-

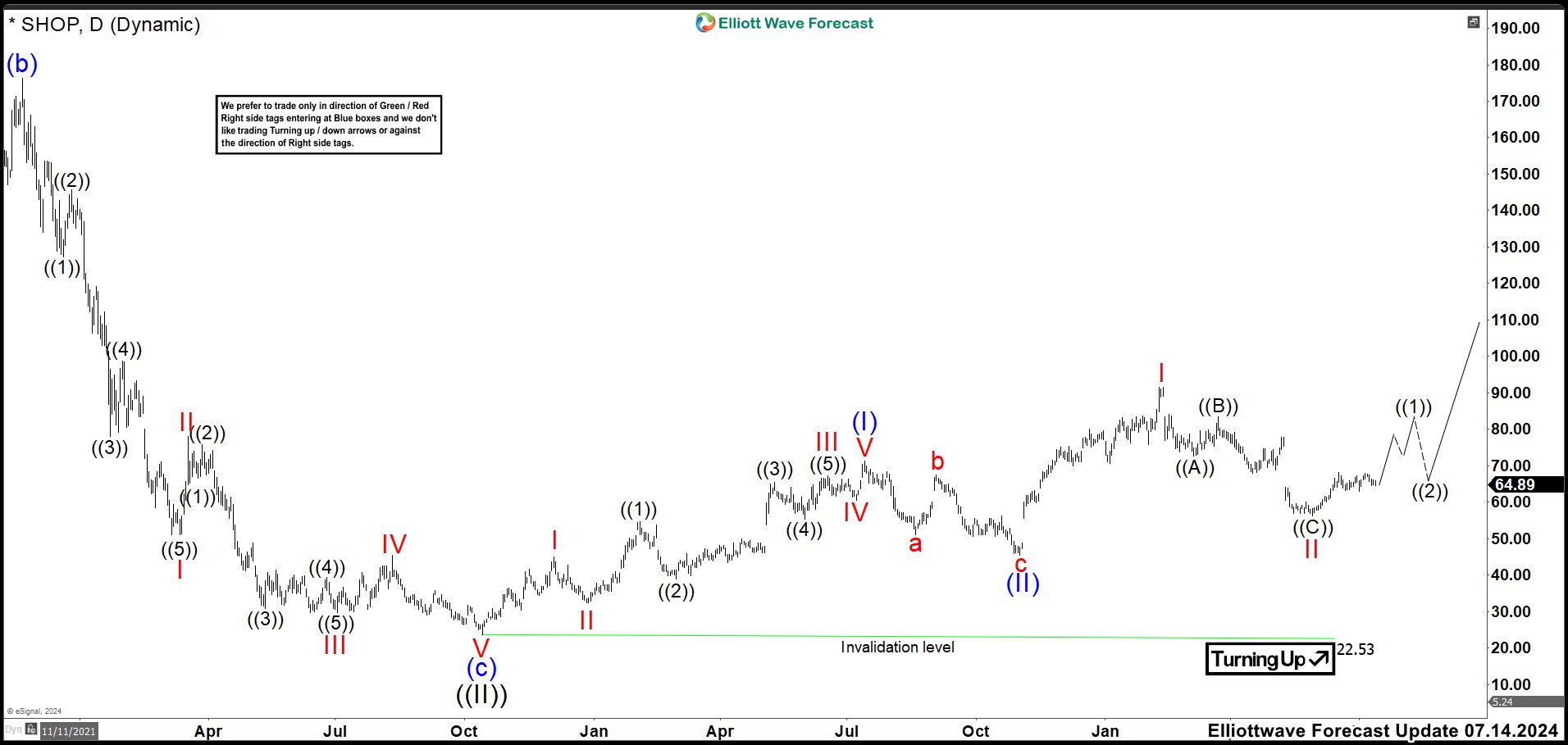

Shopify (SHOP) is Nesting looking for a Rally

Read MoreShopify Inc. is a Canadian multinational e-commerce company in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. SHOP Daily Chart July 2023 Shopify ended a Grand Supercycle in July 2021 and we labeled it as wave ((I)). Since then, […]

-

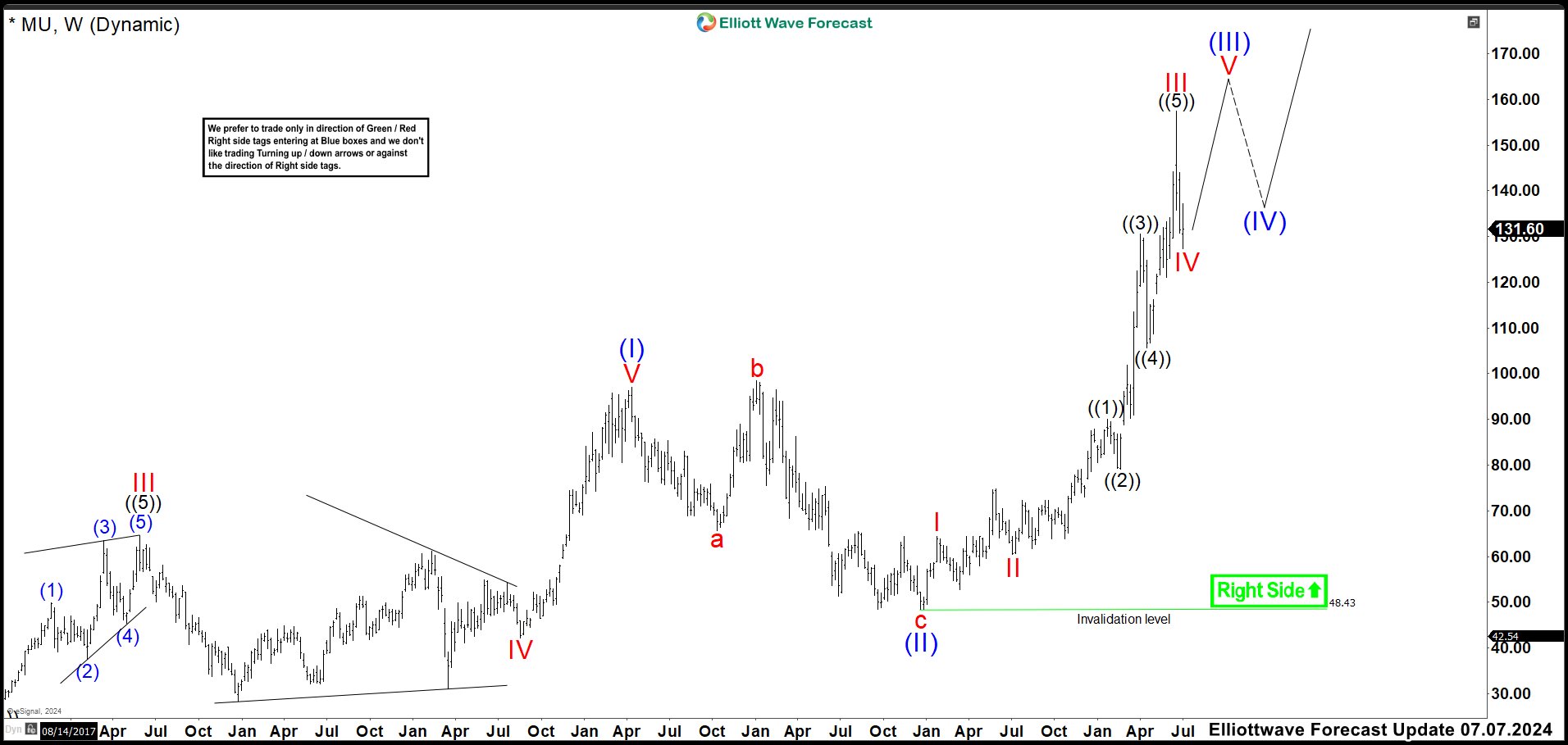

Micron Technology Inc (MU) Rallied as Expected Making More than 200%

Read MoreMicron Technology, Inc. (MU) designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho. MU Weekly Chart March 2023 The last time […]

-

JNJ Should Rally Soon or See 3 Swings Higher At Least

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

The Party at JPMorgan (JPM) Must Continue

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

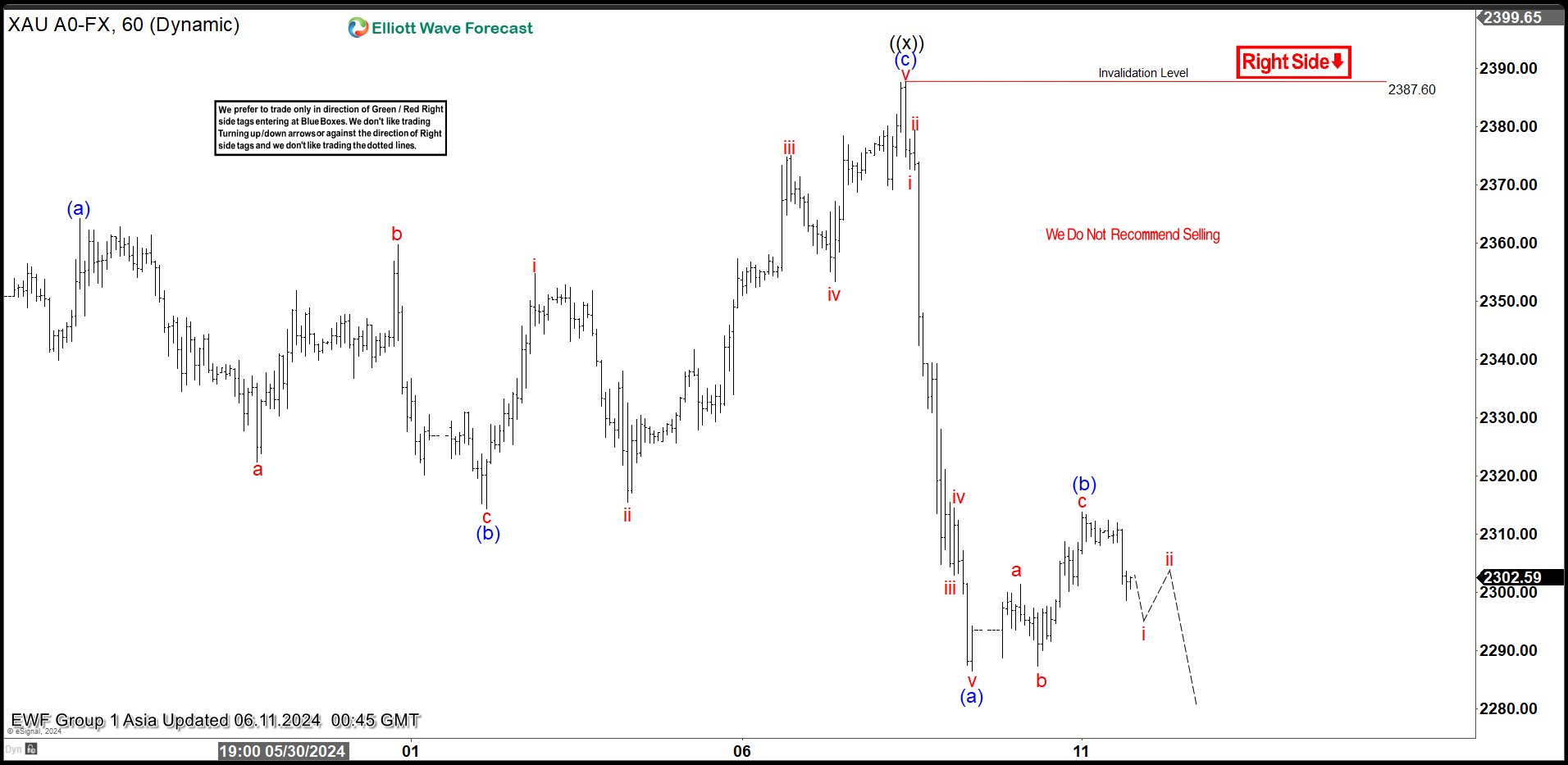

Elliott Wave Analysis Expects Gold (XAUUSD) to Pullback a Bit More

Read MoreGold (XAUUSD) is looking to pullback a bit more to end cycle at the extreme area from 5.20.2024 high before the metal resumes higher.

-

McDonald’s MCD Started a Retracement as Wave (II)

Read MoreMcDonald’s (MCD) is the world’s largest fast food restaurant chain, serving over 69 million customers daily in over 100 countries in more than 40,000 outlets as of 2021. It is best known for its hamburgers, cheeseburgers and french fries, although their menu also includes other items like chicken, fish, fruit, and salads. McDonald’s MCD Weekly […]