-

Lithium ETF (LIT) Should See More Downside To Reach A Blue Box

Read MoreThe Global X Lithium & Battery Tech ETF (LIT) invests in the full lithium cycle, from mining and refining the metal, through battery production. The Global X Lithium & Battery Tech ETF (LIT) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Global […]

-

Block (SQ) Could Be Ready To Rally

Read MoreBlock, Inc. (formerly Square, Inc.) is an American multinational technology conglomerate founded in 2009 and launched its first platform in 2010. It became a public company since November 2015 with the ticker symbol SQ. Square is a payments platform aimed at small and medium businesses. It allows them to accept credit card payments and use smartphone or tablets as payment registers […]

-

Coke (KO) Long Term Structures And Key Levels

Read MoreThe Coca-Cola Company is an American multinational beverage corporation founded in 1892, best known as the producer of Coca-Cola. The Coca-Cola Company (KO) also manufactures, sells, and markets other non-alcoholic beverage concentrates and syrups, and alcoholic beverages. In this blog we are going to analyze the possible Elliott Wave structures that could occur in the long term in KO shares and the different […]

-

Shopify (SHOP) Rally Should Fail At Near Term

Read MoreShopify Inc. is a Canadian multinational e-commerce company headquartered in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. SHOP Daily Chart February 2023 Shopify ended a Grand Supercycle in July 2021 and we labelred as wave ((I)). Since then, […]

-

Do Not Buy NIO Stock Until It Breaks October 2022 Low

Read MoreNio Inc. (NIO) is a Chinese multinational automobile manufacturer headquartered in Shanghai, specializing in designing and developing electric vehicles. The company develops battery-swapping stations for its vehicles, as an alternative to conventional charging stations. The company has raised over $5 billions from investors. In 2021, it plans to expand to 25 different countries and regions by 2025. NIO Daily […]

-

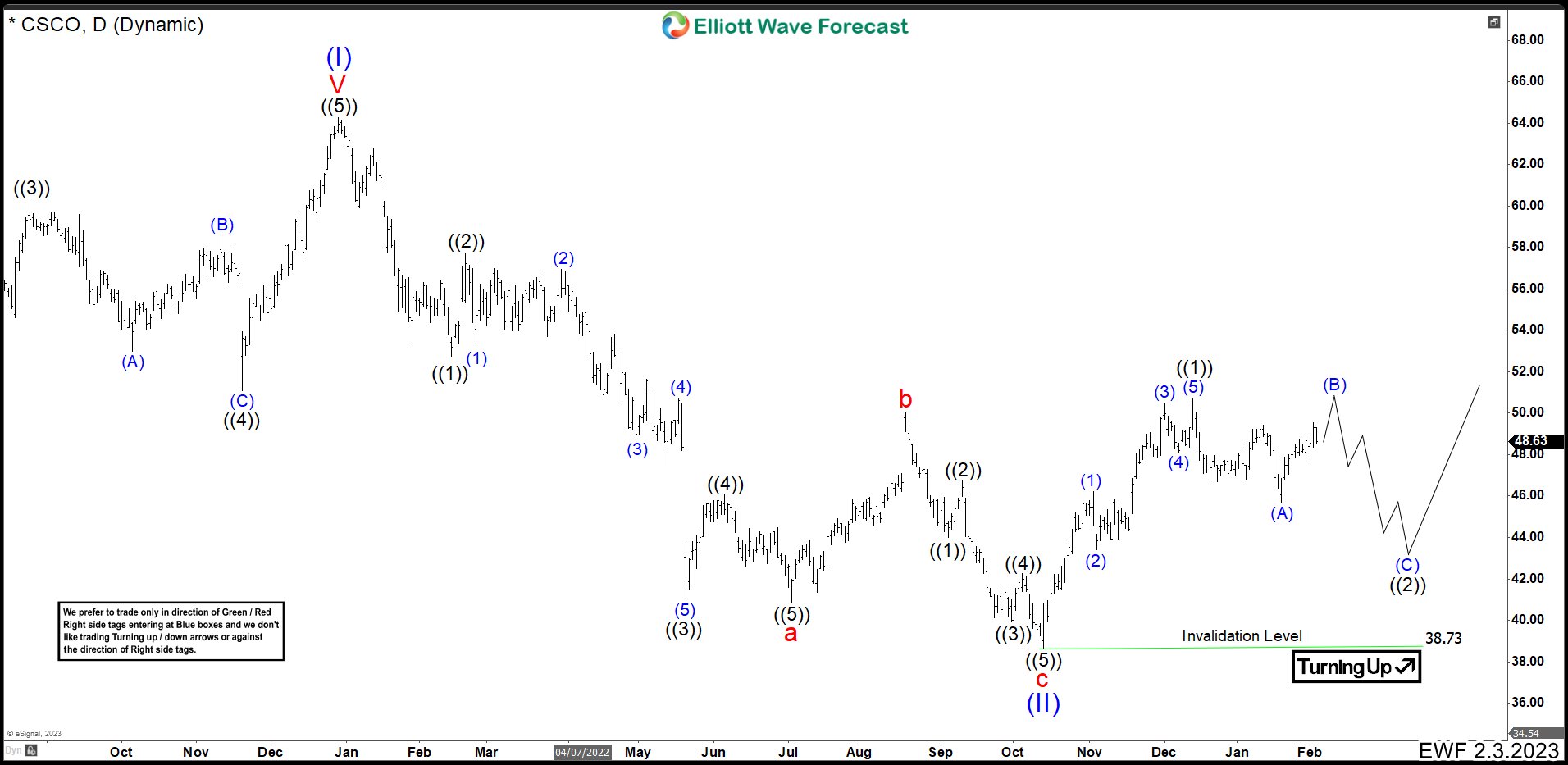

Cisco (CSCO) Ended a Bearish Cycle And It Should Continue With Rally.

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. Cisco specializes in specific tech markets such as: the Internet of Things (IoT), domain security, videoconferencing, and energy management with leading products including Webex, OpenDNS, Jabber, Duo Security, and Jasper. CSCO Daily Chart February 2023 At the end of 2021, Cisco finished […]