-

OIL ($CL_F) Elliott Wave Forecasting The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL. As our members know we were calling for further strength in OIL lately. Pull back against the December’s 26th low ended at 51.24 low as Irregular Elliott Wave Pattern and we’re now in the […]

-

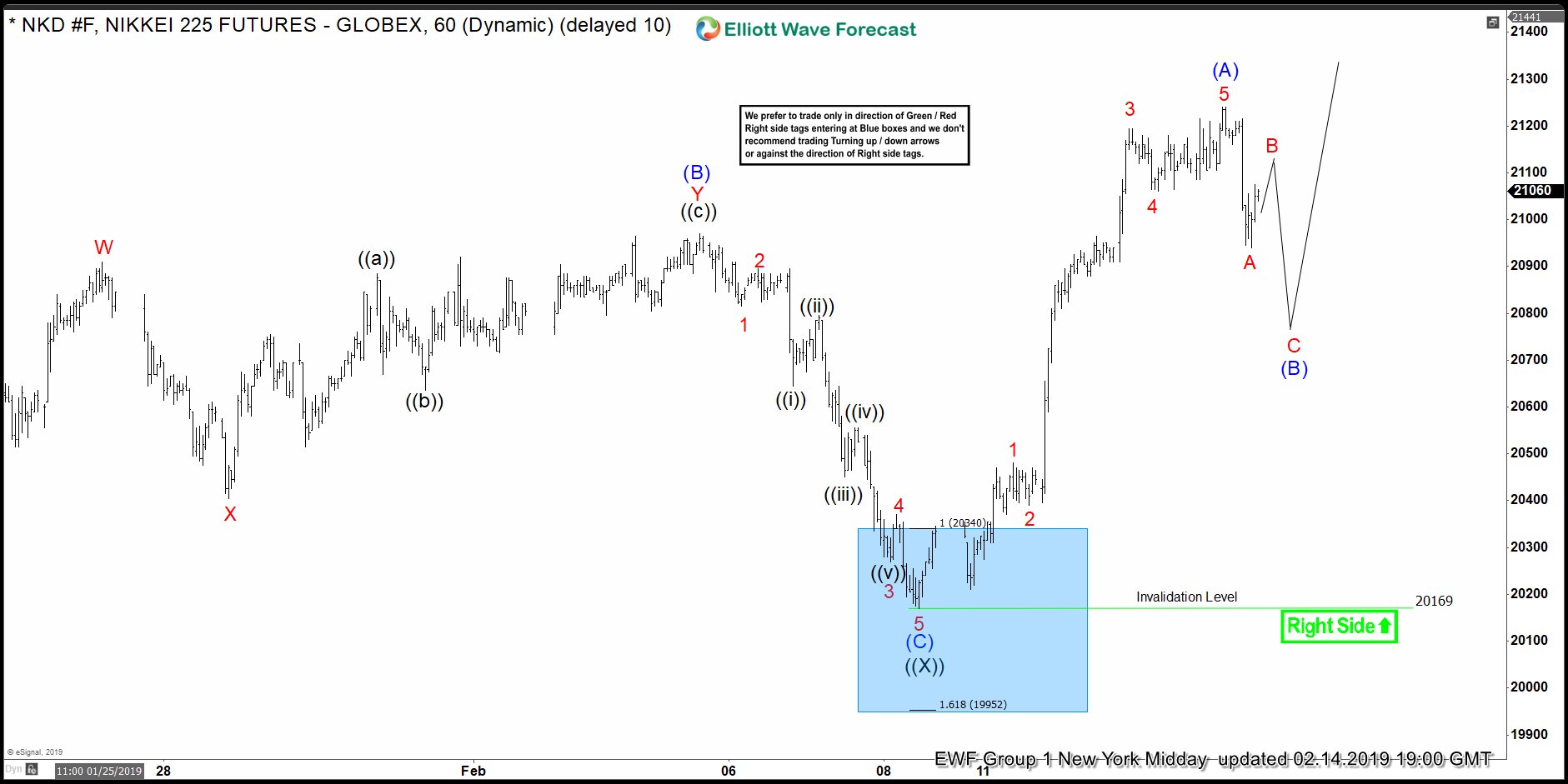

Nikkei Elliott Wave Zigzag Pattern Within February Cycle

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKKEI . Break of February 5th peak has made the cycle from the 12.26 low incomplete to the upside. The price structure is calling for more strength toward 22214-23476 area. At this stage short term cycle […]

-

S&P 500 Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of SPX, published in members area of the website. Back in December 2018 we were calling cycle from the 21st September 2018 peak still unfinshed to the downside. Our Elliott Wave analysis were calling for more […]

-

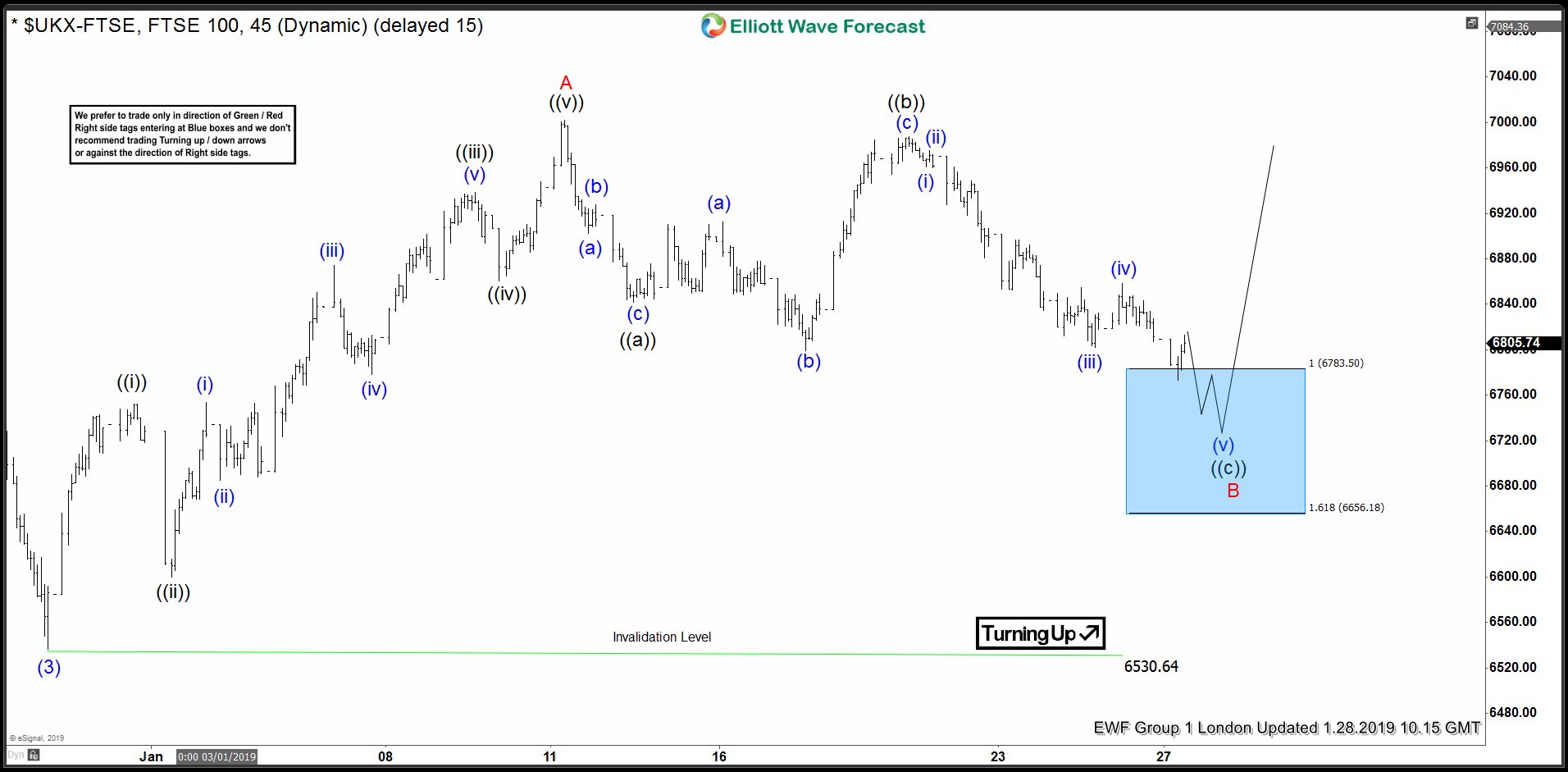

FTSE Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of FTSE. FTSE was correcting the cycle from the 6530.6 low,when the pull back was unfolding as Elliott Wave FLAT pattern. We expected FTSE to trade higher due to 5 waves rally in the cycle from […]

-

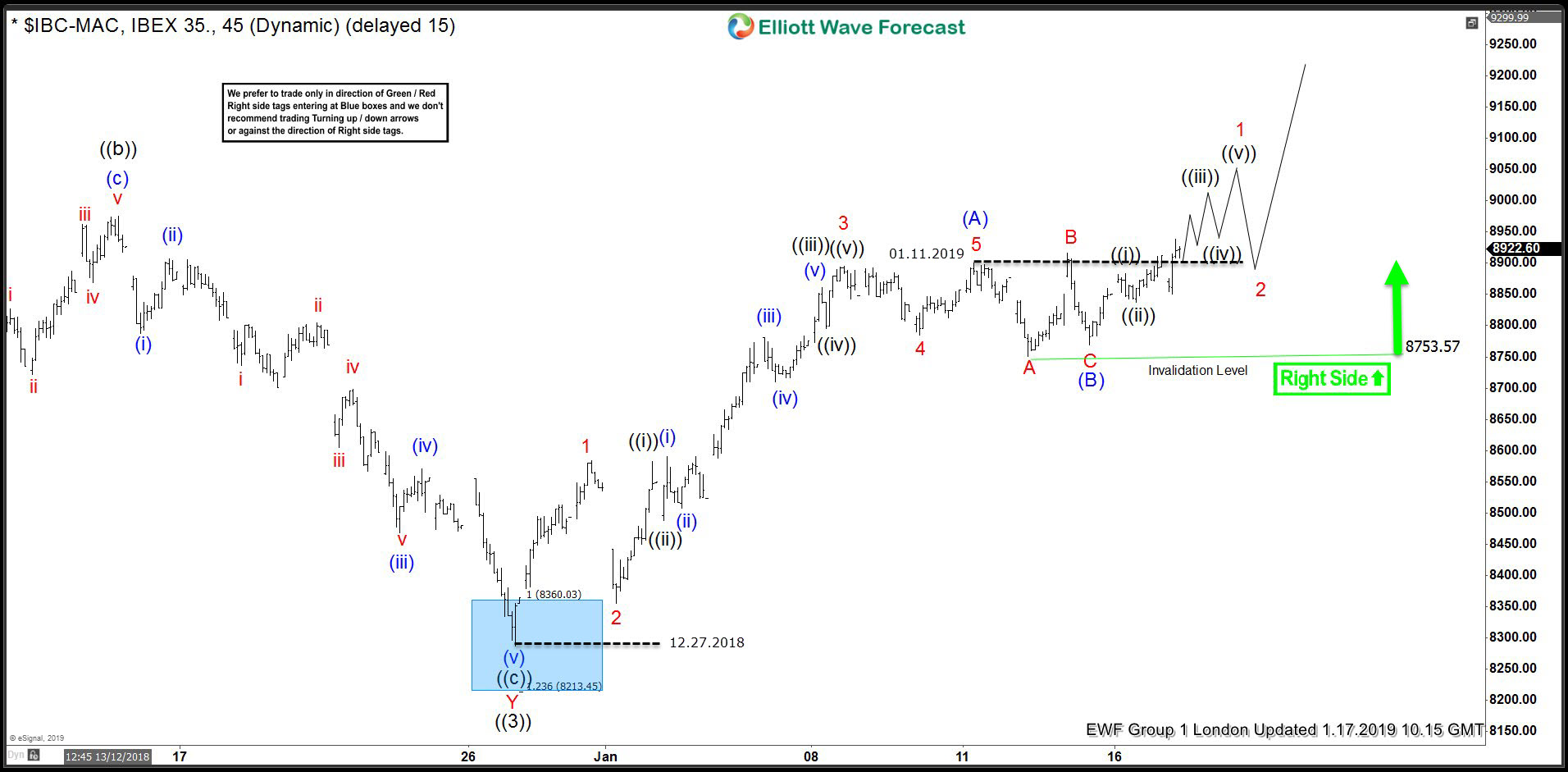

$IBEX Short Term Bullish Sequence Calling The Rally

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of IBEX, published in members area of the website. As our members know, IBEX has made recently incomplete bullish sequence in the cycle from the December 27th 2018 low. The Elliott wave structure had been calling […]

-

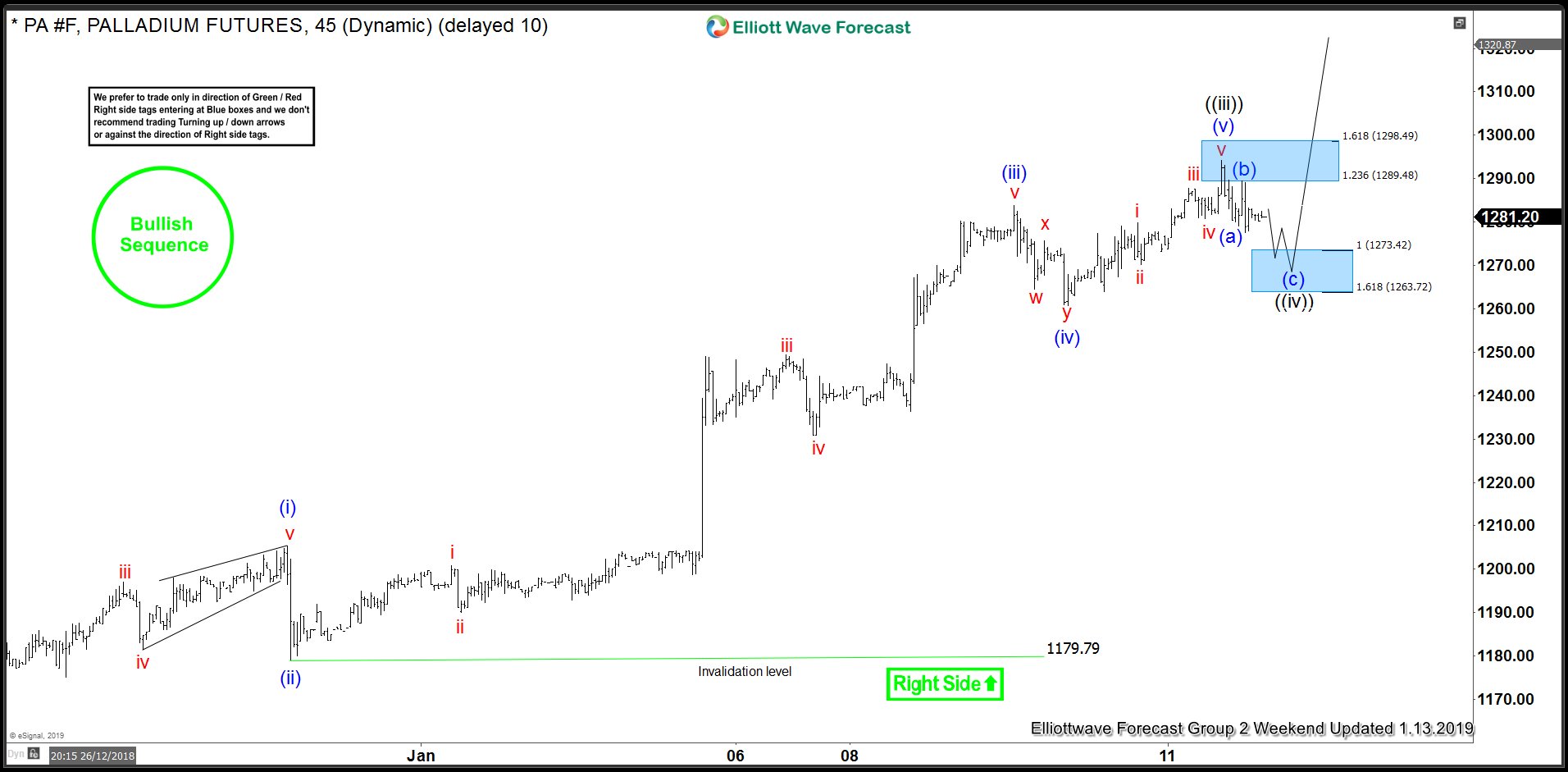

PALLADIUM Forecasting The Rally & Buying The Dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Palladium Futures, published in members area of the website. As our members know, the commodity has had incomplete bullish sequence in the cycle from 1056.56 low. The Elliott wave structure had been calling for further […]