-

BBY Best Buy Earnings Report 08/29/17 – Weekly ElliottWave Count

Read MoreBBY Best Buy Inc. earnings report due to this week, the 29th of August. Before we get into the details few words about the company we are about to analyze. According to Wikipedia, Best Buy Co. (NYSE: BBY), Inc. is an American multinational consumer electronics corporation headquartered in Richfield, Minnesota, a Minneapolis suburb. Internationally, it also operates in Canada and Mexico. It […]

-

HPQ HP Inc Earnings Report and Price Analysis for 08/23/17

Read MoreAccording to Nasdaq.com, NYSE HPQ HP Inc. is expected to report earnings on 08/23/2017 after market close. The report will be for the fiscal Quarter ending Jul 2017. According to Zacks Investment Research, based on 6 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.42. The reported EPS for the same quarter last […]

-

NASDAQ:GOOGL Awaiting New Highs with the new Google Android 8.0 OS Version

Read MoreBefore we get into the subject, Alphabet, Inc. is a holding company and engages in acquisition & operation of different companies and operates through the Google and Other Bets segments. The Google segment includes Internet products such as the Google Search engine, Google Ads, Google Commerce, Google Maps, YouTube, Apps, Cloud, Android, Chrome, Google Play […]

-

SILVER – GOLD VS US DOLLAR | Predicting the Reversal

Read MoreIntroduction | SILVER:XAG and GOLD:XAU Let’s start from what we know so far. Gold:XAUUSD has been devaluated by approximately 42% since 2011’s all times highs 1.920 level and Silver:XAGUSD has been devaluated by almost 73% respectively from 2011’s all times high 49.780 level. Plain and simple Gold has lost almost half of its value while […]

-

Spanish Elections: Destabilization and Implications

Read MoreSpain’s political environment post Sunday’s National Elections has been downgraded to unstable as it was forecasted prior to the 20th of December Elections day. The political scheme now in Spain is consider fragile and it seems it is closing towards the same path as Greece and Portugal, that is into political destabilization. Our pre-elections analysis, covering the Spanish topic in brief, EURUSD in light […]

-

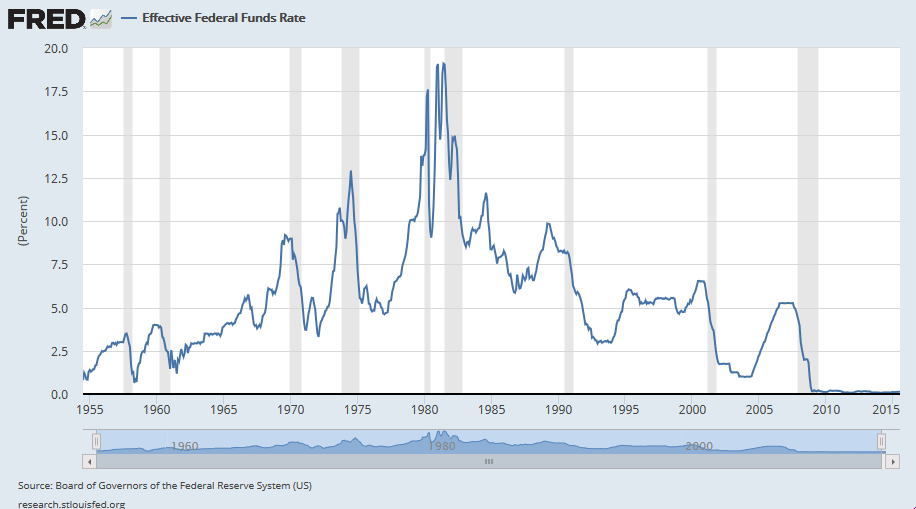

Into the FOMC Event

Read MoreWednesday the 16th of December at 17:00 UTC, the Federal Open Market Committee – FOMC is to announce decision on Fed Interest Rates and few minutes later to proceed with a press conference from FED’s Chair Mrs. Janet Yellen. While hike Expectations are currently holding at 90% in favor, it is to be seen if […]