-

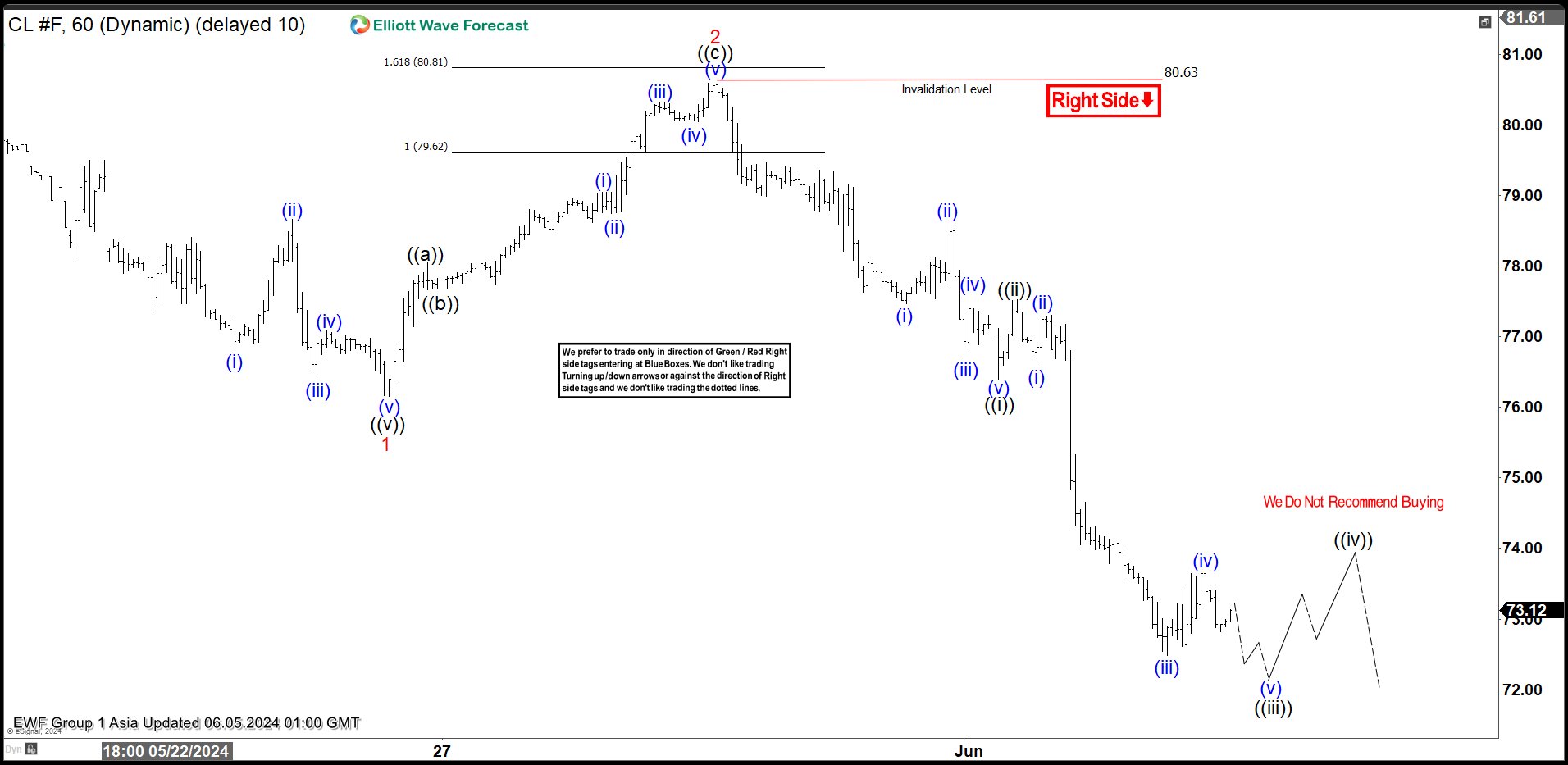

Short Term Elliott Wave Structure in Oil (CL_F) Favors Downside

Read MoreOil (CL_F) shows bearish sequence from 4.12.2024 high favoring more downside. This article and video look at the Elliott Wave path.

-

Elliott Wave Analysis on AMD Suggest a Double Correction

Read MoreShort Term Elliott Wave in AMD suggests the rally from 5.01.2024 low is in progress as an impulse. Up from 5.01.2024 low, wave (1) ended at 174.56 as the 30 minutes chart below showing. Wave (2) pullback is currently in progress. The internal subdivision of wave (2) takes the form of a double three Elliott […]

-

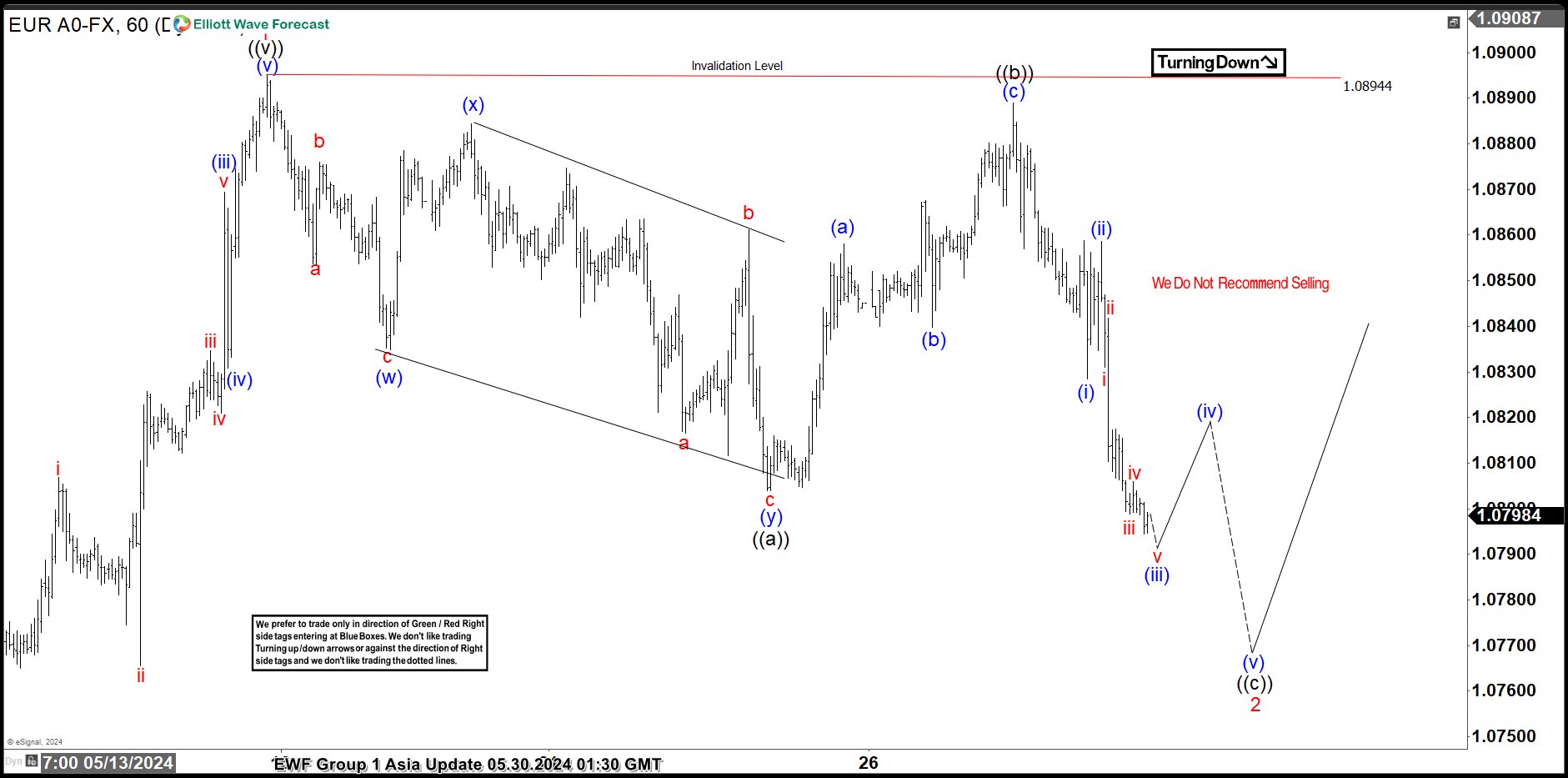

Elliott Wave Analysis Expects a Flat Correction as Wave 2 in EURUSD

Read MoreShort Term Elliott Wave in EURUSD suggests rally from 4.16.2024 low unfolded as a 5 waves impulse Elliott Wave structure. Up from 4.16.2024 low, wave ((i)) ended at 1.0753 and pullback in wave ((ii)) ended at 1.0649. The pair extends higher again in wave ((iii)) ended at 1.0812 and correction in wave ((iv)) towards 1.0723 low. […]

-

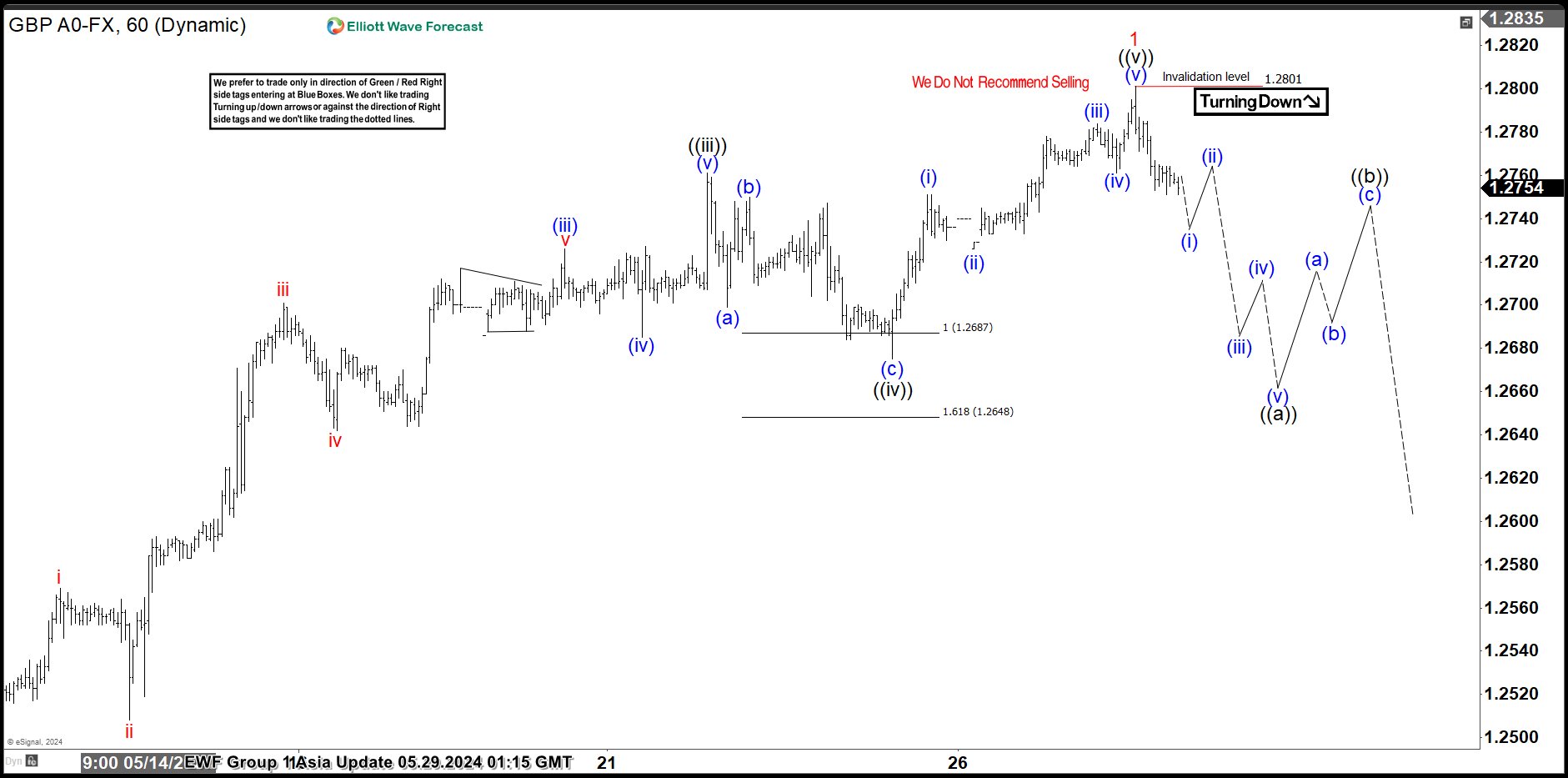

Elliott Wave Analysis Expects GBPUSD to Pullback in Wave 2

Read MoreShort Term Elliott Wave in GBPUSD suggests rally from 4.22.2024 low unfolded as a 5 waves impulse Elliott Wave structure. Up from 4.22.2024 low, wave ((i)) ended at 1.2635 and pullback in wave ((ii)) ended at 1.2445. The pair extends higher again in wave ((iii)) with internal subdivision as an impulse in lesser degree. The […]

-

Elliott Wave Analysis Expects Nasdaq Futures (NQ) Continue Higher

Read MoreShort Term Elliott Wave in Nasdaq Futures (NQ) suggests the rally from 4.19.2024 low is in progress as an impulse. Up from 4.19.2024 low, wave ((i)) ended at 17949 and dips in wave ((ii)) ended at 17386. The NQ extended higher in wave ((iii)) with internal subdivision as another impulse in lesser degree. Up from wave […]

-

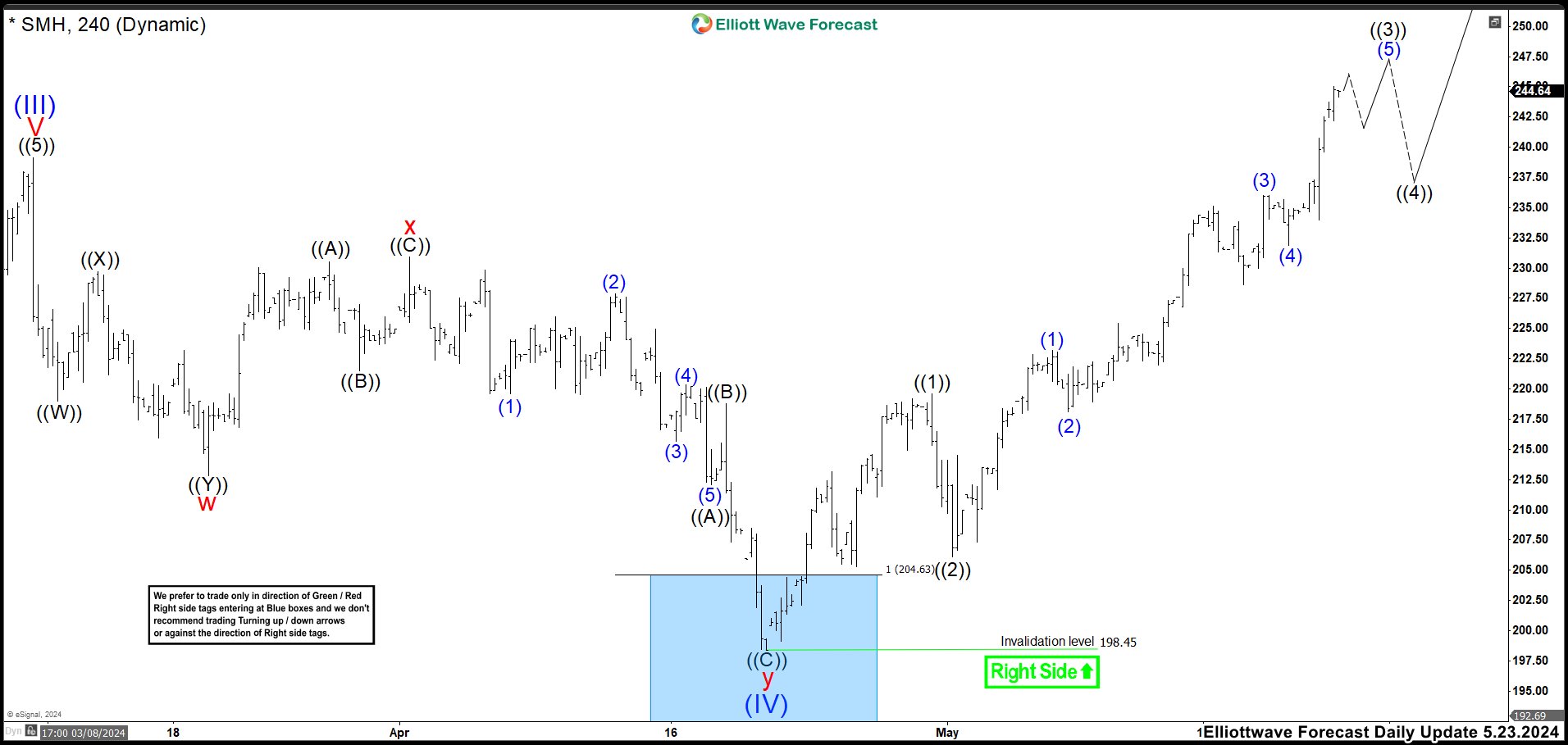

SMH Semiconductor ETF Reacted from a Blue Box Breaking to New Highs

Read MoreThe VanEck Semiconductor ETF (SMH) is an exchange-traded fund that tracks a market-cap weighted index composed of 25 of the largest U.S.-listed semiconductor companies. The top holdings of SMH include companies like NVIDIA, Taiwan Semiconductor Manufacturing, Broadcom Inc., Texas Instruments, QUALCOMM, ASML Holding N.V., Applied Materials, Inc., Lam Research Corporation, Micron Technology, Inc., and Advanced Micro Devices, Inc. SMH 4 Hour Chart April 19th In March 2024, the ETF […]