-

IWM Analysis: Where Should Buyers Look For Next Opportunity?

Read MoreIWM barely breached the November 2021 high before a significant pullback followed. However, the larger bullish cycle should resume in the coming weeks while current pullback ends above 161.69 pivot point. Where should buyers look for the next opportunity? The iShares Russell 2000 ETF (IWM) is one of the most widely traded exchange-traded funds (ETFs) […]

-

AMD Bearish Setup From Blue Box Turns Risk-Free for Sellers

Read MoreHello traders. Welcome to another ‘blue box’ blog post where we discuss trade ideas that Elliottwave-Forecast members took. In this one, we will discuss a recent AMD sell setup from the blue box. Looking at the big picture, we saw that $AMD completed a long-term bullish cycle. This cycle began in July 2015 and ended […]

-

Buyers await TonCoin at the Blue Box to Maximize Profits

Read MoreTonCoin ($TONUSD) is retracing the bullish sequence that gained over 700% between June 2023 and June 2024. Where next can buyers find opportunities? Toncoin (TON) is the native cryptocurrency of The Open Network (TON), a decentralized Layer 1 blockchain initially developed by Telegram. After Telegram ceased its involvement due to regulatory challenges, the project was taken […]

-

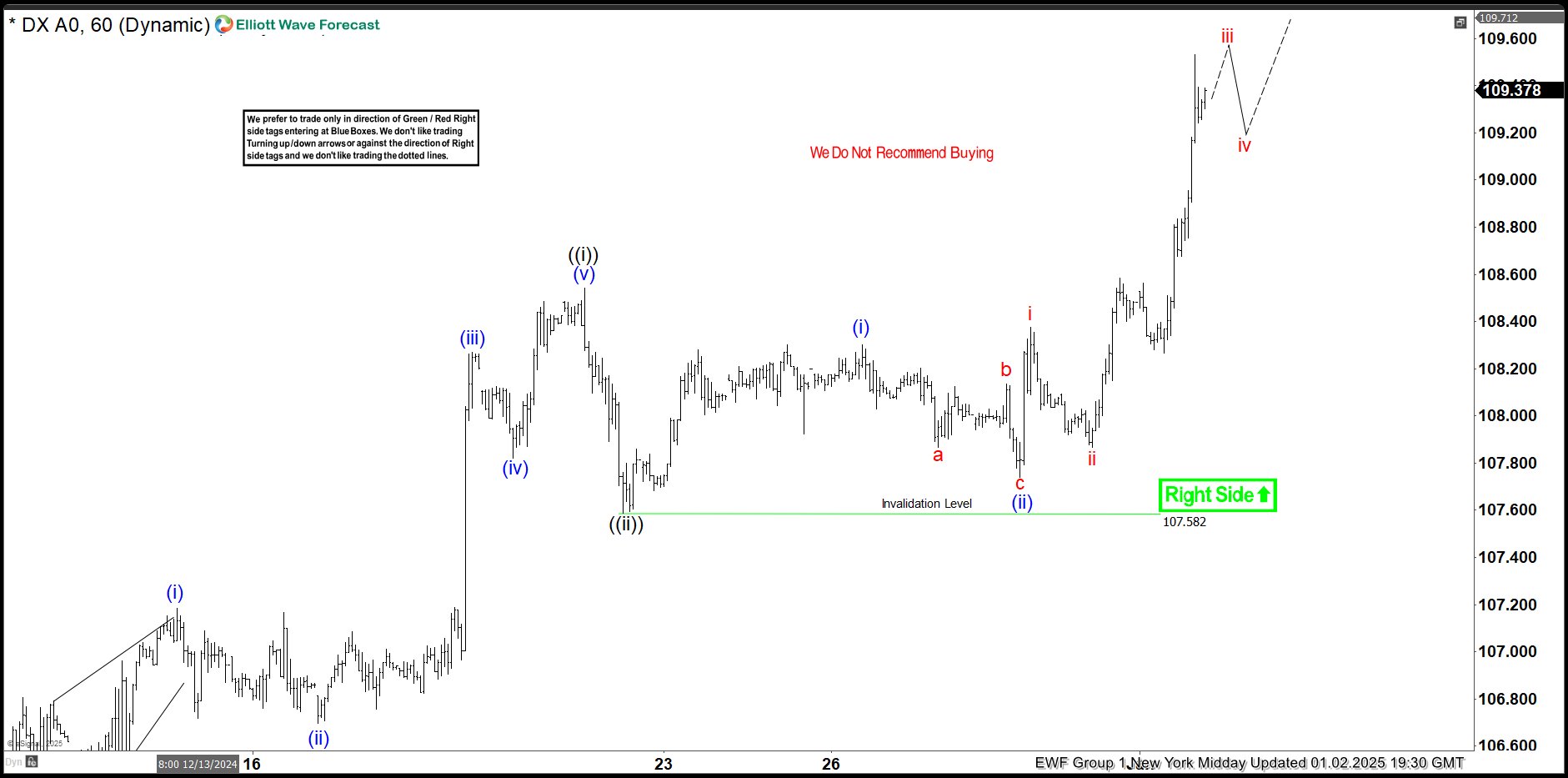

DXY Elliott Wave Analysis – Will USDX Hit $112 Soon?

Read MoreHello traders. Welcome to a new technical analysis blog post. In this one, the spotlight will be on the Dollar Index – DXY, amid a sustained rally since late September 2024. The Dollar Index (DXY) has gained about 9% since September. Thus, adding to the overall bullish corrective cycle from the July 2023 low. The […]

-

EURGBP Elliott Wave Analysis – where can sellers enter again?

Read MoreEURGBP has been one of the most fascinating currency pairs in the forex market for years. After a minor bounce in July, the pair broke lower again and is now approaching the March 2022 lows. Consequently, we expect the downside to continue for several weeks toward our projected targets. So, when and where should traders […]

-

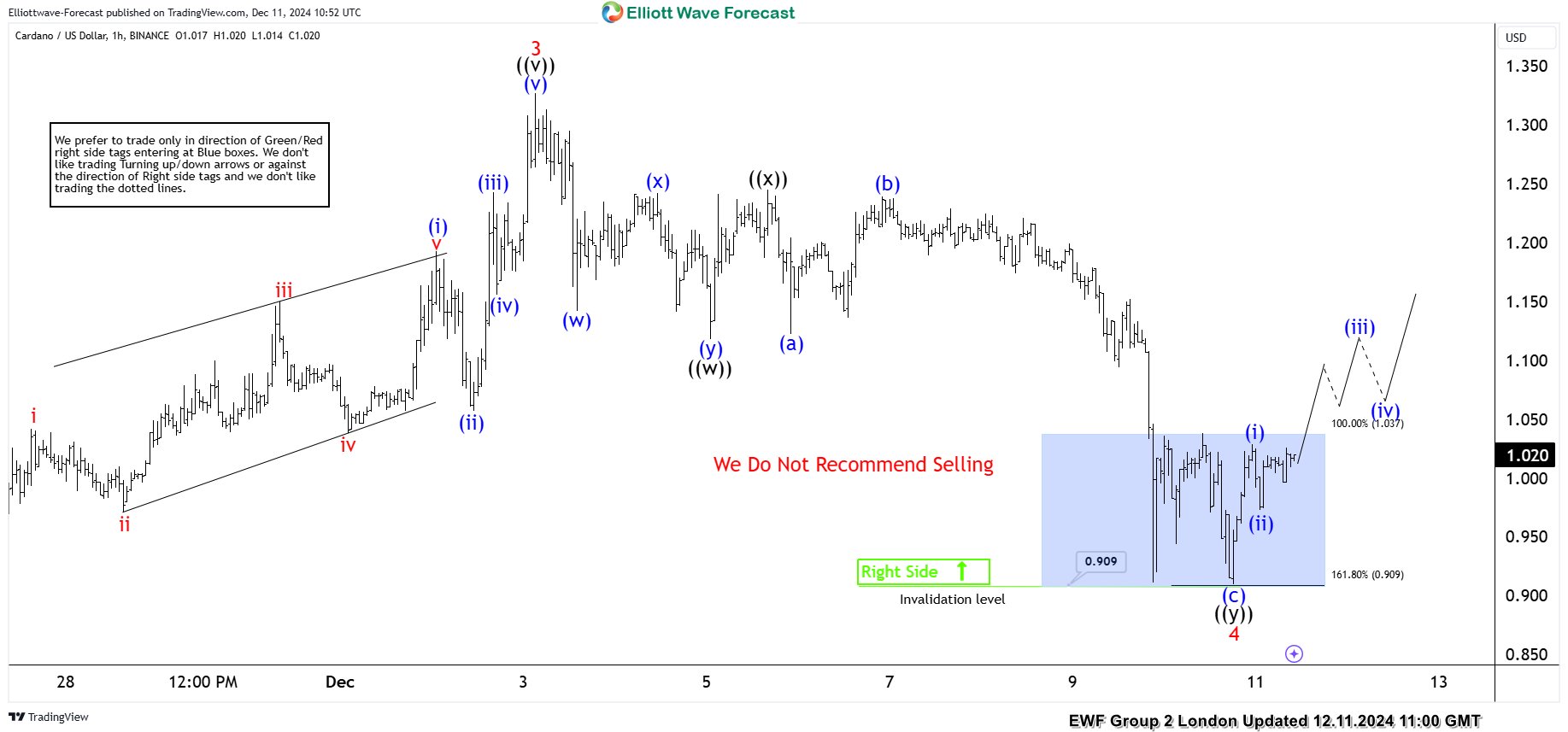

Cardano (ADAUSD) journeys toward $2 from blue box

Read MoreHello traders. Welcome to a new blog post where we discuss trades that Elliottwave-Forecast members took from the blue box. In this post, we will discuss Cardano with symbol ADAUSD ($ADA.X). Cardano is a decentralized blockchain platform and cryptocurrency (ADA) designed to provide a more secure and scalable infrastructure for the development of decentralized applications […]