-

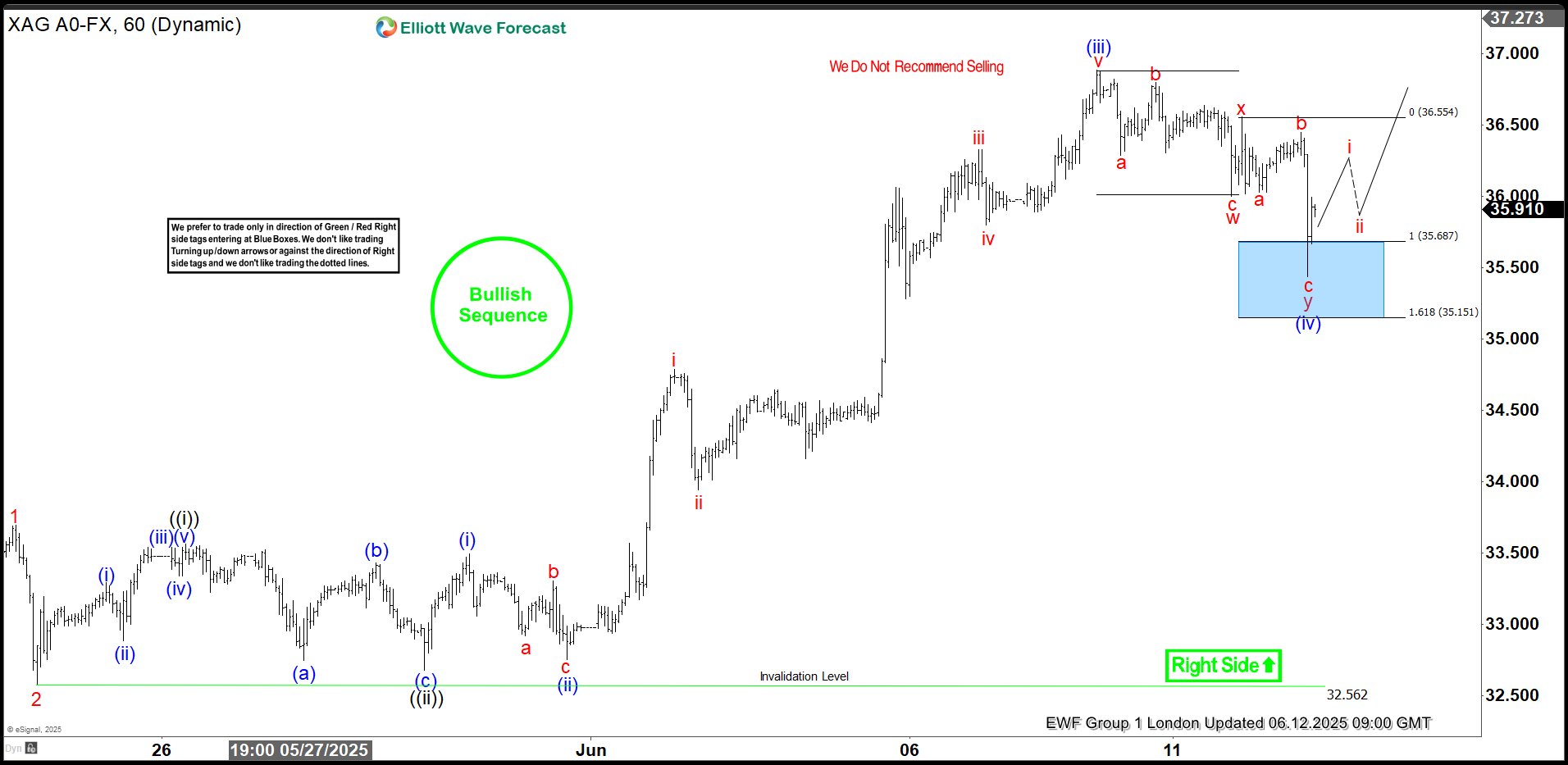

Silver (XAGUSD) Elliott Wave : Intraday Blue Box Buying Opportunity

Read MoreHello traders. As our members know, we have had many profitable trading setups recently. In this technical article, we are going to talk about another Elliott Wave trading setup we got in Silver (XAGUSD). The commodity has completed its correction exactly at the Equal Legs zone, also known as the Blue Box Area. In this […]

-

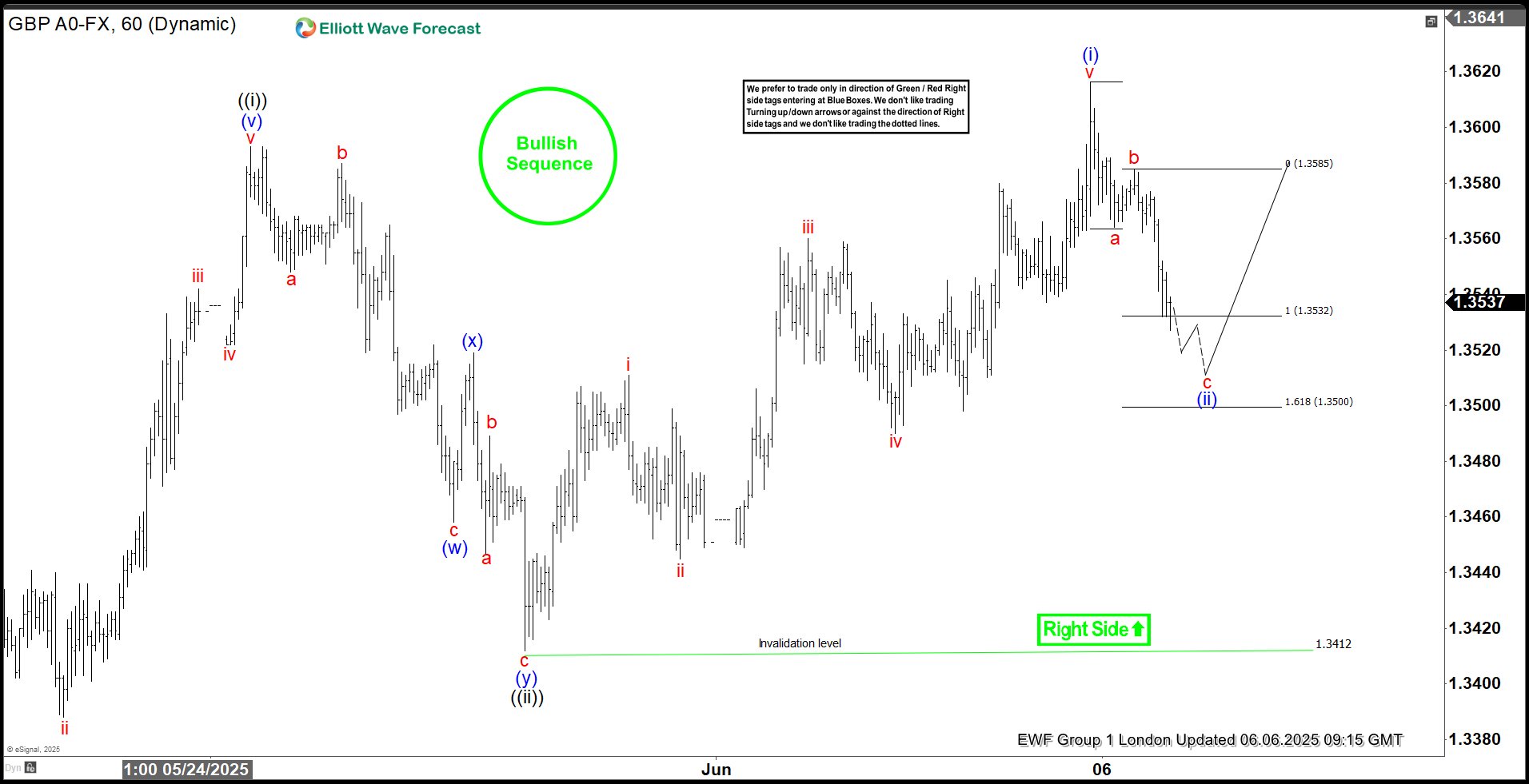

GBPUSD Elliott Wave: Forecasting the Rally from the Intraday Equal Legs

Read MoreHello traders. In this technical article we’re going to look at the Elliott Wave charts of GBPUSD forex pair published in members area of the website. The pair recently delivered an intraday pullback and, as anticipated, attracted buyers precisely at the Equal Legs area. In the analysis below, we’ll break down the Elliott Wave count and […]

-

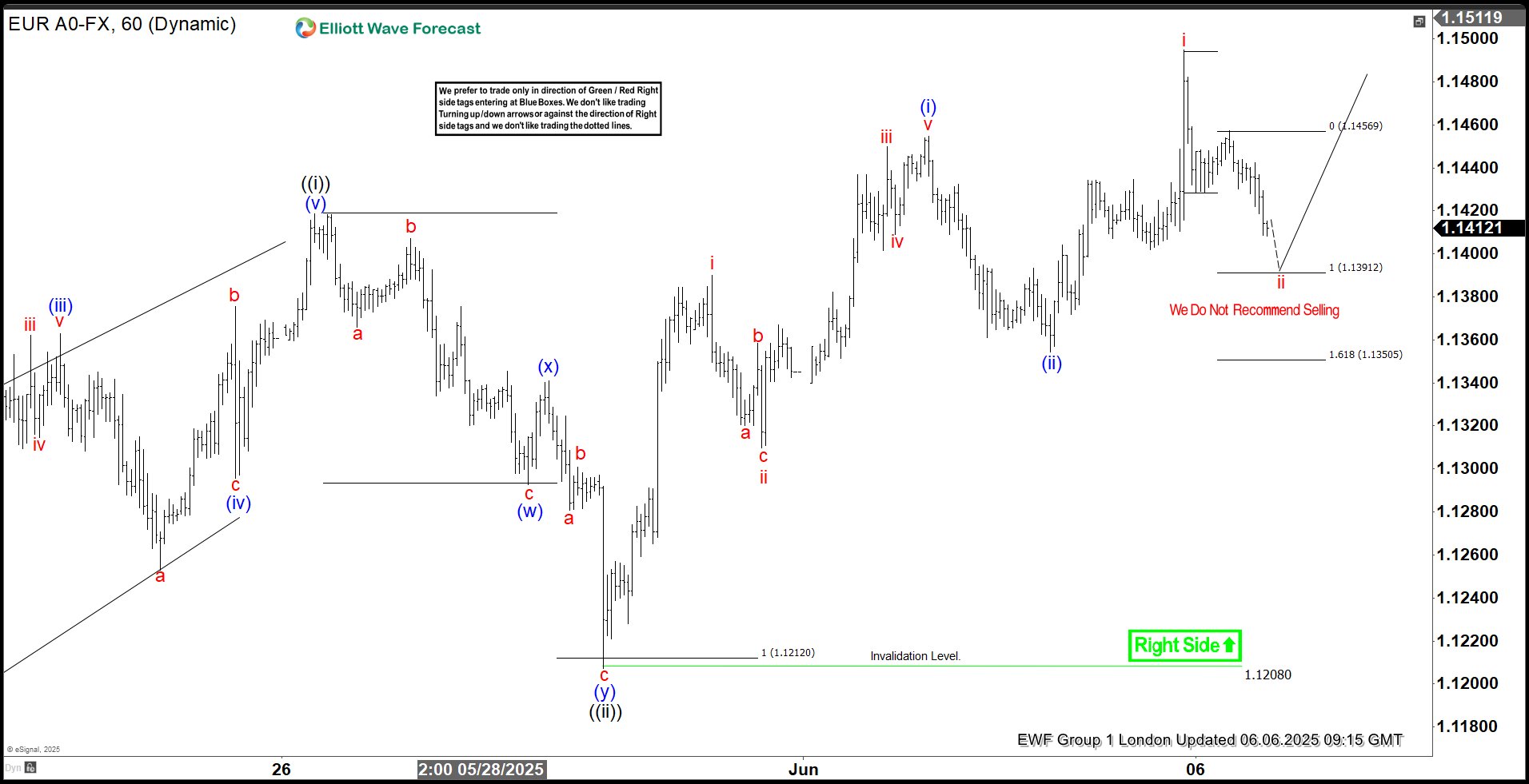

EURUSD Elliott Wave Outlook: Rally Unfolding from Equal Legs Support

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of EURUSD forex pair published in members area of the website. As our members know, we are enjoying profitss in long positions the pair . The pair has recently given us intraday pull back and found buyers again precisely at the […]

-

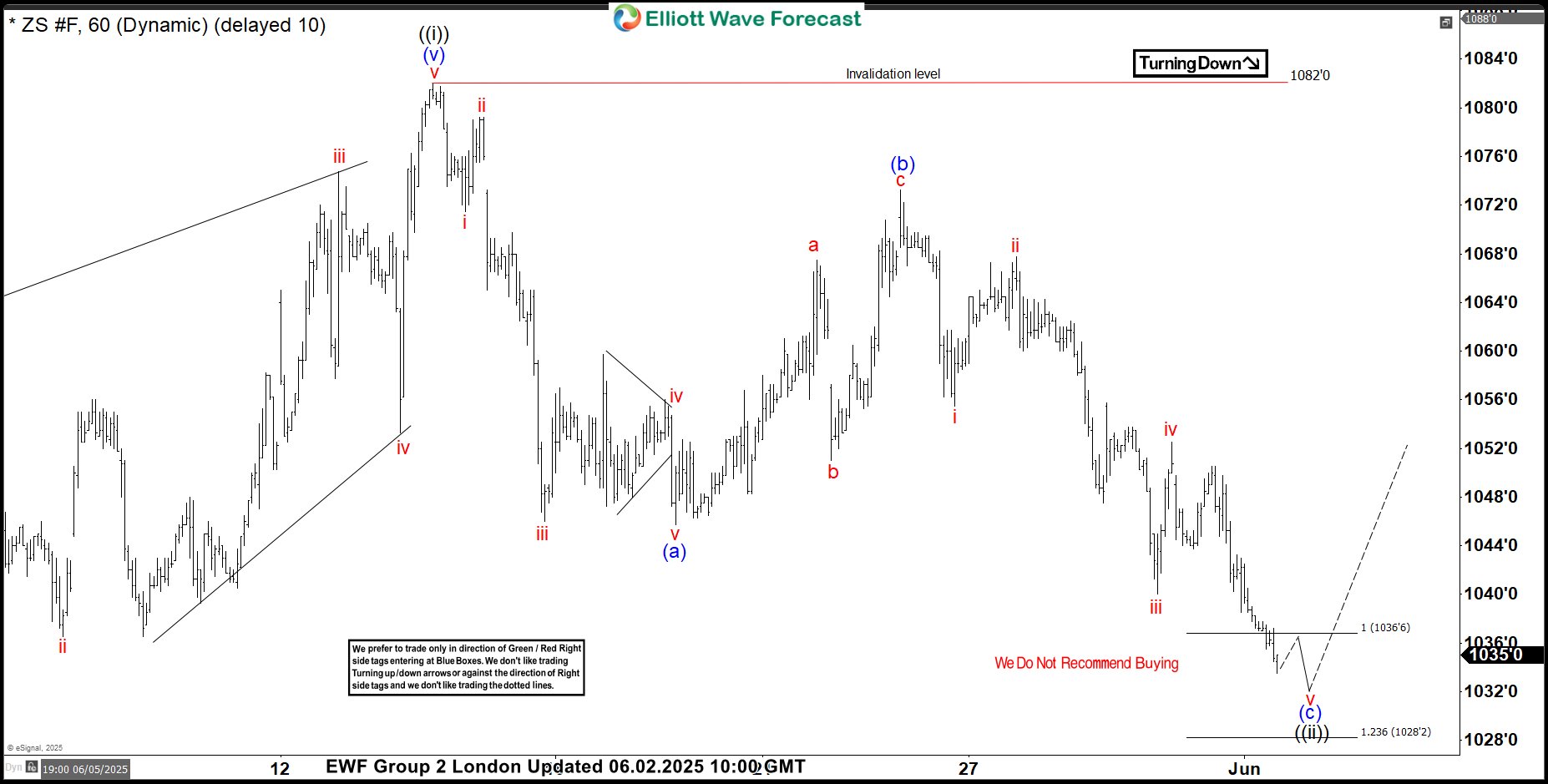

Soybeans (ZS_F) Forecasting the Rally After Elliott Wave Zig Zag Pattern

Read MoreHello fellow traders, In this technical article, we are going to present Elliott Wave charts of Soybeans commodity ZS_F . Recently ,the commodity completed its intraday Zig Zag correction at the Equal Legs zone. In the following sections, we will explain the Elliott Wave count. Before we take a look at the real market example, let’s […]

-

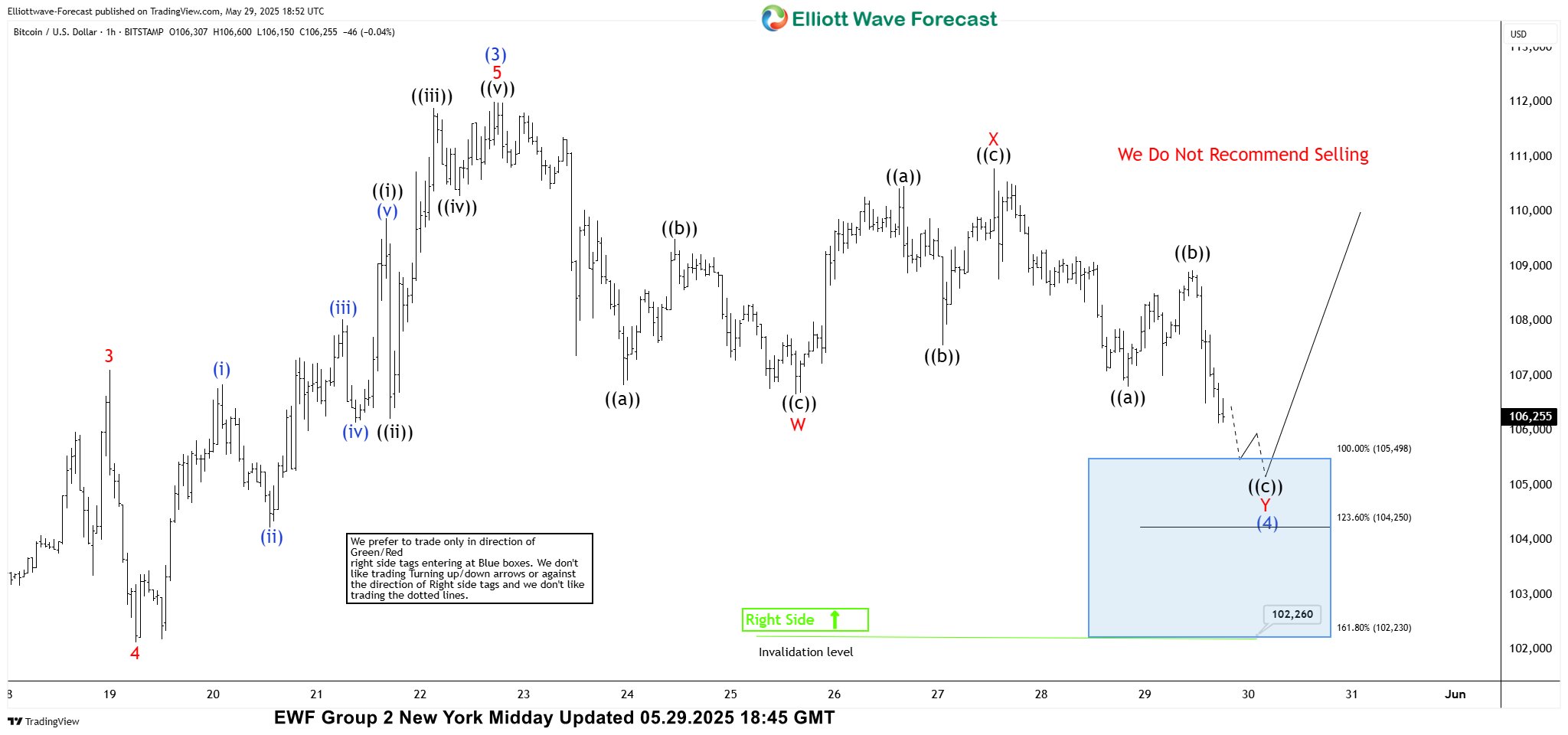

Bitcoin (BTCUSD) Elliott Wave : Buying the Dips at the Blue Box Zone

Read MoreIn this article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD published in members area of the website. BTCUSD is showing impulsive bullish sequences in the cycles from the 74,535 low, that are calling for a further strength. Recently we got a pull back that has reached the […]

-

USDSEK Elliott Wave : Setting Up for a Bearish Breakout

Read MoreHello fellow traders. In this technical article we’re going to look at the Elliott Wave charts of USDSEK forex pair published in members area of the website. As our members know USDSEK is still trading within the cycle from the 11.3229 peak. The pair has been giving us a decline as we expected. In the following […]