-

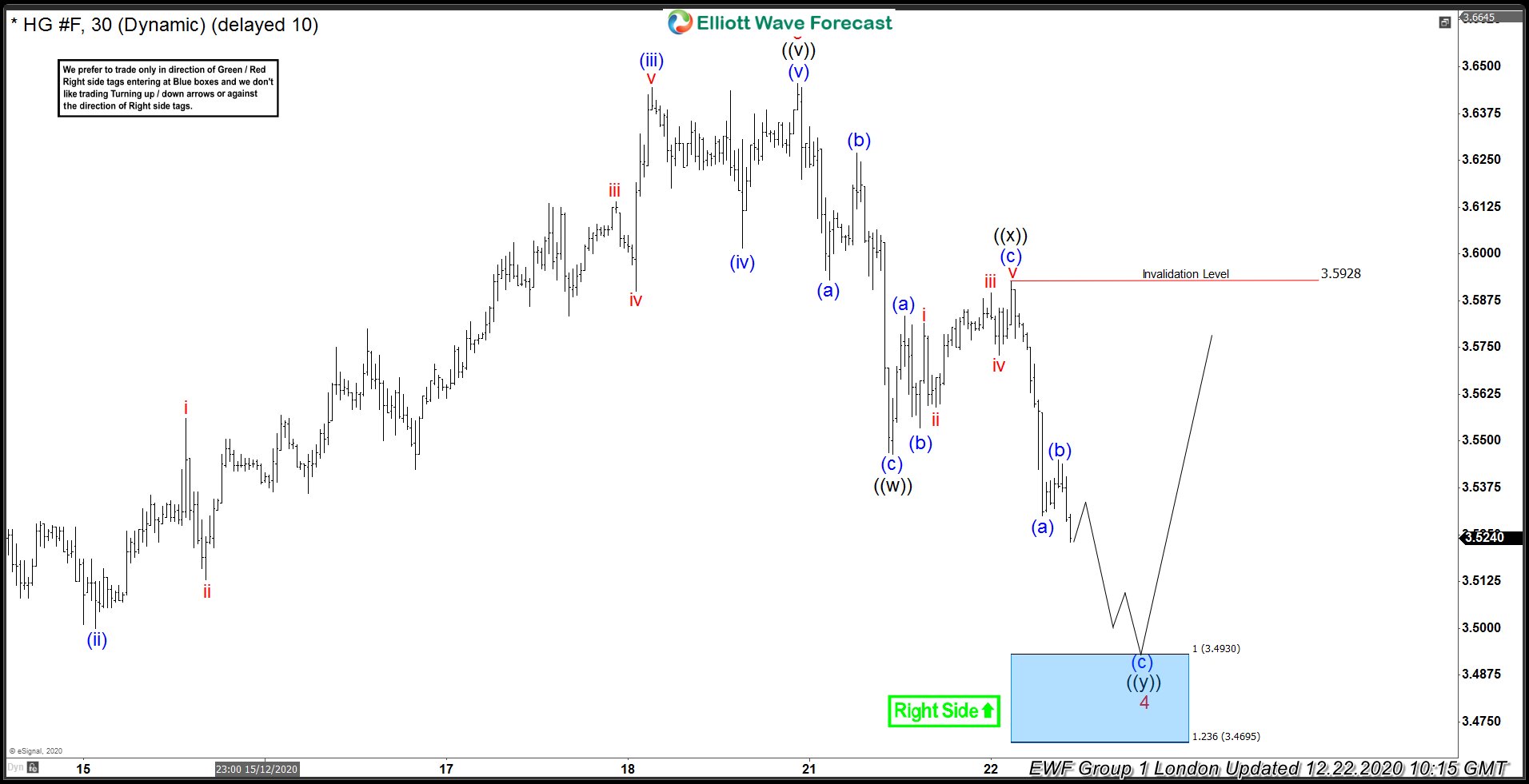

COPPER ( $HG_F ) Buying The Dips After Elliott Wave Double Three

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Copper Futures ( $HG_F) published in members area of the Elliottwave-Forecast . As our members know, Copper is showing higher high sequences in the cycle from the March low ( 19720). Consequently , we recommended our […]

-

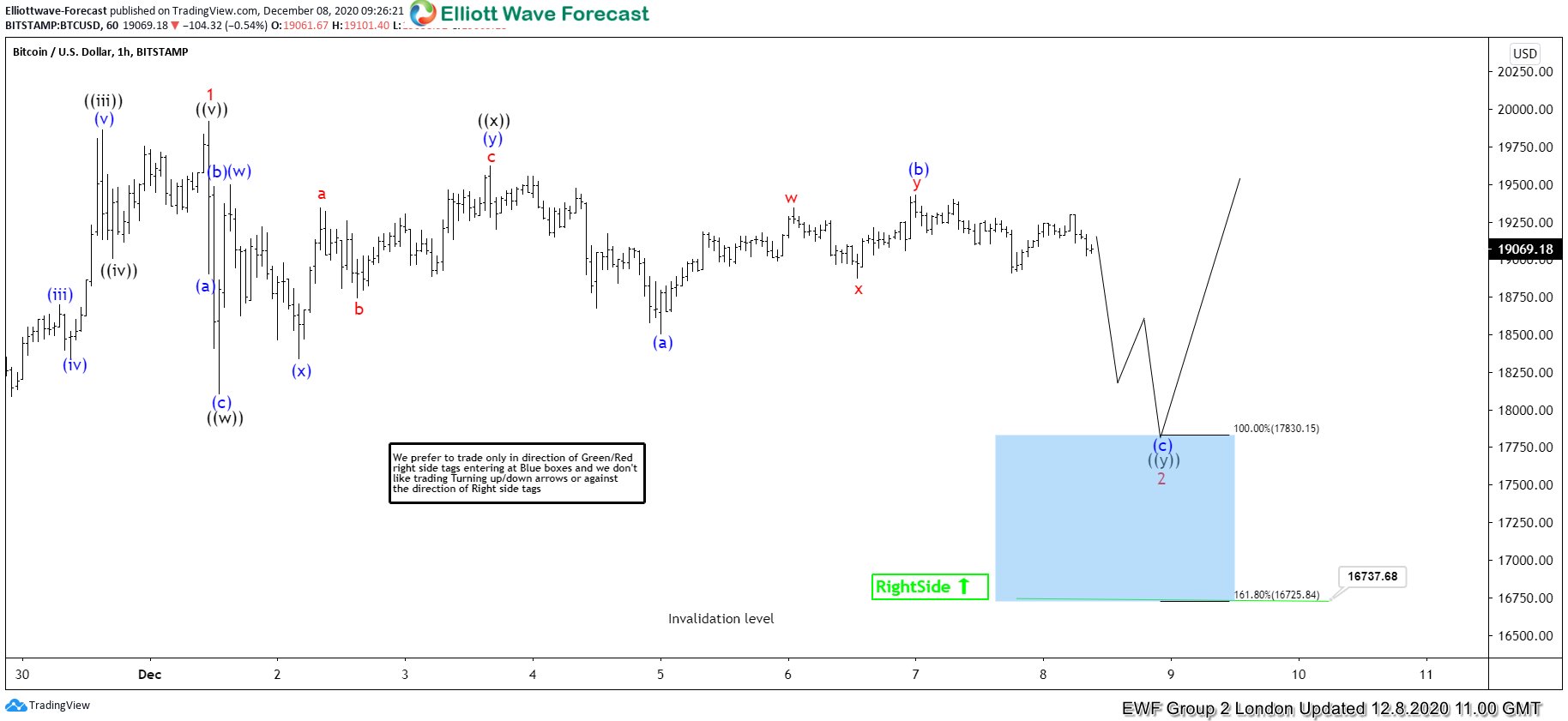

Bitcoin ( BTCUSD ) Buying The Dips At The Blue Box Area

Read MoreAnother instrument that we have been trading lately is Bitcoin ( $BTCUSD ) cryptocurrency from Group 2. In this technical blog we’re going to take a quick look at the Elliott Wave charts of BTCUSD, published in members area of the website. As our members know, BTCUSD has been showing incomplete impulsive sequences from the […]

-

$EURUSD Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURUSD , published in members area of the website. EURUSD is another Forex pair that we have been trading lately. The price is showing impulsive sequences in the cycle from the November 1.1598 low.

-

Tesla ( TSLA ) Elliott Wave Buying The Dips In A Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of Wheat Future TESLA, published in members area of the website. As our members know, TESLA is another instrument that we have been trading lately. The stock is showing impulsive sequences in the cycle from the October low (379.67) […]

-

OIL ( $CL_F ) Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of OIL, published in members area of the website. As our members know, OIL is another instrument that we have been trading lately. The price is showing bullish sequences in the cycle from the April 21st […]

-

USDCAD Turned Lower From The Blue Box ( Sellers Zone)

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of USDCAD published in members area of the website. As our members know, USDCAD is showing lower low sequences in the cycle from the 03/19 peak . We advised clients to avoid buying the pair ,while favoring selling […]