-

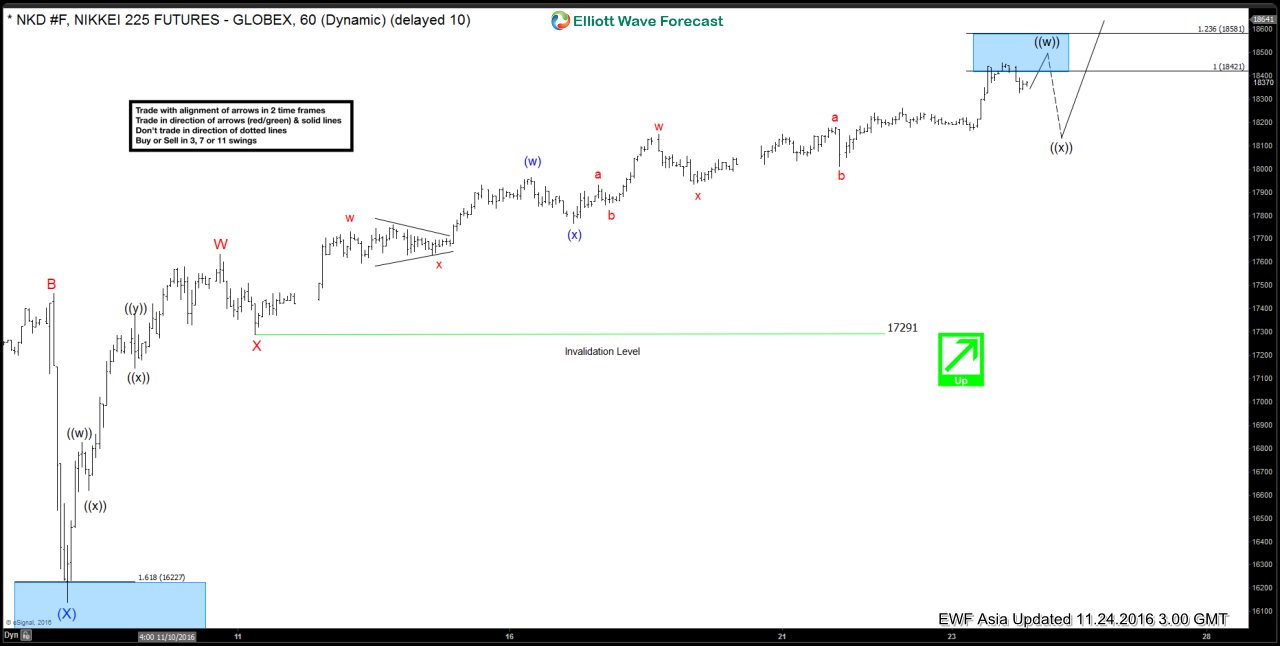

Nikkei Short-term Elliott Wave Analysis 11.25.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term, wave ((w)) is expected to complete at 18421 – 18581 area, and Nikkei index should ideally pullback in wave ((x)) in 3, 7, or 11 swing […]

-

Nikkei Short-term Elliott Wave Analysis 11.24.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term, wave ((w)) is expected to complete at 18421 – 18581 area, and Nikkei index should ideally pullback in wave ((x)) in 3, 7, or 11 swing […]

-

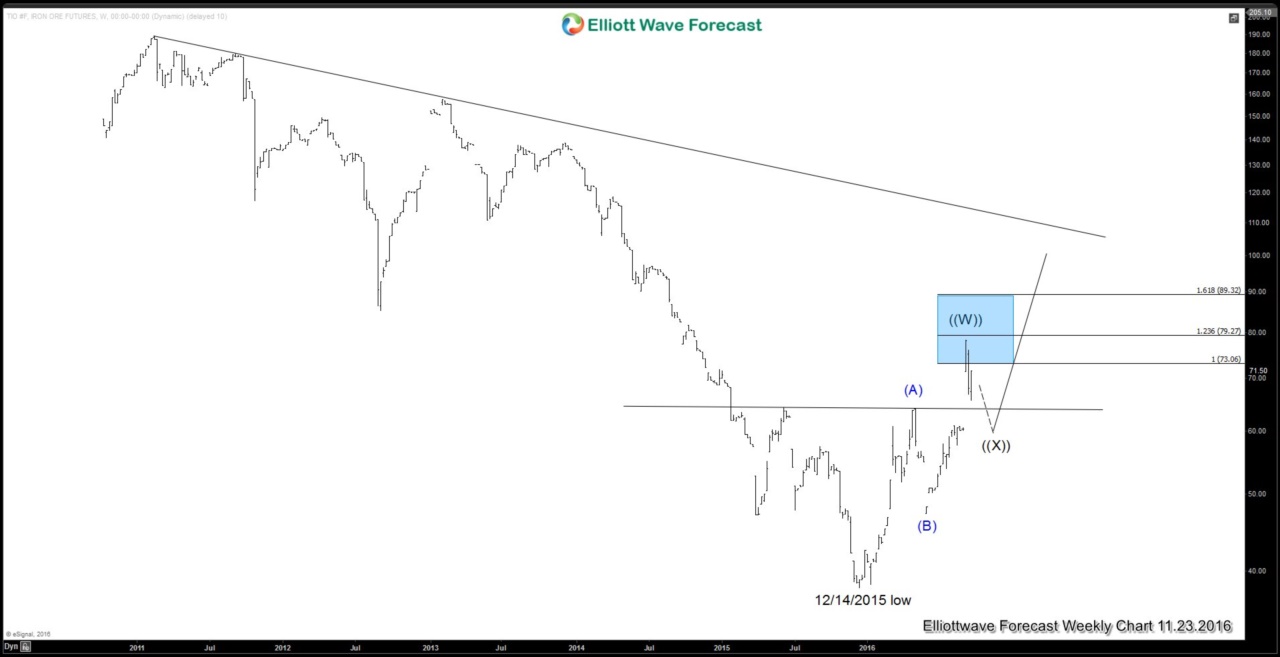

Trump Reflation Trade

Read MoreThe past decade has seen massive reliance on Monetary Policy by Central Bank to maintain economic momentum, but not enough Fiscal Policy or stimulative government intervention. The election of Donald Trump as the new U.S. president is thought to change that. In his first speech as president-elect, Mr. Trump highlighted investment in infrastructure, reinforcing the […]

-

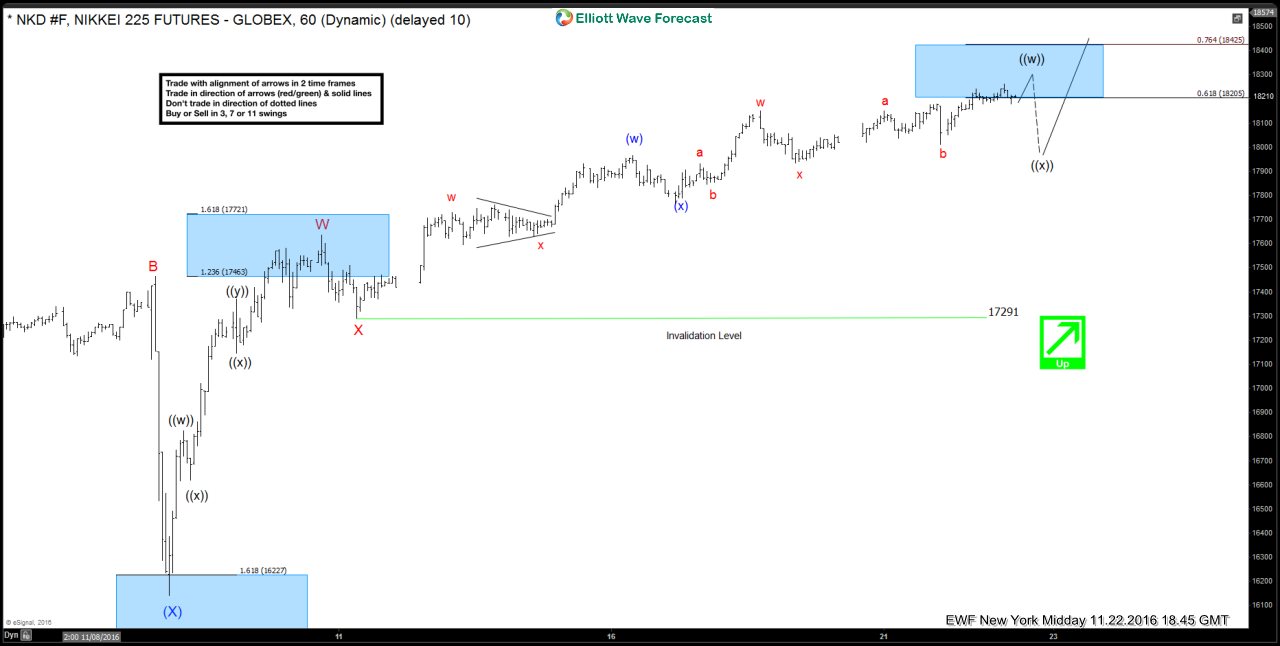

Nikkei Short-term Elliott Wave Analysis 11.23.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18205 – 18425 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]

-

Nikkei Short-term Elliott Wave Analysis 11.22.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18207 – 18427 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]

-

Nikkei Short-term Elliott Wave Analysis 11.18.2016

Read MoreNikkei Short Term Elliott wave cycles suggests that decline to 16140 ended wave (X). Rally from there is unfolding as double three where wave W ended at 17635 and wave X ended at 17291. Near term focus is on 18207 – 18427 area to complete wave ((w)), then it should pullback in wave ((x)) in 3, 7, or 11 […]