-

Is Gold’s luster finally coming back?

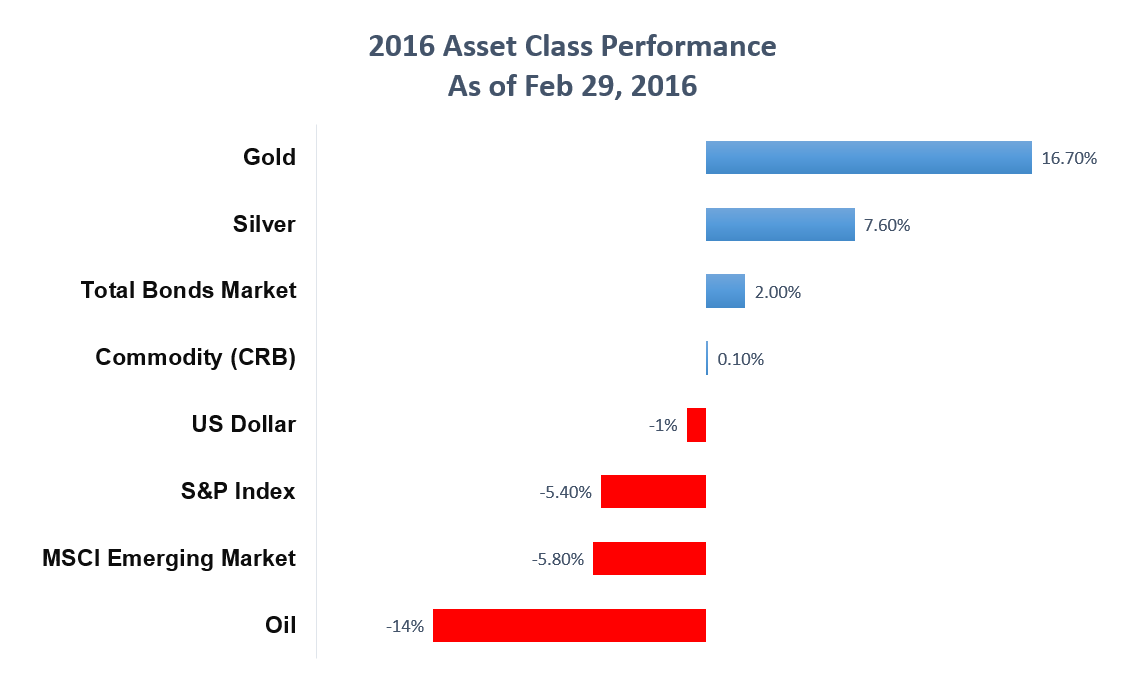

Read MoreAfter being shunned by investors for more than 5 years, gold has made an impressive start in 2016. As of Feb 29, gold registered 16.7% return, which is considerably above other asset classes. Below is the performance comparison between different asset classes as of Feb 29, 2016. There are several factors which contribute to the […]

-

NZDUSD Short-term Elliott Wave Analysis 3.9.2016

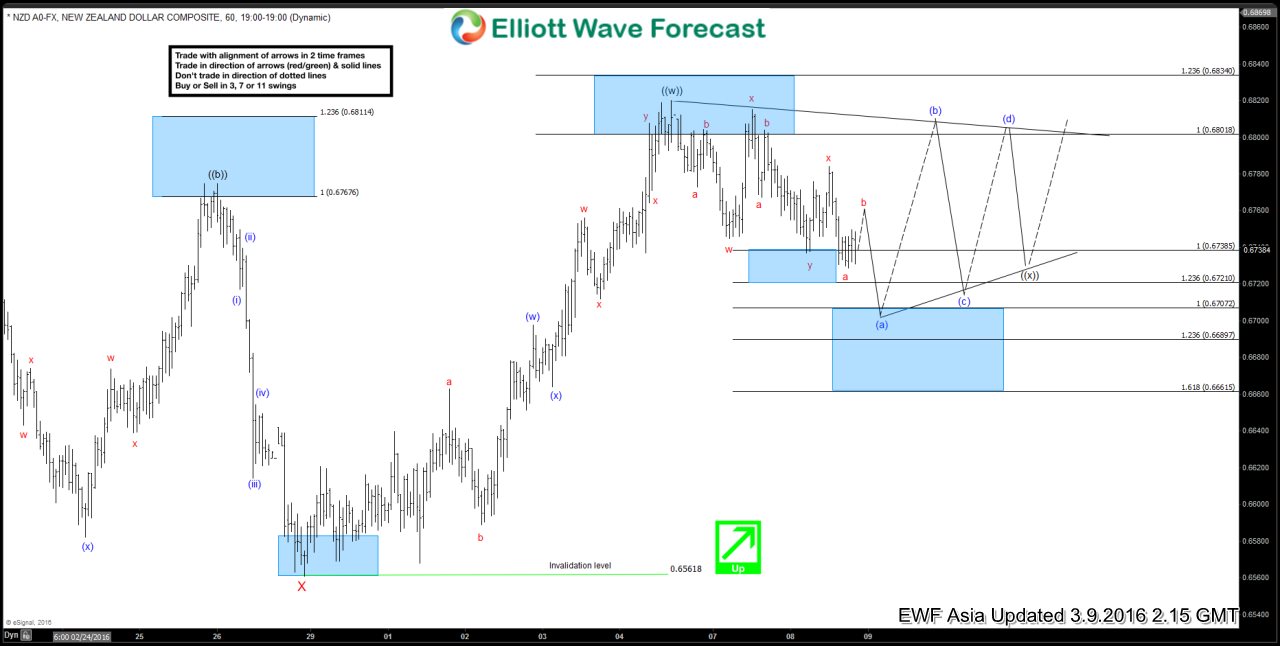

Read MoreShort term Elliottwave structure suggests cycle from 2/29 low ended with wave ((w)) at 0.682. Wave ((x)) pullback is proposed to be unfolding as a triangle where wave (a) is expected to complete at 0.6689 – 0.6707 area, then it should turn higher in wave (b) and continue triangle consolidation. Once wave ((x)) triangle is complete, […]

-

NZDUSD Short Term Elliottwave Analysis 3.8.2016

Read MoreThis is a short term Elliottwave Analysis video on $NZDUSD. Pair is looking to correct rally from 0.6561 in 3, 7, or 11 swing. First 3 swing equal leg area is 0.669 – 0.6738 where buyers can come either for a new high or at least 3 waves bounce. Regardless the structure of the short term pullback, […]

-

NZDUSD Short-term Elliott Wave Analysis 3.8.2016

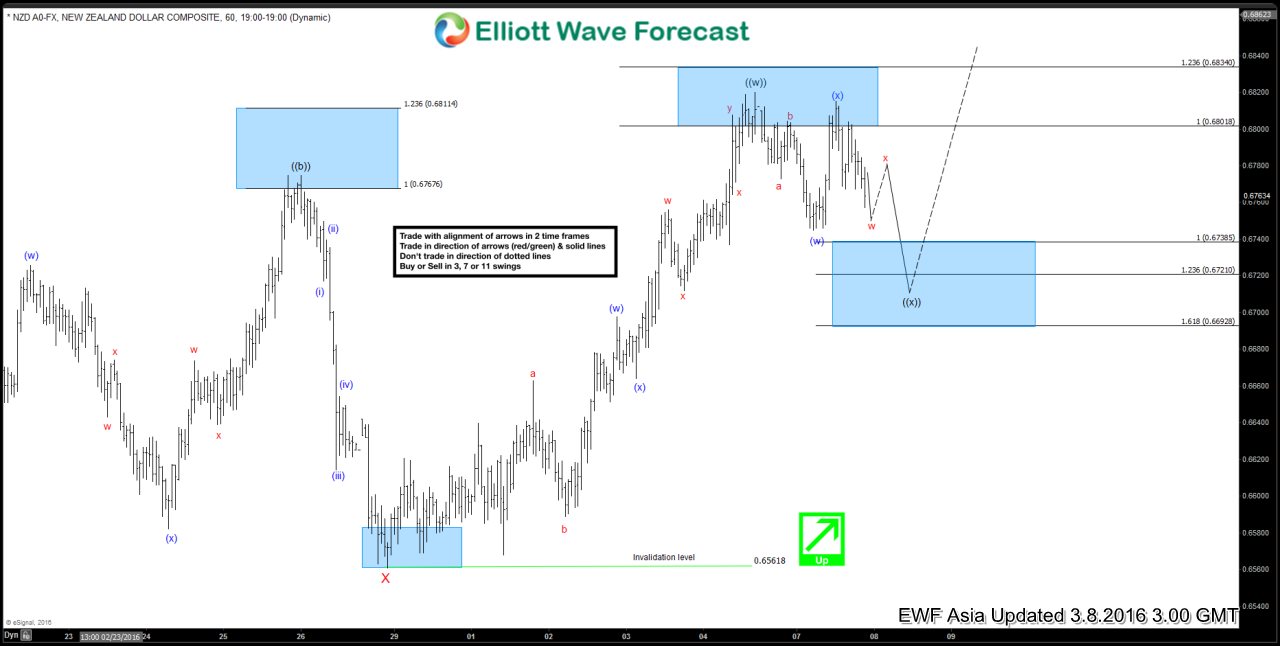

Read MoreShort term Elliottwave structure suggests cycle from 2/29 low ended with wave ((w)) at 0.682 and pair is in wave ((x)) pullback. Internal structure of wave ((x)) is unfolding as a double three where wave (w) ended at 0.6745, wave (x) ended at 0.6815, and wave (y) of ((x)) is in progress towards 0.669 – 0.6738 […]

-

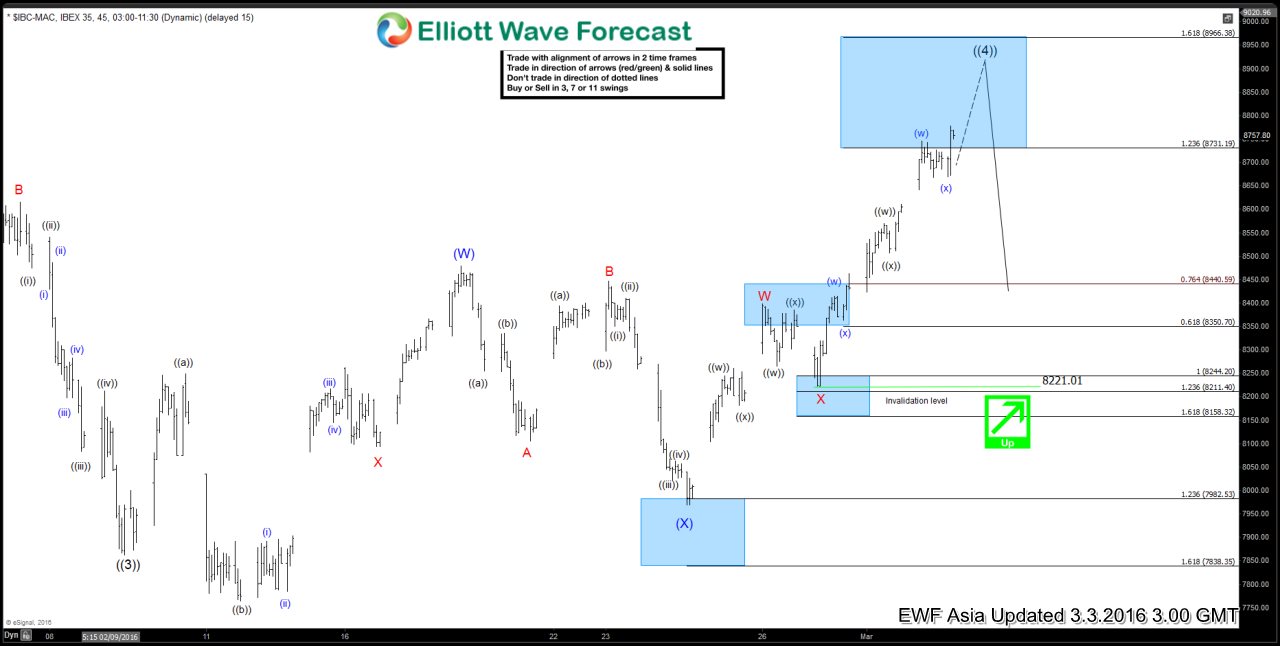

IBEX Short-term Elliott Wave Analysis 3.4.2016

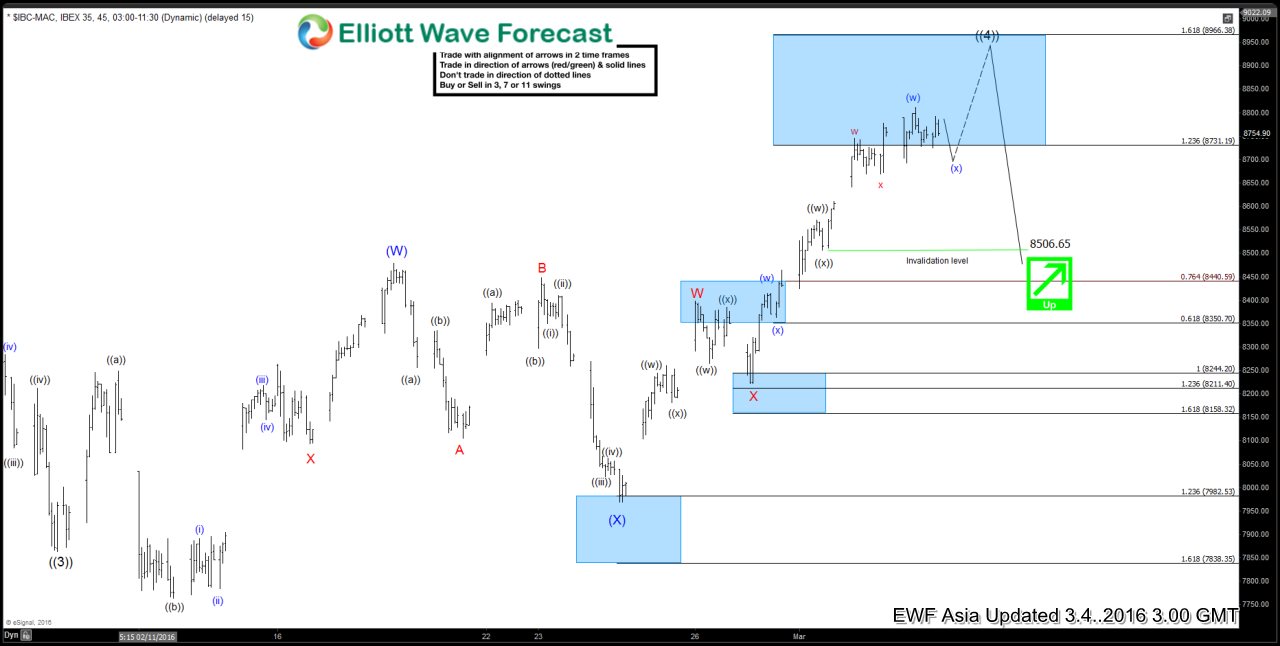

Read MoreShort term Elliottwave structure suggests cycle from 11/4 peak ended with wave ((3)) at 7862.8 and the Index is in wave ((4)) bounce to correct decline from 11/4 peak. Internal of wave ((4)) is unfolding as a double three where wave (W) ended at 8478.9, and wave (X) ended at 7967.88. Cycle from wave ((3)) low is […]

-

IBEX Short-term Elliott Wave Analysis 3.3.2016

Read MoreShort term Elliottwave structure suggests cycle from 11/4 peak ended with wave ((3)) at 7862.8 and the Index is in wave ((4)) bounce to correct decline from 11/4 peak. Internal of wave ((4)) is unfolding as a double three where wave (W) ended at 8478.9, and wave (X) ended at 7967.88. Cycle from wave ((3)) low is […]