-

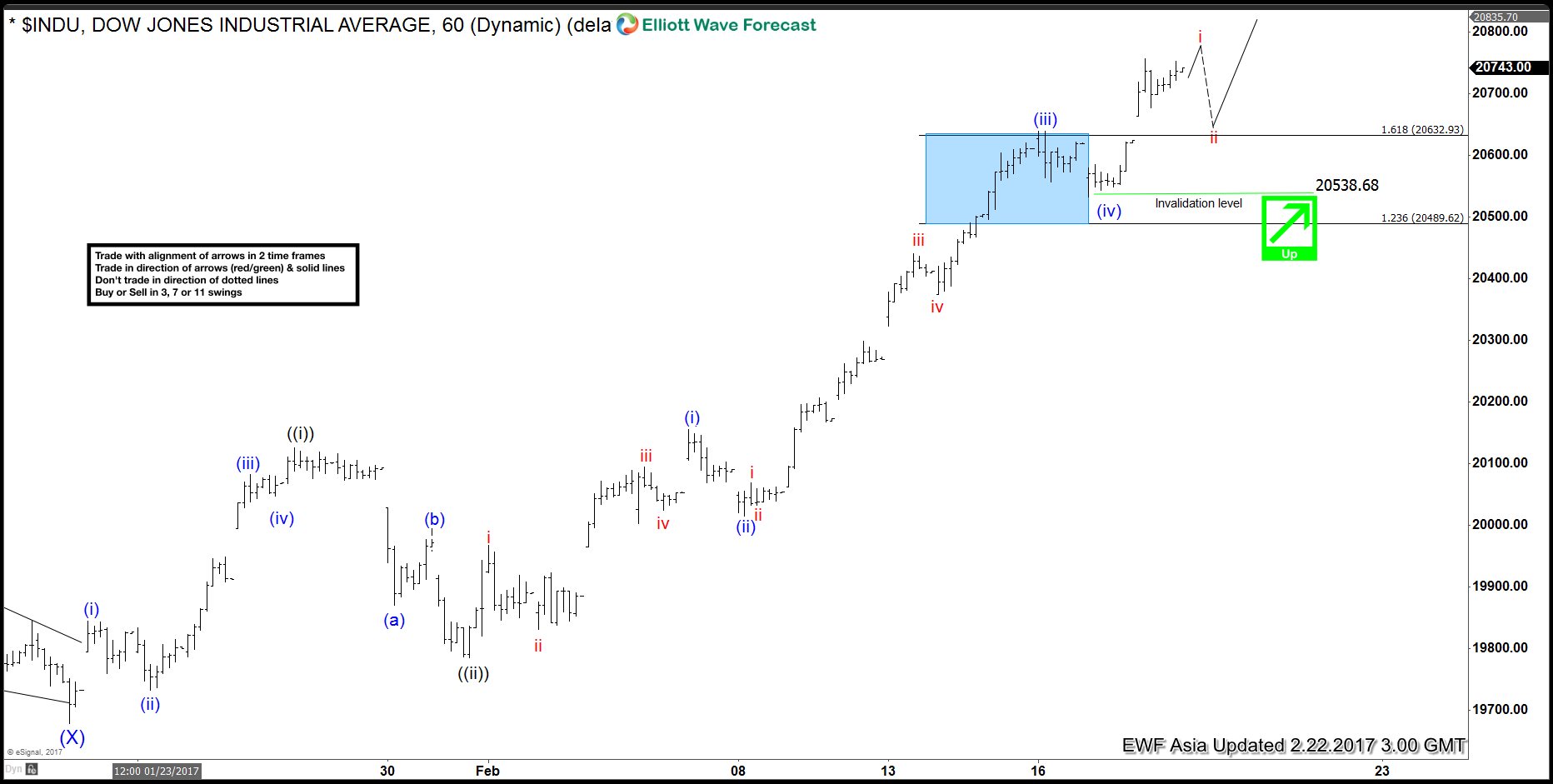

DJIA Elliott Wave View: Wave ((iii)) in progress

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) is showing an extension and […]

-

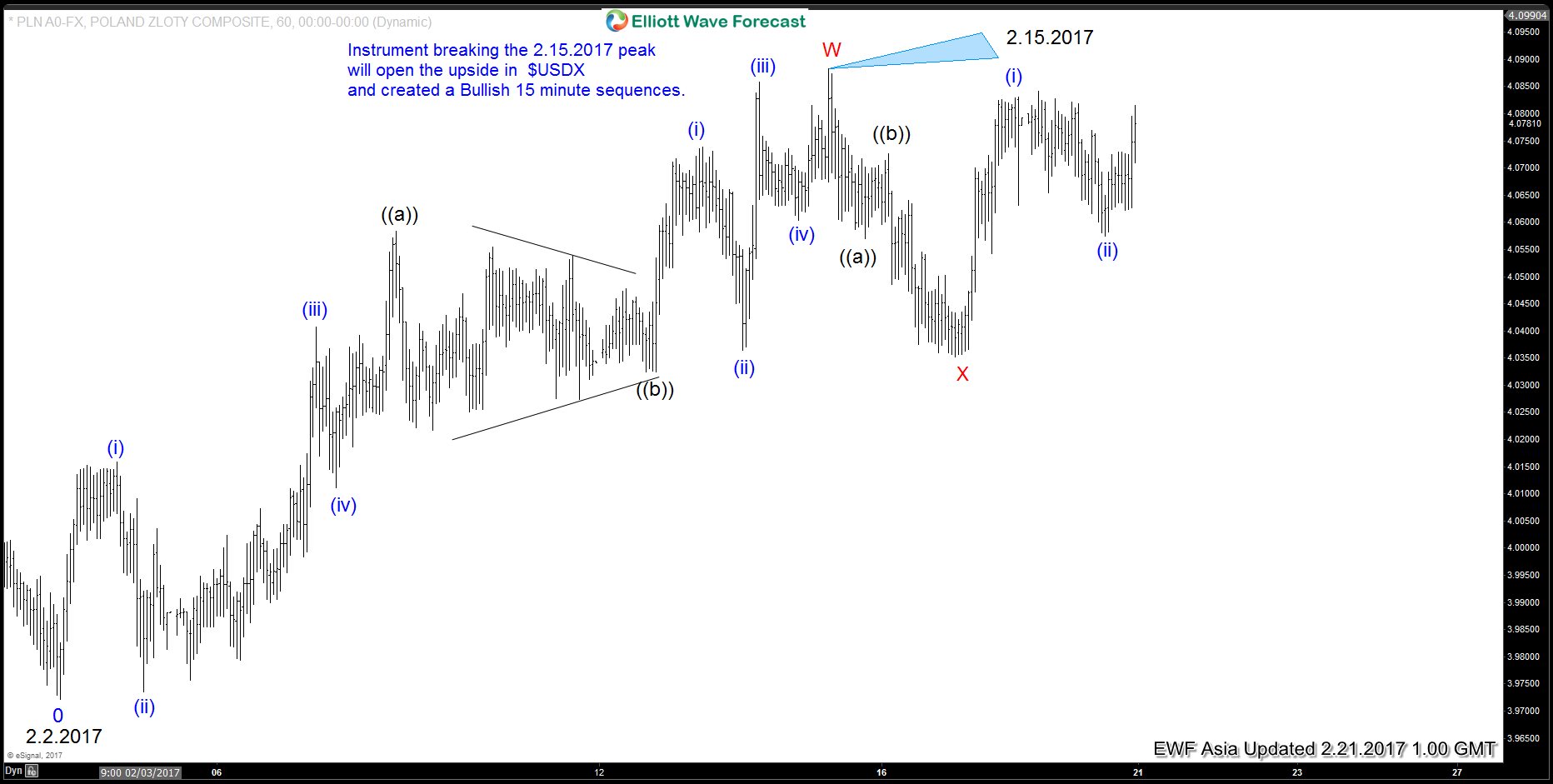

USDPLN Intraday Elliott wave view

Read MoreShort term Elliott wave view of USDPLN (Poland Zloty) suggests that the pair is on the verge of breaking above the 2.15.2017 high at 4.0883. Rally from 2.2.2017 low (3.9722) is unfolding as a double correction Elliott Wave structure where wave W ended at 4.0883 and wave X is proposed complete at 4.0352. Internal of wave W […]

-

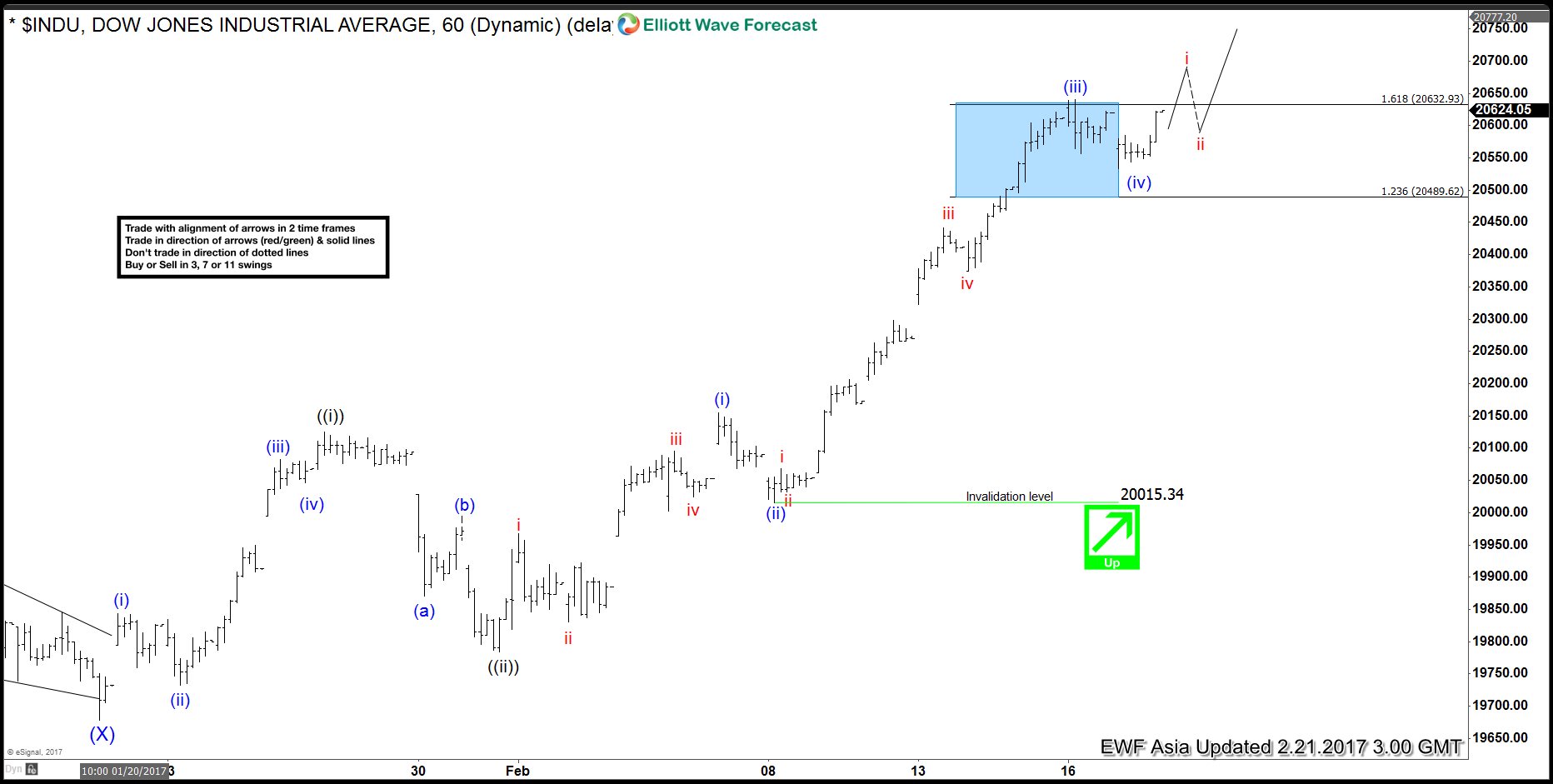

DJIA Elliott Wave View: Marching higher

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) shows an extension and […]

-

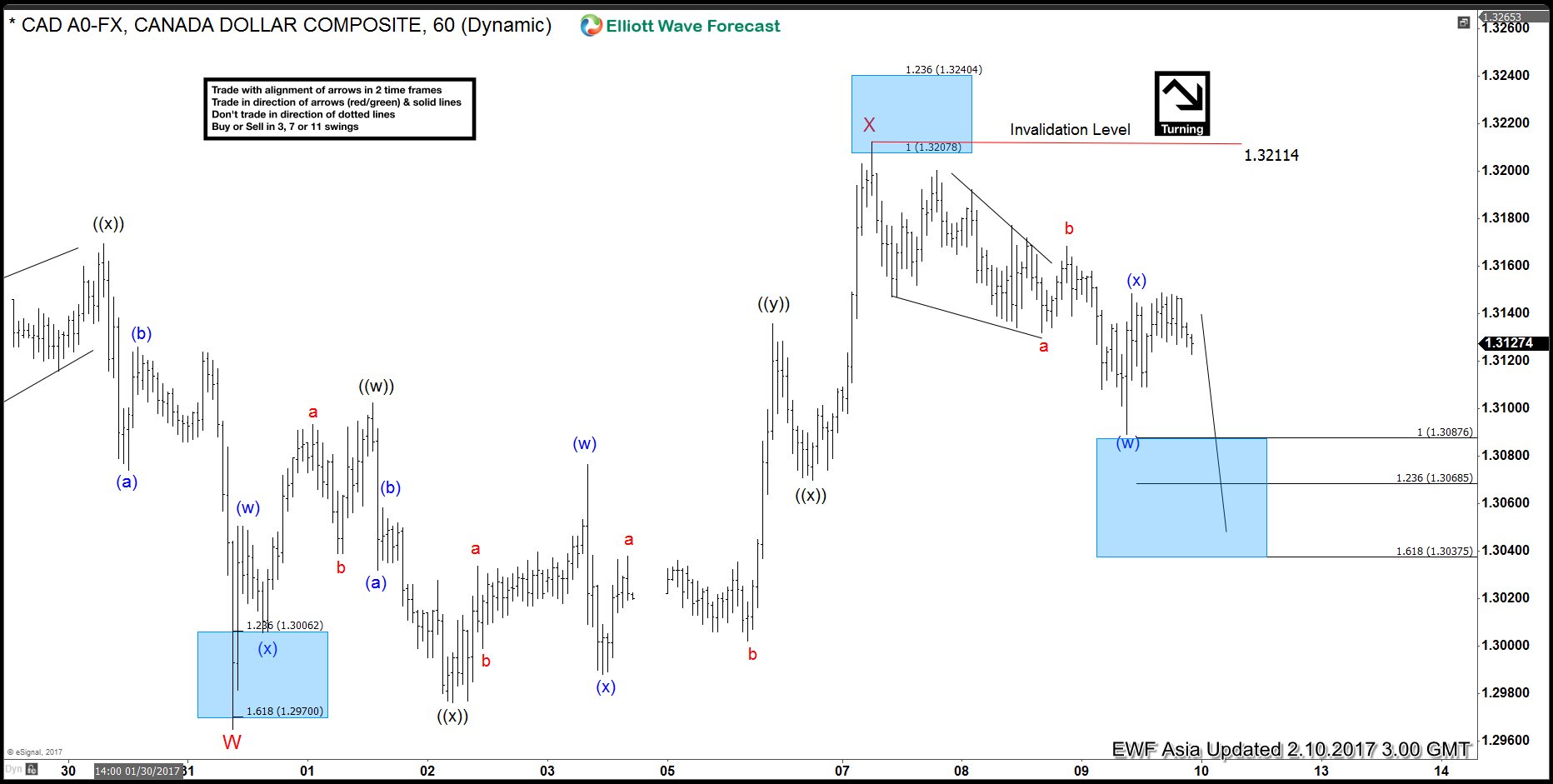

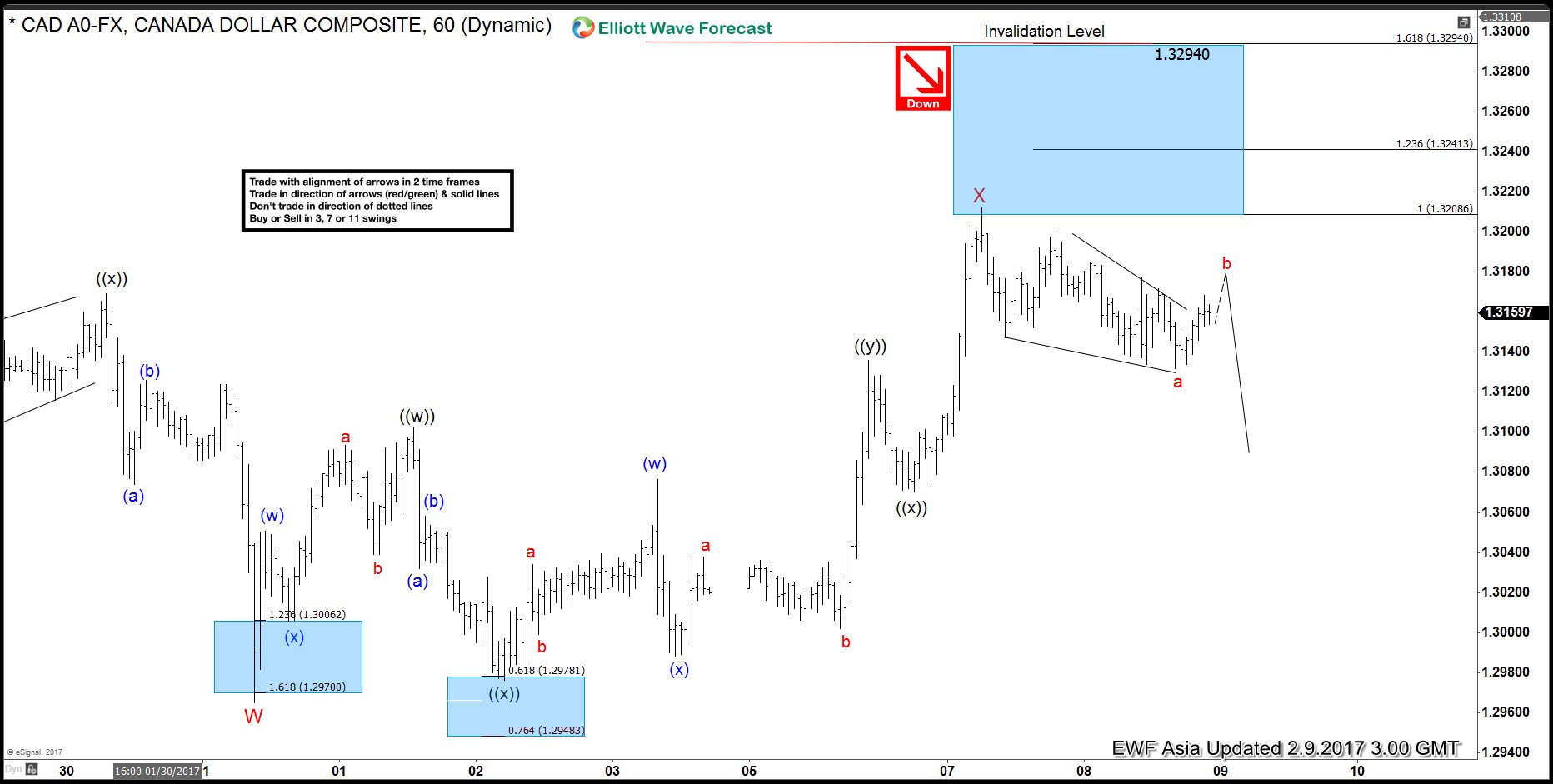

USDCAD Elliott Wave View: More downside

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is proposed complete as a triple three structure where Minute wave ((w)) ended at 1.3102, and Minute wave ((x)) ended at […]

-

USDCAD Short Term Elliott Wave: Turning Lower

Read MorePreferred Elliott wave view in USDCAD suggests that the pair is showing a 5 swing bearish sequence from 12/28 high, favoring more downside. Short term, decline to 1.2965 ended Minor wave W and Minor wave X bounce is proposed complete as a triple three structure where Minute wave ((w)) ended at 1.3102, and Minute wave ((x)) ended at […]

-

Gold: Waiting for the next leg higher

Read MoreThe video below explains the inverse correlation of Gold-to-Silver ratio with Gold and Silver. We also explain why it’s useful to monitor this ratio to determine the next move higher in the precious metal group Take our 14 days FREE trial by clicking here –> risk free trial and get access to professional-grade Elliott wave charts for […]