-

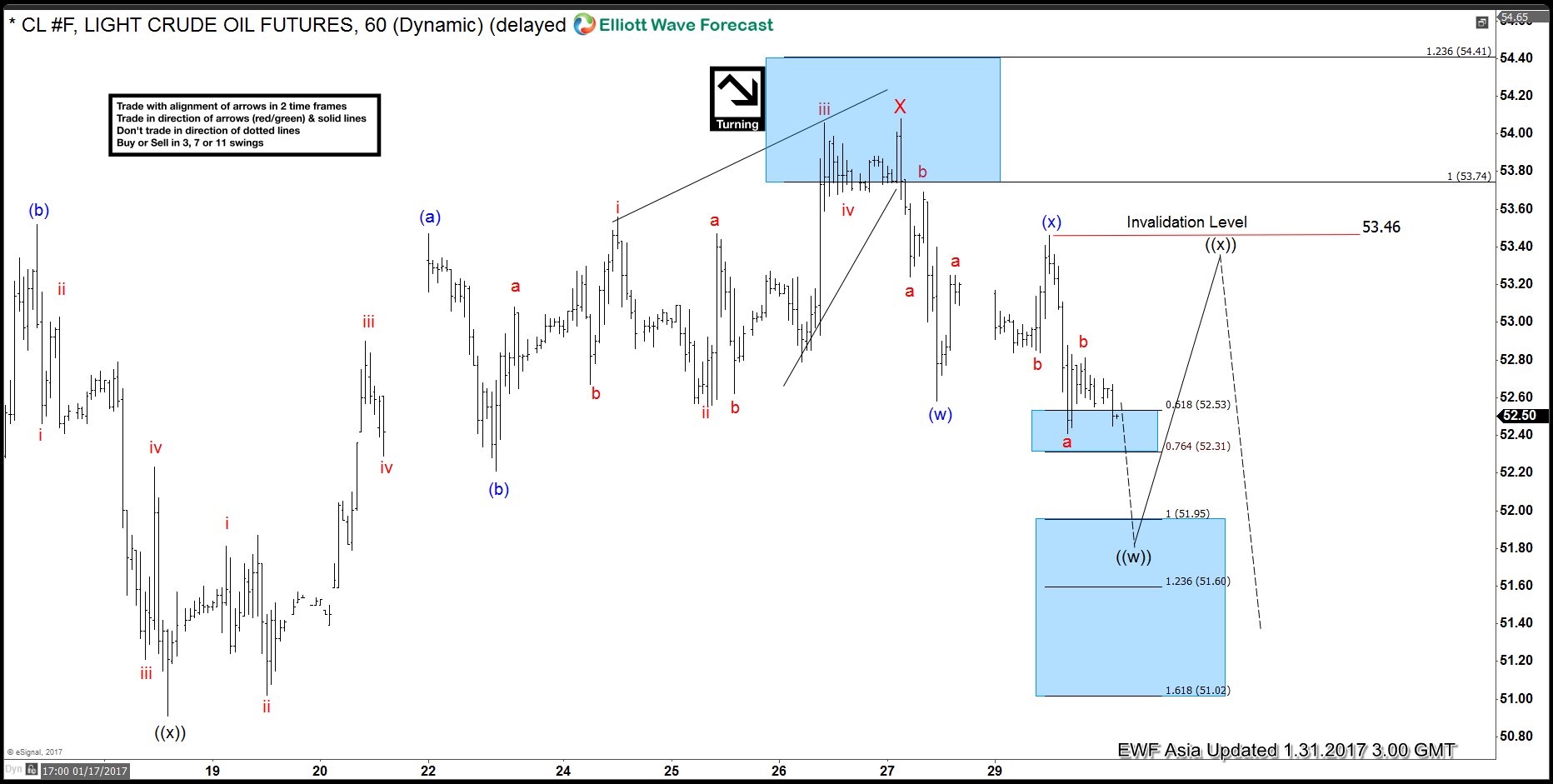

Oil CL_F: Buying Opportunity should come soon

Read MoreRally to 55.24 completed Intermediate wave (W) and ended the cycle from 8/3/2016 low. From 55.24 high, oil turned lower to correct the cycle from 8/3 low as a double three structure where Minor wave W ended at 50.71 and Minor wave X ended at 54.08. Decline from 54.08 high is showing a 5 swing […]

-

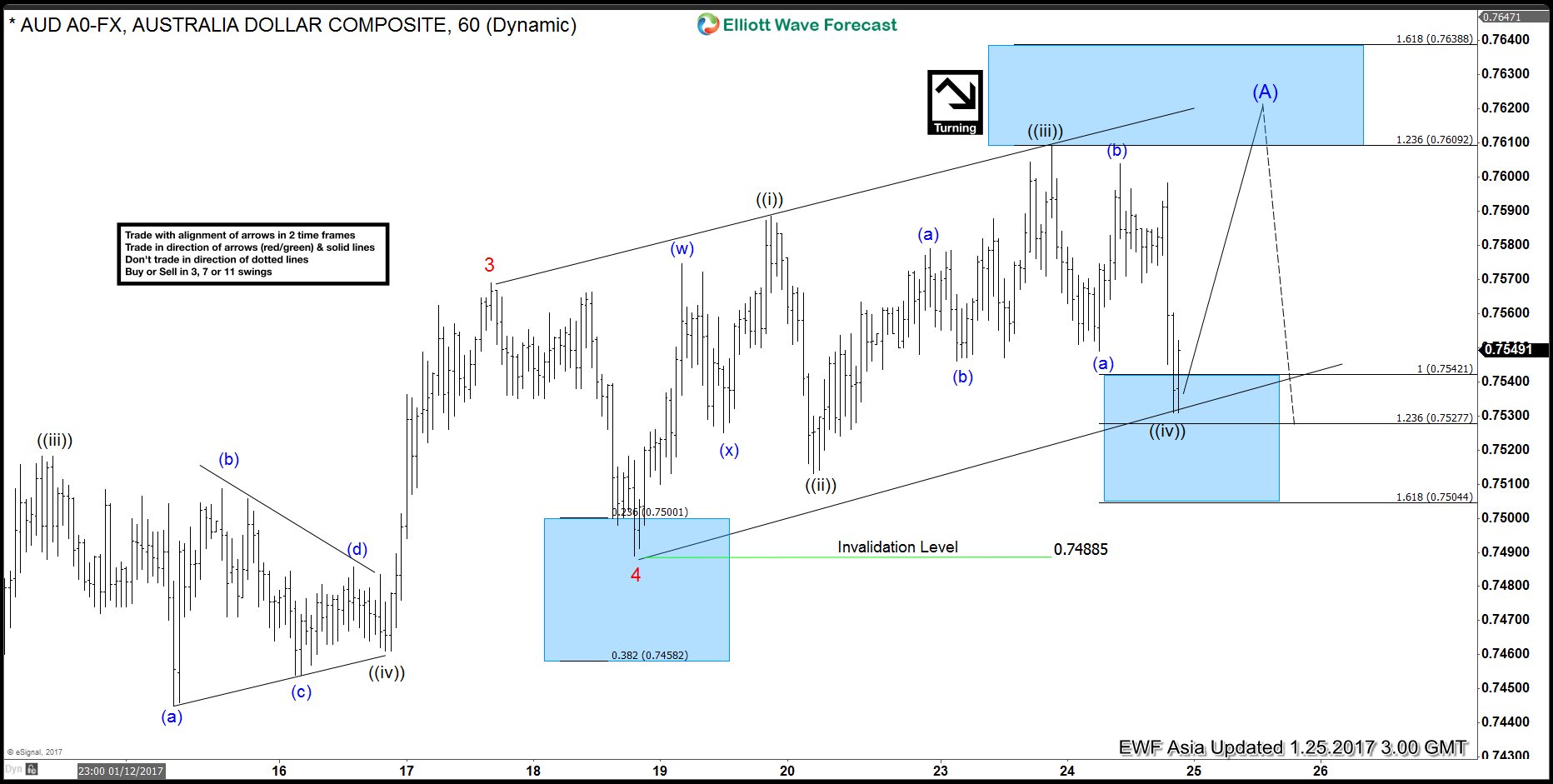

AUDUSD Elliottwave Analysis: Close to turning

Read MoreAUDUSD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, more upside within wave 5 is expected as a diagonal before pair ends the cycle […]

-

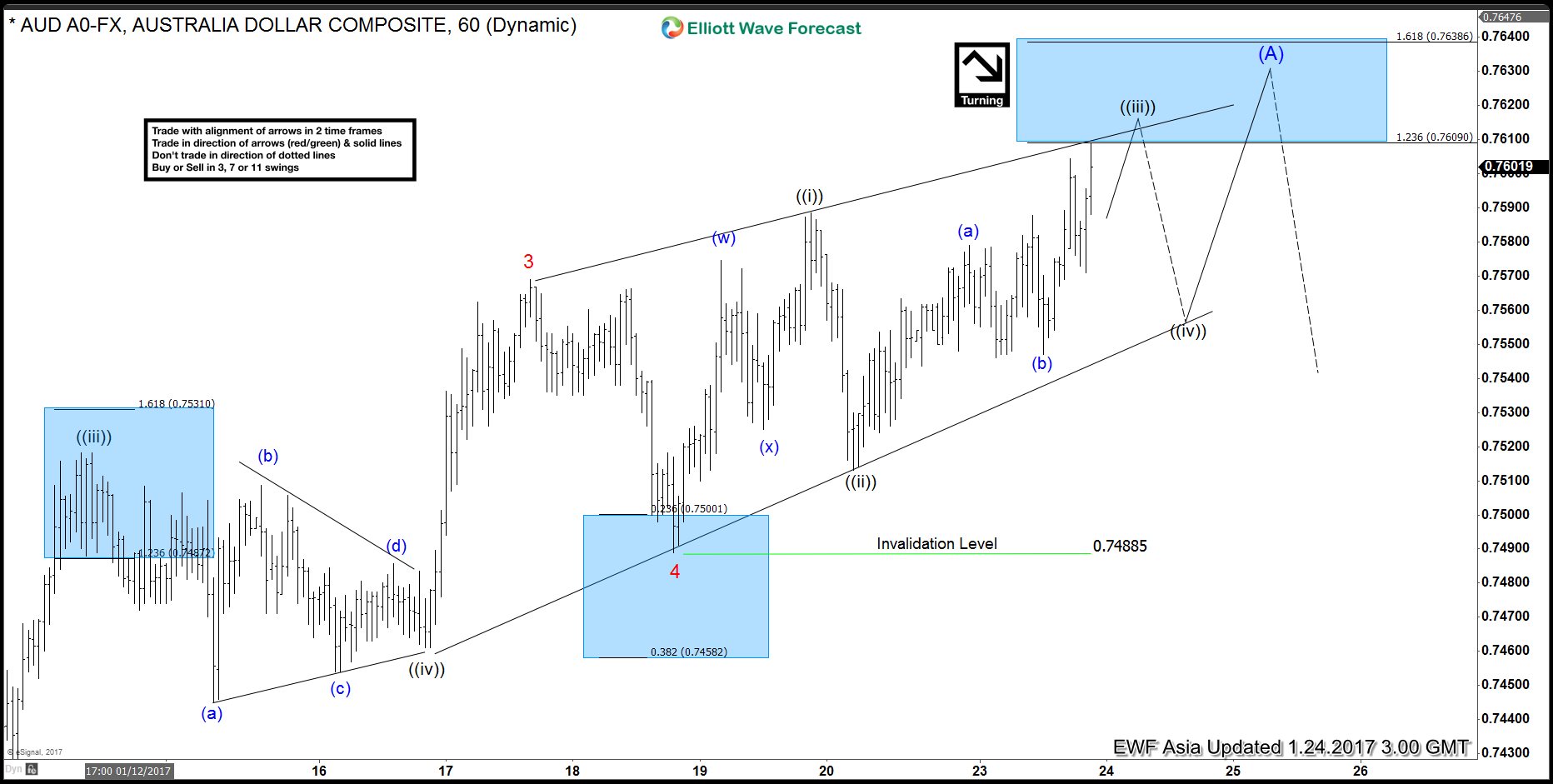

AUDUSD Elliottwave: Ending Wave 5 Diagonal

Read MoreAUDUSD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, more upside within wave 5 is expected as a diagonal before pair ends the cycle […]

-

AUDUSD Turn is Imminent

Read MoreAUDUSD rally from 12/23/2016 low is unfolding in 5 waves and the cycle from Dec 23 low is expected to complete soon and a 3 waves pullback at minimum can be seen. Watch the video, chart and commentary below: AUDUSD Video AUDUSD Chart and Commentary AUDUSD rally from 12/23/2016 low (0.716) is unfolding in […]

-

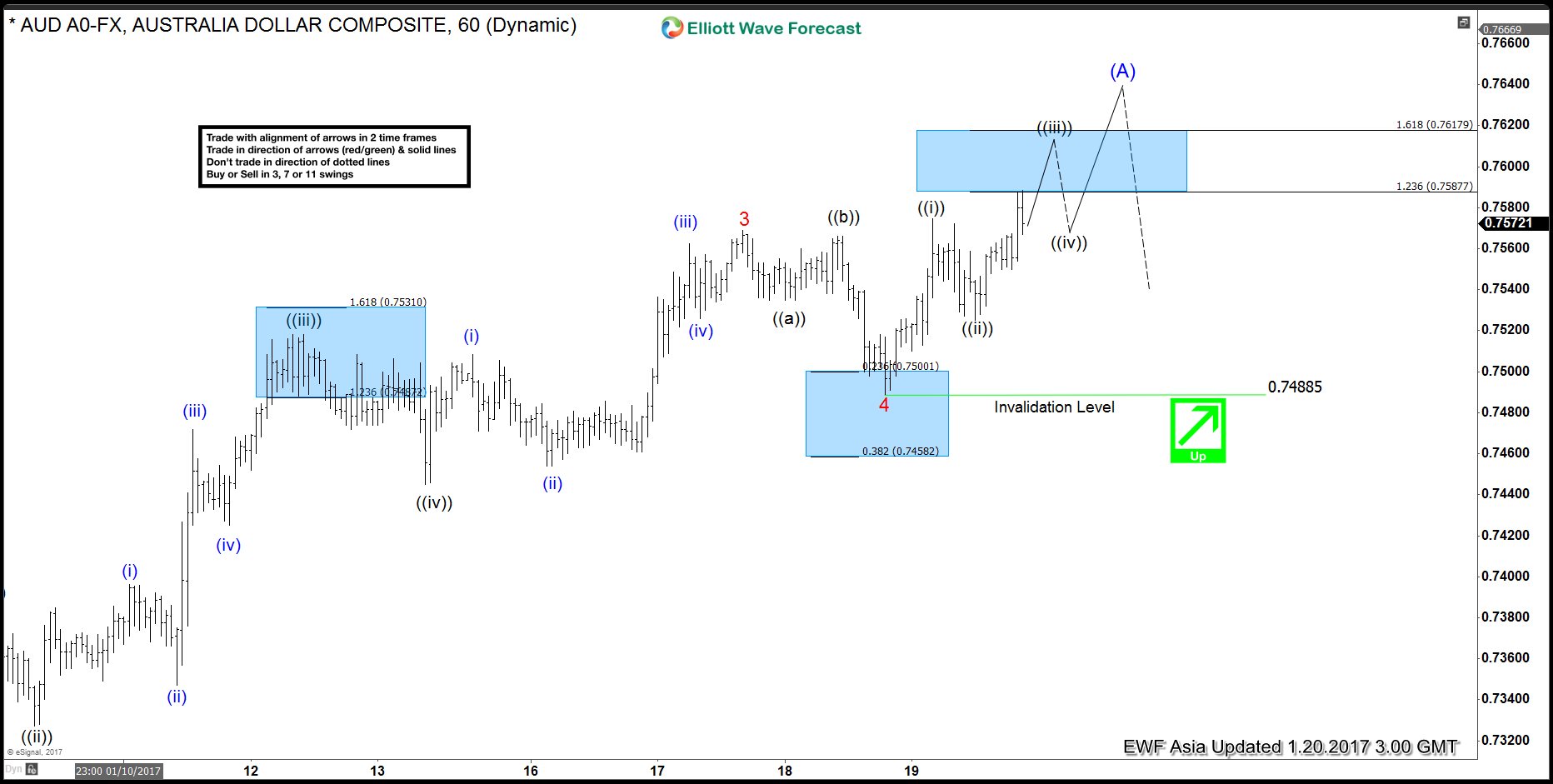

AUDUSD Elliott Wave Analysis 1.20.2017

Read MoreAUDUSD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, more upside within wave 5 is expected before pair ends the cycle from 12/23 low. […]

-

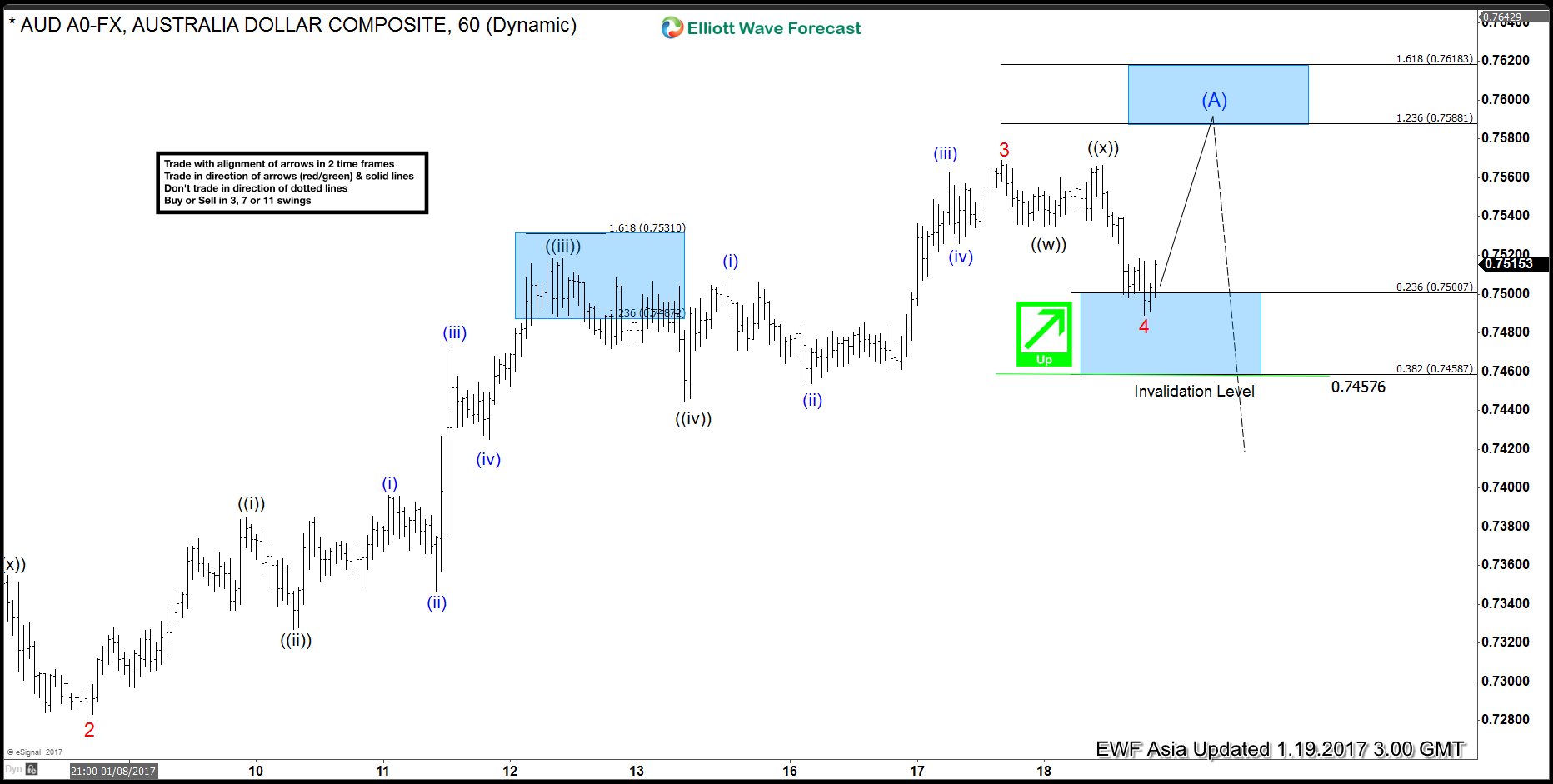

AUDUSD Elliott Wave Analysis 1.19.2017

Read MoreAUDUSD move up from 12/23 low is extending and as pair keeps extending higher with shallow pull backs, it looks like the move up from 12/23 low is unfolding as an Elliott wave impulse and although the cycle is mature, another leg higher in wave 5 still can’t be rule out before pair ends the […]