-

TMUS Finds Blue Box Support, Jumps 7%, Starts Bullish Cycle

Read MoreTMUS may have started a new bullish cycle after ending the bearish cycle from 03.03.2025. Meanwhile, the corrective pullback ended with a 7-swing structure within a blue box. In the coming weeks, this resurgence could advance to a new bullish cycle. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, known for its aggressive […]

-

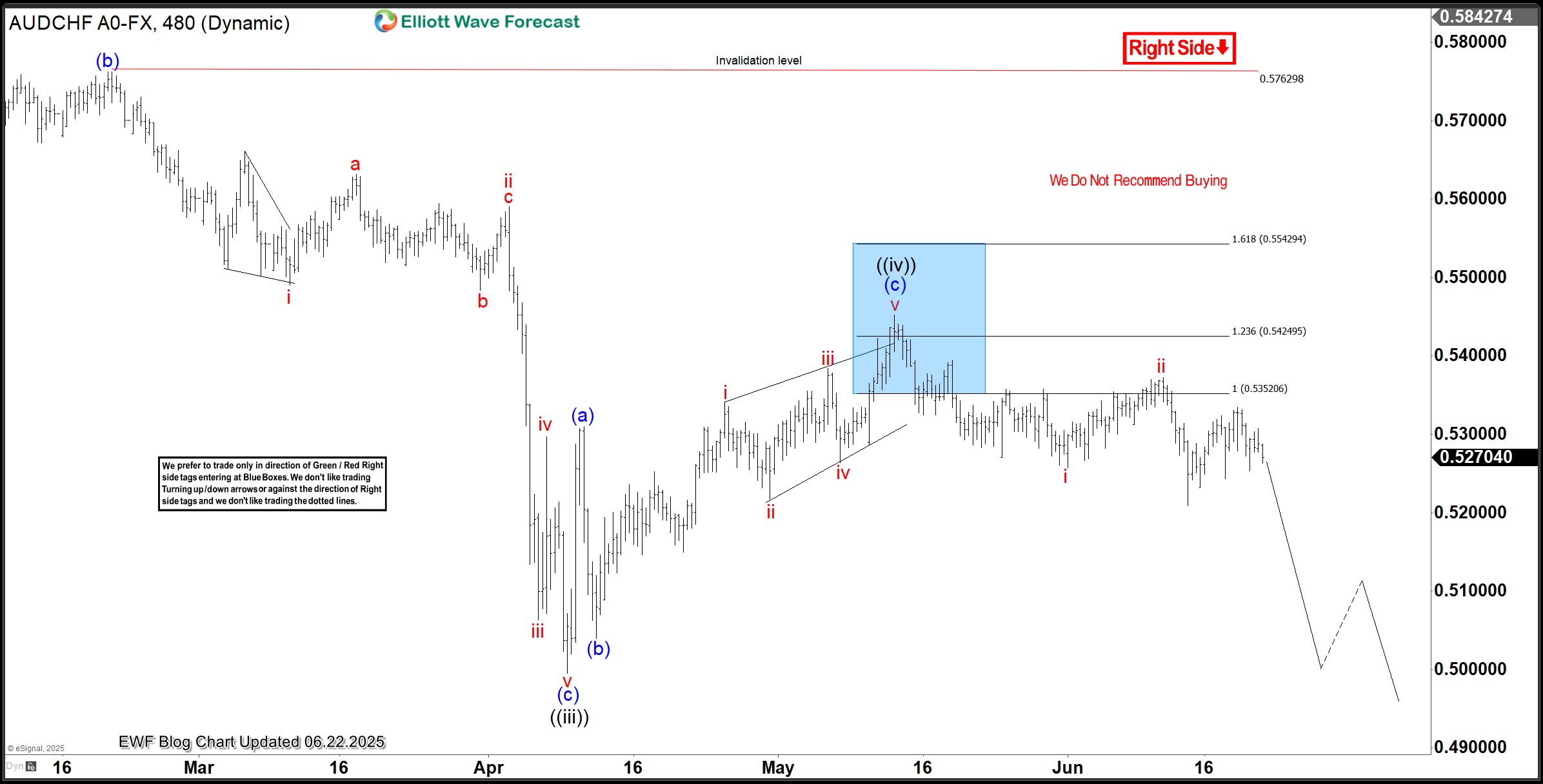

AUDCHF Sells From Blue Box, Aligning With Long-Term Bearish Sequence

Read MoreAUDCHF is on the verge of completing a multi-decade bearish cycle from April 1992. However, it appears sellers will continue to push in the shorter cycles. Thus, the pair should attract short-term sellers, while long-term sellers should watch out. AUDCHF has been in a long-term bearish cycle from April 1992 in a somewhat corrective sequence. […]

-

TXN Rallies 45% From Blue Box, Revives Bullish Sequence

Read MoreAfter completing the bearish cycle from November 2024 at the extreme of a double three correction, TXN has surged by over 45% from the blue box. This rally is re-establishing the all-time bullish cycle and specifically the cycle from October 2002. Buyers are expected to buy the dip as the upside remains favored. Texas Instruments […]

-

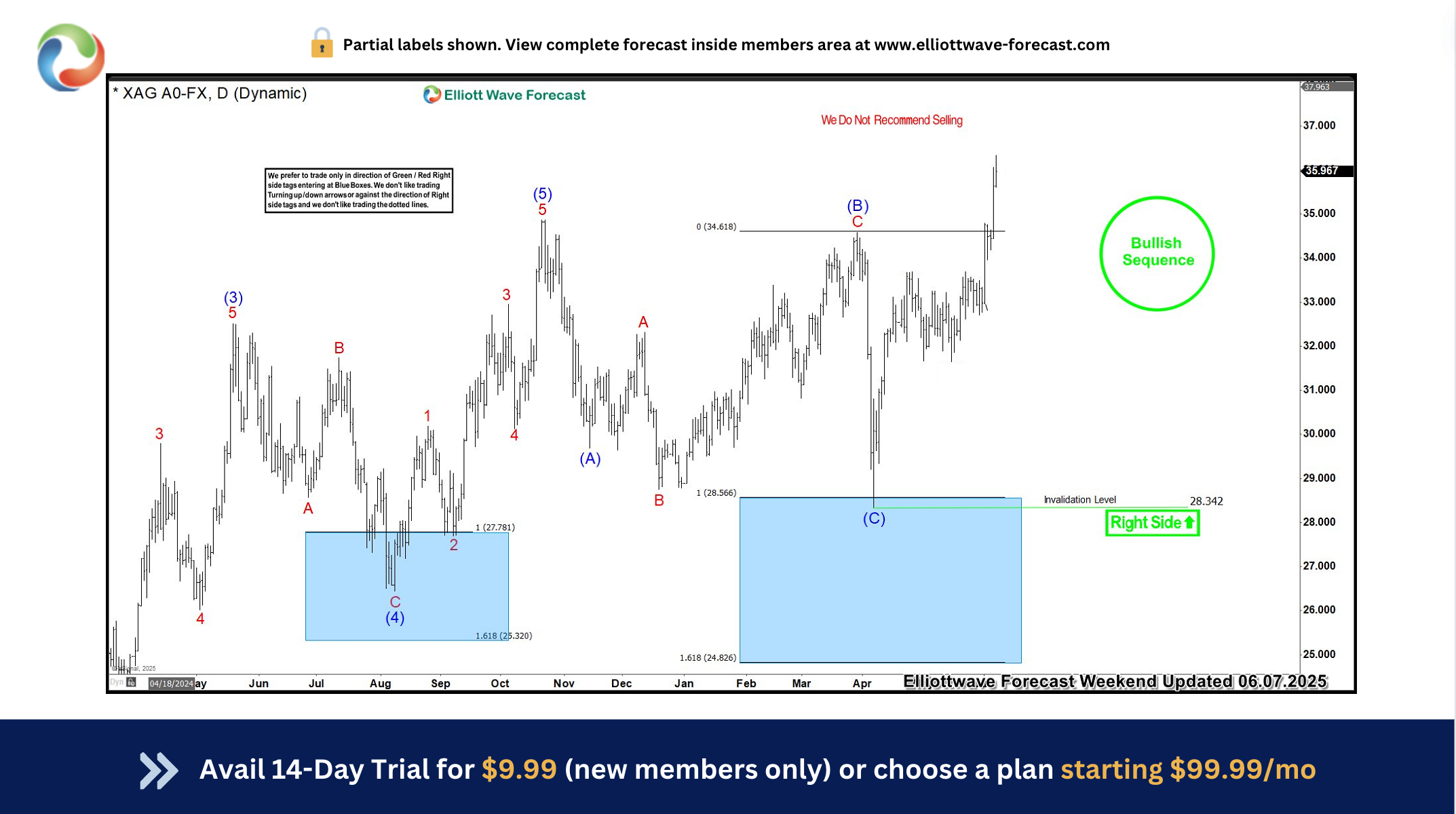

Silver (XAGUSD) Rallies 29% Following April Blue Box Buy Zone

Read MoreHello traders and welcome to another blue box post where we discuss trade setups. In this post, the spotlight will be on Silver amid the recent big break to the upside that might have taken many by surprise. Silver surprised many market participants when it breached its 2024 highs. The commodity has been one of […]

-

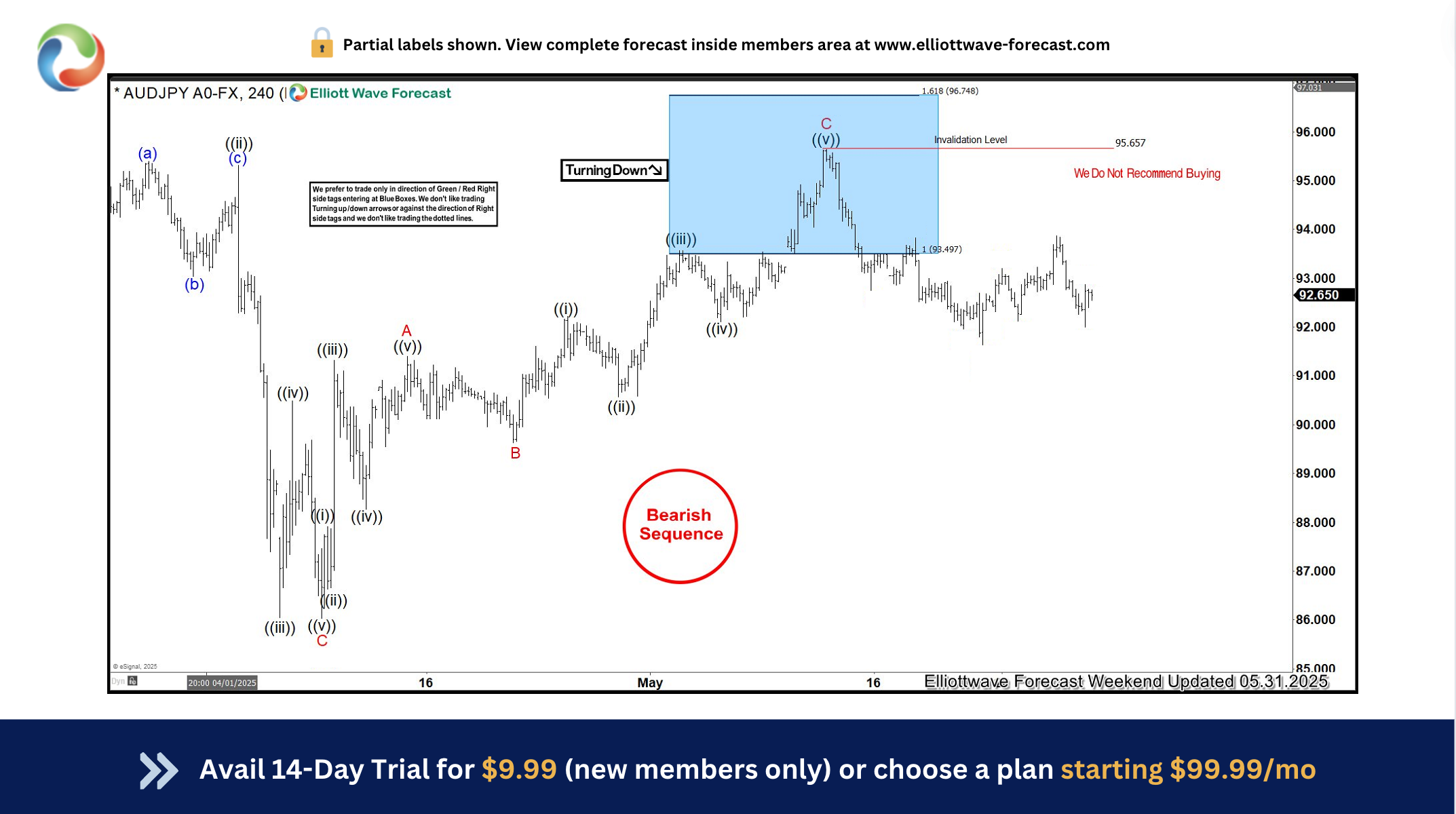

AUDJPY Trade Setup: Perfect Reaction From Blue Box

Read MoreHello traders. Welcome to another blue box post where we cover recent trades that Elliottwave-Forecast members took. This post is for educational purposes; to let readers see how we trade the blue box on all or charts across all the time frames. The spotlight will be on the AUDJPY currency pair. The Blue Box setup […]

-

TMUS Bullish Sequence Finding Blue Box Support, Targeting $400

Read MoreT-Mobile US Inc., TMUS, corrects against the long-term bullish sequence. Meanwhile, the pullback is evolving in a 7-swing structure and is close to the blue box. In this article, we will discuss the blue box where buyers will be waiting to buy the stock again. T-Mobile US (NASDAQ: TMUS) is a leading U.S. wireless carrier, […]