-

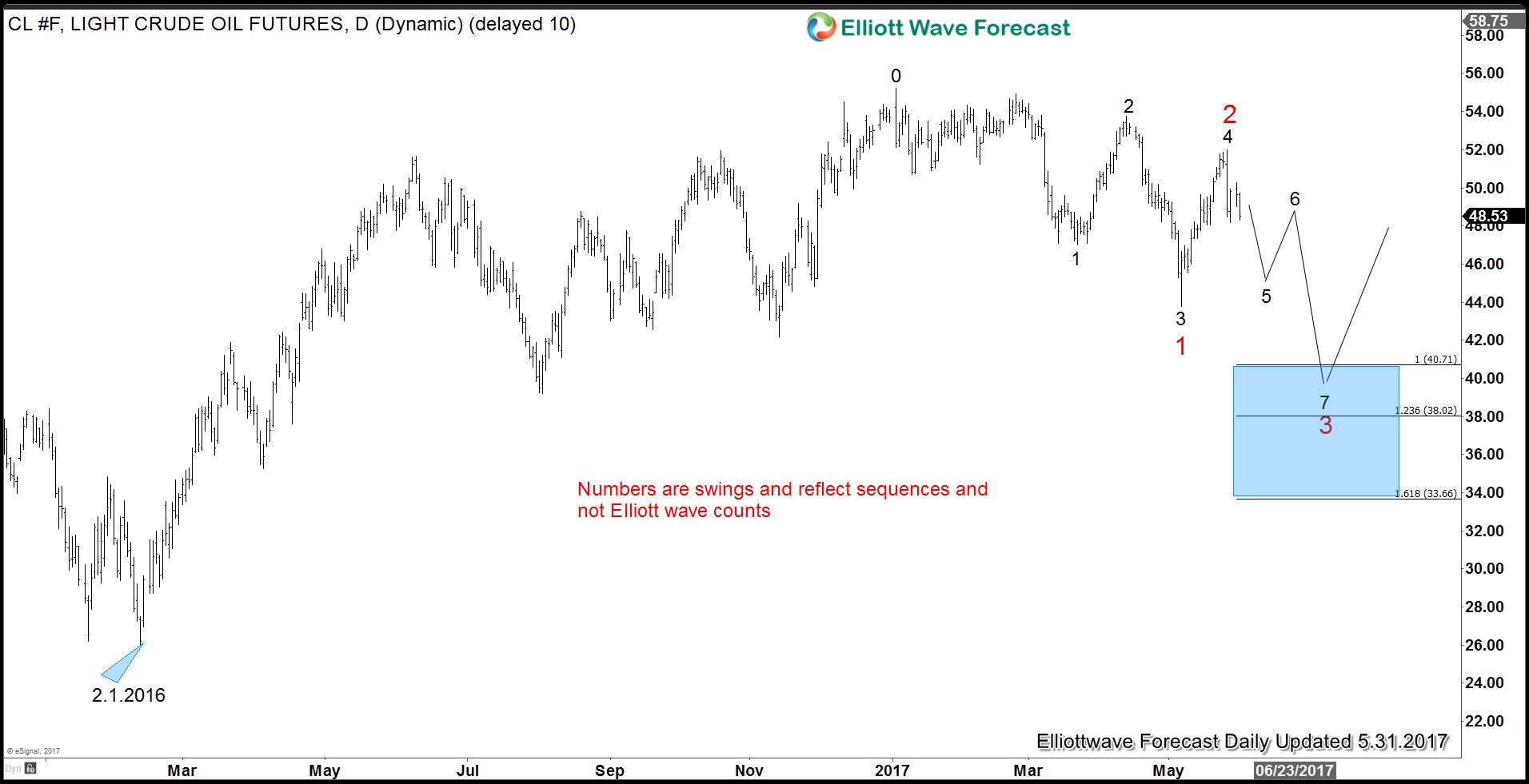

OPEC Meeting and Impact on Crude Oil

Read MoreOPEC ended its highly anticipated meeting on Vienna last Thursday to discuss about extending the production cut in Crude Oil. They have decided to extend the current agreement to cut production output by 1.8 million barrels per day by 9 more months to stabilize oil price. Oil prices plunged by more than 5 percent after the decision. […]

-

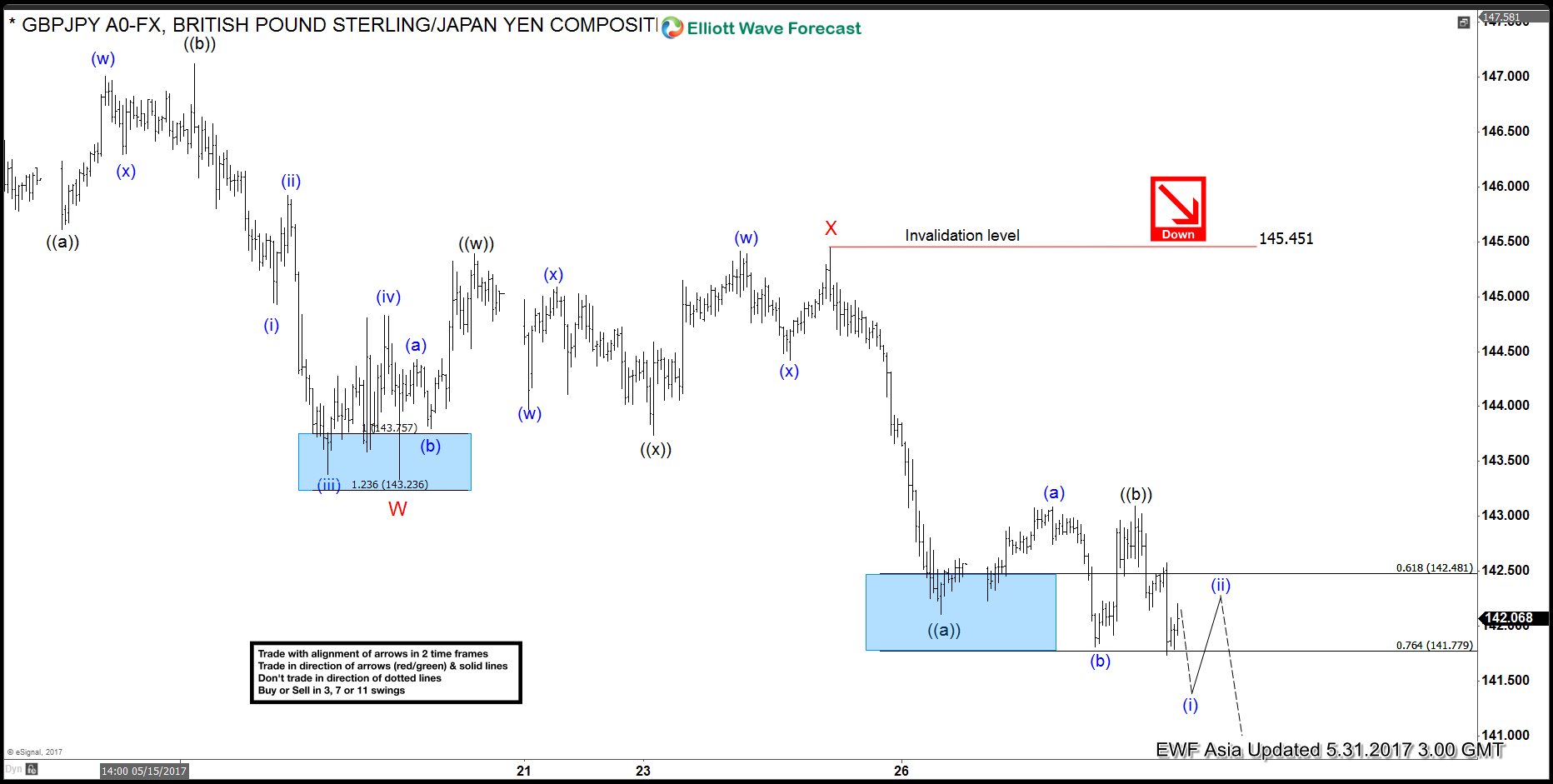

GBPJPY Elliott Wave : Downside Has Resumed

Read MoreShort Term GBPJPY Elliott Wave view suggests the decline from 5/10 peak is unfolding as a double three Elliott Wave structure where Minor wave W ended at 143.33 and Minor wave X ended at 145.45. The subdivision of Minor wave W unfolded as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 145.61, Minute […]

-

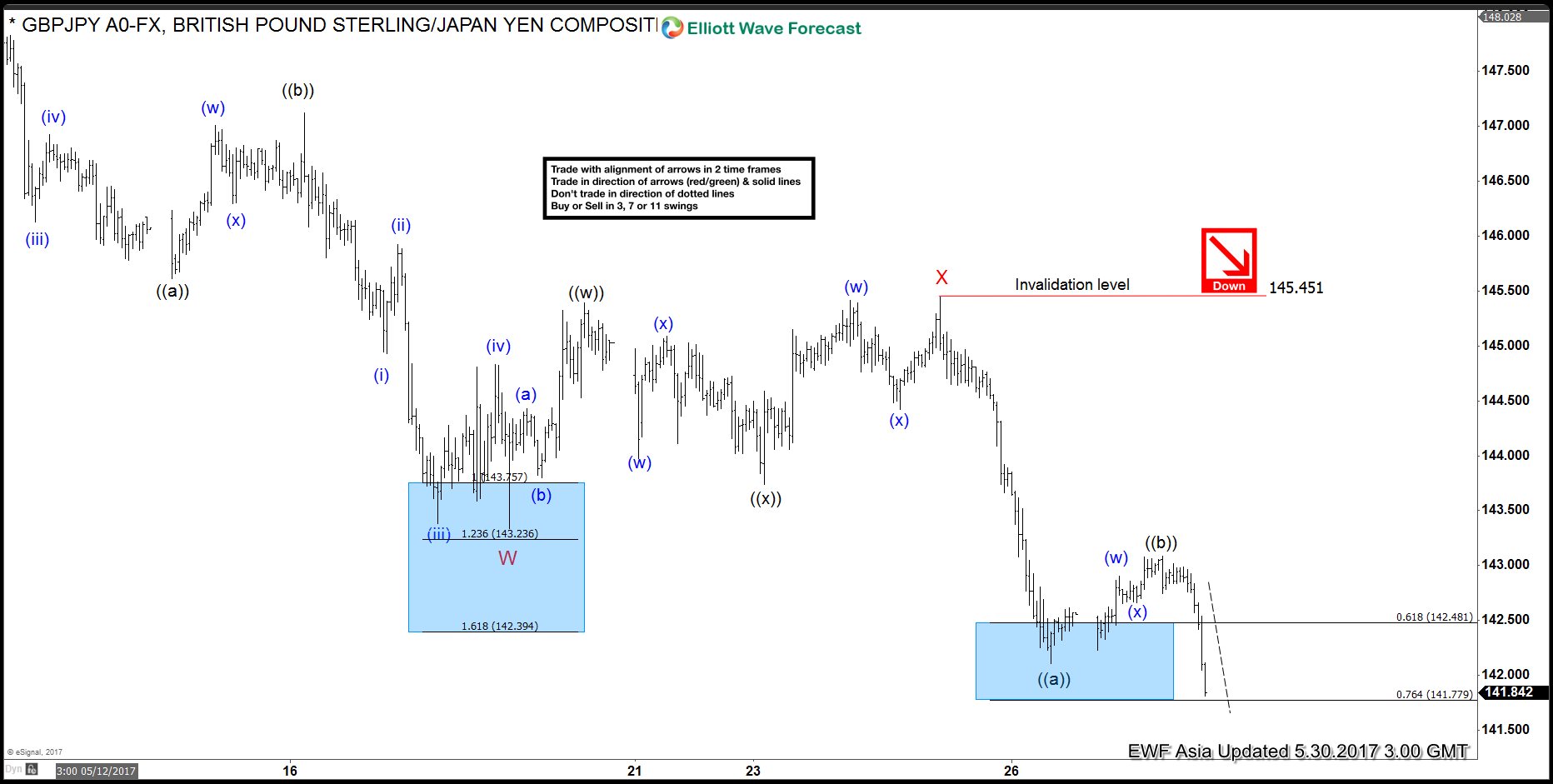

GBPJPY Elliott Wave: More Downside Expected

Read MoreShort Term Elliott Wave view in GBPJPY suggests the decline from 5/10 peak is unfolding as a double three Elliott Wave structure where Minor wave W ended at 143.33 and Minor wave X ended at 145.45. The subdivision of Minor wave W unfolded as a zigzag Elliott Wave structure where Minute wave ((a)) ended at 145.61 […]

-

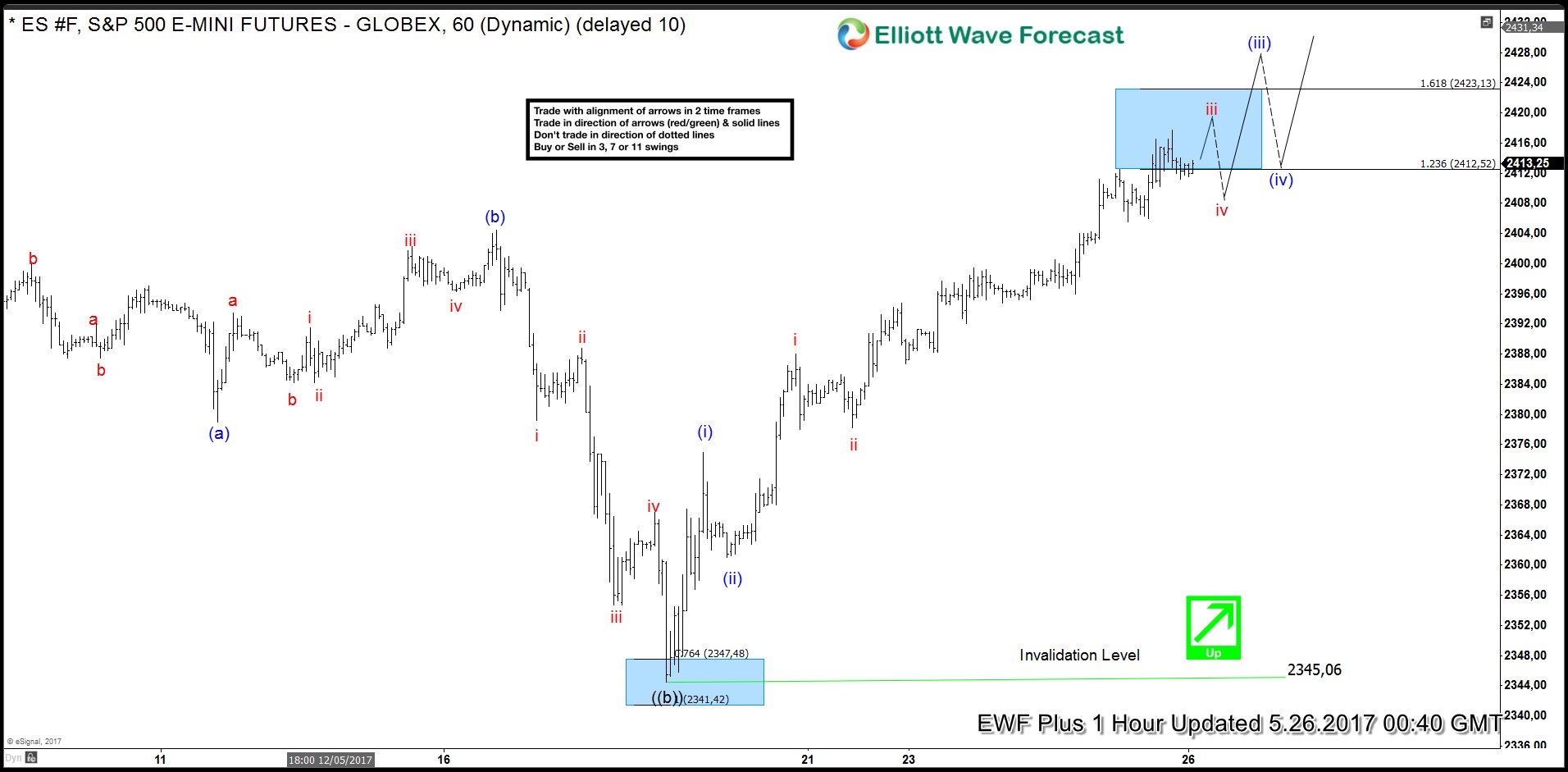

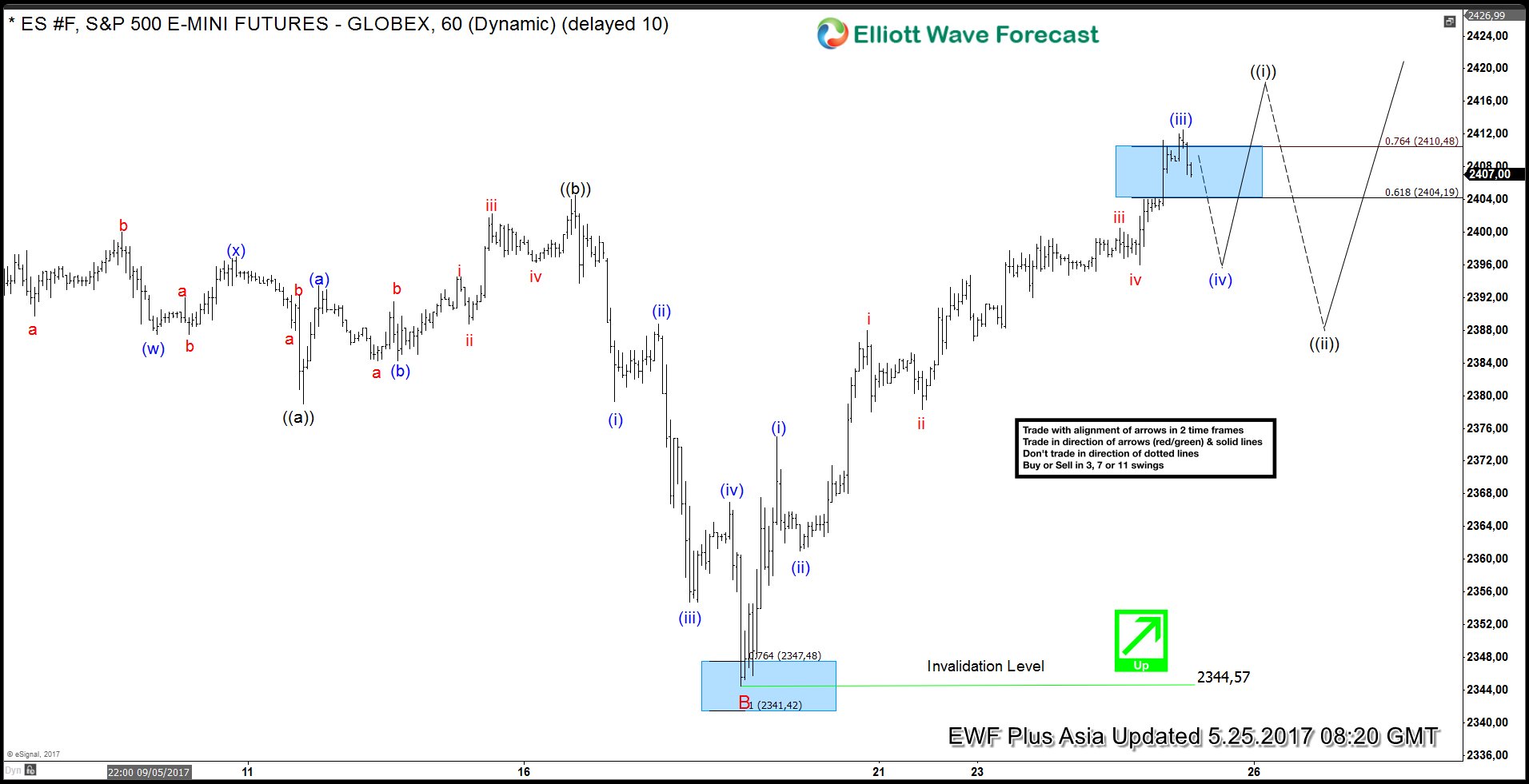

ES_F E-Mini S&P500 Elliott Wave: Ending wave (iii)

Read MoreShort Term Elliott Wave view in ES_F E-Mini S&P500 suggests the rally to 2403.75 ended Minor wave A. Minor wave B unfolded as an Expanded Flat Elliott Wave structure where Minute wave ((a)) ended at 2379, Minute wave ((b)) ended at 2404.5, and Minute wave ((c)) of B ended at 2344.5. After ending the pullback, the Index […]

-

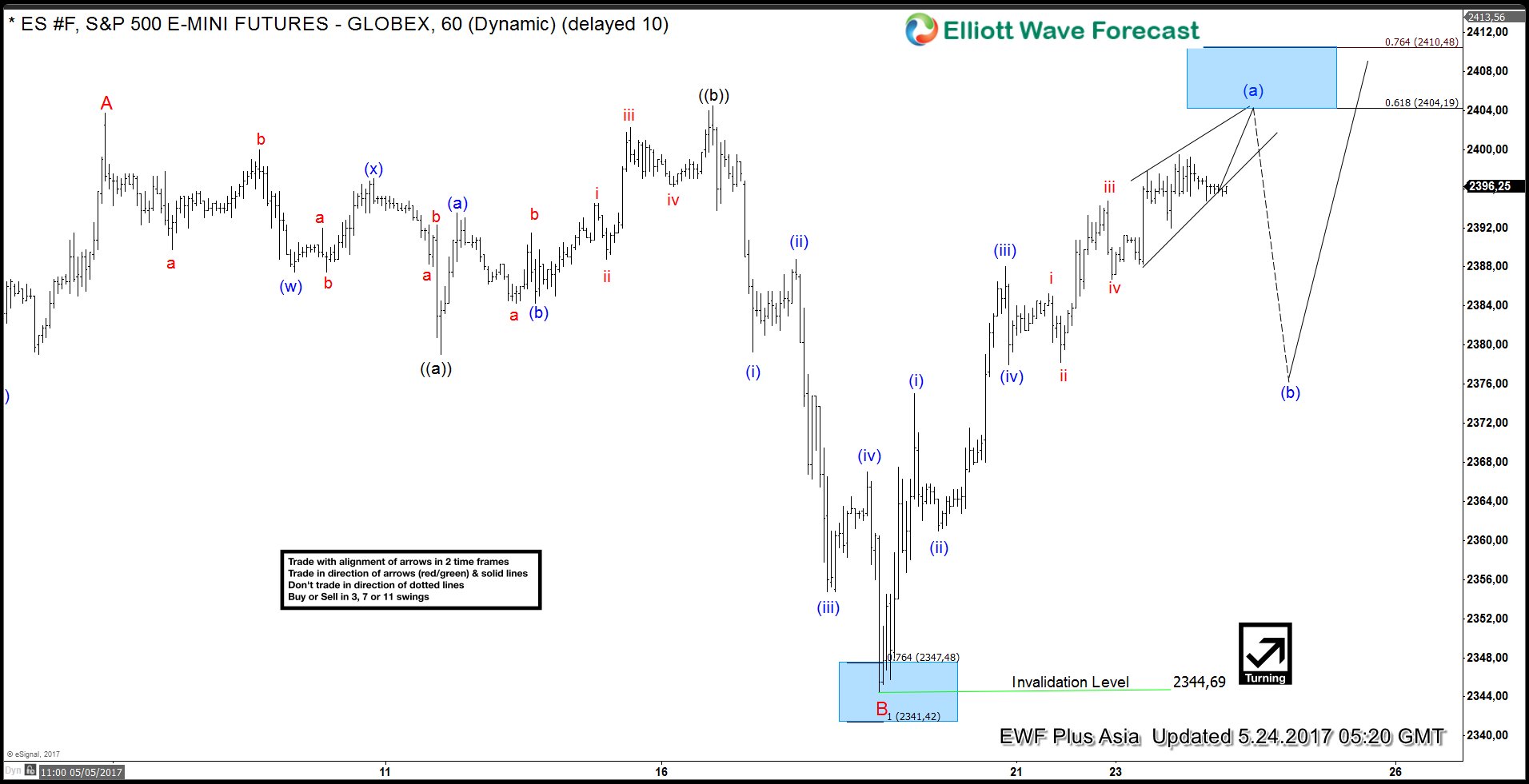

ES_F Index Elliott Wave: Resuming Higher

Read MoreShort Term Elliott Wave view in ES_F Index suggests the rally to 2403.75 ended Minor wave A. Minor wave B unfolded as an Expanded Flat Elliott Wave structure where Minute wave ((a)) ended at 2379, Minute wave ((b)) ended at 2404.5, and Minute wave ((c)) of B ended at 2344.5. After ending the pullback, the Index […]

-

ES_F Elliott Wave View: Ending Impulse

Read MoreShort Term Elliott Wave view in ES_F suggests the rally to 2403.75 ended Minor wave A. Minor wave B unfolded as an Expanded Flat Elliott Wave structure where Minute wave ((a)) ended at 2379, Minute wave ((b)) ended at 2404.5, and Minute wave ((c)) of B ended at 2344.5. After ending the pullback, the Index started a […]