-

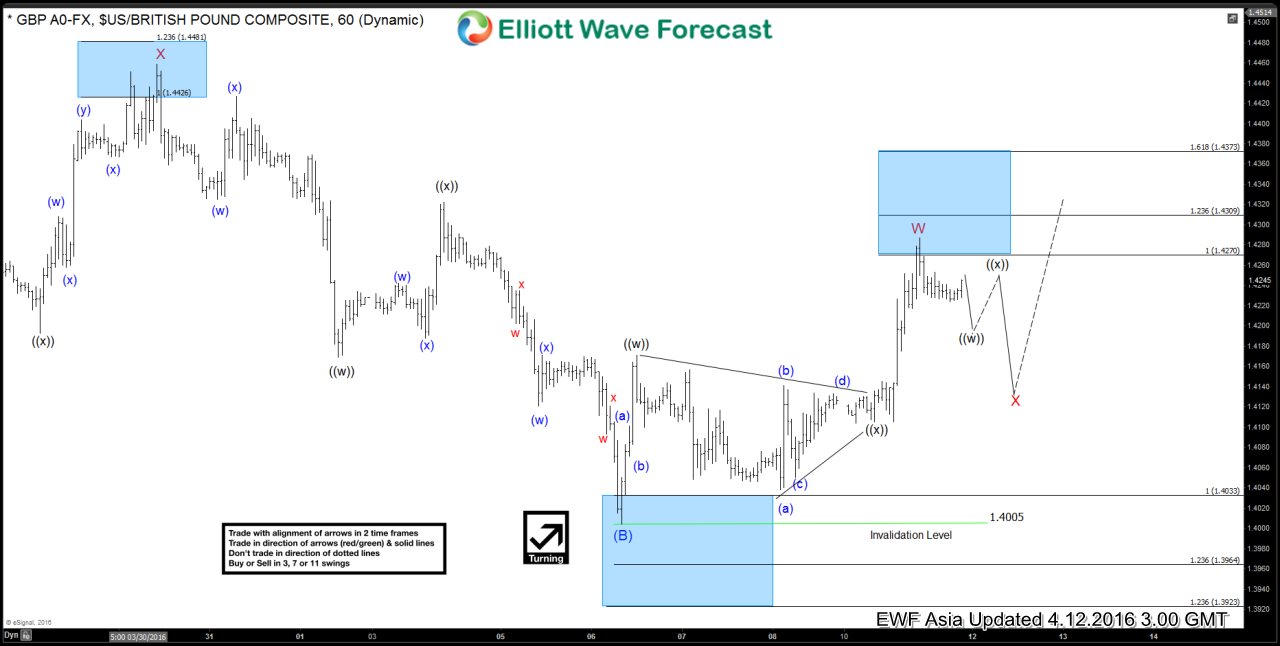

GBPUSD Short-term Elliott Wave Analysis 4.12.2016

Read MoreShort term Elliottwave structure suggests that the decline to 1.4 ended wave (B) of a larger degree triangle. Wave (C) rally is unfolding as a double three where wave W ended at 1.4287, and wave X pullback is in progress to correct the rally from 1.4 in 3, 7, or 11 swing before turning higher again. […]

-

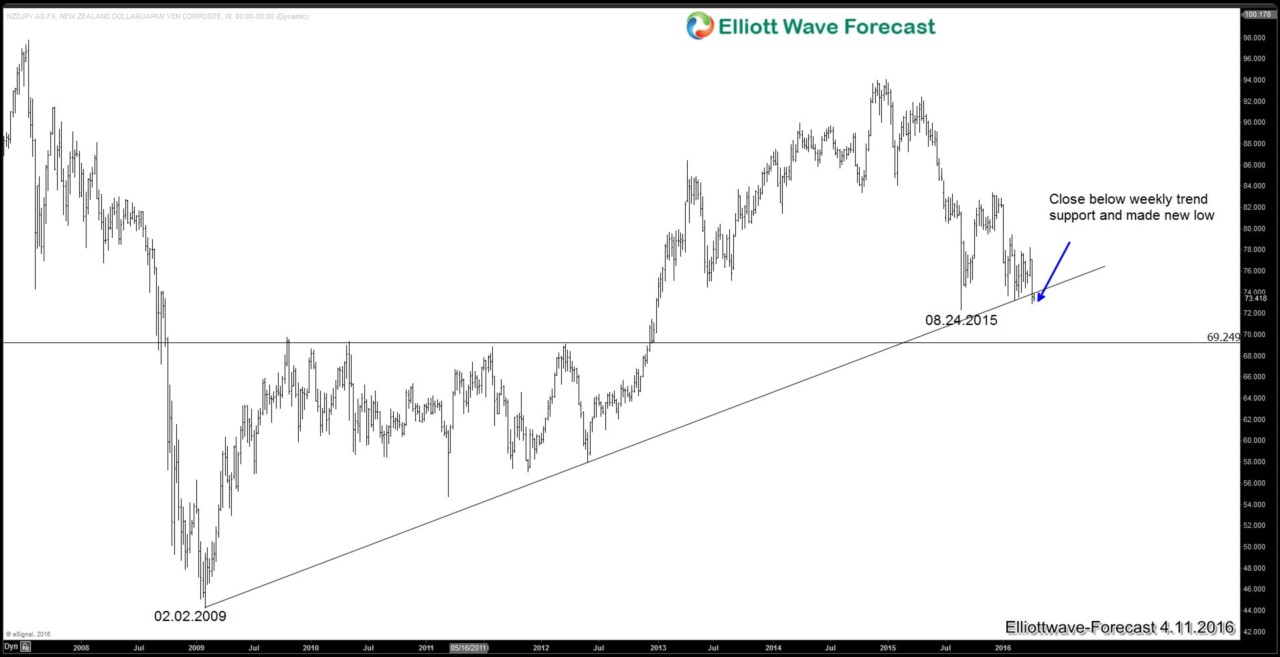

Why NZDJPY may continue lower

Read MoreIn our past article dated Feb 21 titled “Weak NZ Inflation in 4Q 2015 may force RBNZ to cut rate“, we lay out a case that RBNZ (Reserve Bank of New Zealand) is one of the few central banks which still has conventional monetary policy in their toolbox to battle low inflation. With the latest quarterly inflation released […]

-

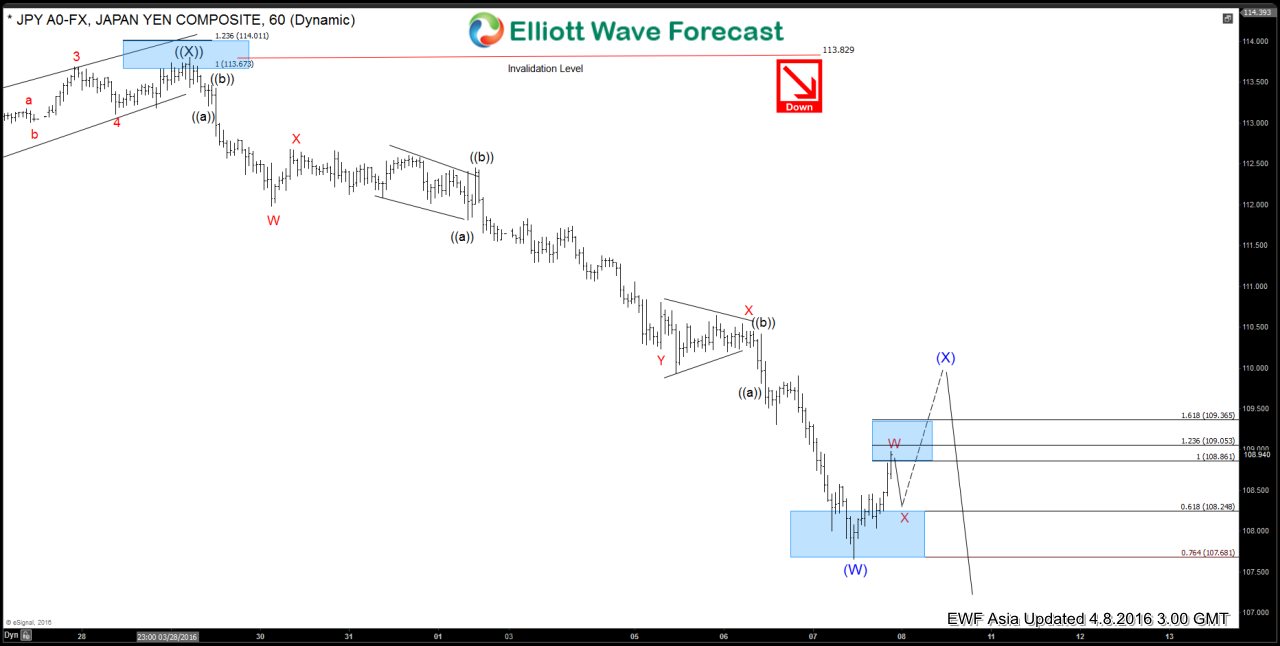

USDJPY Short-term Elliott Wave Analysis 4.8.2016

Read MoreRevised short term Elliottwave structure suggests that rally to 113.8 ended wave ((X)). Wave (W) decline from there has an internal of a triple correction (WXYZ) structure where wave W ended at 111.98, wave X ended at 112.67, wave Y ended at 110.23, 2nd wave X ended at 110.54, and wave Z of (W) is proposed complete at 107.66. Wave (X) bounce […]

-

USDJPY Short-term Elliott Wave Analysis 4.7.2016

Read MoreRevised short term Elliottwave structure suggests decline from wave ((X)) at 113.8 is unfolding as an impulse 5 waves structure where wave ((i)) ended at 111.98, wave ((ii))) ended at 112.67, and wave ((iii)) is in progress. Internal of wave ((iii)) is also in impulsive structure and wave (iii) of ((iii)) is expected to complete at 108.58 […]

-

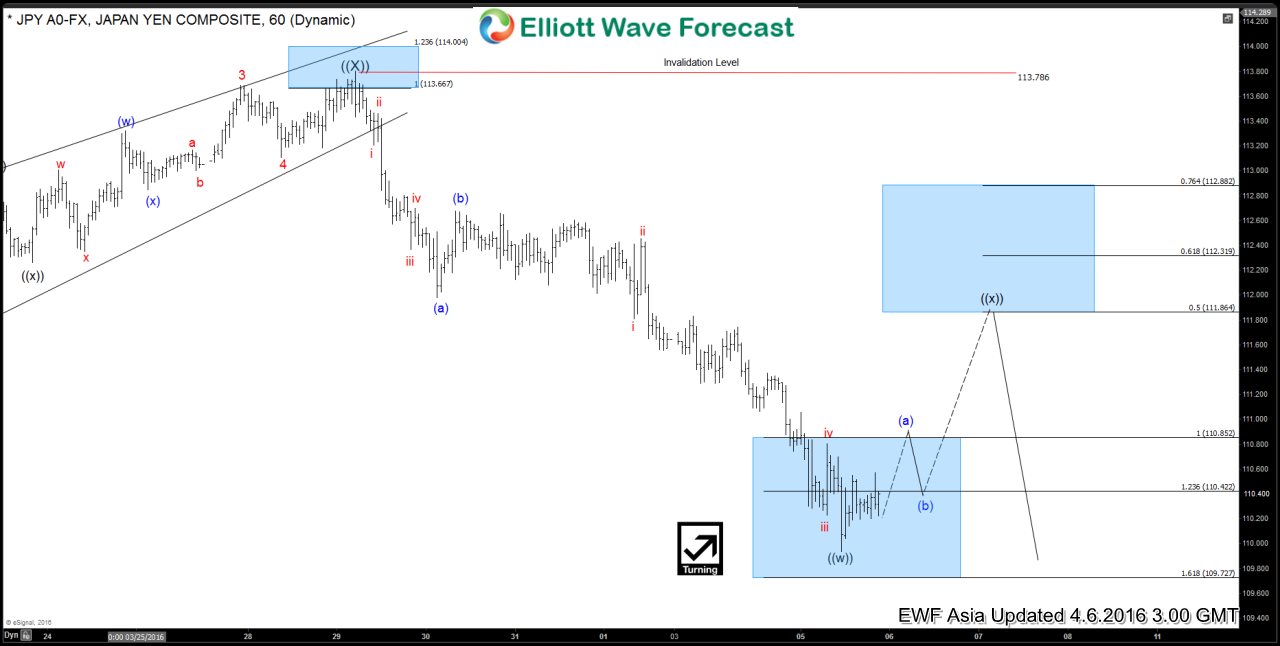

USDJPY Short-term Elliott Wave Analysis 4.6.2016

Read MoreShort term Elliottwave structure suggests decline from wave ((X)) at 113.8 is unfolding as a zig zag structure (5-3-5 structure) where wave (a) ended at 111.98, wave (b) ended at 112.67, and wave (c) of ((w)) is proposed complete at 109.93. Pair is currently correcting the decline from 113.786 in wave ((x)) towards 111.86 – 112.31 […]

-

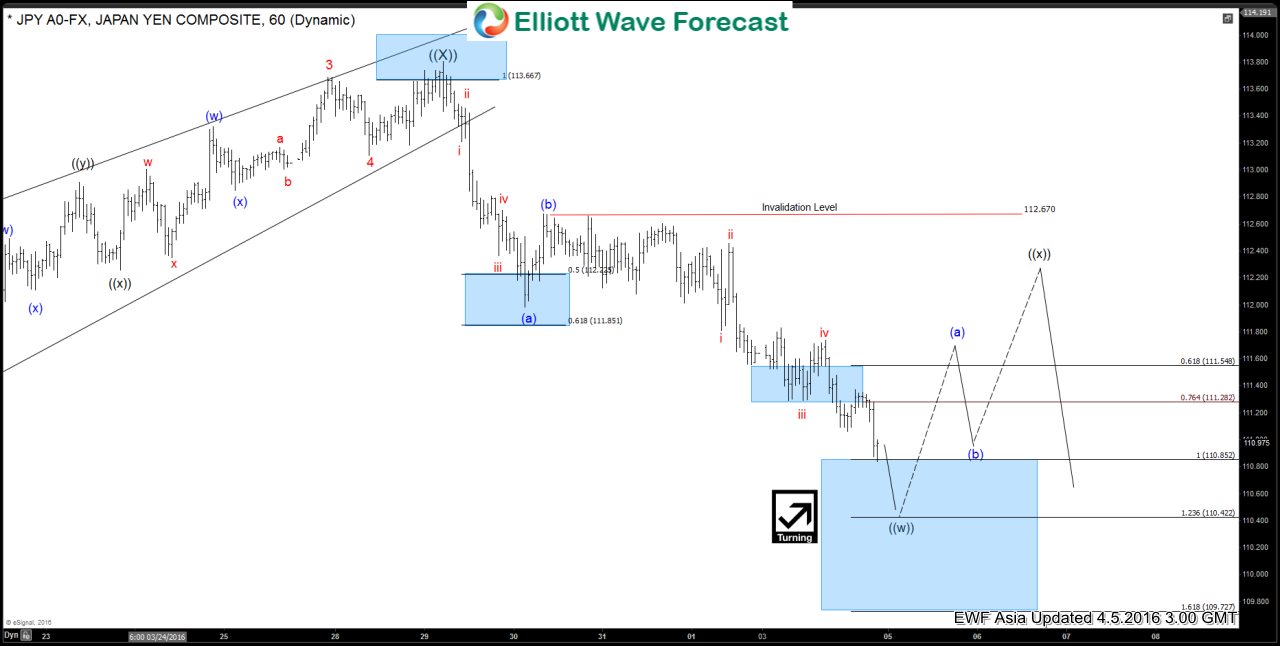

USDJPY Short-term Elliott Wave Analysis 4.5.2016

Read MoreShort term Elliottwave structure suggests decline from wave ((X)) at 113.8 is unfolding as a zig zag structure (5-3-5 structure) where wave (a) ended at 111.98, wave (b) ended at 112.67, and wave (c) of ((w)) is in progress as 5 waves and expected to complete at 110.42 – 110.85 area before a bounce in wave […]