-

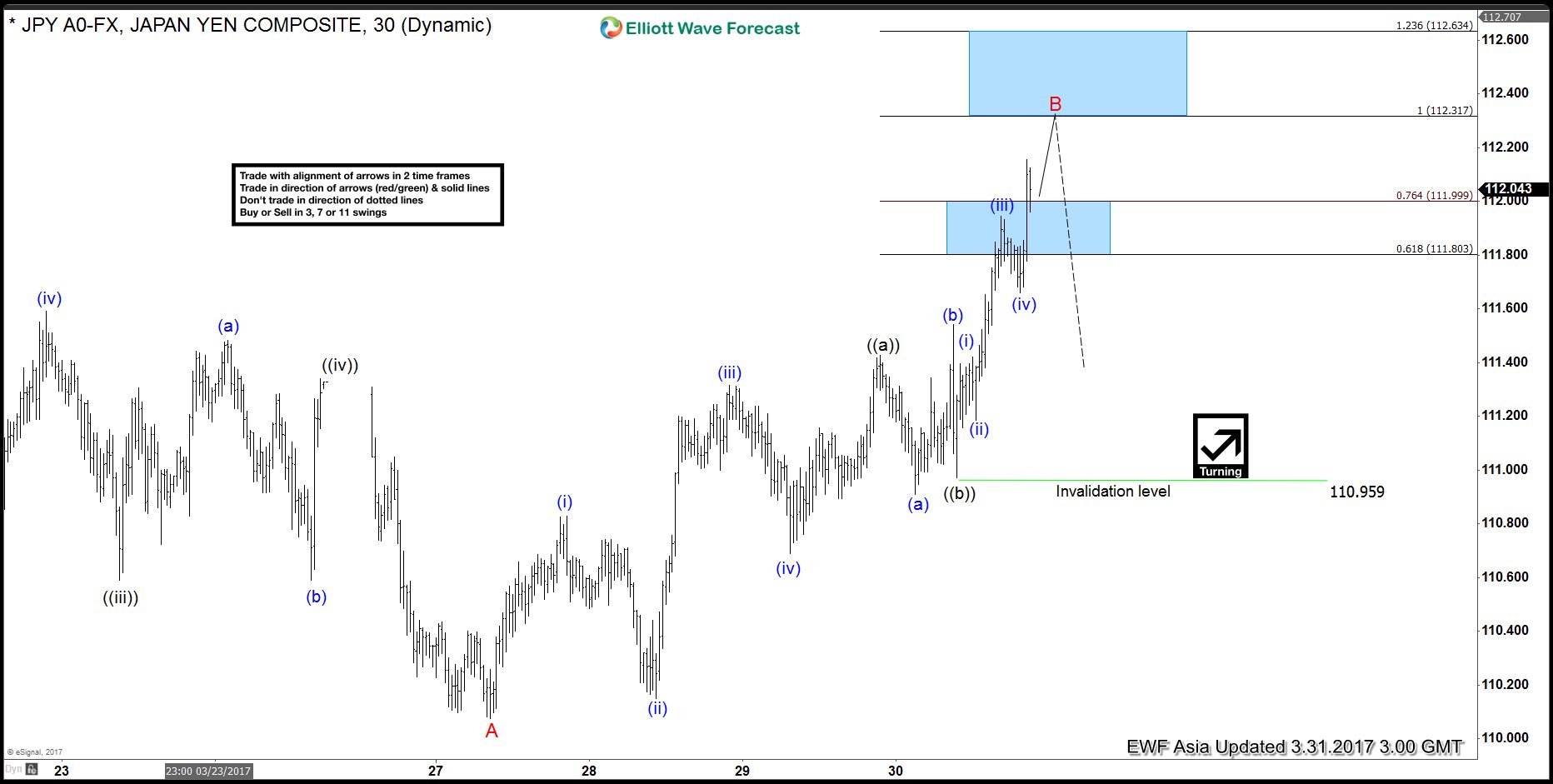

USDJPY Elliott wave View: Extended bounce

Read MoreShort term Elliott Wave view in USDJPY suggests that cycle from 3/10 peak (115.53) has ended with Minor wave A at 110.077. Decline from 115.53 is unfolding as a 5 waves impulse Elliott wave structure with an extension where Minute wave ((i)) ended at 114.46, Minute wave ((ii)) ended at 115.19, Minute wave ((iii)) ended at 110.59, […]

-

DAX Elliott Wave View: Short term top near

Read MoreThe move higher in DAX from 3/22 low is proposed to be unfolding as a zigzag Elliott Wave structure where the first leg Minutte wave (a) is subdivided in a 5 waves impulse Elliottwave structure and the third leg wave (c) is also subdivided into a 5 waves impulse Elliottwave structure. It’s not a good […]

-

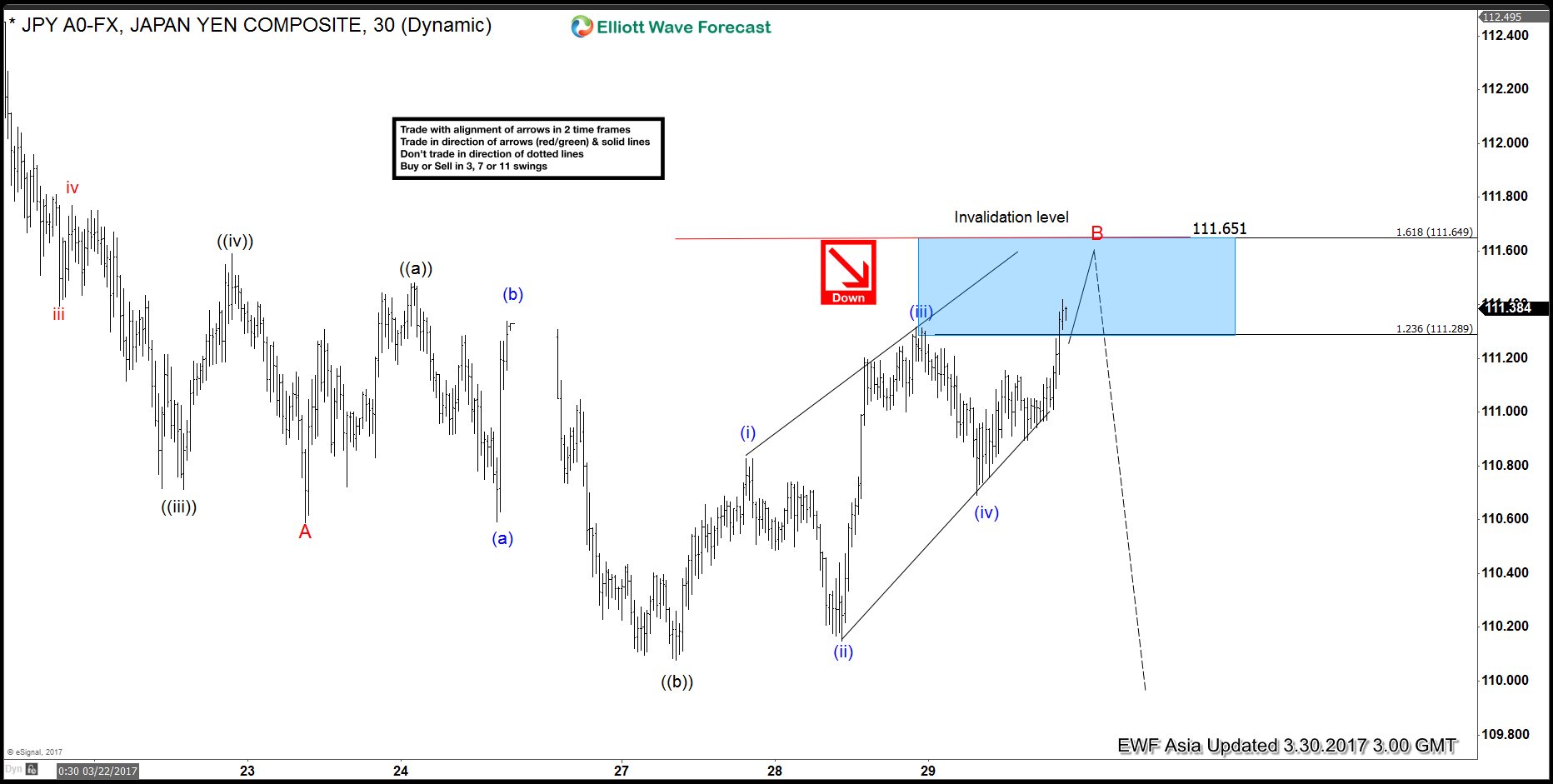

USDJPY Elliott wave View: Flat correction

Read MoreShort term Elliott Wave view in USDJPY suggests that cycle from 3/10 peak (115.53) has ended with Minor wave A at 110.589. Decline from 115.53 is unfolding as a 5 waves impulse Elliott wave structure with an extension where Minute wave ((i)) ended at 114.46, Minute wave ((ii)) ended at 115.19, Minute wave ((iii)) ended at 110.7, […]

-

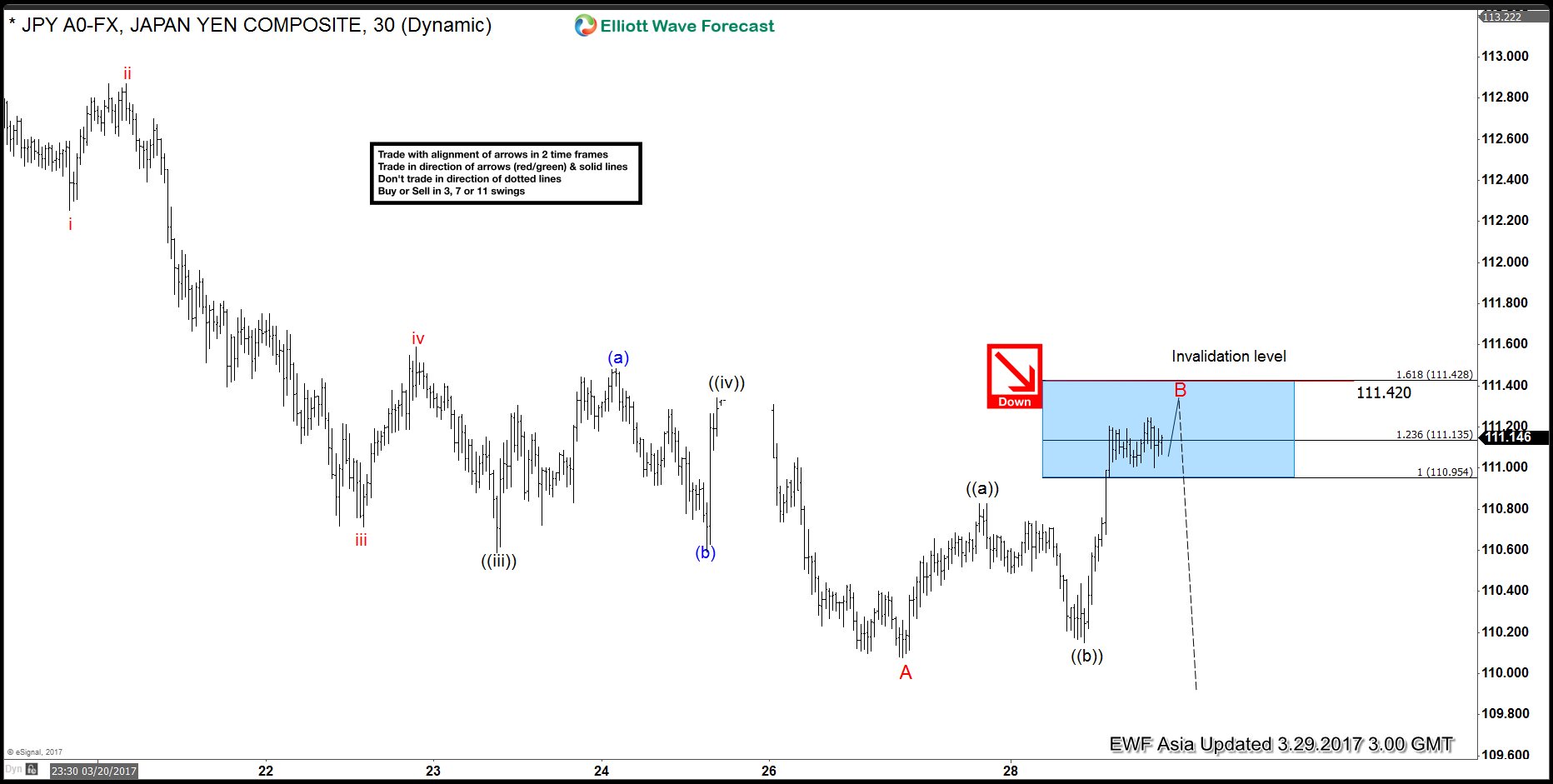

USDJPY Elliott wave View: Ending a cycle

Read MoreShort term Elliott Wave view in USDJPY suggests that cycle from 3/10 peak (115.53) has ended with Minor wave A at 110.07. Decline from 115.53 is unfolding as a 5 waves impulse Elliott wave structure with an extension where Minute wave ((i)) ended at 114.46, Minute wave ((ii)) ended at 115.19, Minute wave ((iii)) ended at 110.59, […]

-

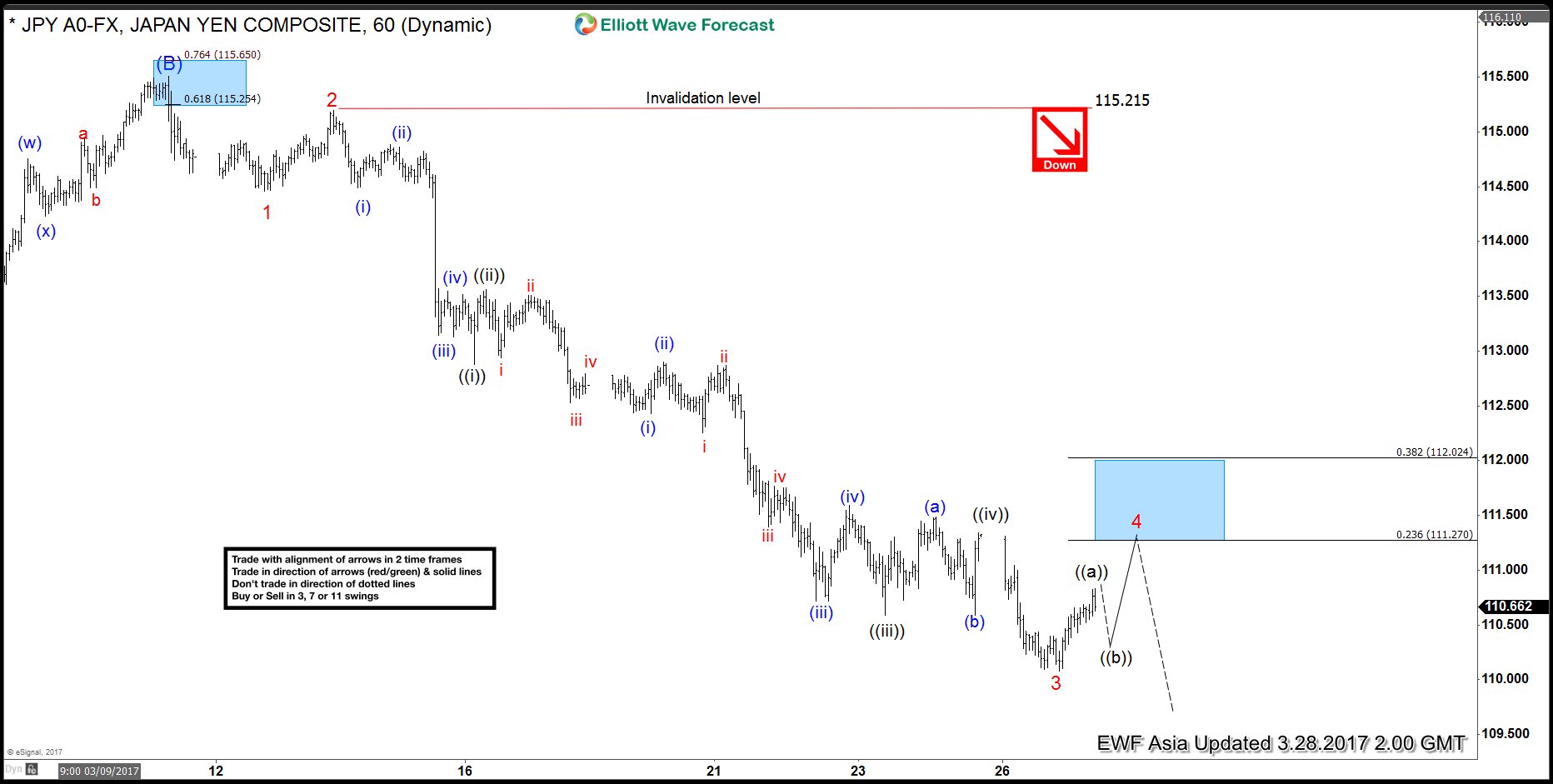

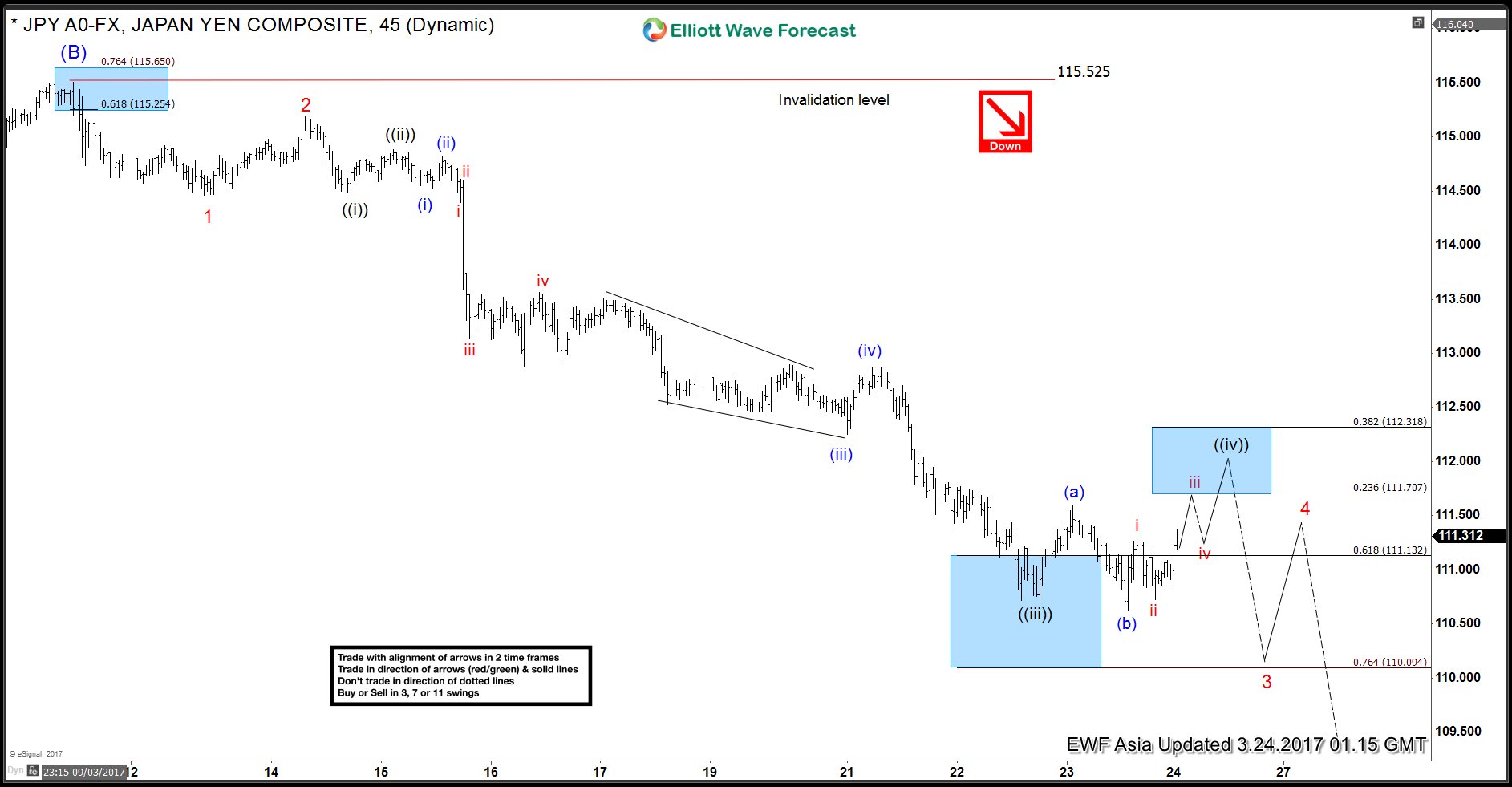

USDJPY Elliott wave View: Extension lower

Read MoreWe are taking the more aggressive view in USDJPY and calling the rally to 115.48 on 3/10 as Intermediate wave (B). Decline from there is unfolding as a 5 waves impulse Elliott wave structure with an extension in wave 3. Down from 115.5, Minor wave 1 ended at 114.46 and Minor wave 2 ended at 115.2. […]

-

USDJPY Elliott wave View: More downside

Read MoreWe are taking the more aggressive view in USDJPY and calling the rally to 115.48 on 3/10 as Intermediate wave (B). Decline from there is unfolding as a 5 waves impulse Elliott wave structure with an extension in wave 3. Down from 115.48, Minor wave 1 ended at 114.46 and Minor wave 2 ended at 115.2. […]