-

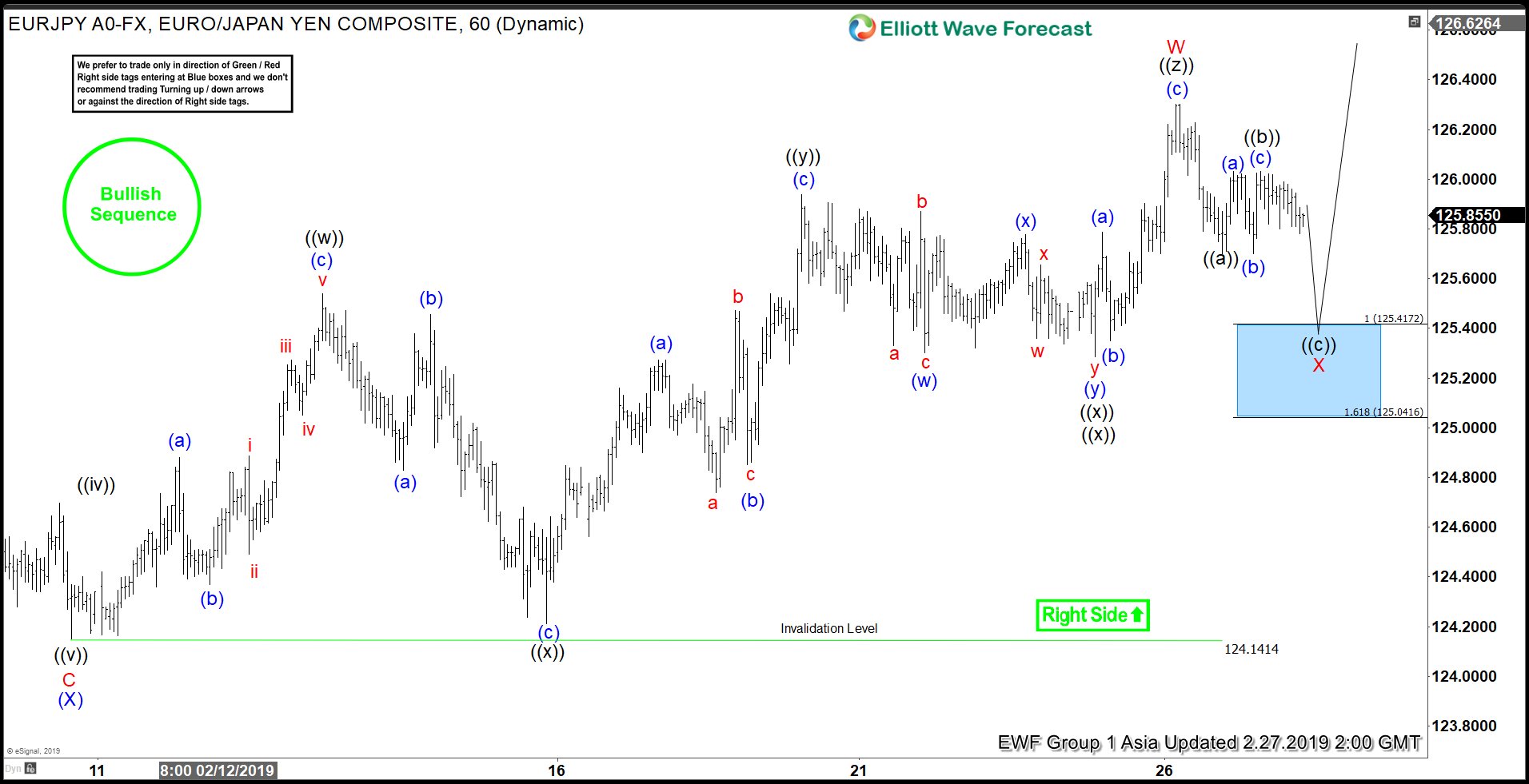

Elliott Wave View: EURJPY Rally Should Resume

Read MoreThis article and video explains the short term Elliott Wave path in EURJPY. Pair shows a bullish sequence from early January favoring more upside.

-

Union Pacific Railroad (NYSE:UNP) – Bullish Sequence Calling Higher

Read MoreUnion Pacific Railroad (NYSE:UNP) is a publicly-traded railroad holding company that was established in 1969. Last year, revenues grew to $22.8 billion, while earnings was up in mid-single-digits to $10.8 billion. Revenue growth was led by strong gains in Intermodal, amid capacity constraints in the trucking industry and a higher industrial production for commodities shipments. Union Pacific’s […]

-

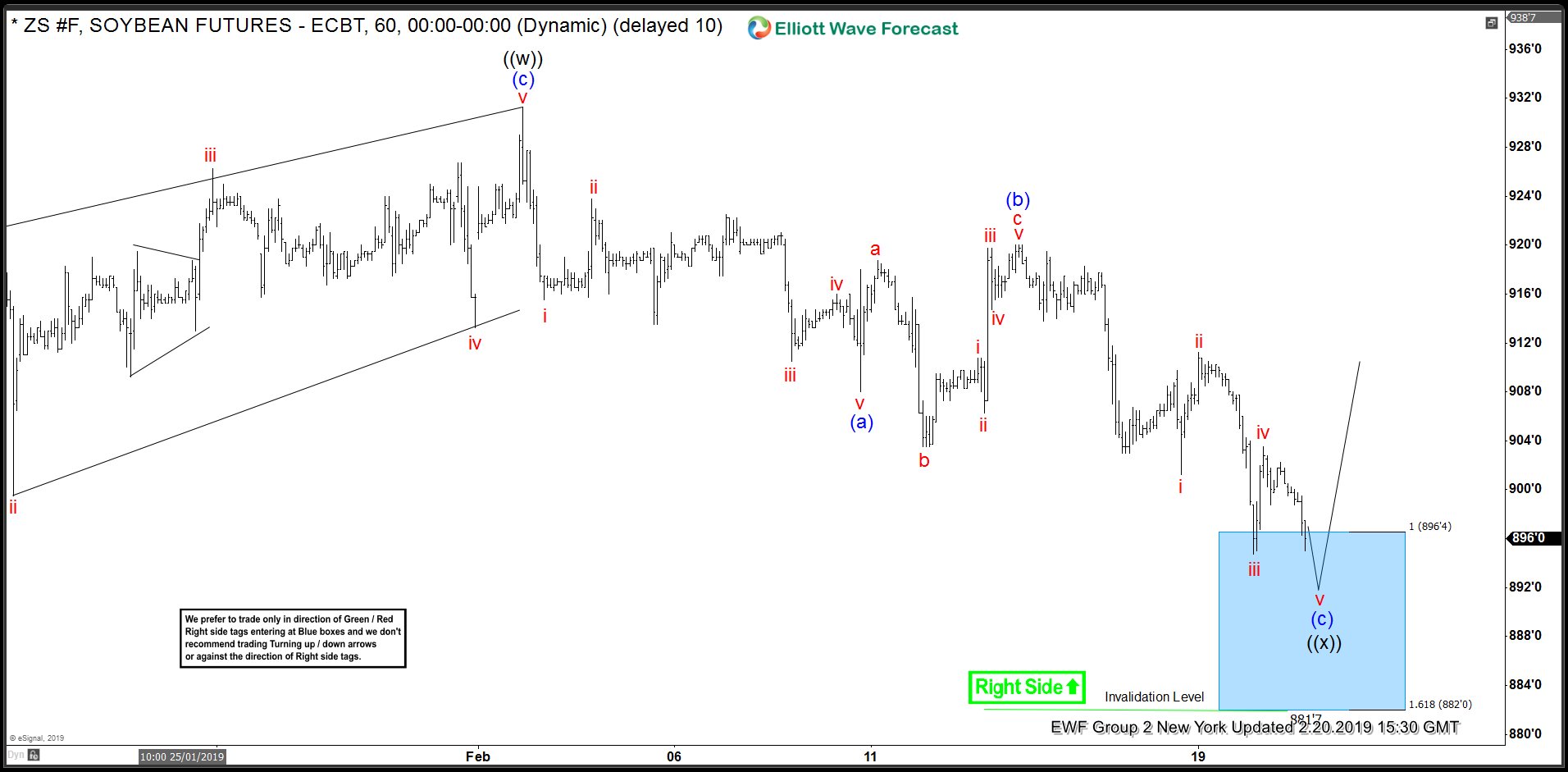

Soybean Futures (ZS_F) Analysis : Found Buyers in Blue Box

Read MoreHello fellow traders. Today, I want to share some Elliott Wave charts of Soybean (ZS_F) which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 02/20/19. showing that ZS has a 1 Hour right side tag against 882 low. From 12/27/18 low (867.2) ZS ended […]

-

OIL ($CL_F) Elliott Wave Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL. As our members know we were calling for further strength in OIL lately. Pull back against the December’s 26th low ended at 51.24 low as Irregular Elliott Wave Pattern and we’re now in the […]