-

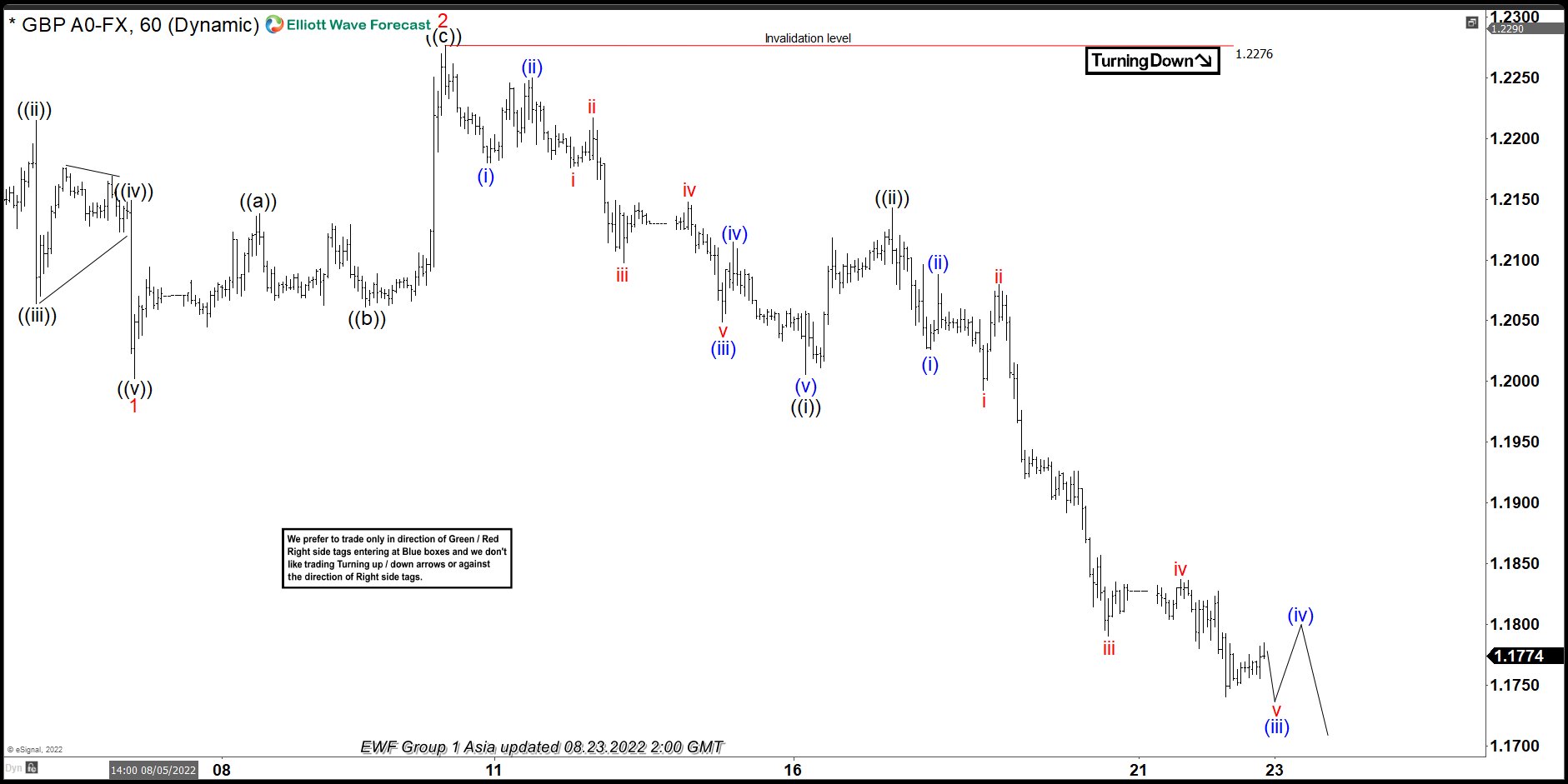

Elliott Wave View: GBPUSD Should Complete an Impulse Lower

Read MoreShort Term Elliott Wave View in GBPUSD suggests the rally from 7.14.2022 low ended a wave (4) hit our blue box in 4 hour chart at 1.2298. Then pair was rejected and did a leading diagonal structure as wave 1 ended at 1.2000. The market bounce doing a zig zag correction, testing the high and […]

-

Johnson & Johnson (JNJ) Should Continue Choppiness Before More Downside

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

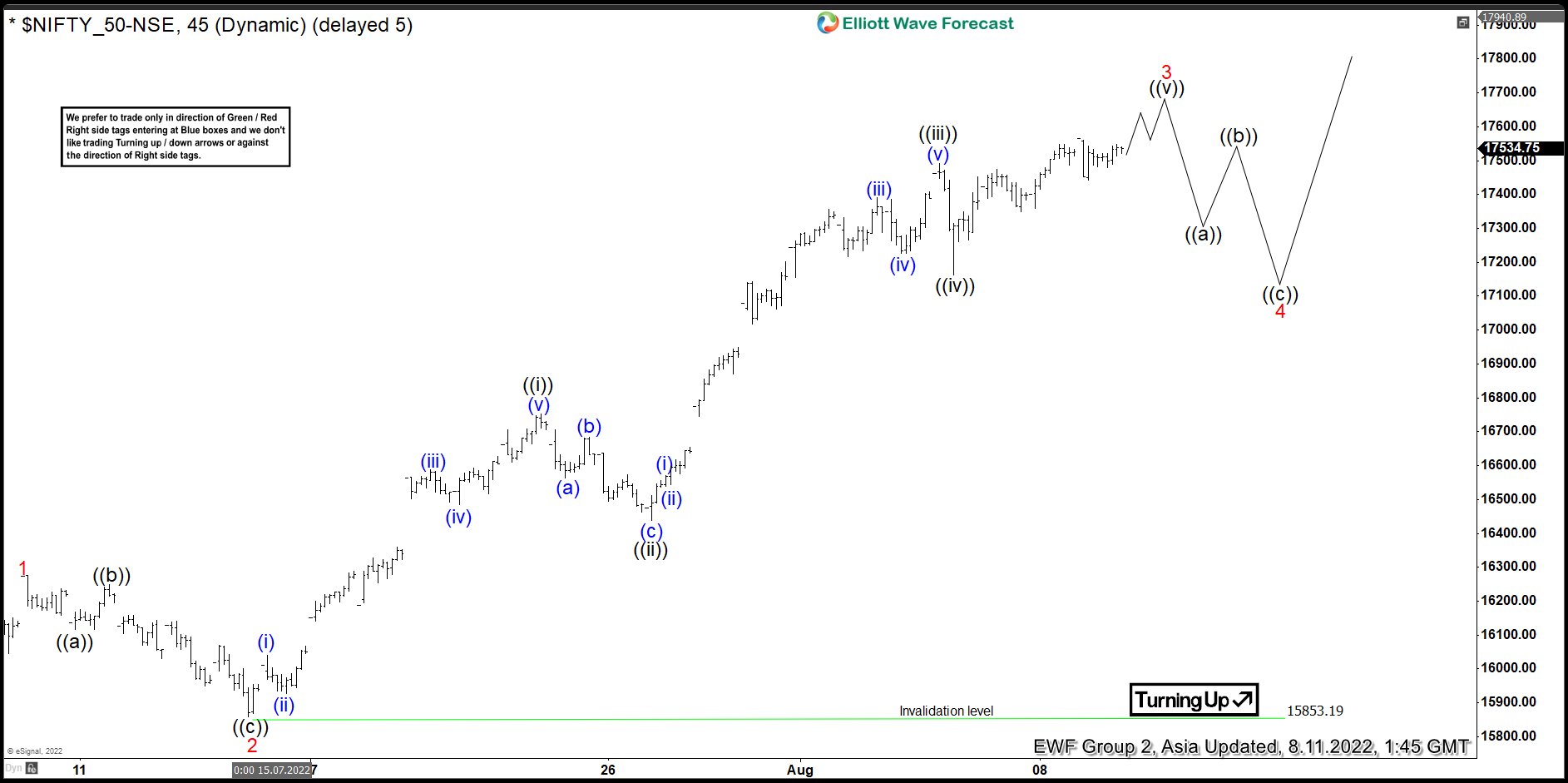

Elliott Wave View: Nifty Near Term Rally Should Extend

Read MoreNifty shows an impulsive rally from 6.17.2022 low and likely to see further upside. This article and video look at the Elliott Wave path.

-

If You Missed To Buy Palantir ($PLTR) You Have A New Opportunity

Read MorePalantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The Commercial segment offers services to clients in the private sector. The Government segment provides solutions to the United States (US) federal government and non-US governments. The firm […]

-

Starbucks ($SBUX) Ended A Double Correction And It Should Continue Higher

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks ($SBUX) Elliott Wave Analysis – […]

-

Elliott Wave View: 5 Waves Rally in SPX Suggests Further Upside

Read MoreSPX shows a 5 waves up from 6.17.2022 low suggesting further upside is expected. This article and video look at the Elliott Wave path.