-

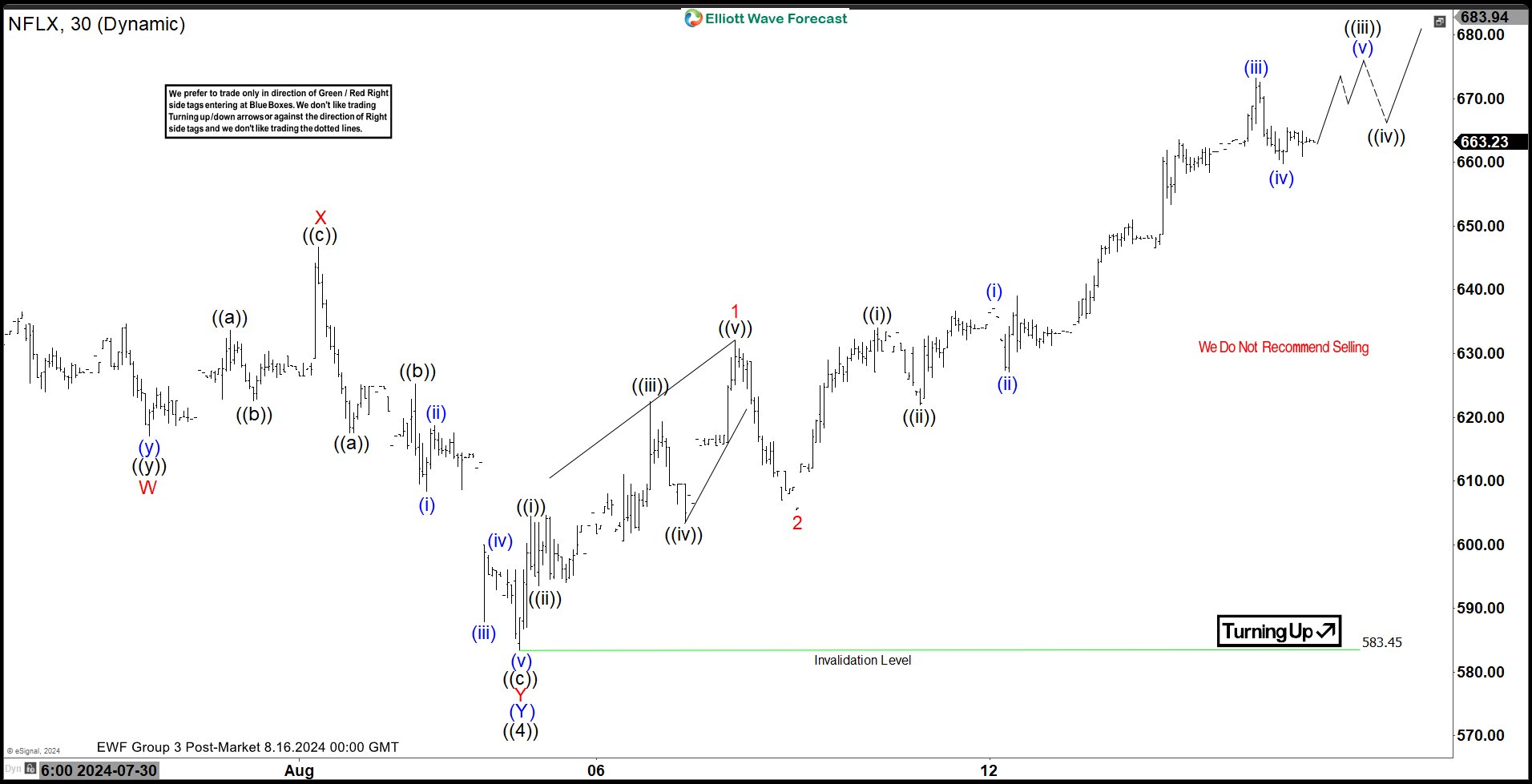

Elliott Wave Intraday Analysis: NFLX Should Continue Rally

Read MoreShort Term Elliott Wave in NFLX suggests that the Stock has completed a bearish sequence from 7.05.2024 high. The decline made a double correction Elliott Wave structure. Down from 7.05.2024 high, wave (W) ended at 600.00 low. Rally in wave (X) ended at 678.97 with internal subdivision as a zig zag correction structure. Up from […]

-

Elliott Wave Intraday Analysis: USDJPY is Correcting Before Resuming Lower

Read MoreShort Term Elliott Wave USDJPY suggests that the pair is developing a bearish sequence from 07.03.2024 high. The decline made a double correction Elliott Wave structure. Down from 07.03.2024 high, wave A ended at 155.36 low. Rally in wave B ended at 157.86 high with internal subdivision as zig zag structure. Then, the pair resuming lower […]

-

Elliott Wave Intraday Analysis: SPX Resumed the Rally

Read MoreShort Term Elliott Wave View in SPX suggests the trend should continue higher within the sequence started from March 2023 low as the part of daily sequence. It favors upside in wave ((5)) while dips remain above 5124.76 low. Since March 2024 high of (3), it starts a correction as wave (4) ending in April […]

-

Elliott Wave Intraday Analysis: FTSE should Continue Higher

Read MoreShort Term Elliott Wave in FTSE suggests that the index has completed a bearish sequence from 5.15.2024 high. The decline made a zig zag Elliott Wave structure. Down from 5.15.2024 high, wave A ended at 8106.79 low. Rally in wave B ended at 8405.24 high with internal subdivision as an expanded flat structure. Up from […]

-

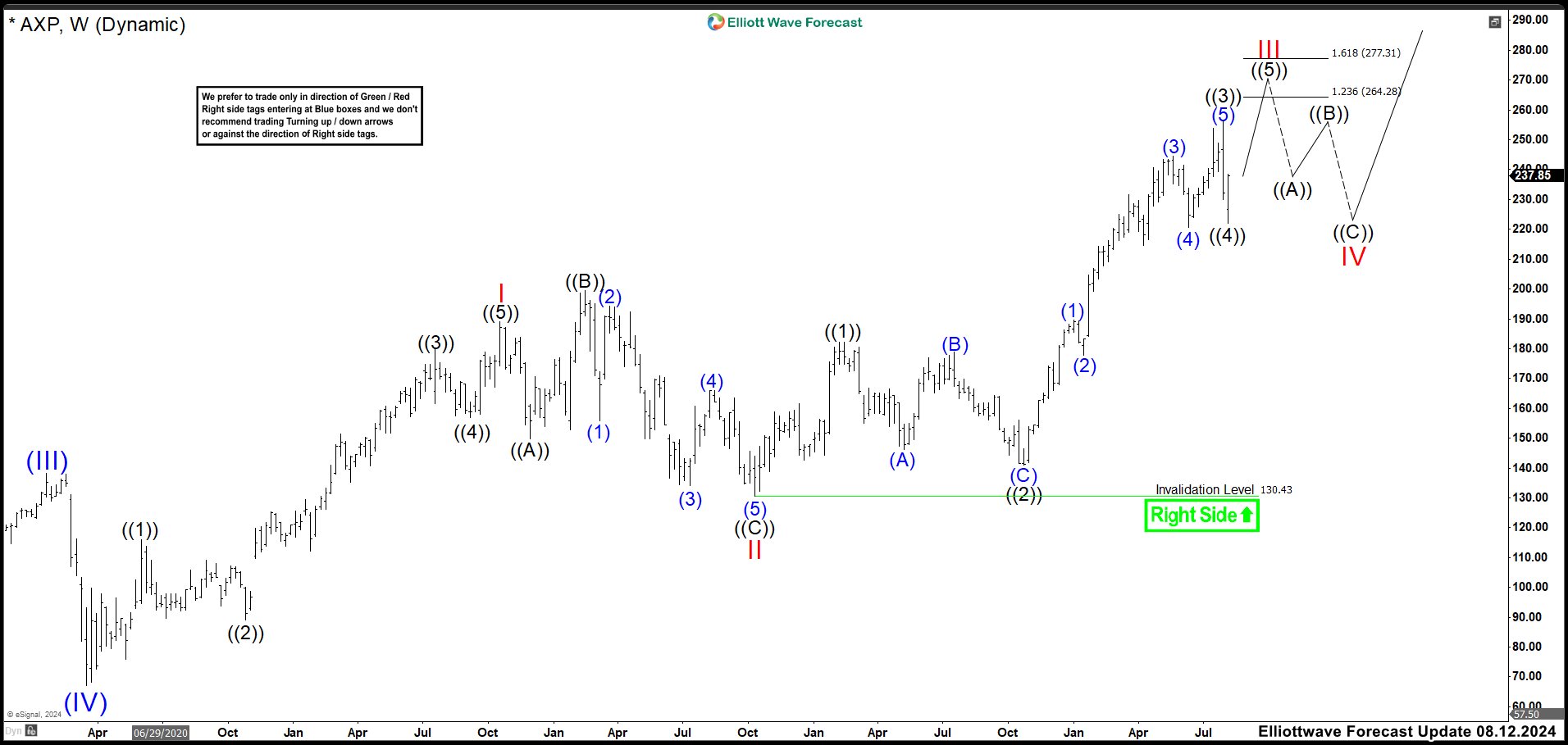

Could be the Last Buying Opportunity on American Express (AXP)?

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart April 2024 The stock was building […]

-

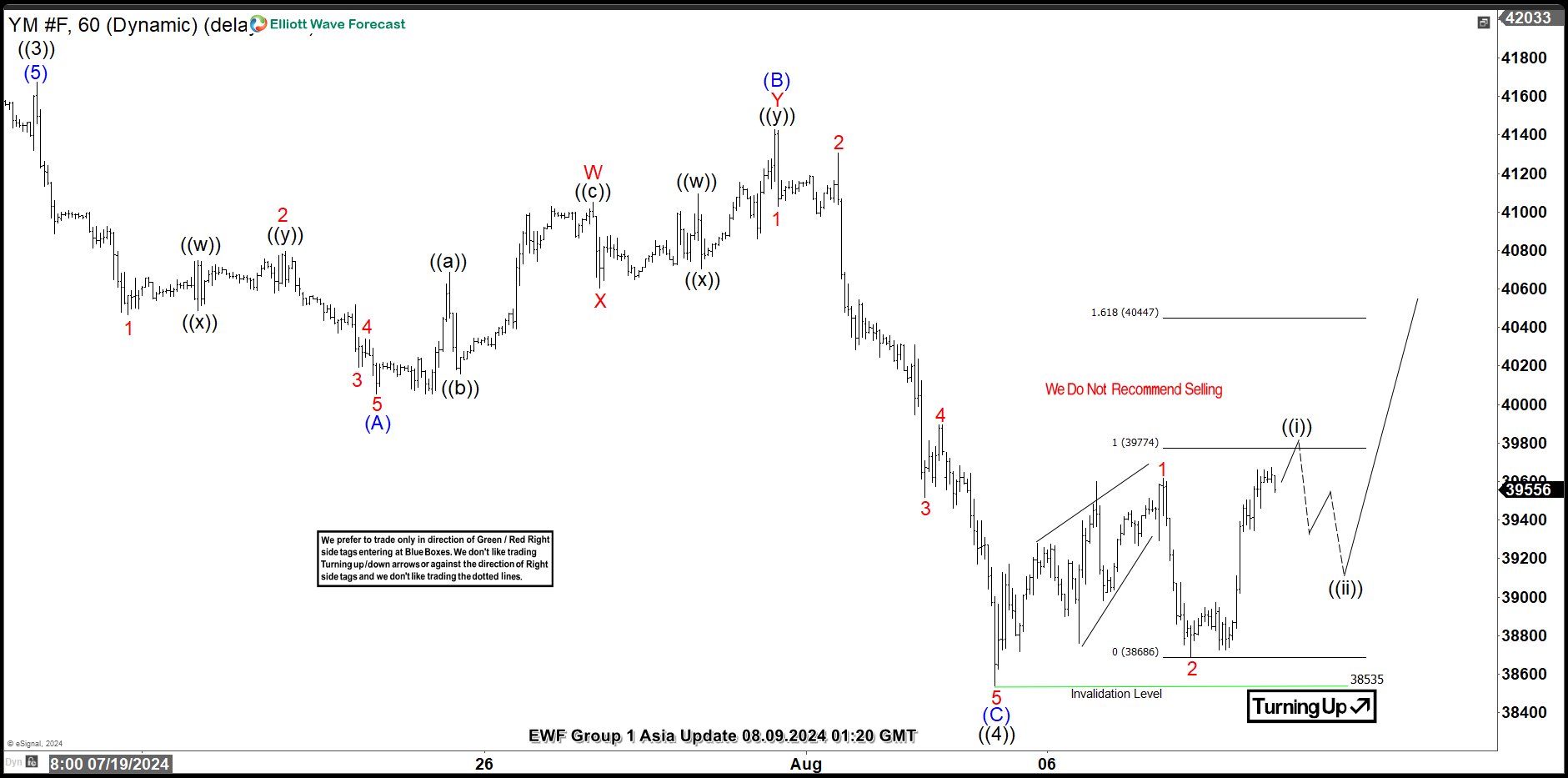

Elliott Wave Intraday Analysis: YM_F should Resume the Rally

Read MoreShort Term Elliott Wave View in E-Mini Dow Jones Futures (YM_F) suggests the trend should continue higher within the sequence started from April-2023 low as the part of daily sequence. It favors upside in wave ((5)) while dips remain above 38535 low. Since April-2024 high of (3), it starts to move sideways for almost 3 […]