-

Sugar $SB_F Short-term Elliott Wave Analysis 5.5.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a zigzag where wave (a) ended at 15.71, and wave (b) ended at 15.01. Wave (c) of ((w)) is expected to complete at 16.72 – 17.12 area, then it should pullback in wave ((x)) to correct the rally […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.4.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a triple three where wave (w) ended at 15.6, wave (x) ended at 15.01, wave (y) is proposed complete at 16.47, and 2nd wave (x) pullback is proposed complete at 15.88. While pullbacks stay above 15.88, and more […]

-

Australian Dollar Outlook after RBA cut

Read MoreReserve Bank of Australia (RBA) made a surprise cut of 25 bps earlier today, taking the interest rate to a record low of 1.75%. Before the meeting, analysts have put the probability of a rate cut as much as 50-50 after the dismal figure of CPI last Tuesday April 26. The CPI report last week showed that […]

-

Sugar $SB_F Short-term Elliott Wave Analysis 5.3.2016

Read MoreShort term Elliottwave structure suggests that decline to 13.99 ended wave X. Rally from there is unfolding as a triple three where wave (w) ended at 15.6, wave (x) ended at 15.01, and wave (y) is proposed complete at 16.47. Second wave (x) pullback is currently in progress towards 15.56- 15.74 area as 3 swings correction before […]

-

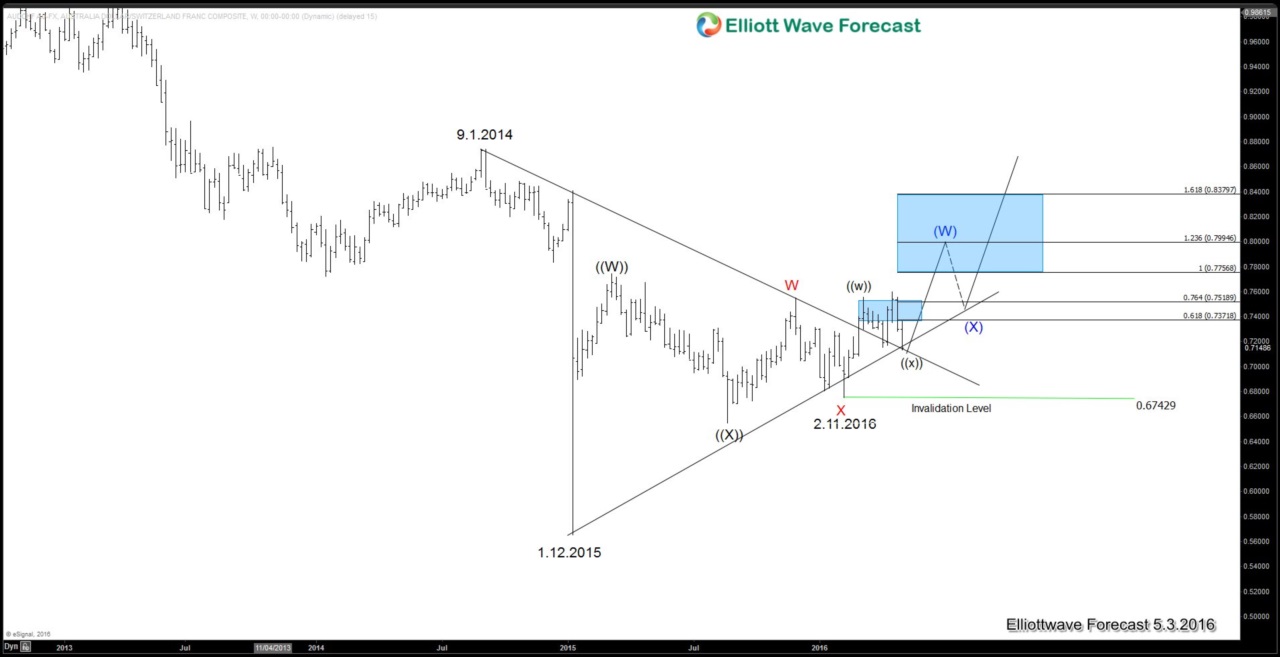

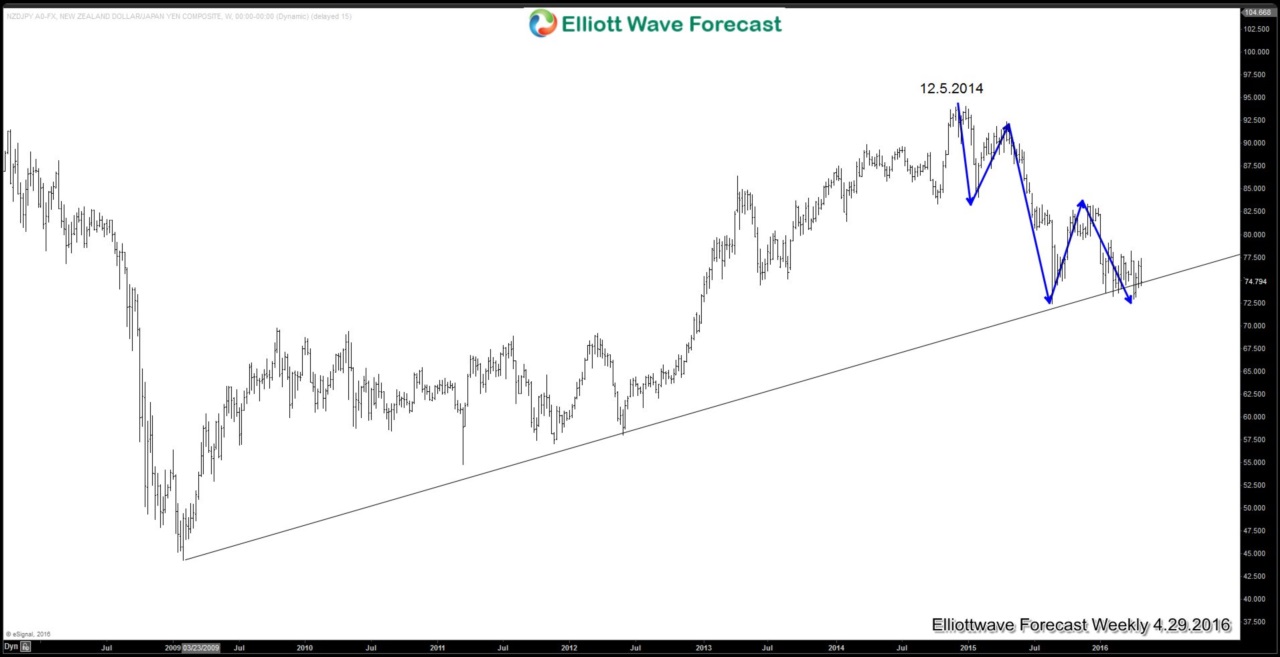

BOJ’s inaction may mean stronger Yen

Read MoreBank of Japan (BOJ) did not take any further easing action on Thursday (April 28) monetary policy meeting, sending Yen soaring more than 3% against the U.S. dollar and Nikkei tumbling 3.6%. Coming into the meeting, expectation by market participants was very high that BOJ would take further actions considering that Yen has strengthened for much of 2016, hitting the strongest […]

-

Oil Short-term Elliott Wave Analysis 4.29.2016

Read MoreShort term Elliottwave structure suggests that rally from 35.23 on 4/5 remains alive as a triple three where wave W ended at 42.42 on 4/13, wave X ended at 37.61 on 4/18, wave Y ended at 44.49 on 4/21, and 2nd wave X pullback is proposed complete at 42.51 on 4/28. Near term, cycle from 4/28 low is expected to complete soon with wave ((w)) […]