-

Dow Jones $DJIA Short-term Elliott Wave Analysis 6.9.2016

Read MoreShort Term Elliottwave structure suggests that dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three where wave ((w)) ended at 17891.6 and wave ((x)) ended at 17660.87 on 6/1. From 6/1 low, pair then continues to rally higher as a 5 waves diagonal. There’s enough number of swing to call wave (a) completed although a marginal […]

-

Weekly Market Report June 8

Read MoreU. S. Dollar – Biased lower Last Friday, Non Farm Payroll number came out very weak with job growth increased only by +38K in May, far below the consensus of +160K. This is one of the largest misses since 2011 and cooling off the expectation of rate hikes. Further adding to the woe, April’s job gains was also […]

-

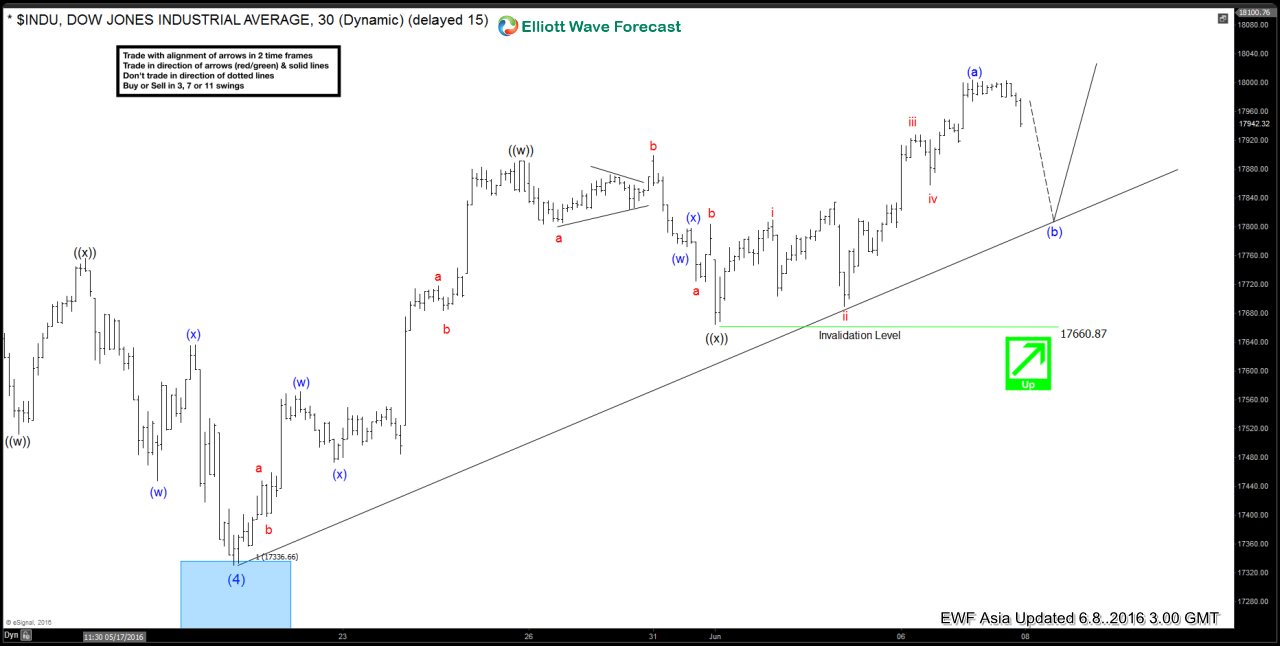

Dow Jones $DJIA Short-term Elliott Wave Analysis 6.8.2016

Read MoreCycle from 1/21 low remains in progress as 5 waves and dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three structure where wave ((w)) ended at 17891.6 and wave ((x)) ended at 17660.87 on 6/1. Near term, cycle from 6/1 low is proposed complete as 5 waves diagonal with wave (a) […]

-

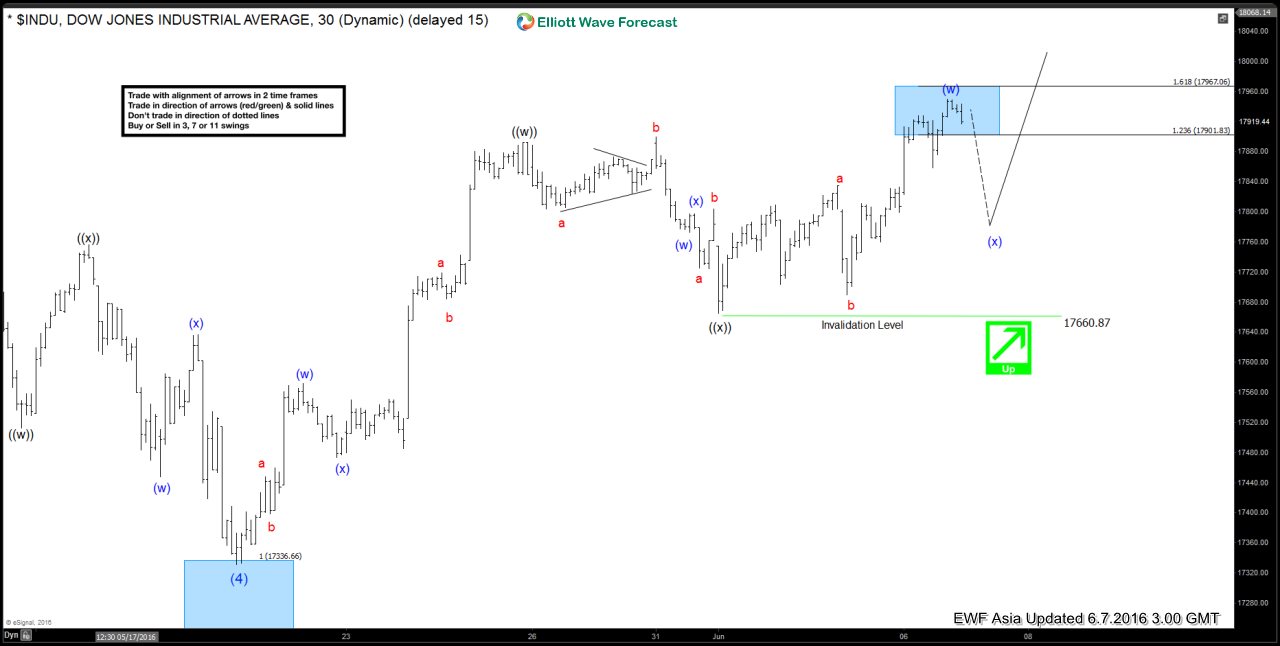

Dow Jones $DJIA Short-term Elliott Wave Analysis 6.7.2016

Read MoreCycle from 1/21 low remains in progress as 5 waves and dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three structure where wave ((w)) ended at 17891.6 and wave ((x)) ended at 1660.87 on 6/1. Near term, cycle from 6/1 low is proposed complete with wave (w) at 17948.9, and the […]

-

$CADJPY Short-term Elliott Wave Analysis 6.2.2016

Read MoreShort term Elliottwave structure suggests that the cycle from 5/6 low has ended with wave (X) at 85.5. Decline from there is taking the form of a zigzag. Wave ((a)) of the zigzag is currently in progress as 5 waves diagonal where wave (i) ended at 84.13, wave (ii) ended at 84.85, wave (iii) ended at 83.28 and wave […]

-

USDPLN Elliottwave Analysis 6.1.2016

Read MoreIn the Daily view, the pair has met the minimum requirement for wave X bounce to complete. However, short term, while the pair stays above trend line channel and above wave ((x)) low at 3,767, ideally pair makes an extension higher towards 4.052 – 4.082 area to complete wave X before pair then resumes lower. For more trading […]