-

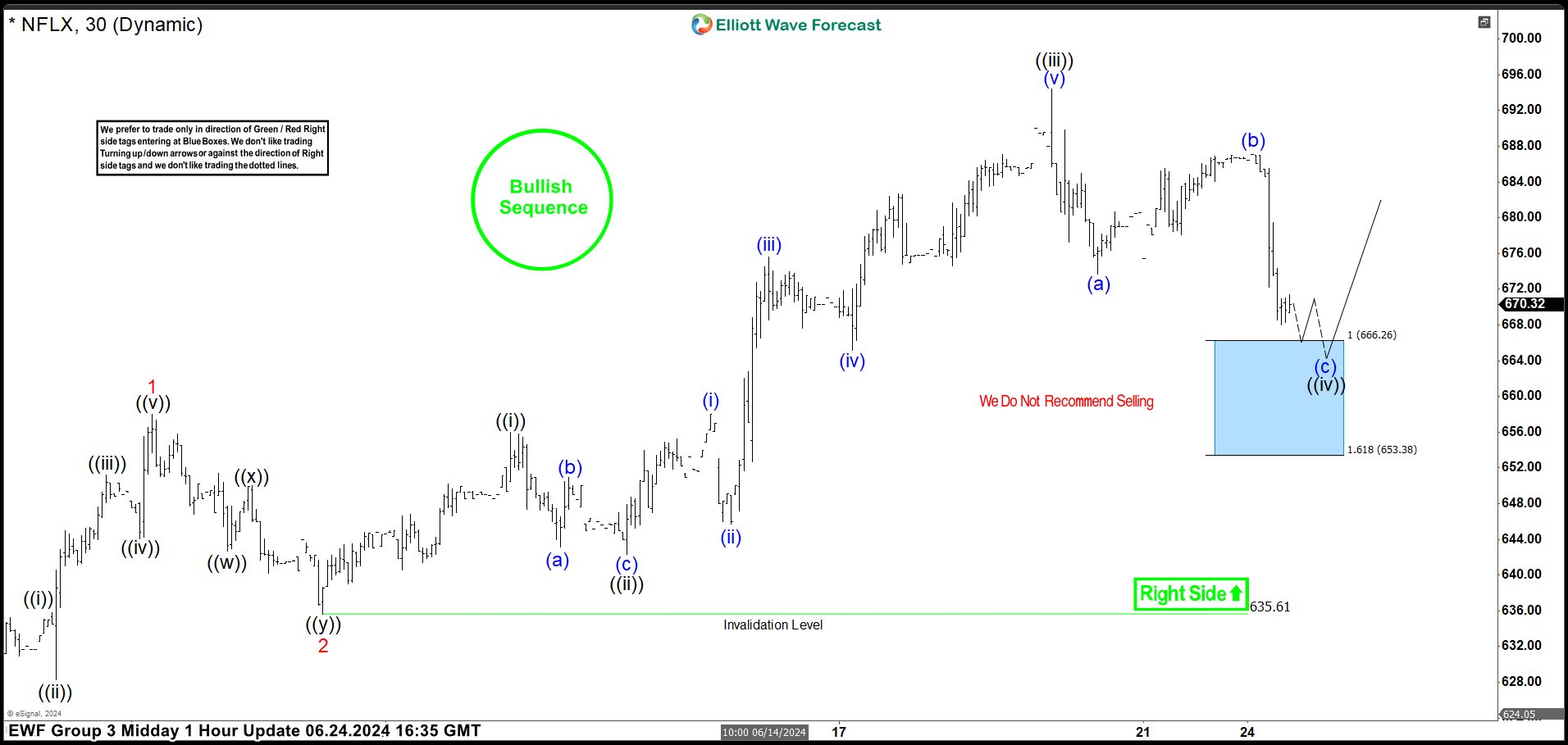

Netflix Stock (NFLX) Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Netflix (NFLX) Stock published in members area of the website. Our members are aware of the numerous positive trading setups we’ve had among stocks and indices recently. One of them is NFLX, which made a […]

-

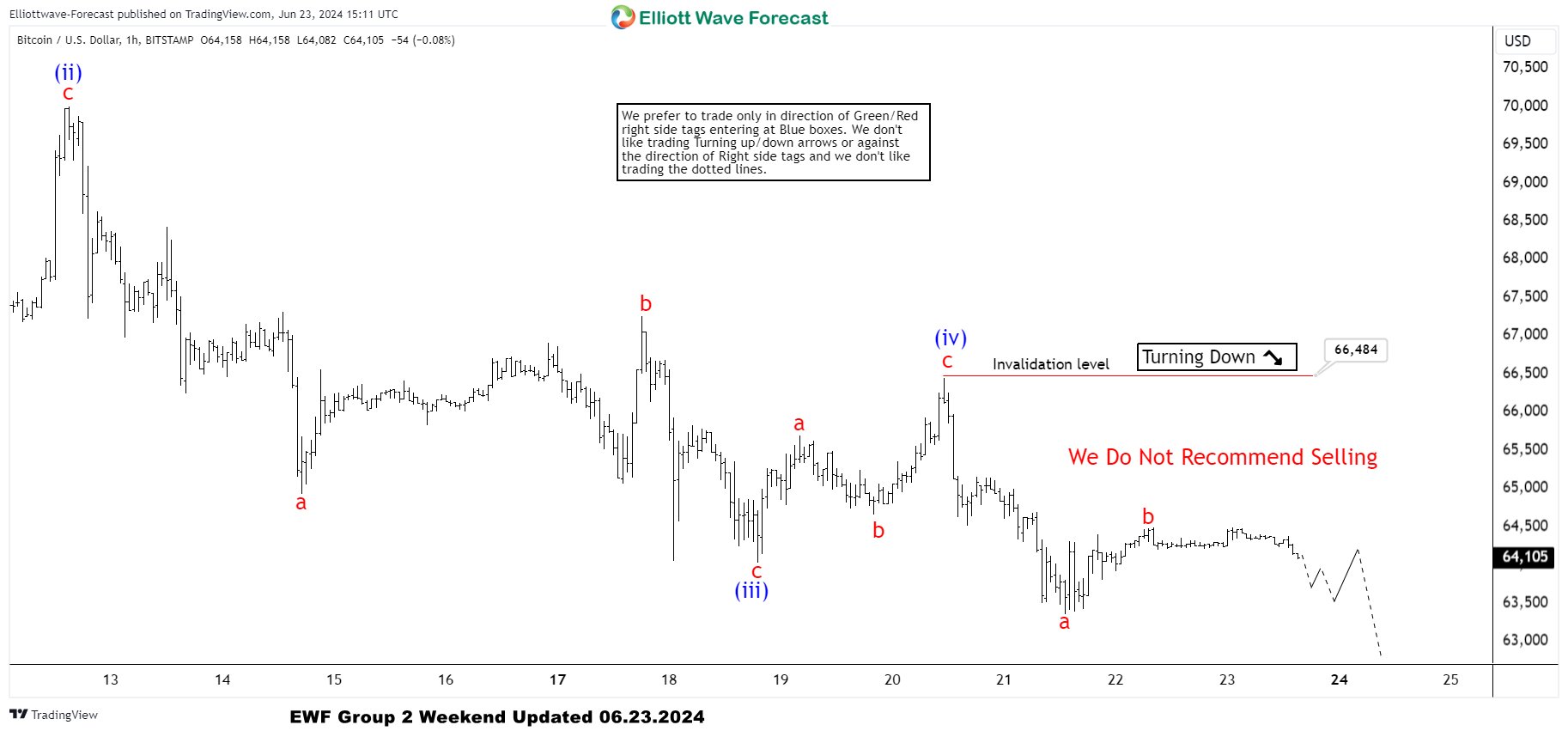

BTCUSD Elliott Wave : Forecasting the Decline Toward New Lows

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD , published in members area of the website. As our members know, Bitcoin is doing a correction against the 56510 low, which is unfolding as a Flat pattern. Now, the crypto is showing impulsive sequences in […]

-

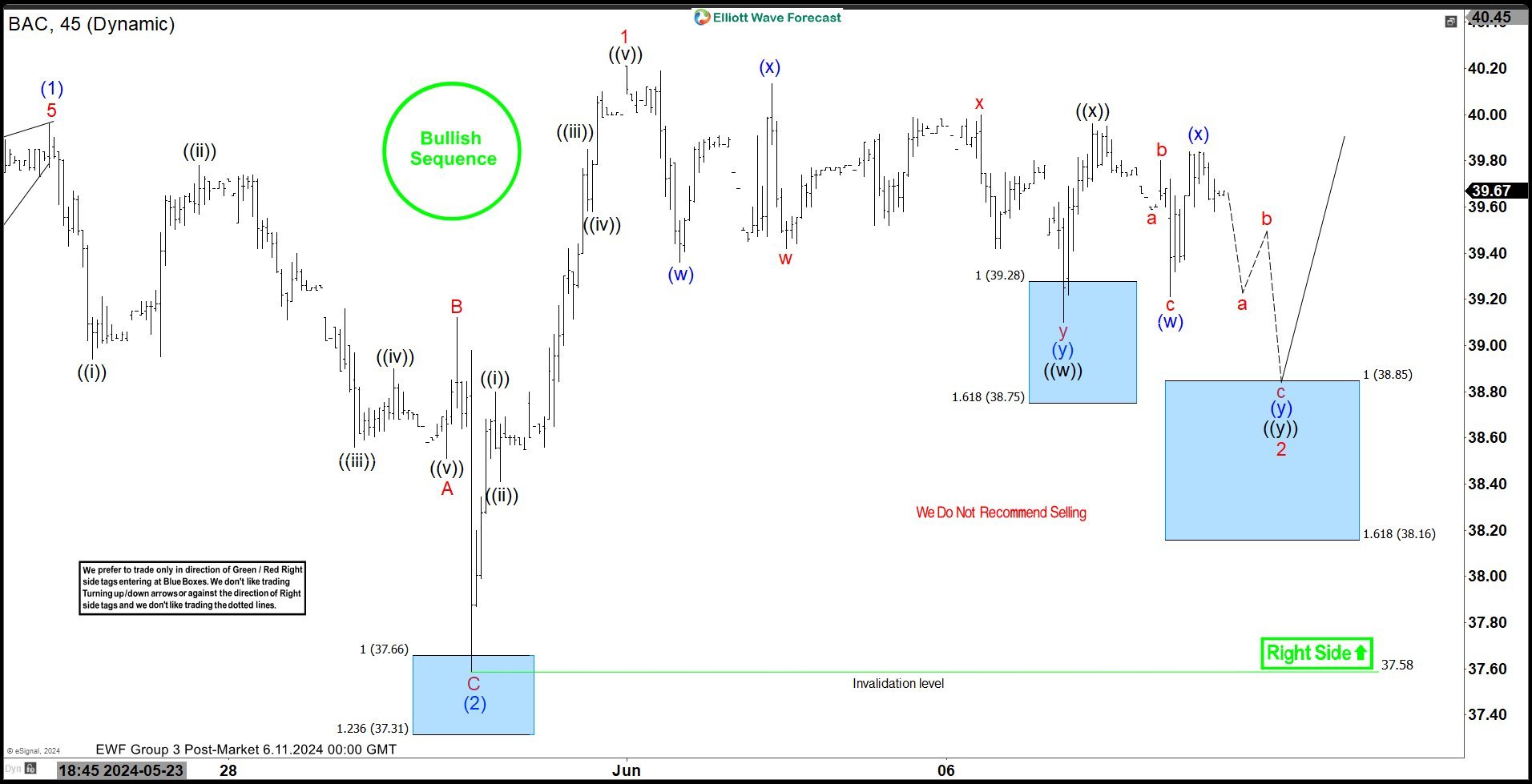

Bank of America Corp (BAC) Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Bank of America Corp (BAC) Stock published in members area of the website. Our members are aware of the numerous positive trading setups we’ve had among Stocks and Indices recently. One of them is BAC […]

-

Exxon Mobil Corp (XOM) Found Sellers at the Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Exxon Mobil Stock (XOM) published in members area of the website. As our members know the stock has been showing incomplete sequences in the cycle from the April 12th peak. Recently XOM has given us […]

-

AUDUSD: Buying The Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of AUDUSD Forex pair , published in members area of the website. As our members know, AUDUSD has recently given us correction against the 0.63618 low. The pair reached our target zone and completed correction right at the Equal […]

-

SILVER (XAGUSD) Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical article, we’re going to take a look into the Elliott Wave charts of SILVER (XAGUSD), exclusively presented in the members’ area of our website. As our members know SILVER has recently made pull back that made clear 3 waves down from the May 20th peak . The commodity completed […]