-

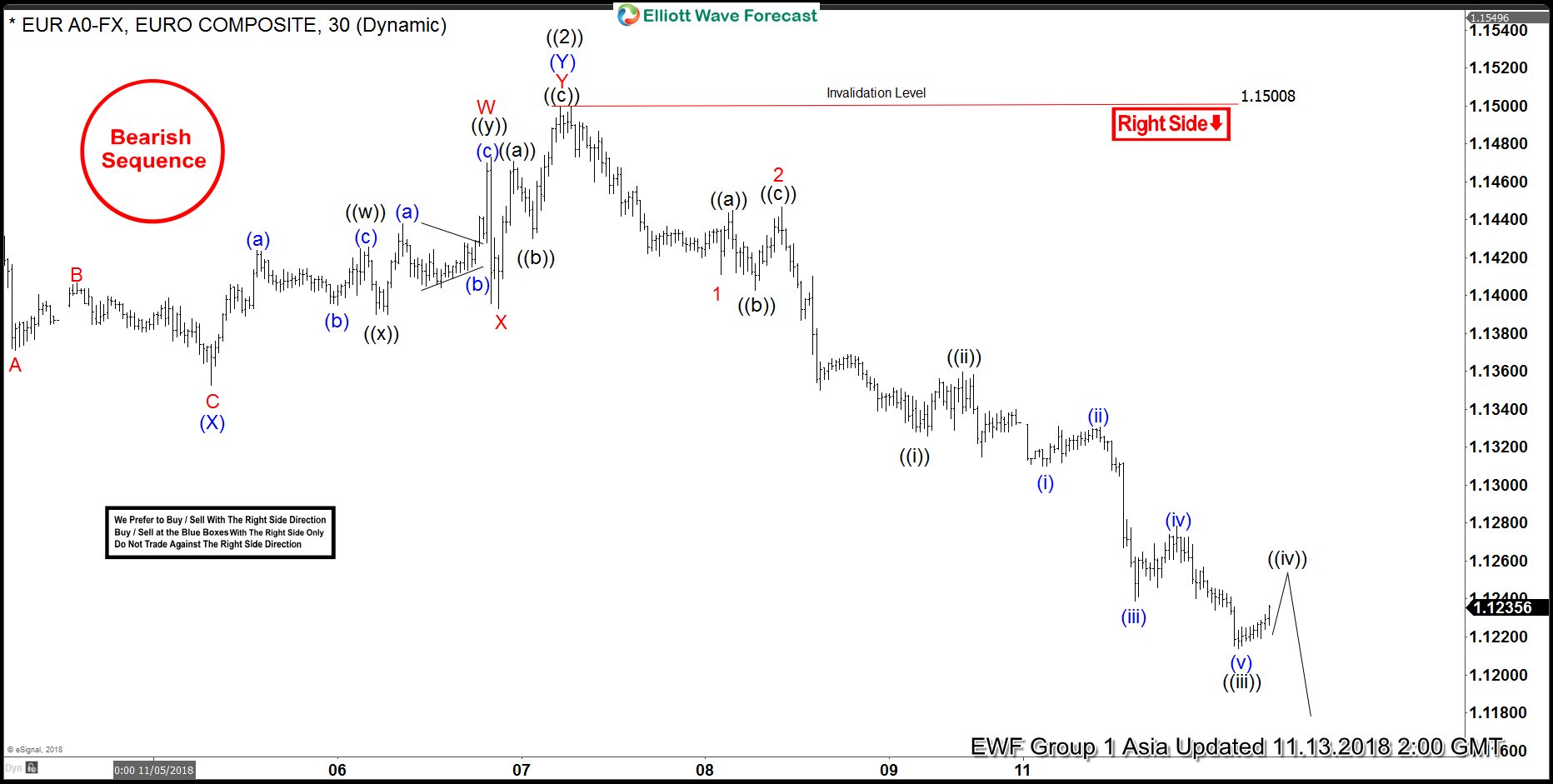

Elliott Wave Analysis: Further Downside Expected in EURUSD

Read MoreEURUSD has broken below Nov 1 low (1.13) and now the pair shows a 5 swing bearish sequence from Sept 24 high (1.1815), favoring further downside. Short term Elliott Wave view suggests that the move higher to 1.15 ended wave ((2)) in Primary degree. Internal of wave ((2)) unfolded as a double three Elliott Wave […]

-

Knowing Your Identity is Important to Trading Success

Read MoreIt’s important for financial market players to know their identity to be successful in the world of trading. A mistaken identity is often the cause of a failure for new aspiring traders. There are at least 3 distinct categories of financial market players and some combination of them: Investor Speculator Gambler 1. Investor An investor […]

-

Elliott Wave Analysis: GBPJPY in Correction Before Next Leg Higher

Read MoreShort Term Elliott wave view in GBPJPY suggests that the decline to 142.77 ended wave (2) in Intermediate degree. Up from there, the pair rallies as an impulse and ended Minor wave A at 149.49. Minor wave B pullback is currently in progress to correct cycle from Oct 26 low (142.77) before the next leg […]

-

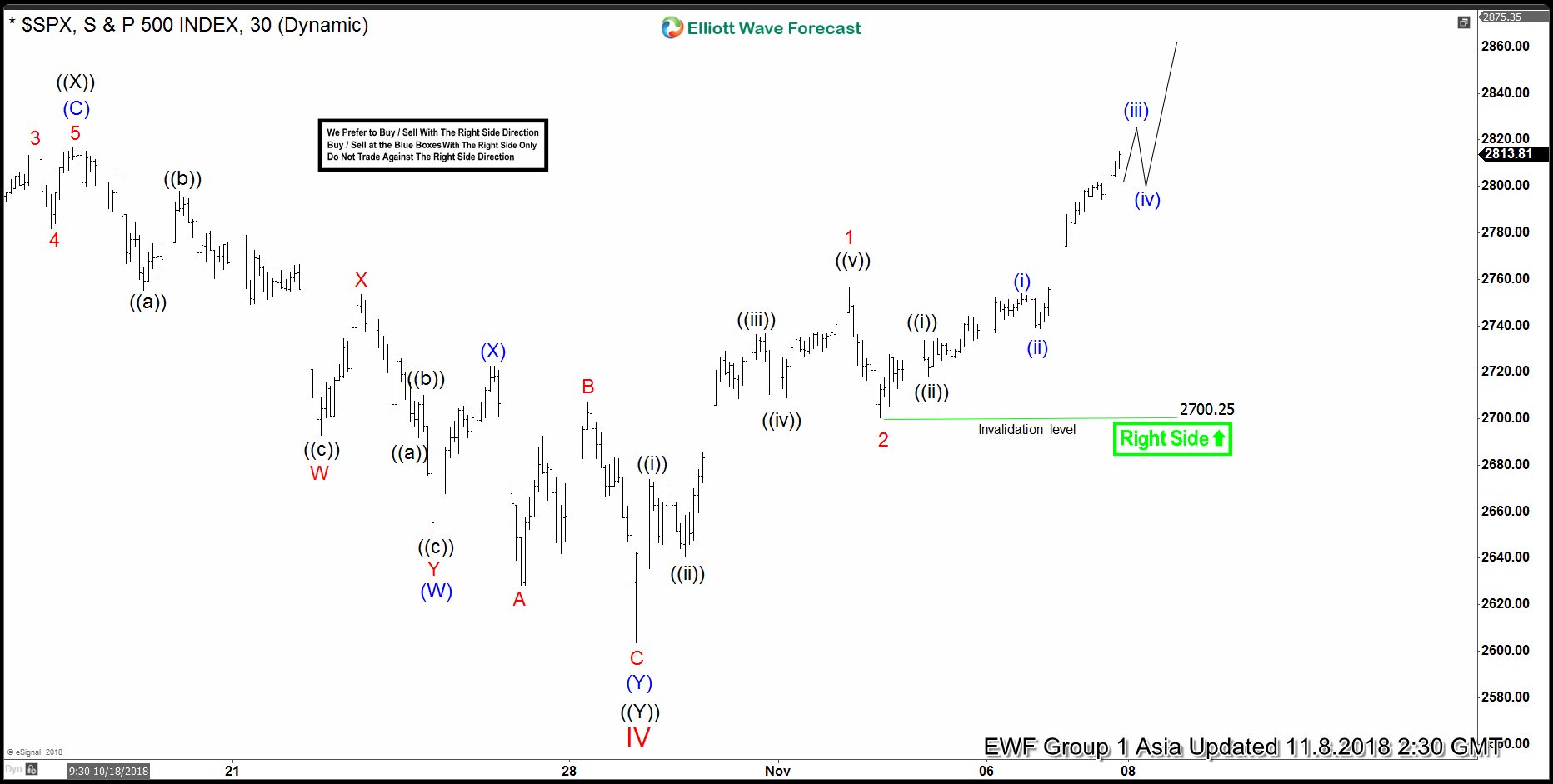

Elliott Wave View: SPX Starts a New Impulsive Rally

Read MoreShort term S&P 500 (SPX) Elliott wave view suggests that the selloff starting from Sept 21 high (2940.9) has ended at Oct 29 low (2603.54). We take the most aggressive view and call the low at 2603.54 as wave IV in Cycle degree. This suggests that SPX is ready to rally in a new bullish […]

-

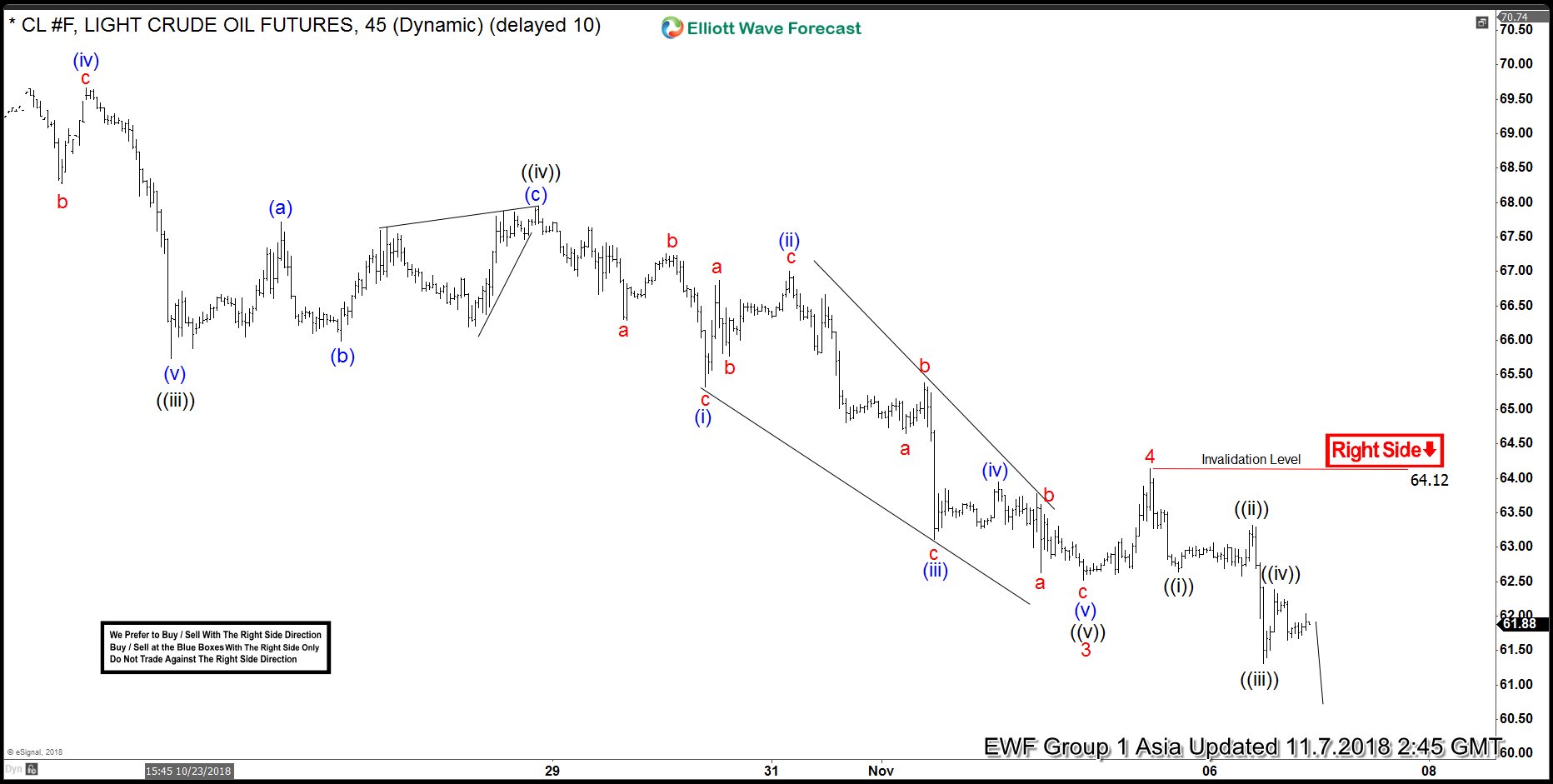

Elliott Wave Analysis: Oil (CL_F) looking to end 5 Waves

Read MoreOil (CL_F) short-term Elliott wave analysis suggests that the decline from Oct 3rd high is unfolding as a 5 waves impulse structure. In an impulse structure, the internals of wave 1, 3, and 5 also subdivide in another 5 waves of lesser degree. We propose Minor wave 3 ended at $62.52 , Minor wave 4 […]

-

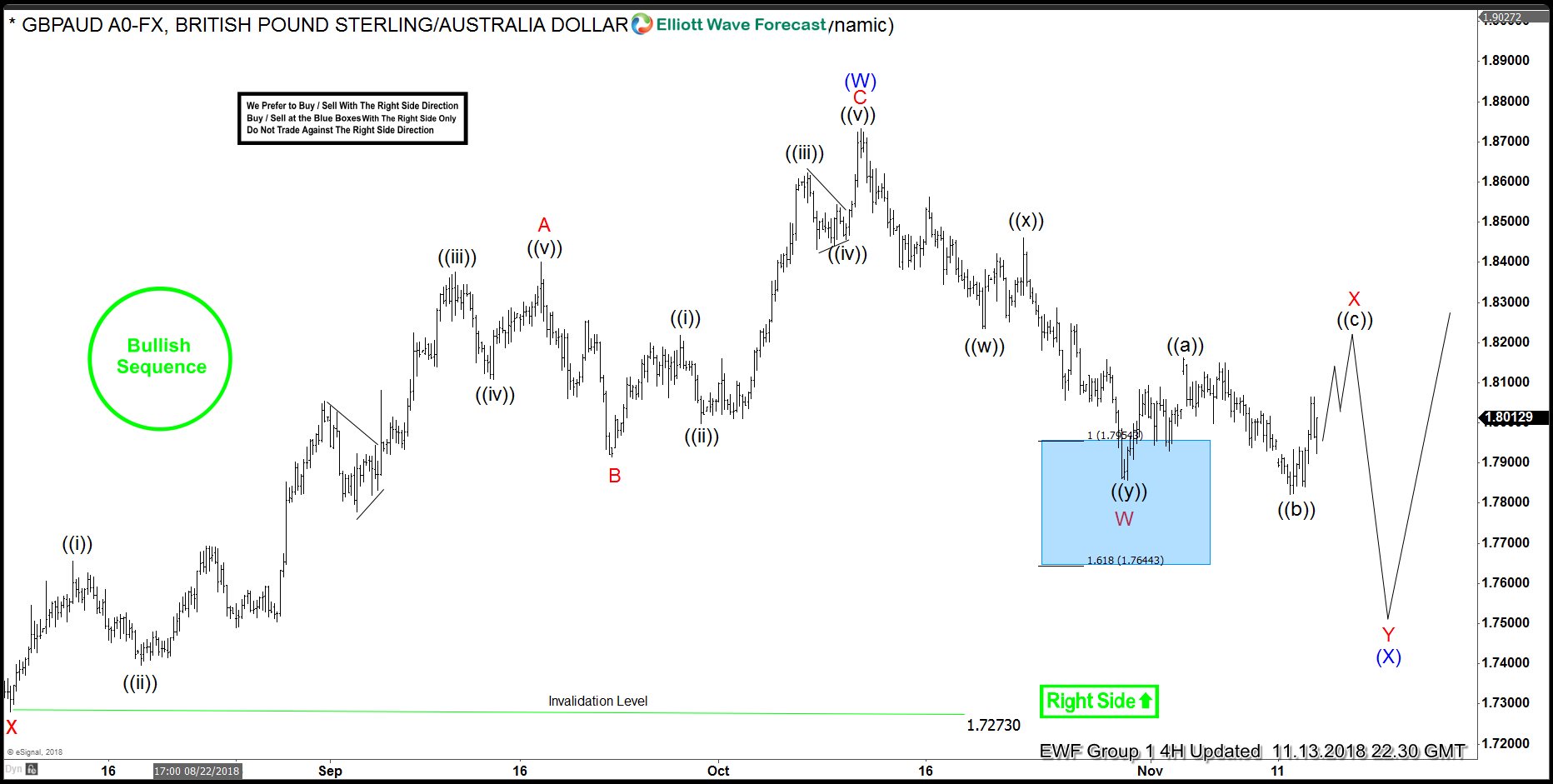

Brexit Progress May Turbocharge Poundsterling

Read MoreThere’s no question the most important risk event and near term key driver for Poundsterling remains to be Brexit. This month may shape up to be an important week for Poundsterling as Prime Minister Theresa May’s Cabinet discusses about it throughout the month of November. The Sunday Times reports last weekend that Mrs. May has […]