The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

FXY Longer Term Cycles & Elliott Wave

Read MoreFXY Longer Term Cycles & Elliott Wave Firstly the FXY instrument inception date was 2/12/2007. The instrument tracks changes of the value of the Japanese Yen versus the US Dollar. There is plenty of data going back into the longer term 1970’s time frame available for the currency cross rate in the USDJPY. The foreign […]

-

Elliott Wave View: Has Silver Started the Next Leg Higher

Read MoreSilver shows a short term incomplete sequence from Oct 1 low, favoring more upside. This article and video looks at the short term Elliott Wave path.

-

S&P 500 (SPX) Outlook in the Week of U.S – China Trade Talk

Read MoreThis week’s trade talk is critical to the path of the stock market. This article outlines three possibilities and most likely scenario & Elliott Wave path.

-

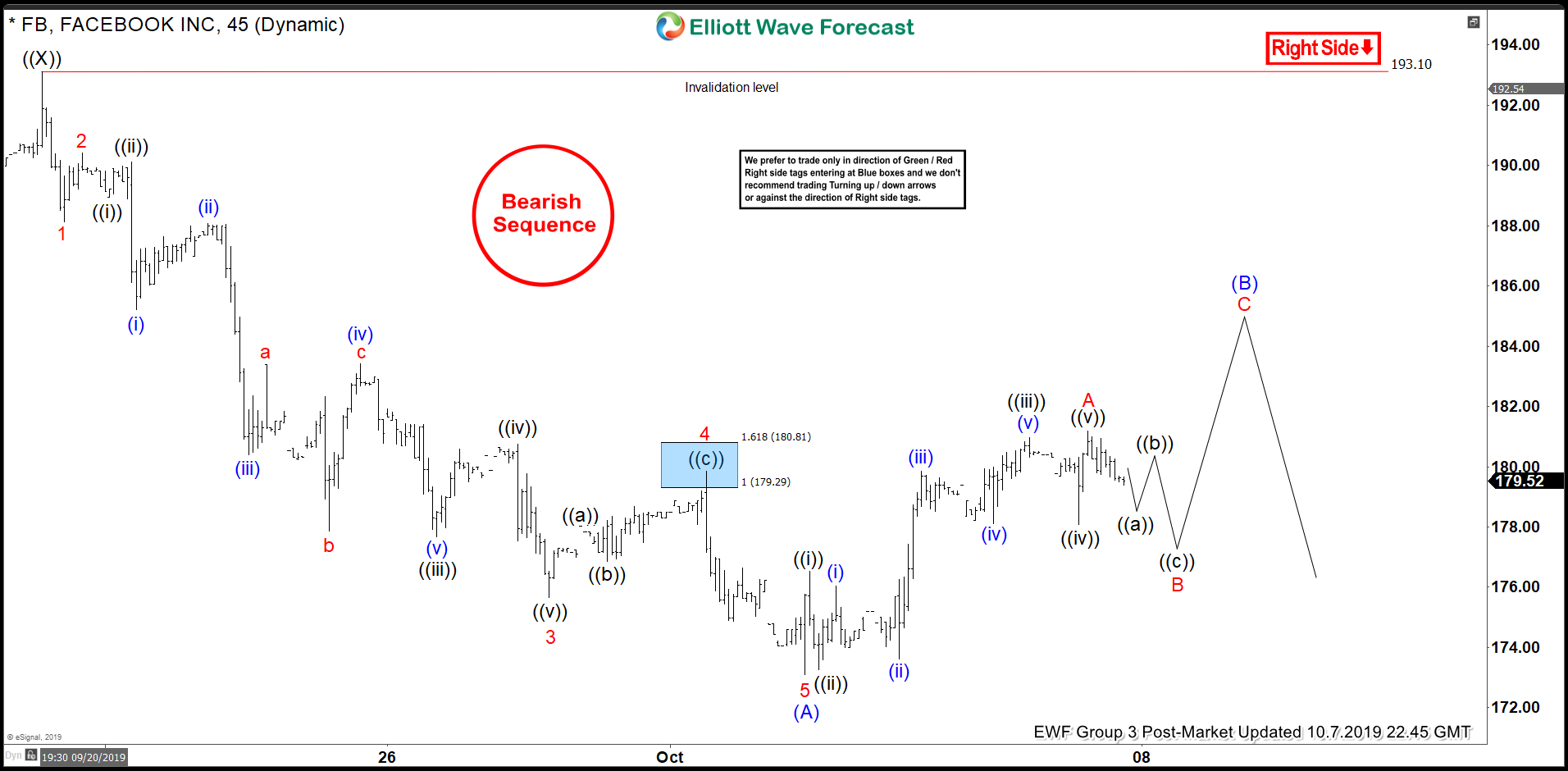

Elliott Wave View: Facebook can See Larger Correction

Read MoreShort term Elliott Wave view on Facebook (ticker: FB) suggests the rally to 193. ended wave ((X)). The stock has resumed lower within wave ((Y)) which is unfolding as a zigzag Elliott Wave structure. Down from 193.1, wave (A) of the zigzag ended at 173.09. Internal subdivision of wave (A) unfolded as 5 waves where […]