-

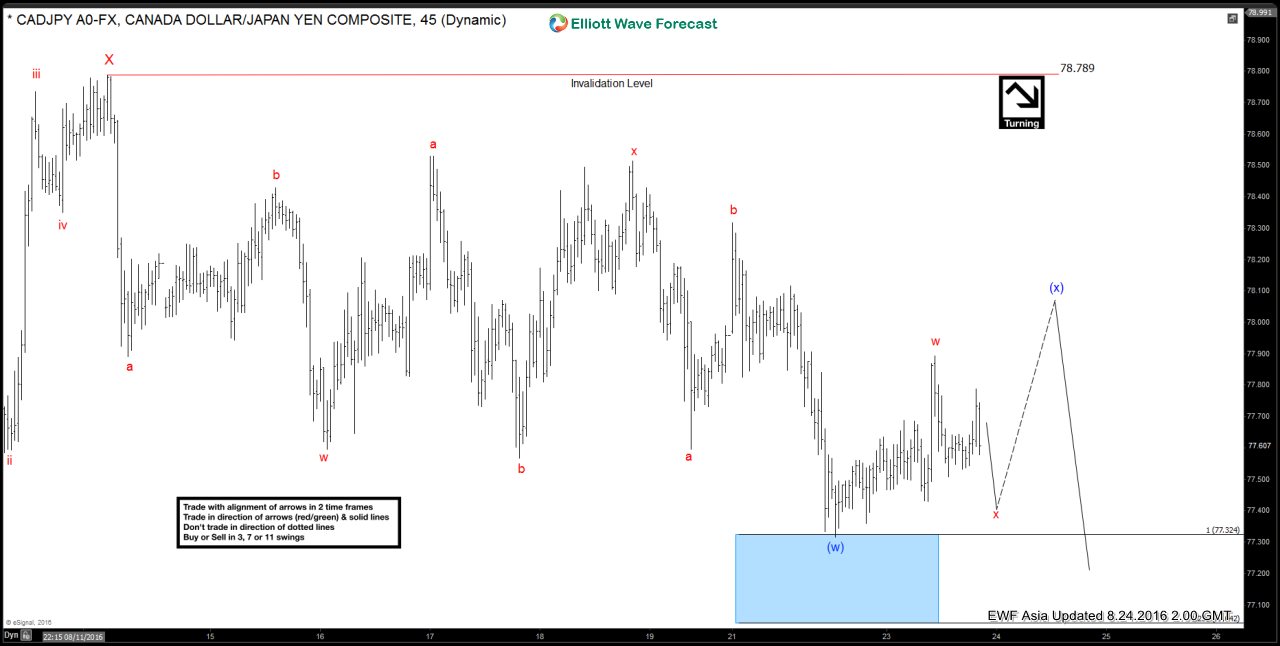

$CADJPY Short-term Elliott Wave Analysis 8.24.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. While near term wave (x) pullback stays above there, expect the pair to turn higher in wave y of (x) before the decline resumes again. We don’t like buying the […]

-

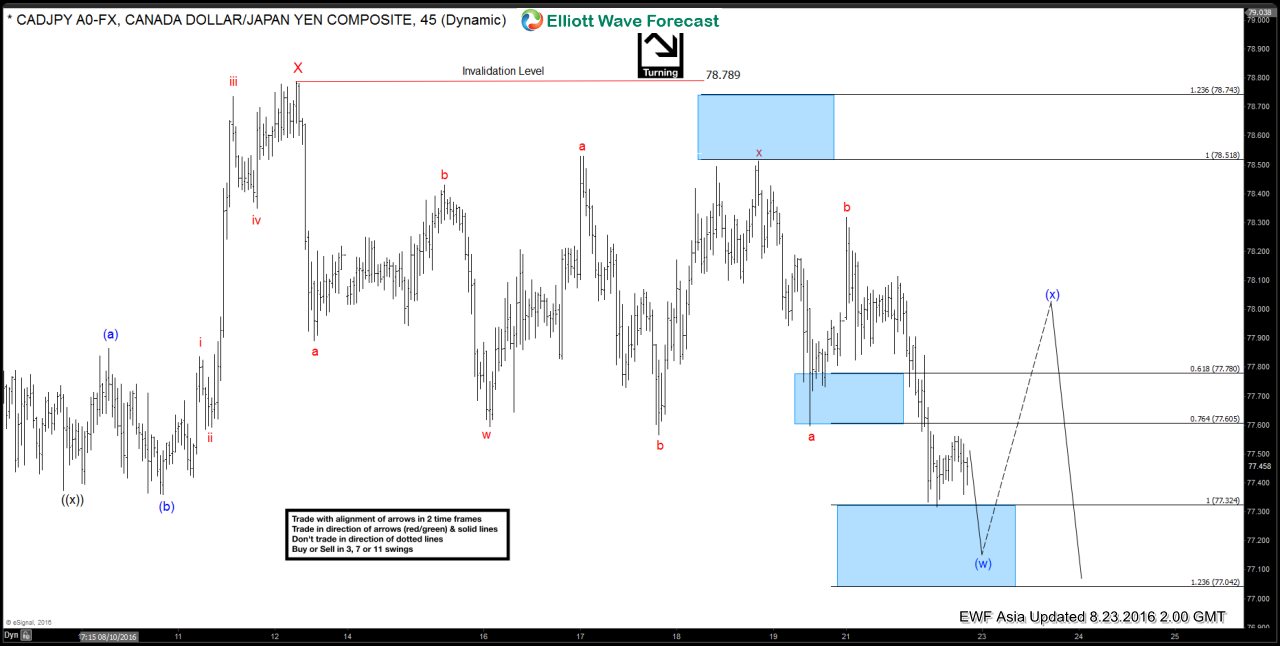

$CADJPY Short-term Elliott Wave Analysis 8.23.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Down from there, there’s enough number of swing and extension to call wave (w) completed. After wave (w) is confirmed over, likely from 77 – 77.3 area which it has already reached, then it should bounce in wave (x) before pair resumes lower again. We don’t […]

-

$AUDUSD Short-term Elliott Wave Analysis 8.19.2016

Read MorePreferred Elliott wave count suggests that rally to 0.776 ended wave ((w)) and wave ((x)) pullback is proposed complete at 0.7673. Rally from there is unfolding as a double three where wave w ended at 0.7723 and while wave x pullback stays above 0.7606, expect pair to resume higher. A break below 0.7606 suggests pair can extend lower to 0.7566 – […]

-

USD may range trade

Read MoreRecent U.S economic data has been mixed. Good data came from the job report, with July’s Non Farm Payroll number came out strong at 217K, which is comfortably beating the market expectation of 170K. Despite the good news, job number has been volatile and unpredictable. Recall that May’s job number only came out at 25K vs 152K consensus […]

-

$AUDUSD Short-term Elliott Wave Analysis 8.18.2016

Read MorePreferred Elliott wave count suggests that rally to 0.776 ended wave ((w)) and wave ((x)) pullback is proposed complete at 0.7673. Rally from there is unfolding as a double three and there’s enough number of swing to call wave “w” completed although a marginal high still can’t be ruled out towards 0.774 area. Pair is expected to pullback […]

-

$AUDUSD Short-term Elliott Wave Analysis 8.17.2016

Read MorePreferred Elliott wave count suggests that rally to 0.776 ended wave ((w)). Pullback from there is unfolding as a double three where wave (w) ended at 0.7634 and wave (x) ended at 0.775. While pair remains below wave ((w)) at 0.776, expect pullback to continue in wave (y) of ((x)) towards 0.759 – 0.762 area before pair resumes the rally higher. […]