-

$NZD/CAD & $AUD/CAD Update 6/11/2015

Read MoreThis is a short video update on $NZD/CAD and $AUD/CAD using Elliott Wave Principle as the tool to analyze. These two pairs are not part of the 42 instrument we cover. You can watch the original analysis videos on $NZD/CAD and $AUD/CAD by clicking the underlined words. If you are interested to learn more about Elliott Wave […]

-

GBPAUD Short Term Elliott Wave Update 6.11.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) takes the form of a FLAT and ended at 2.0128. The pair then pullback in wave […]

-

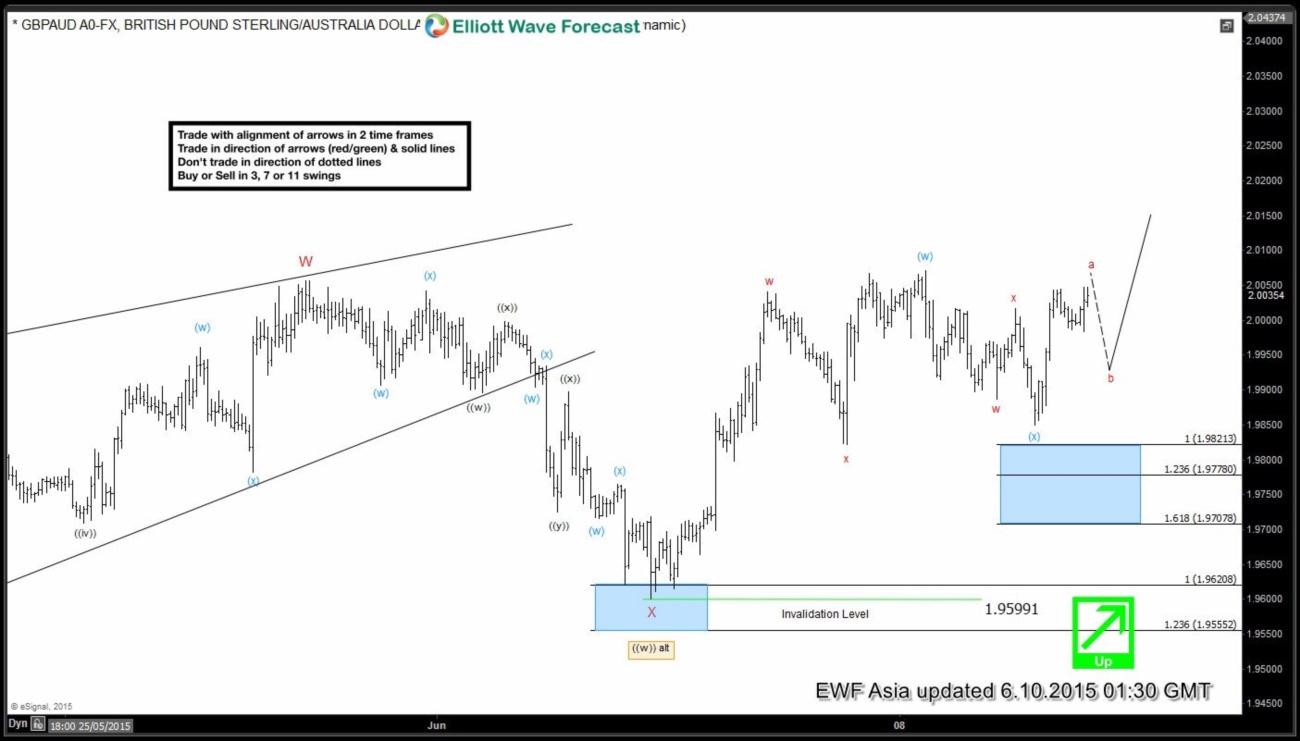

GBPAUD Short Term Elliott Wave Update 6.10.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) ended at 2.00707. The pair then pullback in wave (x) also in the form of a […]

-

GBPAUD Short Term Elliott Wave Analysis 6.9.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) ended at 2.00707. The pair then pullback in wave (x) also in the form of a […]

-

Straits Times Index (STI) Elliott Wave Analysis 6.3.2015

Read MoreGood news Singapore traders and those who trade Straits Times Index (STI). STI is a Singapore benchmark stock index, and below I will do a technical analysis in the Weekly and Daily time frame using Elliott Wave Principle. This index is currently not part of the 42 instrument covered by EWF. After watching the videos and reading the commentary below, […]

-

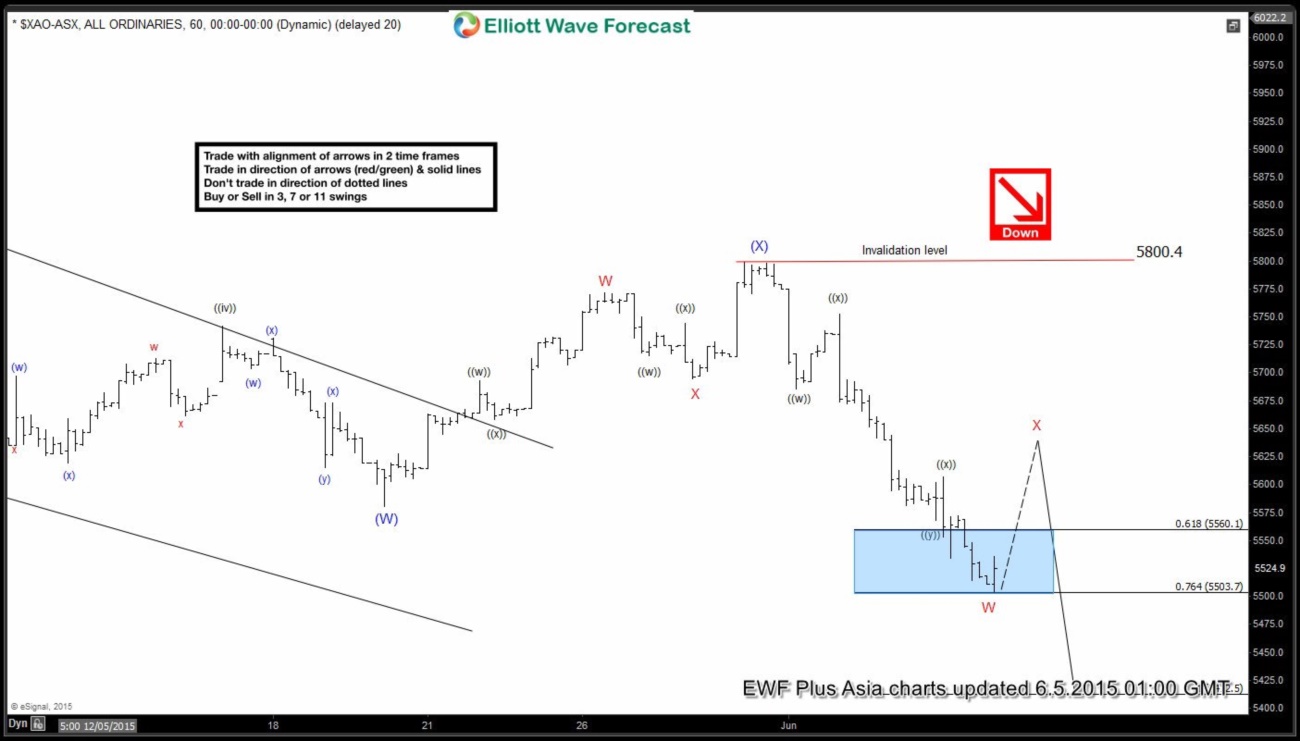

ASX All Ordinary Short Term Elliott Wave Analysis 6.5.2015

Read MoreBounce to 5800.4 completed wave (X). From this level, the Index declined in a triple correction form ((w))-((x))-((y))-((z)) where wave ((w)) ended at 5685.6, wave ((x)) ended at 5752.3, wave ((y)) ended at 5581.9 , second wave ((x)) ended at 5606.6, and wave ((z)) of W is expected to complete at 5503.7 – 5560.1 area. […]