-

AAPL Rebounding from Pullback to Continue Long-Term Bullish Trend

Read MoreAfter hitting a record high in December 2024, AAPL pulled back, retracing its bullish sub-cycle from January 2023. However, it has recovered more than half of the decline. The current rebound could reach a new high, but there is also a chance of a deeper double correction. In this blog post, we will explore both […]

-

PepsiCo May End The Bearish Cycle From 2023 Soon

Read MorePepsico ($PEP) has been in a bearish cycle since May 2023. However, the cycle is getting extreme and the sell-off may relax in the coming weeks or months. While we may not know what will trigger the buyers to find entries soon, traders should be aware of this key zone for opportunities. PepsiCo is a […]

-

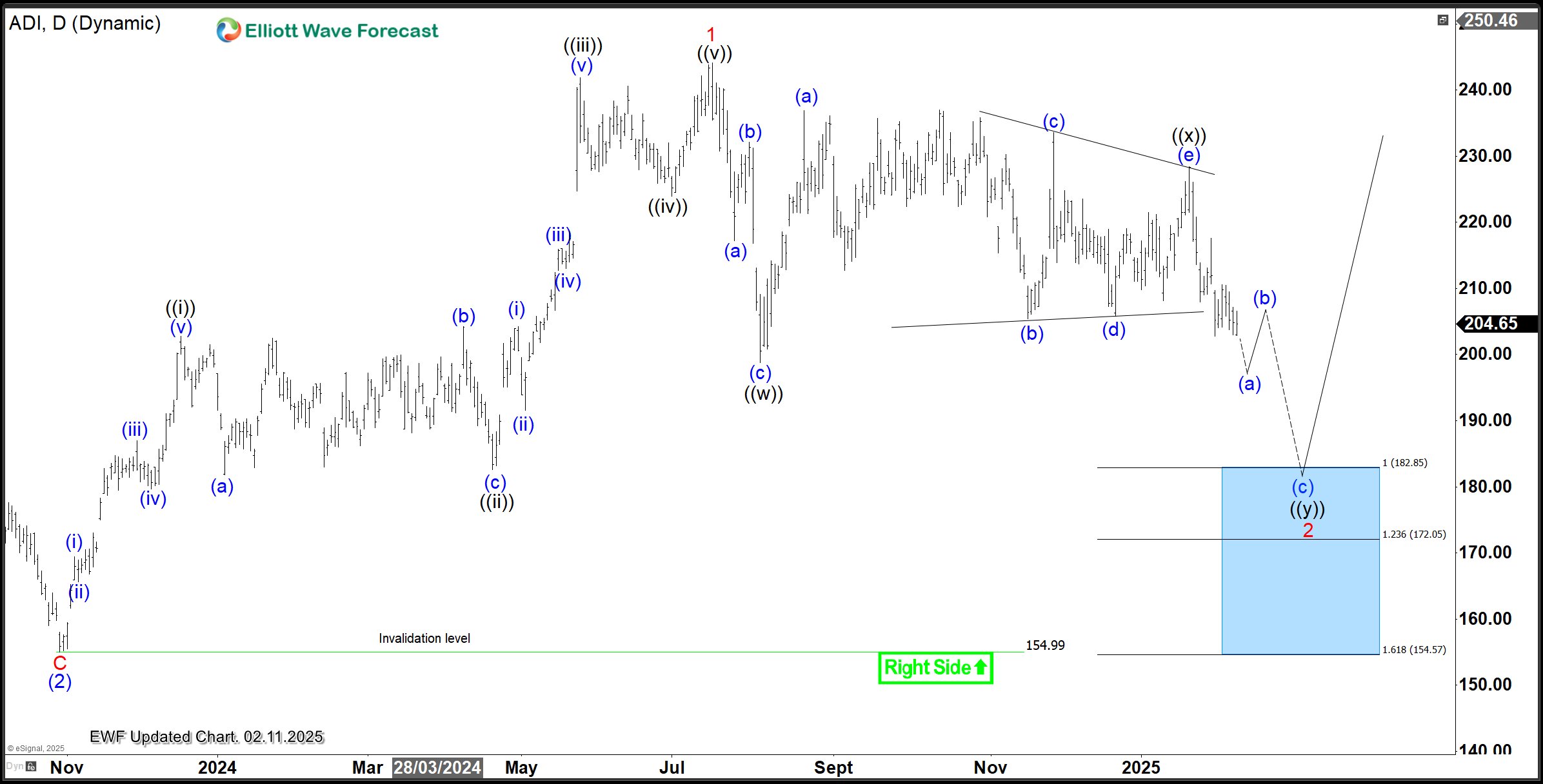

ADI Analysis: Buyers Await Next Blue Box After Booking Profit

Read MoreHello traders, welcome to another blog post discussing trading opportunities from the blue box. In this one, the spotlight will be on the Analog Devices, Inc. ADI. The post aims to reveal where to buy the ADI stock. Analog Devices, Inc. ADI is a global leader in designing and manufacturing integrated circuits and analog, mixed-signal, […]

-

TXN Gained 34% From Blue Box. A New Setup Is Close

Read MoreTXN gained 34% from the blue box where buyers went long in April 2024. While the stock has maintained the long term bullish sequence, the pullback from November 2024 may present another trading opportunity for buyers from the dip. In this blog post, we will explore this opportunity and see if we could get another […]

-

NASDAQ (NQ): Two Scenarios That Show Perfect Setup For Traders

Read MoreNASDAQ E-Mini Futures (NQ) appears to be extending the bullish sequence from October 2022. Will the sequence finish soon and lead to a big sell-off across the US indices? While the sequence persists, where should traders eye the next opportunity? The NQ chart is very clear. After the markets recovered from Covid in March/April 2020, […]

-

Chainlink (LINK) Elliott Wave Analysis Targeting $50 From Pullback

Read MoreChainlink (LINK) is set to extend the recovery from May 2023. However, it must finish the current pullback from the high of December 2024. Where will the pullback most likely finish for buyers to find fresh entries? Chainlink (LINKUSD) is a decentralized oracle network that enables smart contracts on blockchains to securely interact with real-world […]