-

AUDUSD: Bearish Sequence Called The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of AUDUSD published in members area of the website. As our members know, AUDUSD has incomplete bearish sequences in the cycle from the January 2018 peak. Price structure suggests that the pair is targeting 0.6938 area as […]

-

$SPX Forecasting The Rally & Buying The Dips

Read MoreHello fellow Traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $SPXpublished in members area of the website. Another trading opportunity we have had lately is long trade in $SPX. As our members and followers already know, the right side in $SPX is long side. Recently […]

-

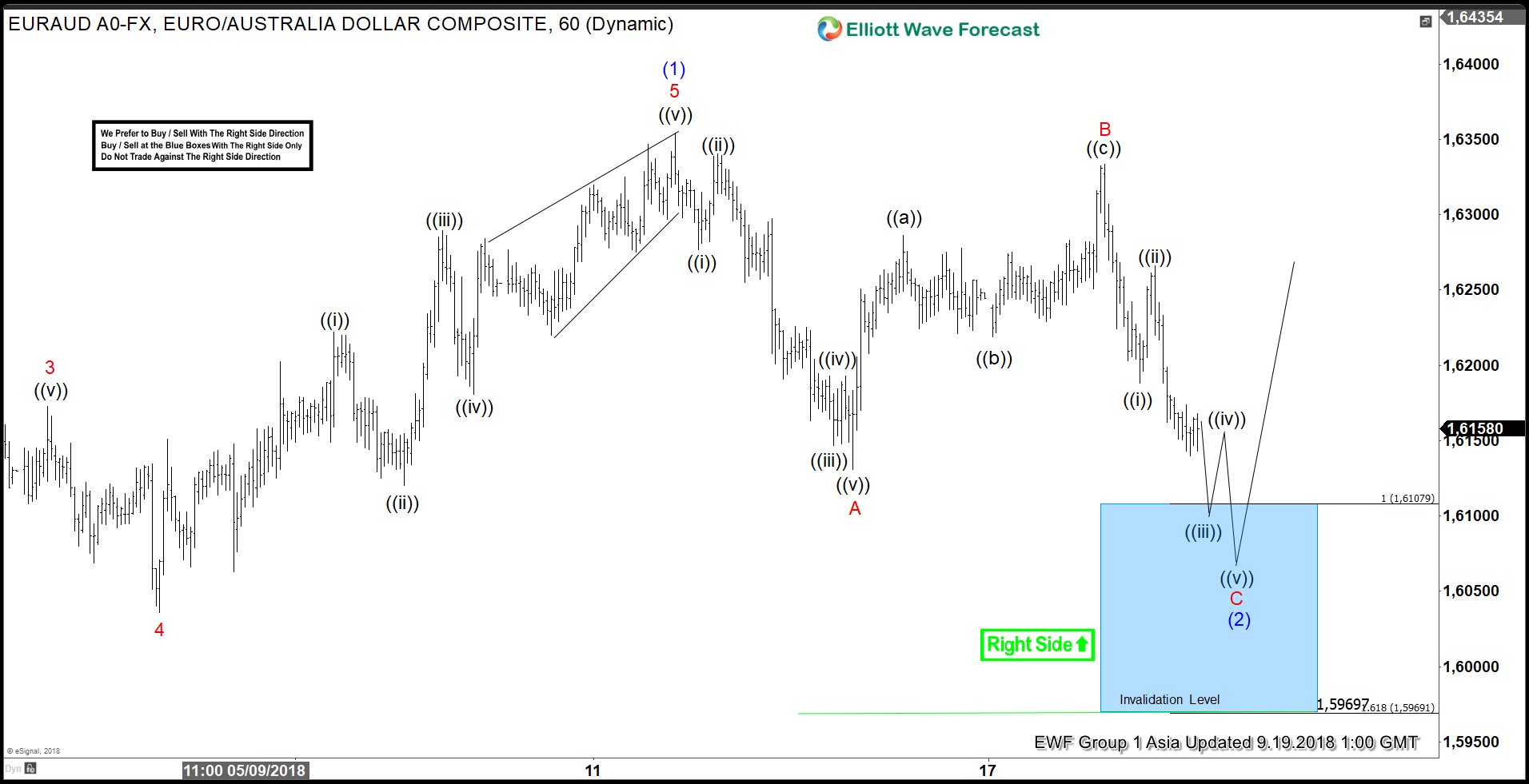

EURAUD Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. Another trading opportunity we have had lately is EURAUD. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURAUD published in members area of the website. As our members know, EURAUD has incomplete bullish sequences. Break of March 28th peak has made cycle from […]

-

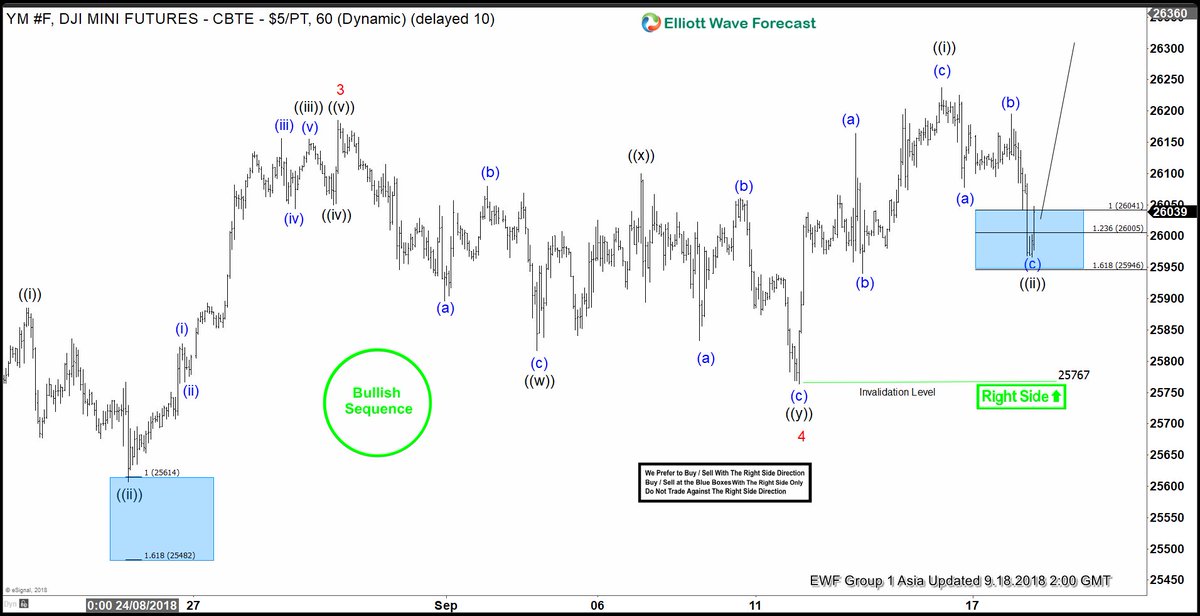

$DJI ( YM #F) Buying The Intraday Dips in 3,7,11 Swings

Read MoreAnother trading opportunity we have had lately is long trade in $DJI Mini Futures. In this technical blog we’re going to take a quick look at the Elliott Wave charts of $DJI published in members area of the website. As our members know, the right side in $DJI is long side. Futures has incomplete bullish […]

-

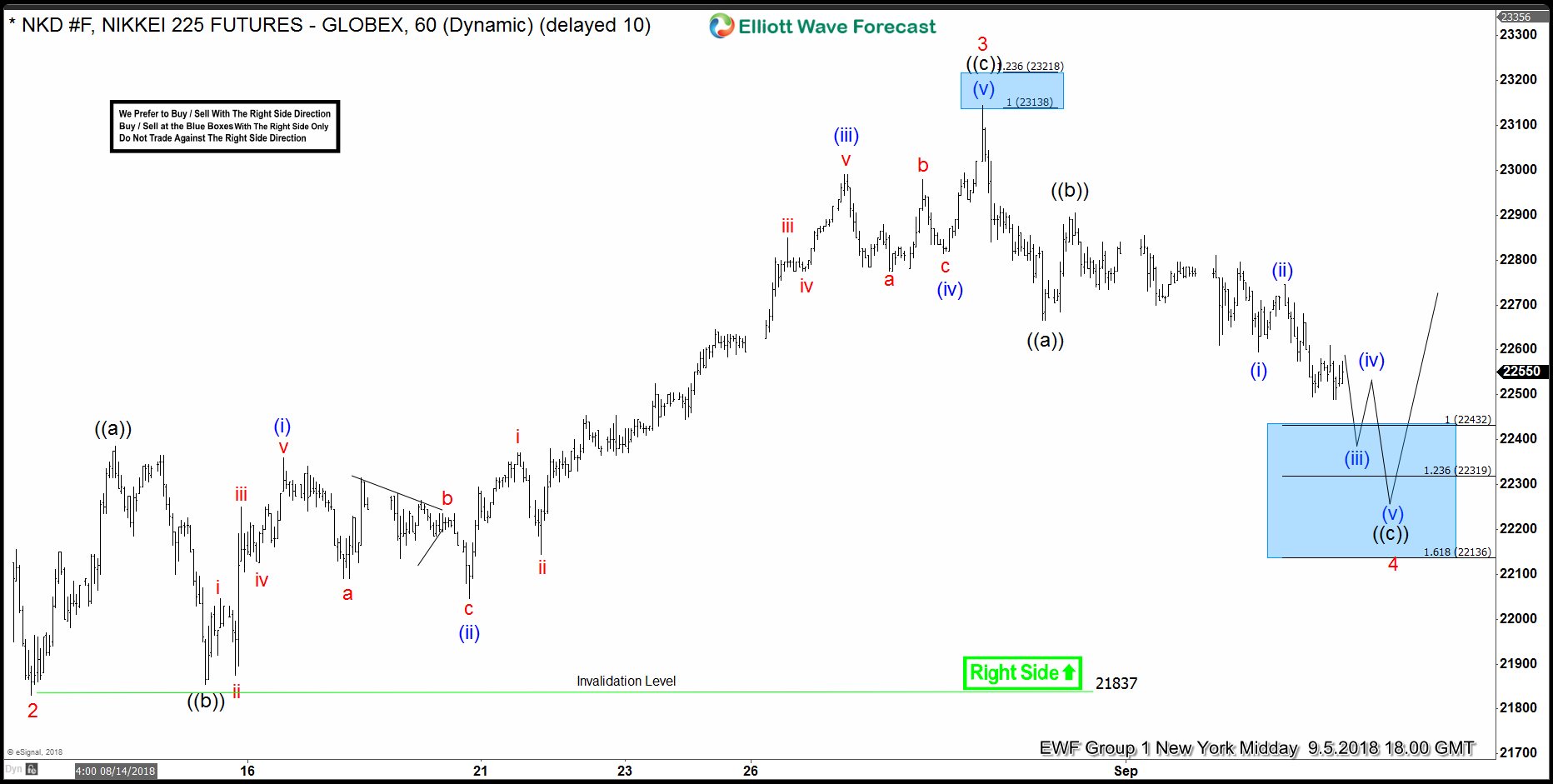

NIKKEI Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI NKD #F , published in members area of the website. As our members know, NIKKEI Futures has had incomplete bullish sequences according to Sequence Report. Consequently, we advised our members to avoid selling it […]

-

COPPER Forecasting The Decline & Selling The Rallies

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of COPPER. As our members know, COPPER has had cycle from the 13th October 2017 in progress as expanded Flat structure. The Commodity was missing another swing down to complete proposed pattern, approximately at 2.622-2.458 ( according to […]