The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Xilinx (NASDAQ: XLNX) Another Buying Opportunity

Read MoreXilinx (NASDAQ: XLNX) is an American technology company that is primarily a supplier of programmable logic devices. It designs, develops and markets complete programmable logic solutions, including advanced integrated circuits, software design tools, predefined system functions, customer training, field engineering and technical support. Since the dot com crash, XLNX struggled to recover and it only managed to make […]

-

GOLD ( $XAUUSD ) Buying The Dips At The Extreme Zone

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GOLD ( $XAUUSD ), published in members area of the website. As our members know we are favoring the long side in the commodity. We advised members to avoid selling GOLD and keep buying the […]

-

USO United States Oil Fund Longer Term Cycles & Elliott Wave

Read MoreUSO United States Oil Fund Longer Term Cycles & Elliott Wave Firstly the USO instrument inception date was 4/10/2006. CL_F Crude Oil put in an all time high at 147.27 in July 2008. USO put in an all time high at 119.17 in July 2008 noted on the monthly chart. The decline from there into the […]

-

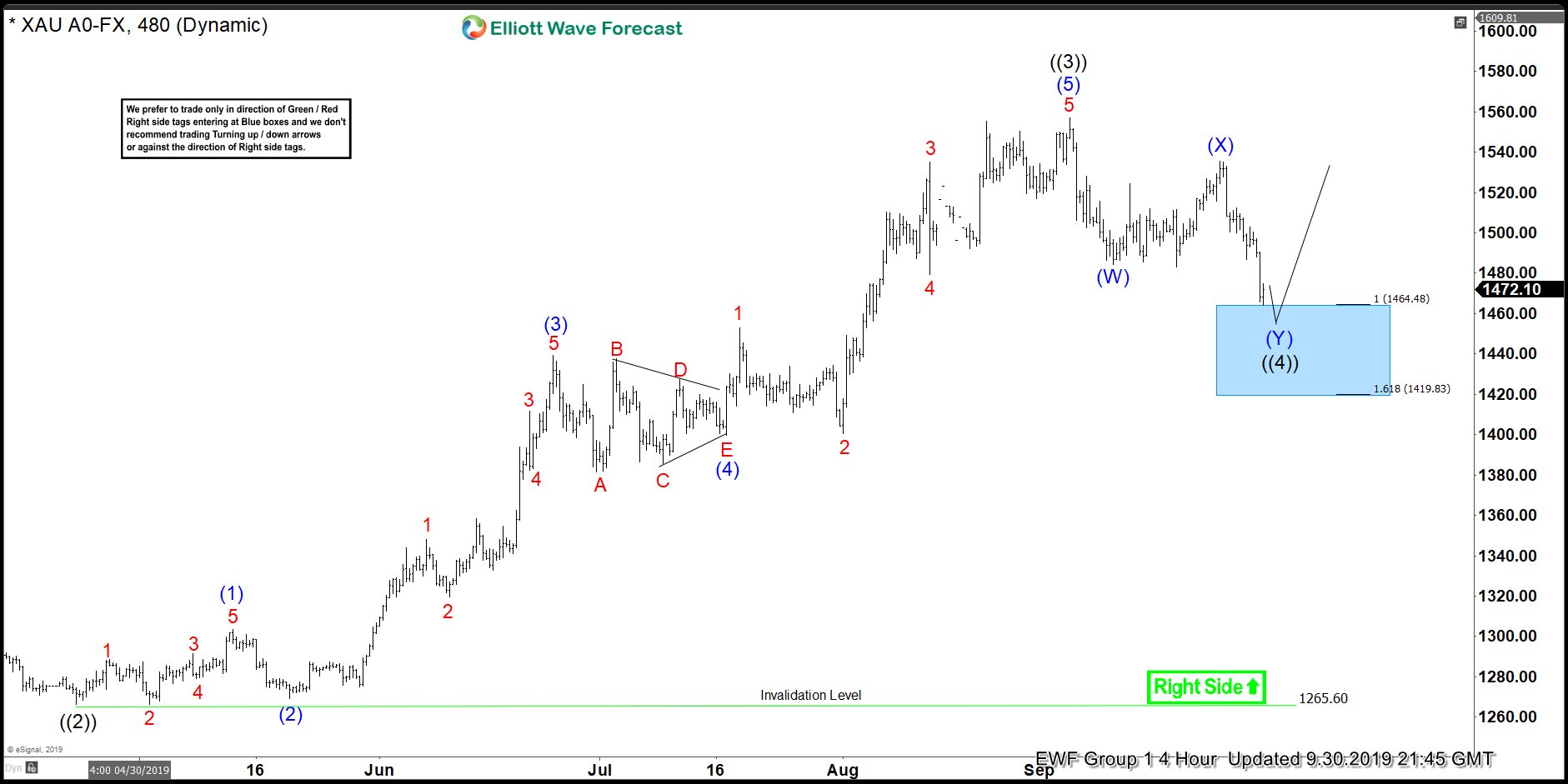

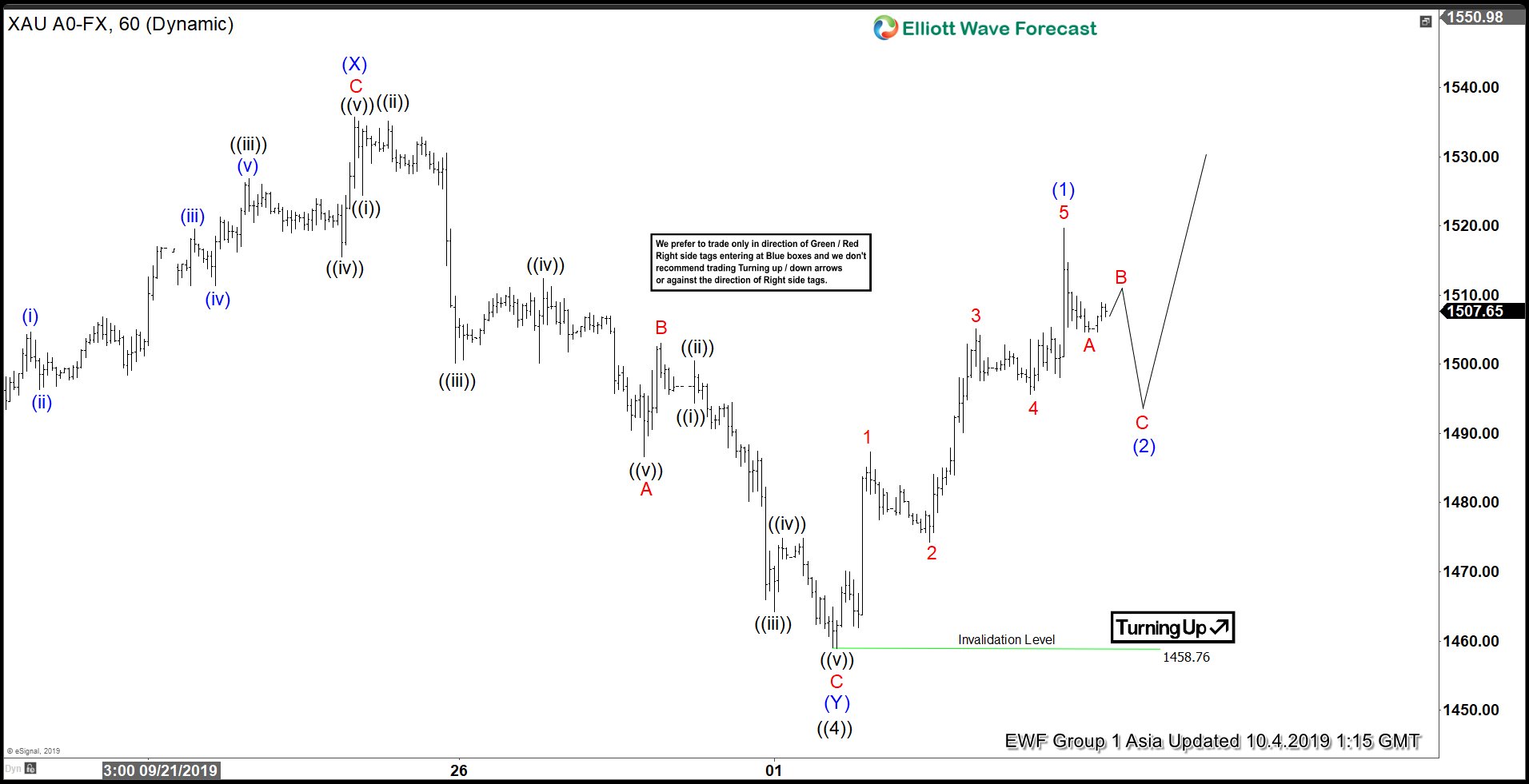

Elliott Wave View: Gold May Have Completed Correction

Read MoreElliott Wave view on Gold suggests the rally from August 2018 low last year remains in progress as a 5 waves impulse Elliott Wave structure. On the 1 hour chart below, we can see wave ((4)) of this impulse is proposed complete at 1458.76. Internal subdivision of wave ((4)) unfolded as a double three where wave […]