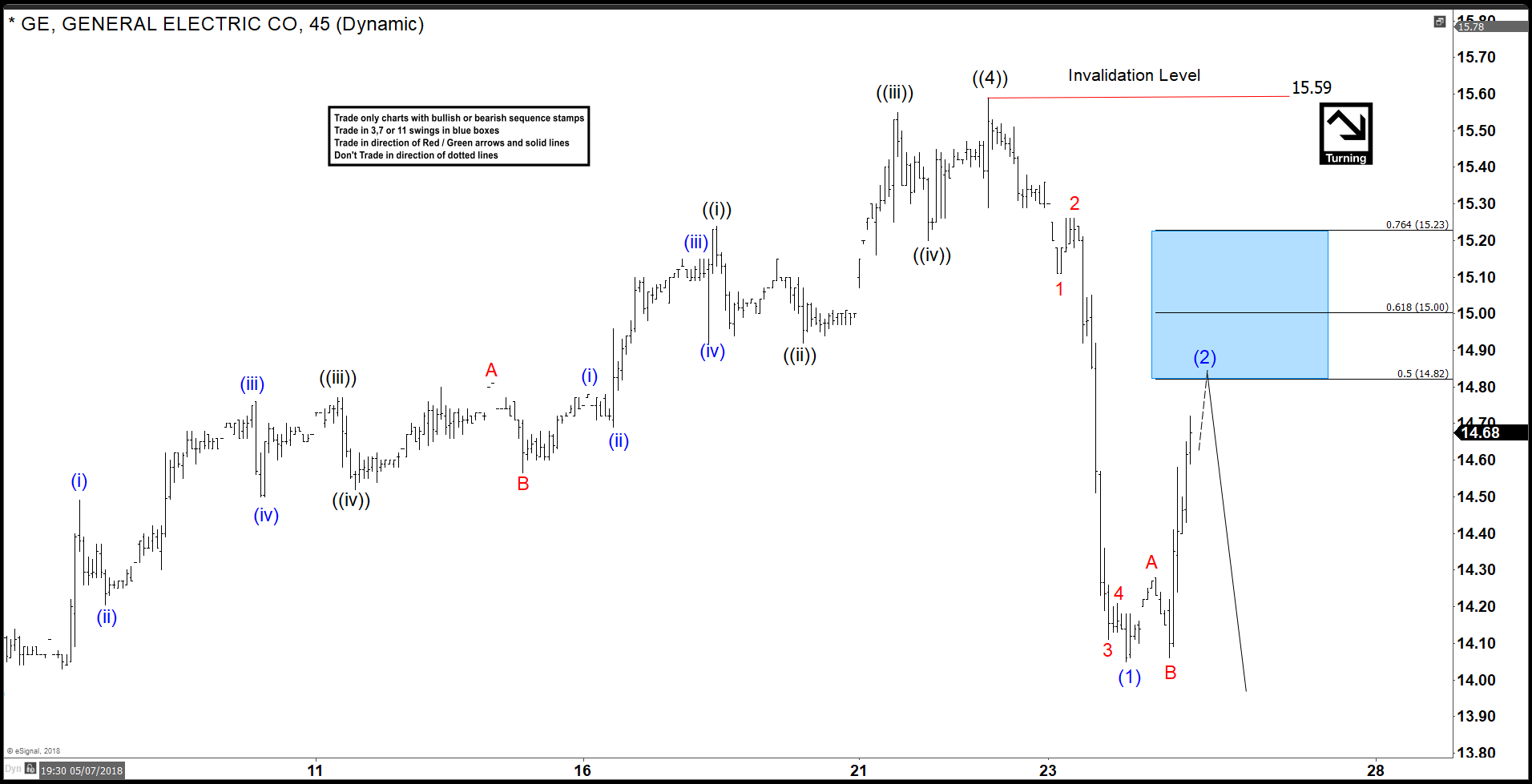

General Electric (GE) Ending Elliott Wave Impulse Soon

Read MoreGeneral Electric ticker symbol: GE short-term Elliott Wave view suggests that the rally to 5/22/2018 high 15.59 ended primary wave ((4)). When intermediate degree wave (Y) of ((4)) ended as a Zigzag correction with Minor wave A ended at 14.79 and Minor wave B ended at 14.58 low. Down from 15.59 high, the decline unfolded […]