-

Nikkei Short-term Elliott Wave Analysis 8.9.2016

Read MorePreferred Elliott wave count suggests that dips to 15926 ended wave (X) and Index has started a rally higher in the form of a double three structure where wave ((w)) ended at 16740. While Index stays below there, expect the Index to pullback in wave ((x)) to correct the rally from 15926 in 3, 7, or 11 swing. Then, as far […]

-

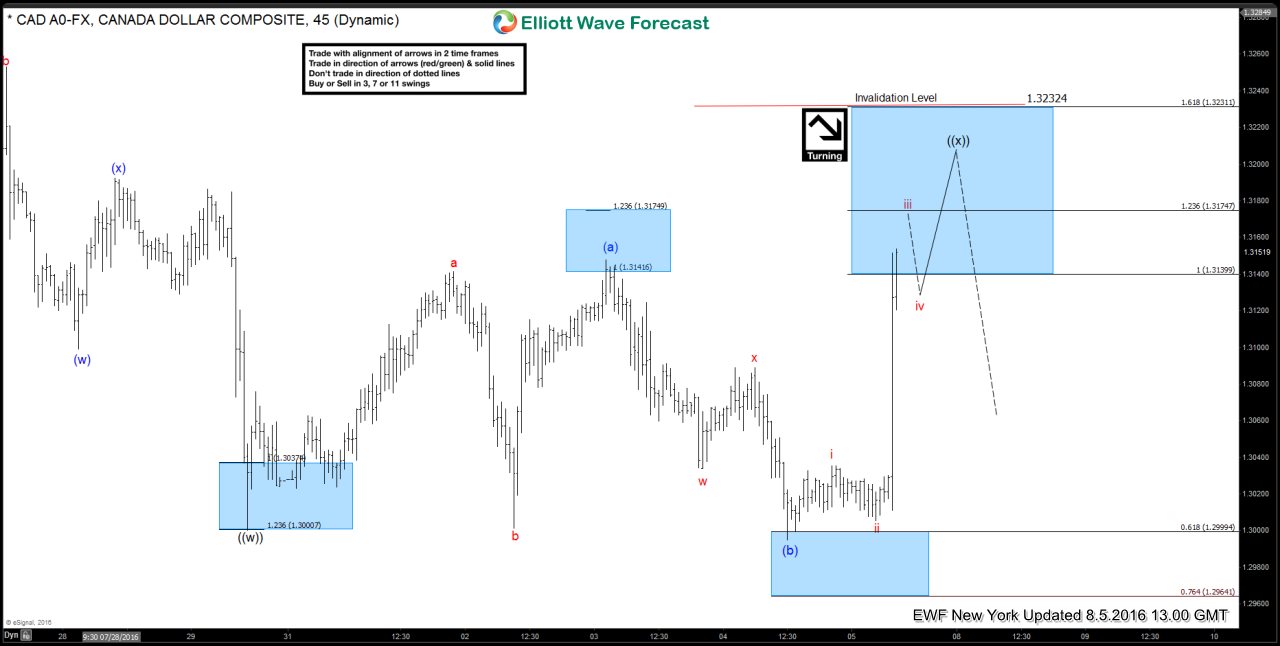

USDCAD Short-term Elliott Wave Analysis 8.5.2016

Read MorePreferred Elliott wave count suggests that rally to 1.324 ended wave W. Wave X pullback is in progress as a double three structure where wave ((w)) ended at 1.30, wave ((x)) is unfolding as as FLAT and should ideally fail below 1.3232 high for another push lower in wave ((y)) of X toward 1.2953 – […]

-

$USDPLN Elliottwave Trade Setup 8/4/2016

Read MoreBelow is a video update on $USDPLN and also the journal to trade it with a clear and concise setup, including risk:reward calculation. This is one of the pairs we like to sell in Live Trading Room. Everyday we will take the heavy groundwork and scan the market for potential trades in commodities, forex, and indices. Then at 7 […]

-

AUDJPY Short-term Elliott Wave Analysis 8.3.2016

Read MorePreferred Elliott wave count suggests that decline from wave X at 79.57 is unfolding as a triple three where wave ((w)) ended at 77.6, wave ((x)) ended at 79.51, wave ((y)) ended at 77.4 and second wave ((x)) ended at 78.18. Wave ((z)) is in progress with the internal unfolding as a double three where wave (w) […]

-

AUDJPY Short-term Elliott Wave Analysis 8.2.2016

Read MoreAUDJPY while below 78.18 the pair is expected lower toward 76.17-75.36 area to complete wave (X) & end the cycle from 7/15 & while the dip shows it will remain above the 6/23 cycle lows we expect the pair turns higher in wave (Y) of ((X))

-

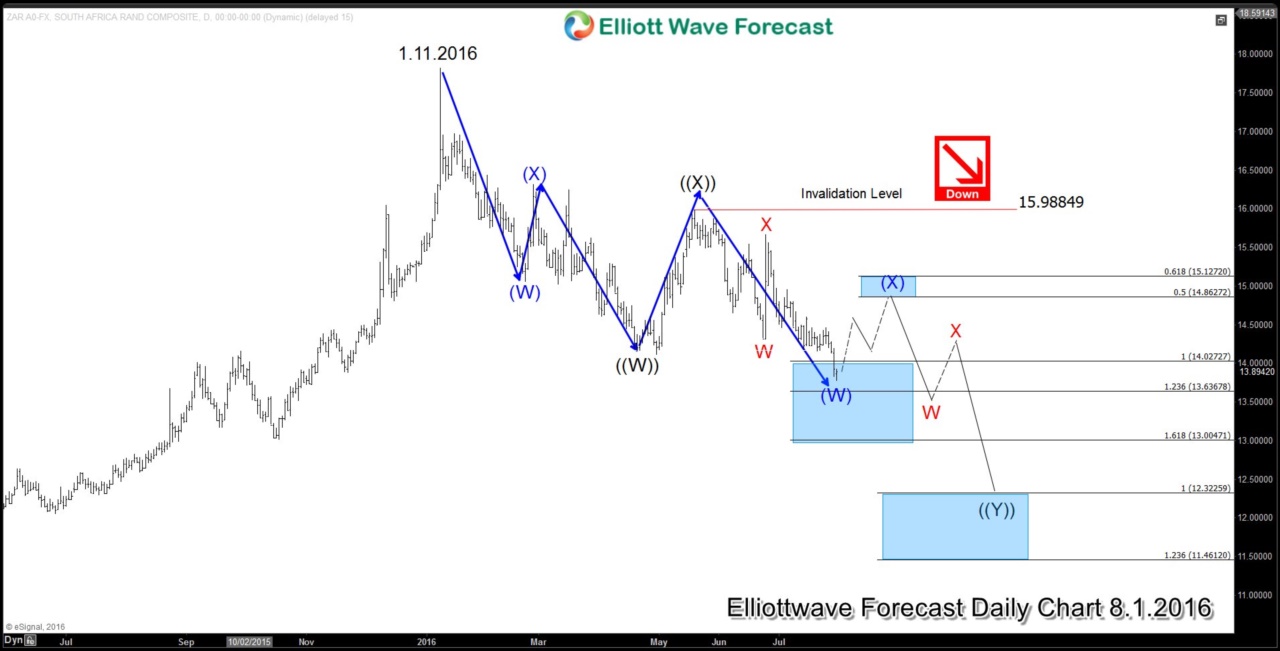

USDZAR may see more downside

Read MoreOne of the most common structures in today’s market is the double correction, or sometimes called WXY. A double correction WXY is called a double zigzag if the subdivision of the W and the Y is in an ABC zigzag. Below is the general structure of a 7 swing WXY As can be seen from the graph above, the […]