-

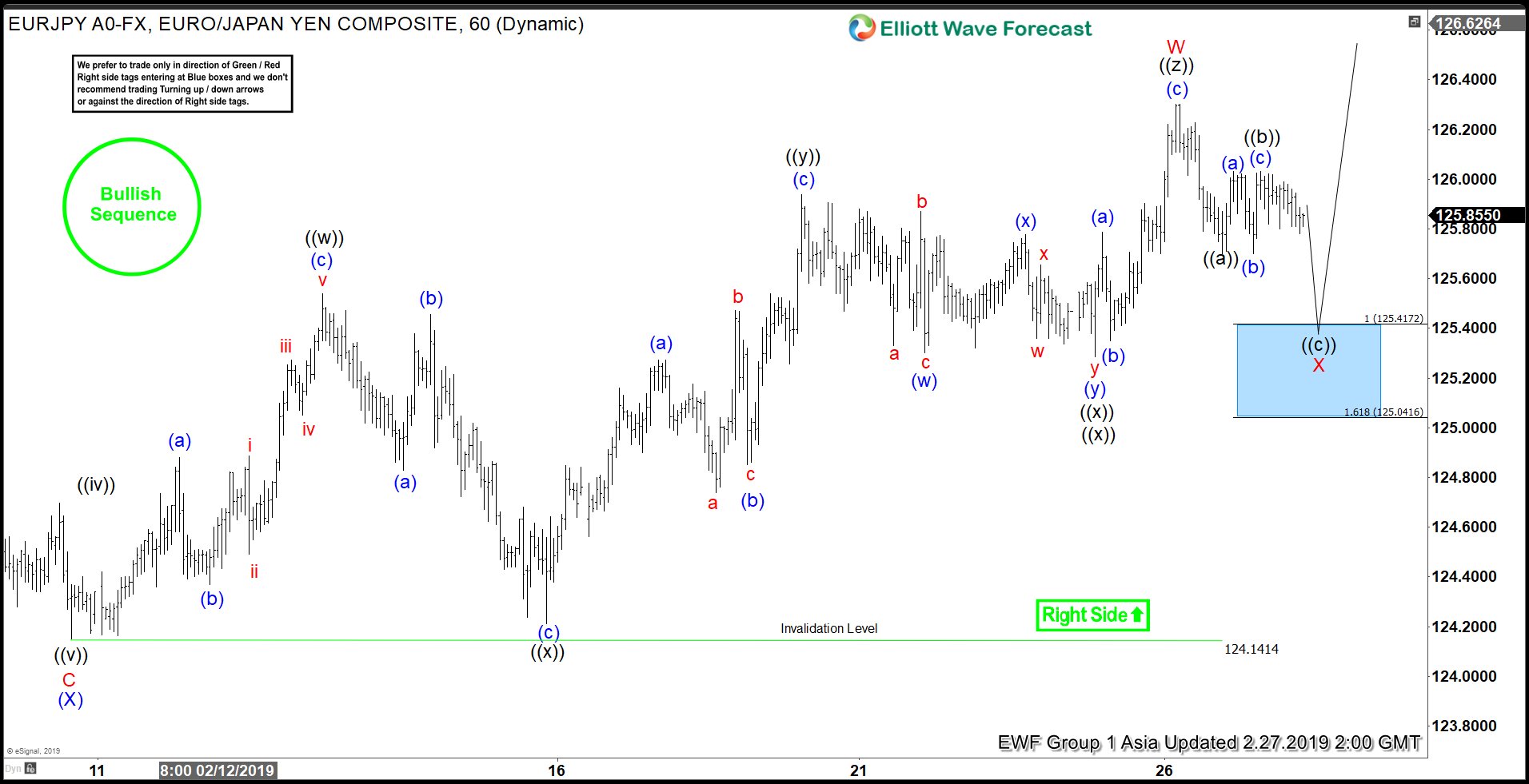

Elliott Wave View: EURJPY Rally Should Resume

Read MoreThis article and video explains the short term Elliott Wave path in EURJPY. Pair shows a bullish sequence from early January favoring more upside.

-

Elliott Wave View: Downside Pressure in EURGBP

Read MoreElliott Wave sequence in EURGBP shows a 5 swing bearish sequence from August 29, 2017 high, suggesting more downside. This article & video looks at the next path of the pair.

-

Progress in Brexit Negotiation Supports Poundsterling

Read MoreBritish Pound Sterling is the best performing major currency last week. The Pound Sterling shows strength as the market senses progress towards a Brexit deal. This follows news pointing to progress in Brexit negotiations. Last week UK Prime Minister Theresa May and EU President Jean-Claude Juncker met in Brussels to secure a deal. Both have […]

-

Elliott Wave View: Dow Jones Futures (YM_F) Starts Correction

Read MoreThis article and video explain the short term Elliott Wave path and target of Dow Jones Futures (YM_F). The Index has started a correction within wave IV.

-

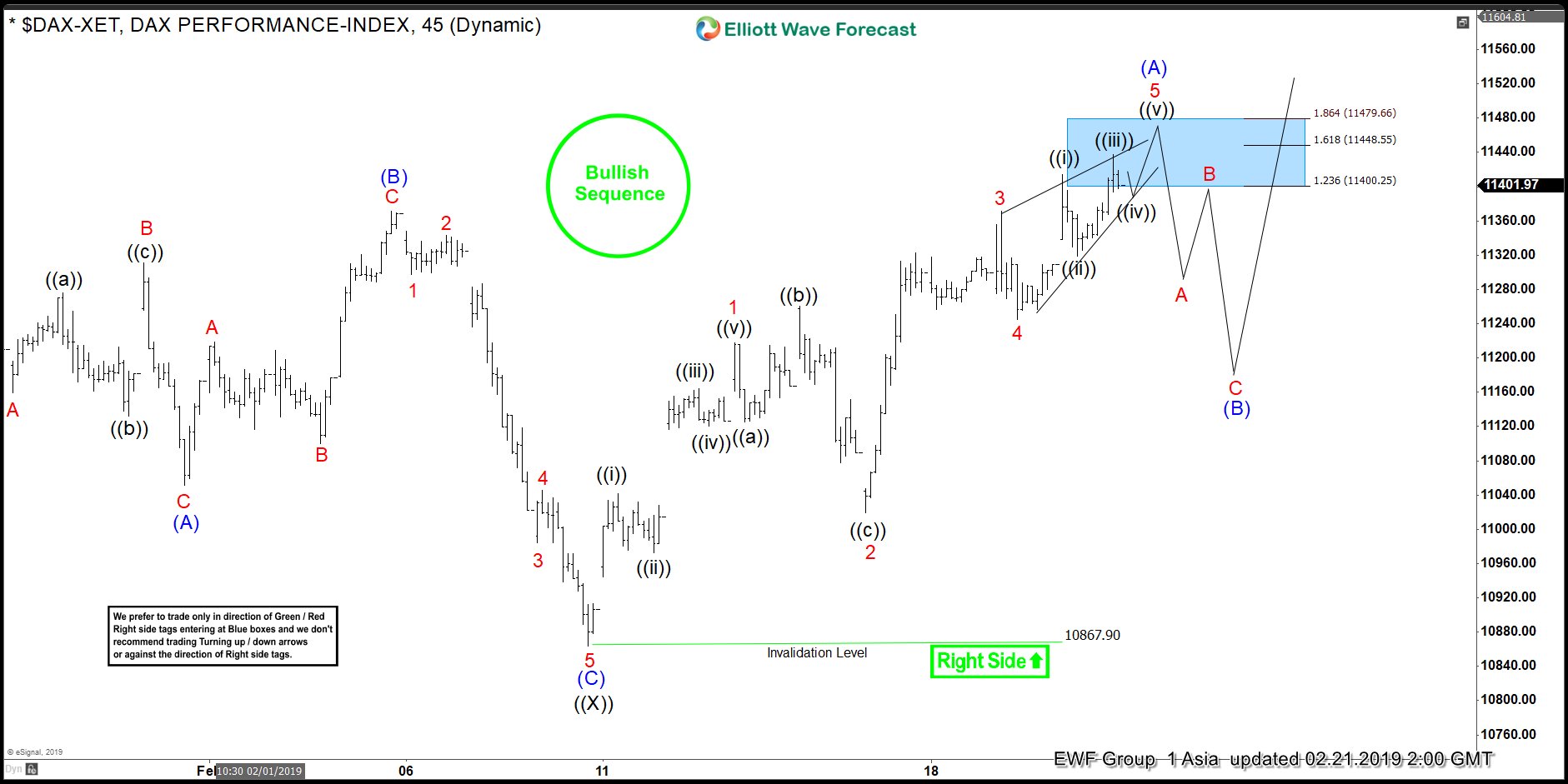

Elliott Wave View: DAX Bullish Sequence Favors More Upside

Read MoreThis article and video explains the short term Elliott Wave path for DAX. The Index shows a bullish sequence from December 2018 low favoring more upside

-

Elliott Wave View: Gold Looking to break 2018 High

Read MoreThis article and video explains the long term and short term view of Gold. Near term, the yellow metal still has scope to extend higher to retest 2018 high