-

Ethereum ( ETHUSD ) Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of ETHUSD published in members area of the website. As our members know, Ethereum has given us good buying opportunity recently . Our team recommended members to avoid selling , while keep favoring the long side […]

-

Ethereum ( ETHUSD ) Elliott Wave: Forecasting The Path

Read MoreHello traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Ethereum ( ETHUSD ) published in members area of the website. As our members know ETHUSD reached extreme zone ( buying zone) in the cycle from the April 16th peak. In further text we’re going to […]

-

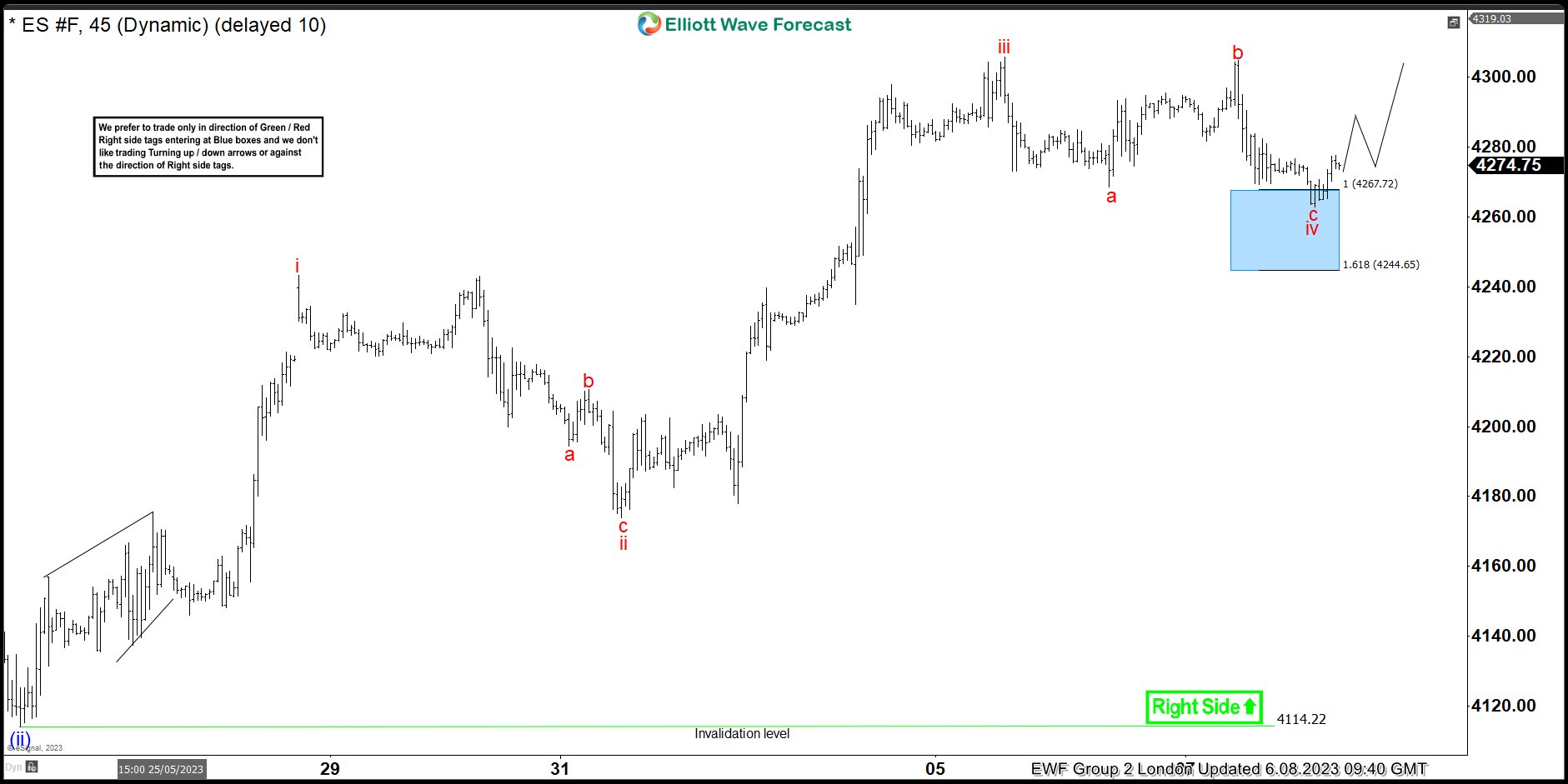

S&P 500 E-Mini Futures ( ES_F ) Made Rally From The Blue Box Area

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of E-Mini S&P 500 ( ES_F) published in members area of the website. ES_F is showing impulsive bullish sequences in the short term cycles. Recently we got a 3 waves pull back that has ended right at the […]

-

GBPCAD Forecasting The Path & Selling The Rallies At The Blue Box

Read MoreHello traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of GBPCAD published in members area of the website. Recently the pair made short term recovery against the 1.6931 peak that has reached the extreme zone. It made clear 3 waves up from the lows and made […]

-

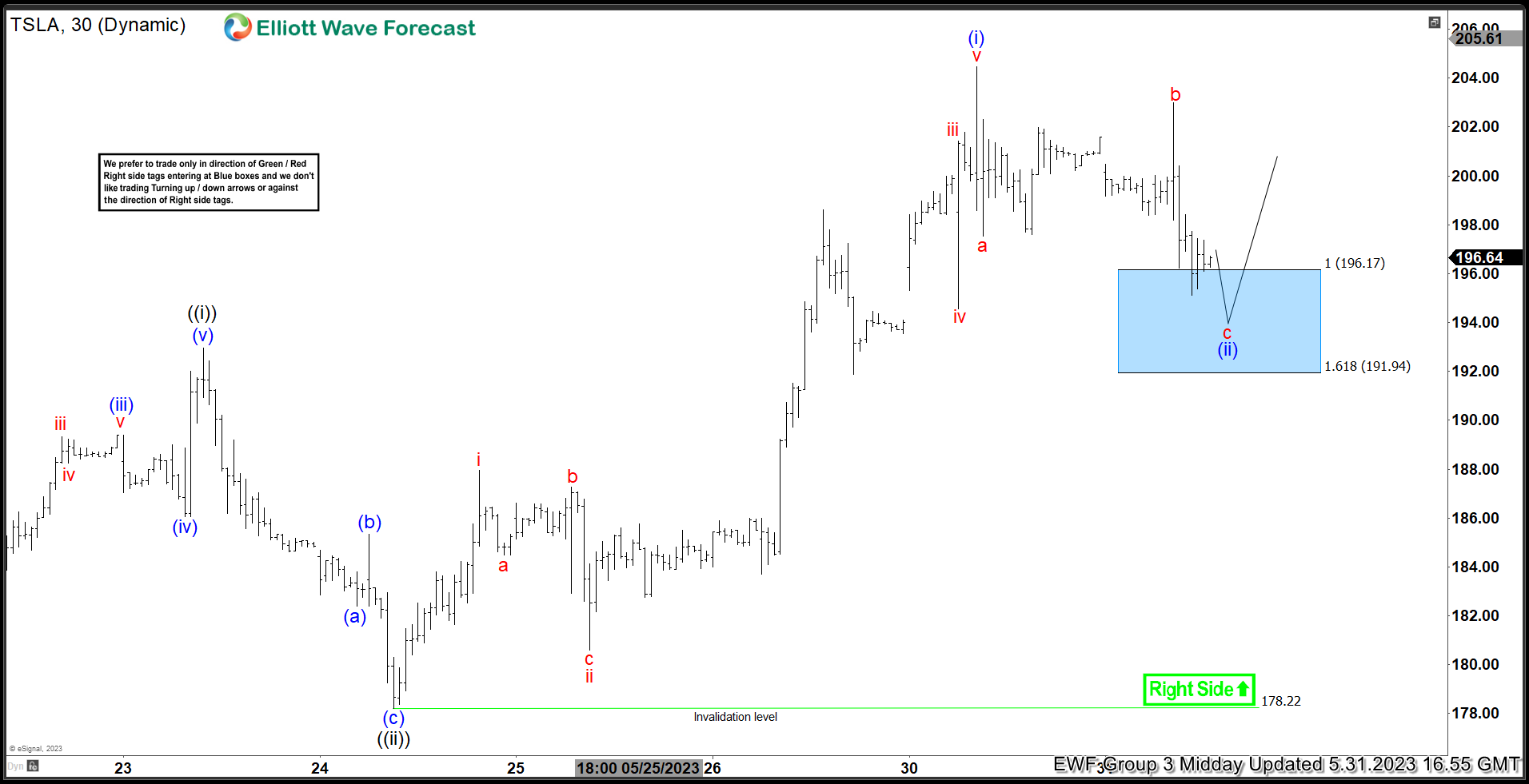

Tesla Stock ( $TSLA ) Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Tesla Stock ( $TSLA ) . As our members know, the stock is trading within the cycle from the April 27th low. We have been calling for the rally in the stock after 3 waves […]

-

USDCHF Found Sellers After Elliott Wave Double Three Pattern

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of USDCHF forex pair published in members area of the website. As our members know USDCHF has recently made recovery against the 0.944 04 peak that has unfolded as Elliott Wave Double Three Pattern. It made […]