-

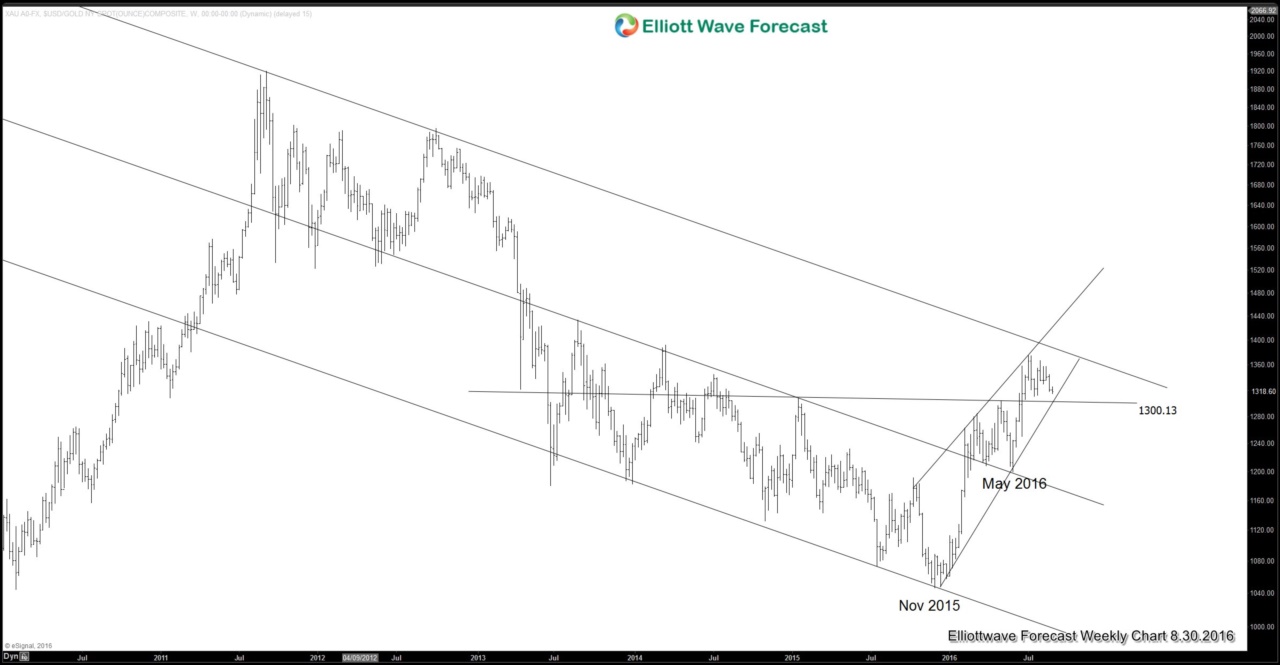

How far will USD rally? Gold may provide the answer

Read MoreFed Chairwoman Janet Yellen and other Fed members gave hawkish comments at Jackson Hole meeting last week, boosting the U.S. dollar against several currencies. Janet Yellen suggested that in light of the solid performance in the labor market, the case for an increase in federal funds rate has strengthened in recent months. However, she did not specifically say […]

-

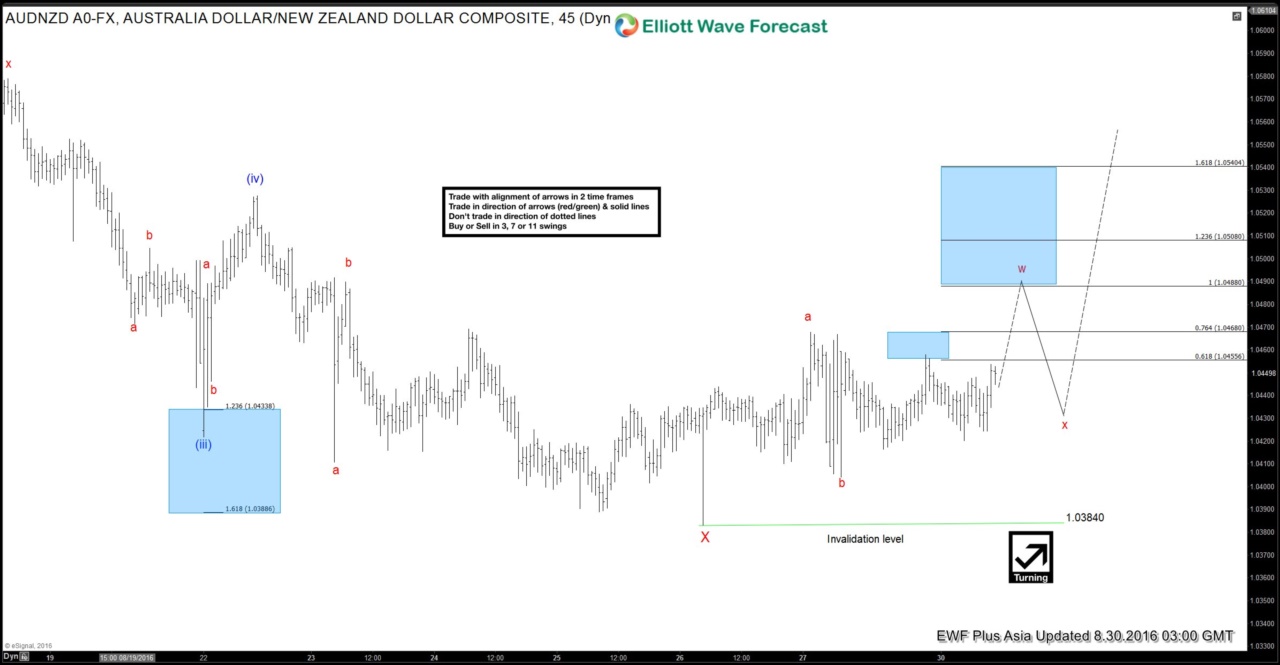

$AUDNZD Short-term Elliott Wave Analysis 8.30.2016

Read MorePreferred Elliott wave count suggests that decline to 1.0384 on 8/26 ended wave X. While pair remains above the level, expect further upside to 1.0488 – 1.051 area to complete wave w before ending the cycle from 8/26 low. Afterwards, a pullback in wave x is expected to take place to correct the rally from 8/26 low […]

-

$NZDUSD Live Trading Room Setup from 8/17

Read MoreWe issued a market buy order for $NZDUSD on Aug 17 Live Trading Room. We adjusted the target profit on Aug 23 to 0.738 and took profit on Aug 26 for a +144 pips profit. Each day in Live Trading Room, members attending the session will receive a similar trading journal like the one below for 26 instrument we cover […]

-

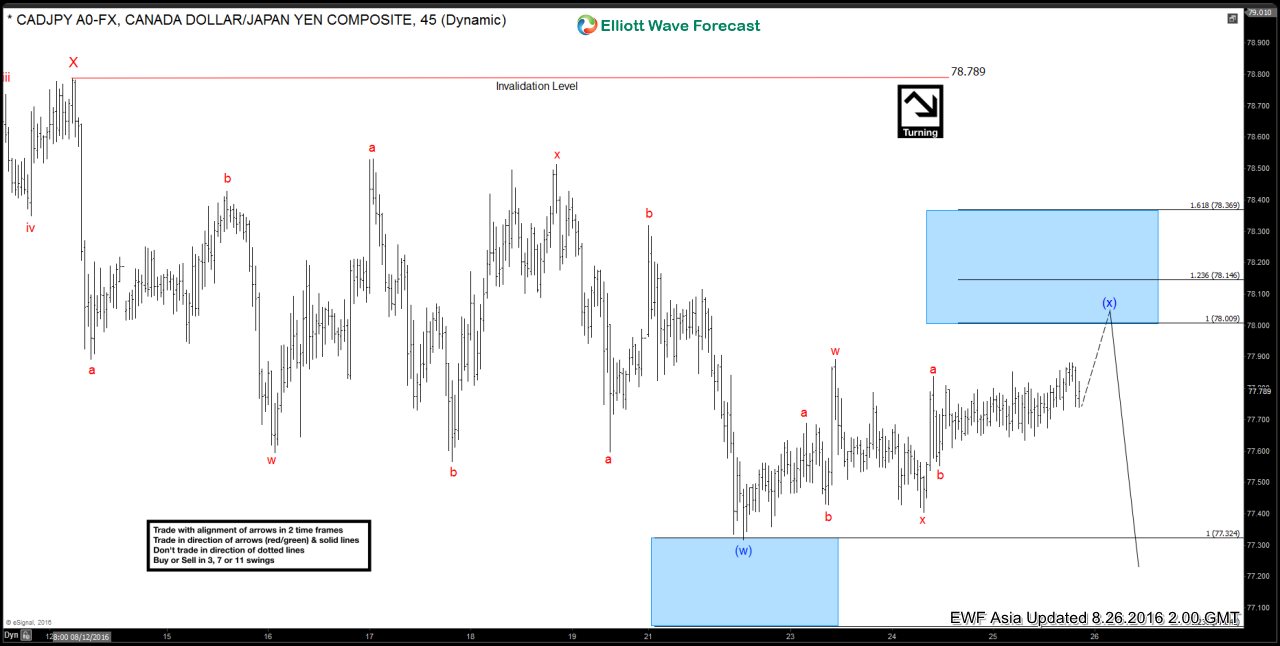

$CADJPY Short-term Elliott Wave Analysis 8.26.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. Wave (x) bounce is currently in progress towards 78 – 78.15 area, then pair is expected to extend lower or at least pullback in 3 waves to correct rally […]

-

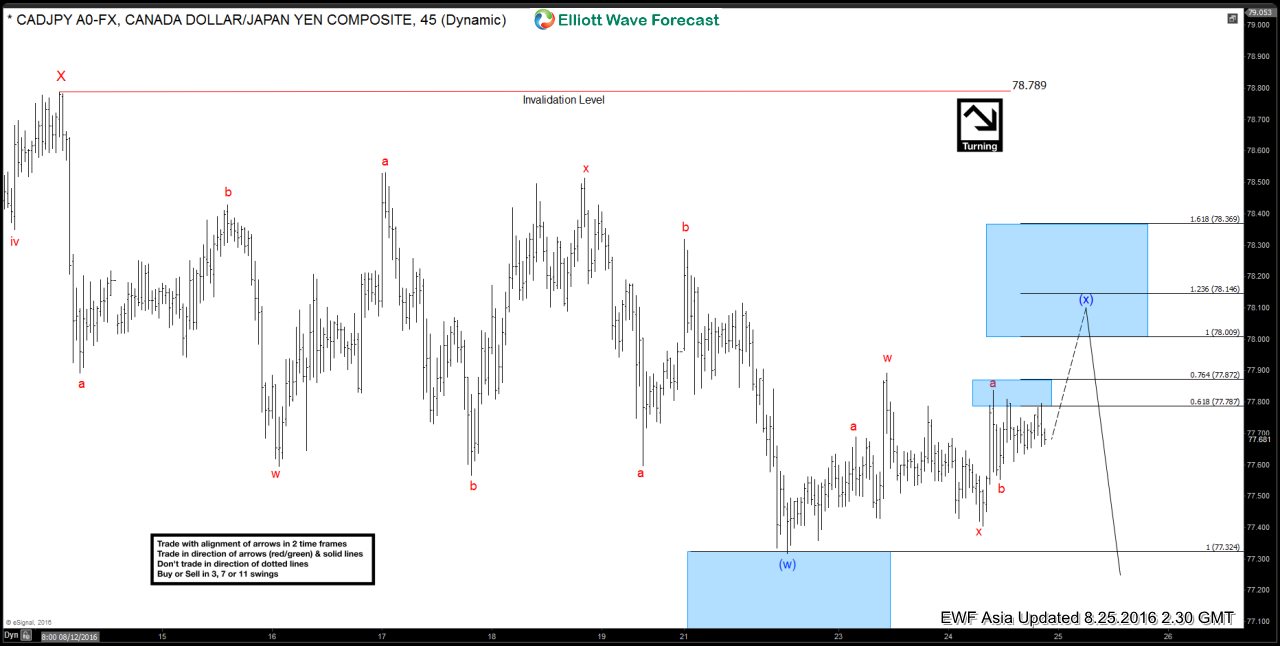

$CADJPY Short-term Elliott Wave Analysis 8.25.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. Wave (x) bounce is currently in progress towards 78 – 78.15 area, then pair is expected to extend lower or at least pullback in 3 waves to correct rally […]

-

$GBPJPY Live Trading Room Setup from 8/18

Read MoreWe issued a buy order for $GBPJPY on Aug 18 Live Trading Room and got filled on Aug 19 at 130.97. We took profit on Aug 24 at 132.6 for a +163 pips profit. Here’s the trade setup at 8/18 Live Trading Room Journal. Each day in Live Trading Room, members attending the session will receive a similar journal like the […]